In today's fast-paced world, managing finances efficiently is crucial, and sometimes that means sending out an urgent payment request. Whether you're a small business owner or an individual freelancer, it's essential to communicate clearly and professionally when payment deadlines loom. Crafting a compelling letter that conveys your request while maintaining a positive relationship with the recipient can make all the difference. Curious about how to effectively frame your message? Read on for a well-crafted letter template that will help you get the results you need!

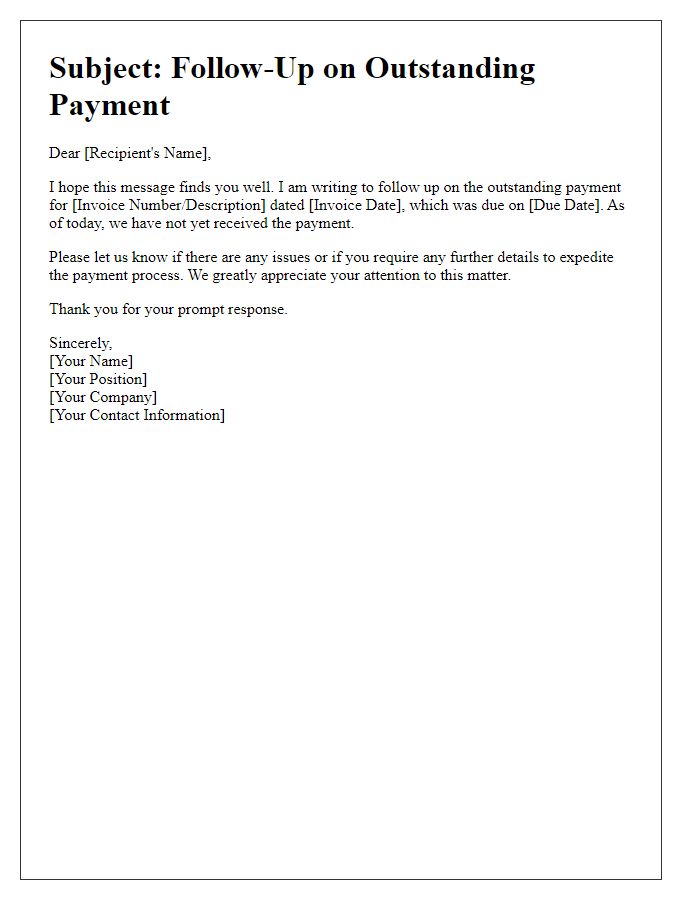

Subject Line Clarity

Urgent payment requests often originate from unmet financial obligations, typically involving invoices that are past due. Specific amounts, like $1,500 for services rendered, can be crucial for cash flow management of businesses like small construction firms or freelance graphic design agencies. Payment delays can disrupt operational budgets, leading to additional costs such as late fees or interest rates that may exceed 3% monthly. Clear and direct subject lines, such as "Immediate Attention Required: Past Due Invoice #1023," can effectively convey urgency, improving the likelihood of swift action. In high-stake situations, such as ongoing contracts or services at risk of suspension, a follow-up email within three business days is often advisable for reinforcement.

Polite Tone

A delayed payment can significantly disrupt business operations, particularly in small enterprises that rely on timely receipts. Invoice numbers, such as #12345, from service-rendering dates on September 15, 2023, remain outstanding, totaling $5,000. The agreed payment terms of net 30 days have now passed by an additional 14 days. Adhering to cash flow regulations is essential for maintaining operational stability. Payment could be facilitated via electronic fund transfer or traditional check, details provided in the original invoice. Prompt settlement of this balance is essential to sustain ongoing service and meet financial obligations.

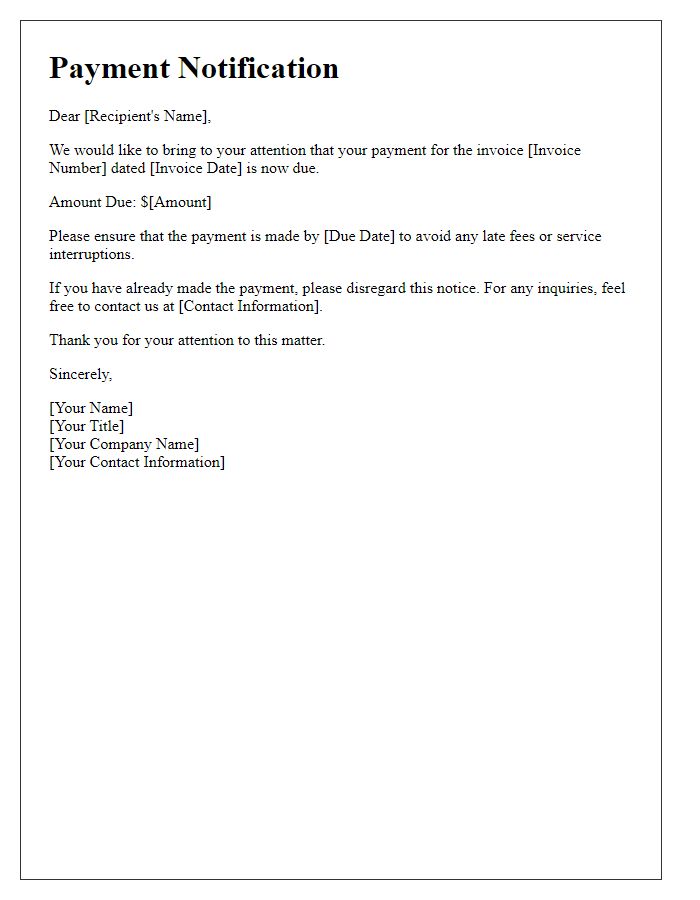

Invoice Details

An urgent payment request typically includes specific invoice details for clarity. Invoice number serves as a unique identifier, indicating the specific transaction. Due date signifies the deadline for payment, often requiring immediate attention. Amount due represents the total required payment, including any overdue charges, ideally specified in currency format (e.g., USD, EUR). Invoice date indicates when the invoice was generated, providing context on payment timeline. Service description outlines the goods or services rendered, offering transparency to the recipient. Payment methods listed (e.g., bank transfer, credit card) facilitate the transaction process, ensuring timely processing.

Payment Methods

Urgent payment requests often involve various payment methods that facilitate quick transactions. Common options include credit card payments, which allow immediate authorization through networks such as Visa or MasterCard. Bank transfers represent another method, typically enabling funds to move directly from one bank account to another, often processed within 1-2 business days, depending on the financial institution's policy. Third-party services, like PayPal or Venmo, expedite payments through mobile applications, providing secure transaction options that can transfer funds instantly. Direct debit arrangements offer automated recurring payments, ensuring timely fulfillment of obligations until cancelled. Each payment method presents its own advantages and potential delays, making it crucial to choose the most efficient option for pressing financial commitments.

Contact Information

Urgent payment requests often arise in various business contexts, necessitating formal communication to ensure timely resolution. Typical elements include the company's name, address, and phone number to establish credibility. Important details like invoice number, due date, and outstanding amount should be included for clarity, ensuring the recipient understands the urgency. Clear statements regarding late fees for delays, specifying percentages or fixed amounts based on the overdue period, can motivate prompt payment. Including a call-to-action, such as requesting immediate confirmation of the payment date, can facilitate quicker responses.

Comments