Are you tired of your payment methods causing unnecessary headaches? Updating your payment information can streamline your transactions and ensure everything runs smoothly. In this article, we'll explore simple ways to request an updated payment method effectively and professionally. So, grab a cup of coffee and join us as we delve into this essential topic!

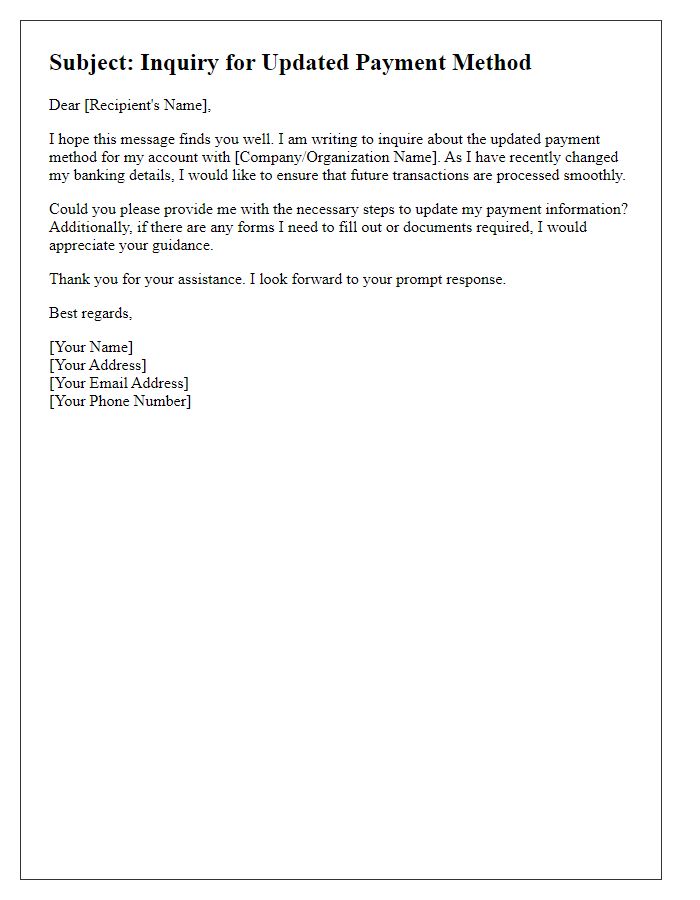

Professional tone and clarity

A secure payment method is essential for ensuring smooth financial transactions in modern business, particularly in digital platforms such as e-commerce websites. Users may face difficulties if outdated payment options (like credit cards expired after three years) remain on file, leading to failed transactions and interrupted services. In regions like North America, the preferred methods include contactless payments (such as Apple Pay or Google Pay) that promote streamlined checkouts and enhance security with encryption technology. Regular updates to payment methods ensure compliance with evolving regulations and standards, particularly the Payment Card Industry Data Security Standard (PCI DSS), which mandates stringent security measures to protect sensitive information.

Subject line and header inclusion

Subject: Request for Updated Payment Method Dear [Recipient's Name], [Your Company/Organization Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] I am writing to request an update regarding the payment method associated with our account. As we transition to a more efficient payment process, it is crucial to ensure that our details reflect current information for seamless transactions. Please provide the necessary steps and documentation needed to facilitate this change. Thank you for your assistance. Sincerely, [Your Name] [Your Position] [Your Company/Organization Name]

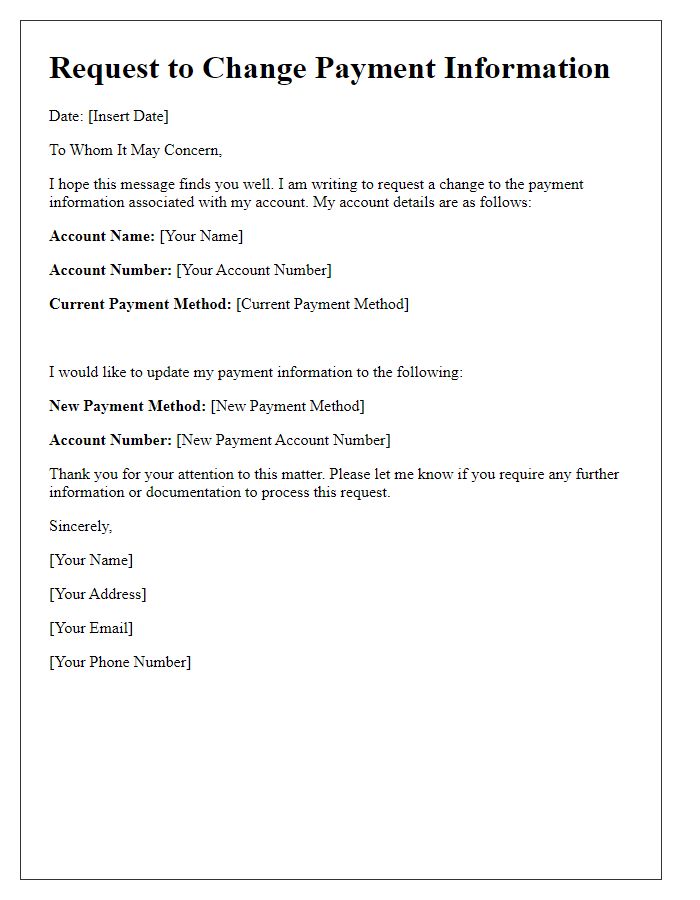

Specific payment details

In a rapidly evolving digital landscape, businesses increasingly require updated payment methods to ensure seamless transactions. Payment details, such as credit card information, include specific numbers (16-digit card numbers), expiration dates (month and year), and CVV codes (three or four digit security codes). Additionally, banking options like direct debits, PayPal (an online payment system used globally), and mobile wallets (such as Apple Pay or Google Pay) are integral for flexibility and user convenience. Companies may also need updated invoice addresses and billing emails to maintain accurate financial records, especially for compliance with local laws and regulations, which can vary significantly by region such as European Union VAT laws or United States tax reporting requirements.

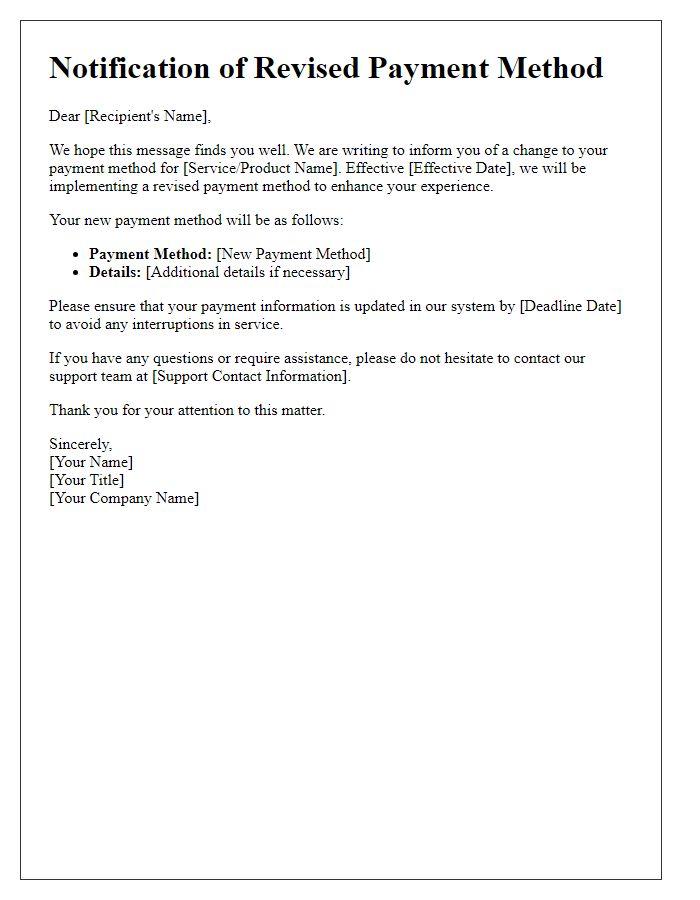

Call-to-action and deadlines

Payment processing systems are essential for maintaining smooth financial transactions in businesses. Many organizations require updated payment methods to adapt to evolving financial technologies. Clients should provide new payment details, such as credit card information or bank account numbers, by specific deadlines, often within a 15-day period, to avoid processing delays. Failure to communicate updated payment methods may result in service interruptions, late fees, or penalties. Adopting prompt communication channels, such as emails or online portals, enhances the efficiency of updating payment methods and reinforces ongoing business relationships.

Contact information for inquiries

Businesses often require an updated payment method to ensure seamless transactions. For example, a company might switch from traditional checks to electronic payments for efficiency. The updated payment method could involve submitting bank account details for direct deposit or using secure online payment platforms like PayPal or Stripe. It's essential to provide clear contact information for inquiries, including phone numbers, email addresses, and mailing addresses, so customers can reach out for clarification or assistance.

Comments