Hey there! If you're facing a chargeback situation, it's crucial to address it promptly and professionally. A well-crafted letter can help communicate your position clearly and facilitate a smoother resolution. Ready to dive into the nitty-gritty of chargeback notifications? Let's explore how to effectively inform your clients and protect your interests.

Header with company logo and contact information

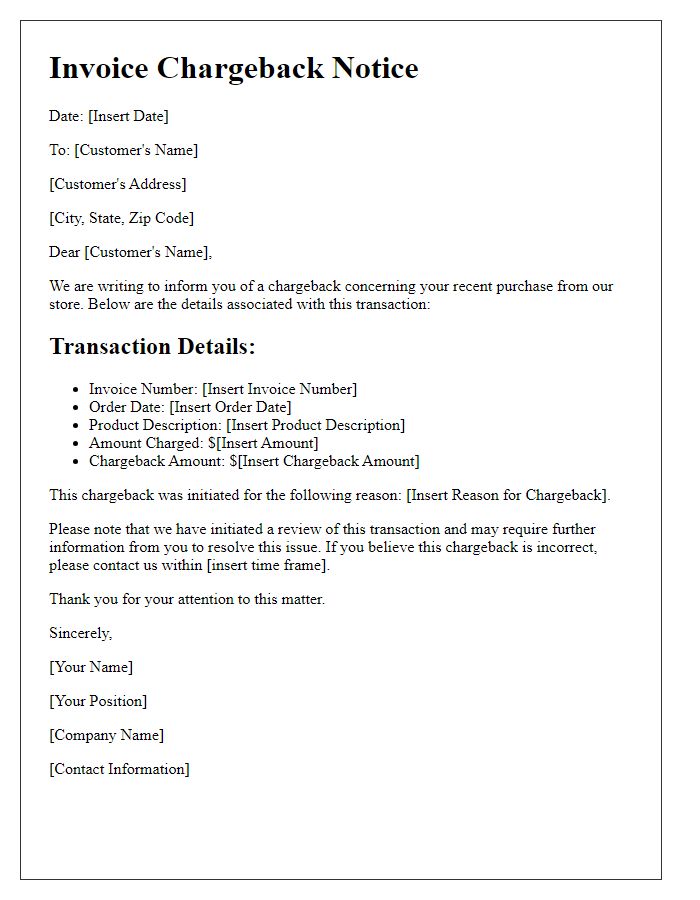

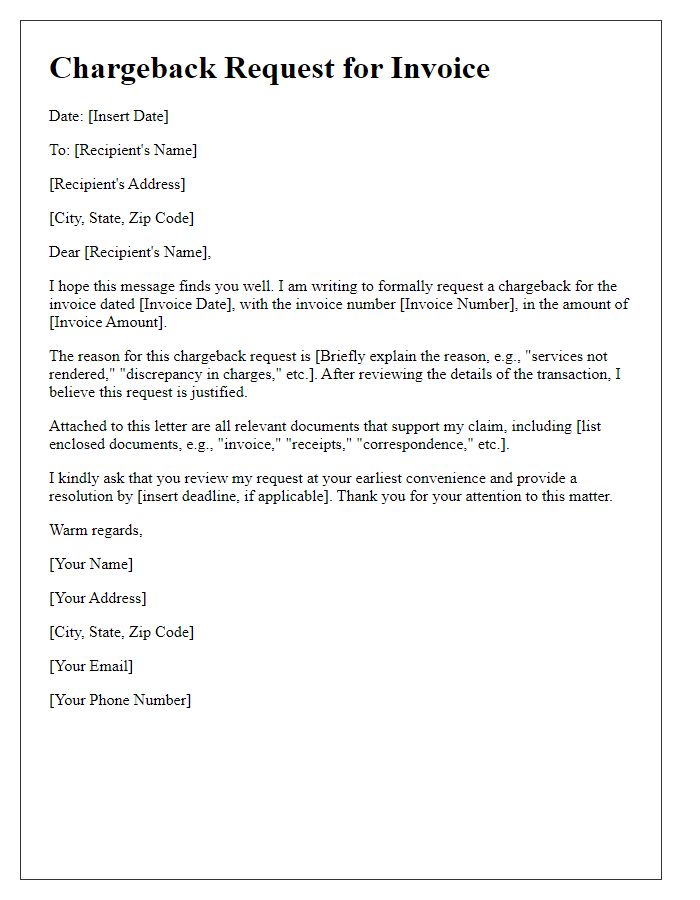

A chargeback notification may include essential details, such as the company logo at the top representing the business identity (e.g., XYZ Corp), clear contact information like business address (123 Business Lane, City, State, Zip) and phone number (123-456-7890). The subject line should explicitly state "Chargeback Notification" to highlight the document's purpose. Include invoice details, such as invoice number (INV-1010), date of issue (January 1, 2023), and the amount charged ($150.00). Clearly outline the reason for chargeback, which may be related to service dissatisfaction or fraudulent activity. Incorporate instructions on how the recipient can respond, such as providing supporting documents or contacting a designated customer service representative. Ensure that the tone remains professional, while addressing any concerns regarding the transaction.

Customer's account details and invoice reference number

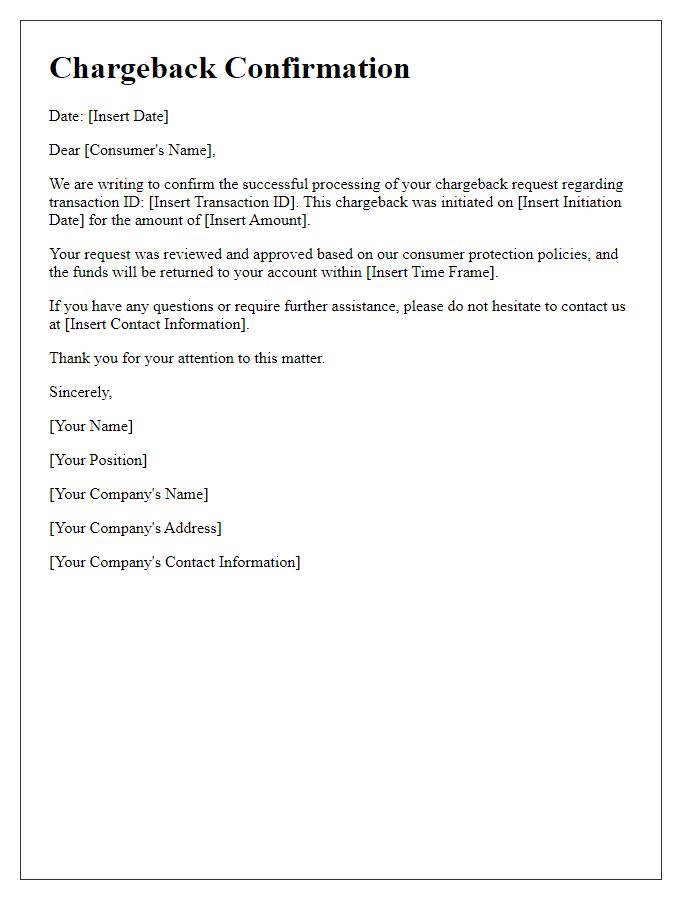

A chargeback notification involves informing the customer about a reversal of a transaction on their account due to various reasons, such as disputes regarding the invoice. Notification includes critical elements like customer account details, with specific reference numbers (e.g., invoice reference number 12345) indicating the transaction in question. These details help ensure clarity in communication, facilitating accurate identification of the associated payment issue. Sending the notification promptly ensures the customer is made aware of the chargeback process for the disputed amount, maintaining transparency and trust in the customer relationship. Additionally, including instructions for further disputes or inquiries enhances customer service.

Clear statement of the chargeback and amount

A chargeback notification can occur when a consumer disputes a credit card transaction, resulting in a reversal of funds. In this case, the invoice chargeback amount of $500 (for services on September 15, 2023) was initiated due to perceived discrepancies. The issuing bank's investigation indicated insufficient documentation regarding the charge. It's crucial to respond promptly to provide supporting evidence, such as the signed service agreement and transaction receipts, to contest the chargeback effectively. Failure to address this matter could lead to additional fees and potential damage to the merchant's reputation.

Explanation of chargeback reason and relevant transaction details

A chargeback notification serves to inform parties involved regarding a reversal of a transaction charge. Recent case studies highlight reasons for chargebacks, including fraud, dissatisfaction with goods, or service issues. For instance, in an e-commerce scenario, a chargeback could occur when a customer disputes a $150 payment for a pair of shoes from an online retailer due to quality concerns, initiated 30 days after the purchase date. This transaction may involve the payment processor (Visa), the merchant bank, and the customer's bank. Important details include invoice number (INV123456), date of charge (October 1, 2023), and reference number (REF987654), all of which are vital for tracking and resolution. Timely notification and documentation are necessary to address such disputes effectively, enabling the involved parties to reconcile accounts and maintain customer satisfaction.

Instructions for next steps and contact information for queries

A notice regarding invoice chargeback informs clients about a reversal of payment on an invoice, typically tied to underlying issues like disputes or unsatisfactory services. Clients should carefully review the invoice associated with the chargeback to ensure all details are accurate, including the unique invoice number (for reference). For further assistance, clients can reach out via the provided support contact (usually a designated email or customer service phone number), operational during business hours (specifically, 9 AM to 5 PM). It is advisable for clients to prepare any relevant documentation to support their query, enhancing the resolution process. Prompt communication can prevent escalated issues and foster effective customer relations, ensuring clarity regarding outstanding balances or potential resolutions.

Letter Template For Notifying Invoice Chargeback. Samples

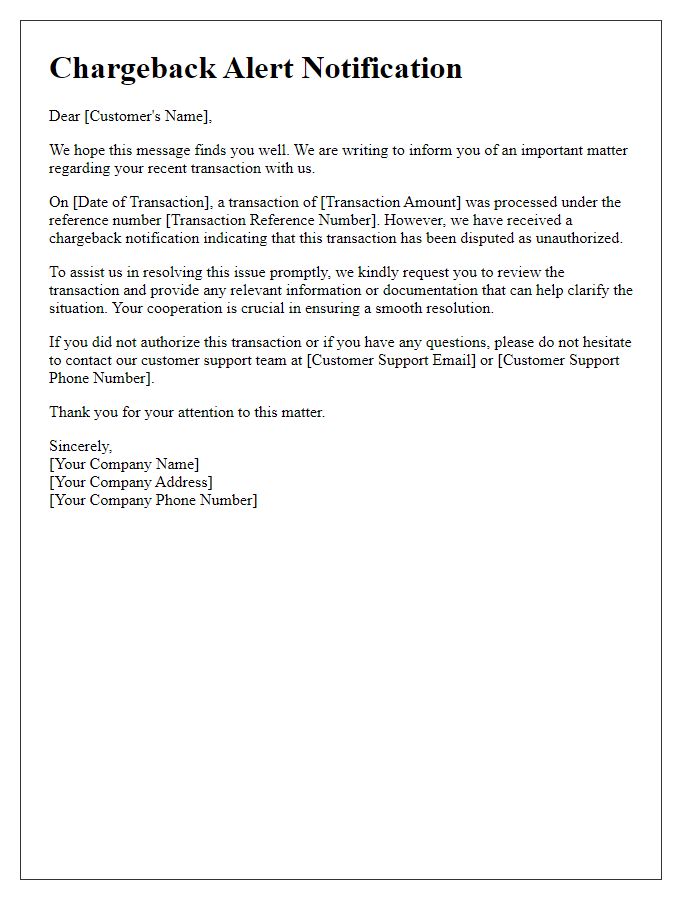

Letter template of invoice chargeback alert for unauthorized transaction.

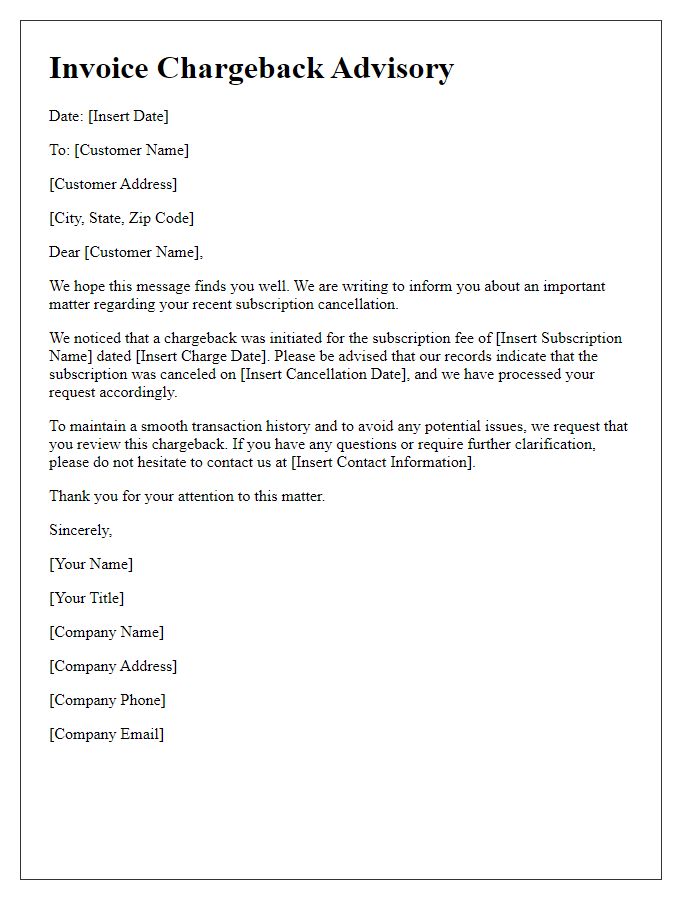

Letter template of invoice chargeback advisory for subscription cancellation.

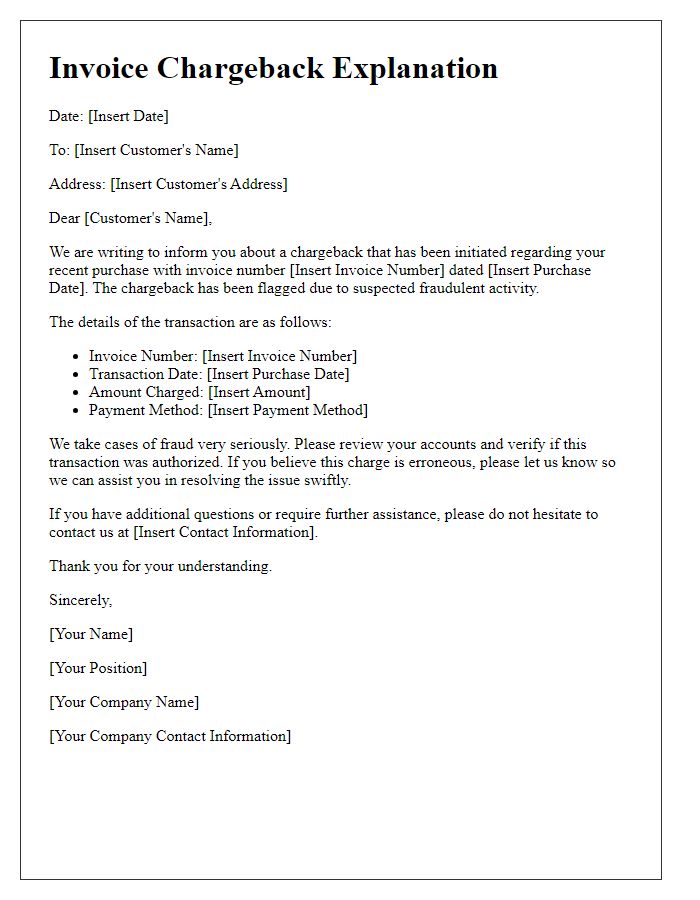

Letter template of invoice chargeback explanation for fraudulent purchase.

Letter template of invoice chargeback update for payment processing issue.

Letter template of invoice chargeback reminder for pending investigation.

Comments