Are you feeling a bit lost when it comes to understanding your recent invoice? You're not aloneâmany folks find themselves needing a little help to clarify payment details. In this article, we'll guide you through crafting a clear and effective letter that communicates your request for clarification professionally. So, grab a cup of coffee and let's dive in to make sure you're equipped with the right tools for smooth communication!

Subject line: Clear and concise request for payment clarification.

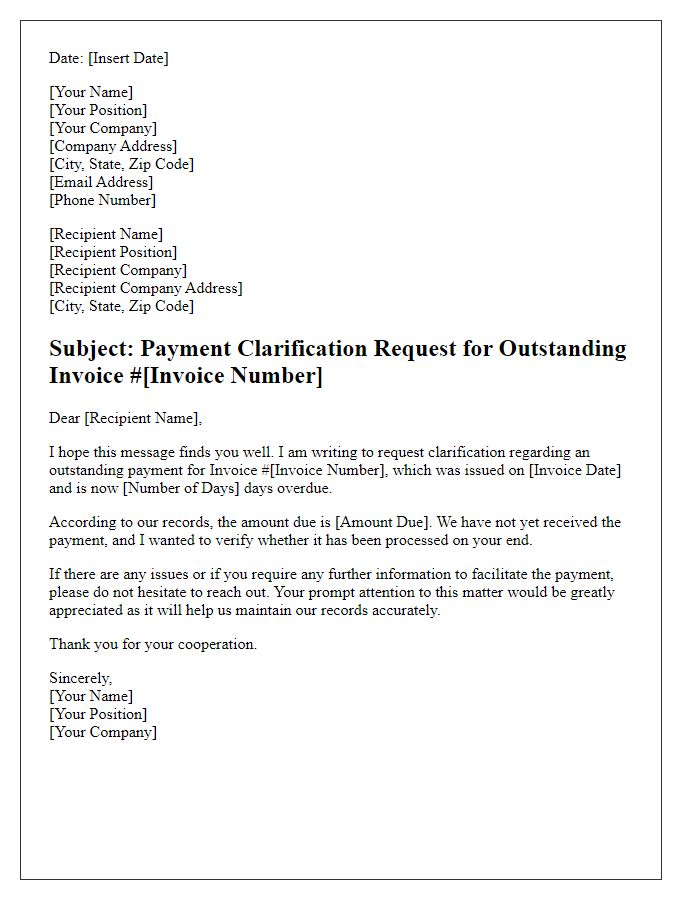

Requesting payment clarification is essential for maintaining accurate financial records. Invoices marked with unique identifiers, such as invoice numbers (e.g., 12345) and dates (e.g., issued on January 10, 2023), should be examined to confirm payment status. Discrepancies in amounts can arise from factors such as discounts applied or additional services rendered (e.g., consulting hours) that were not previously discussed. Financial software, like QuickBooks or FreshBooks, can aid in tracking these payments and flagging inconsistencies. Clear communication with the accounts payable department of the respective company can facilitate understanding and ensure that all parties are aligned with the agreed terms. Utilizing specific data points in an email, including due dates and outstanding balances, can expedite the clarification process.

Salutation: Professional greeting to the recipient.

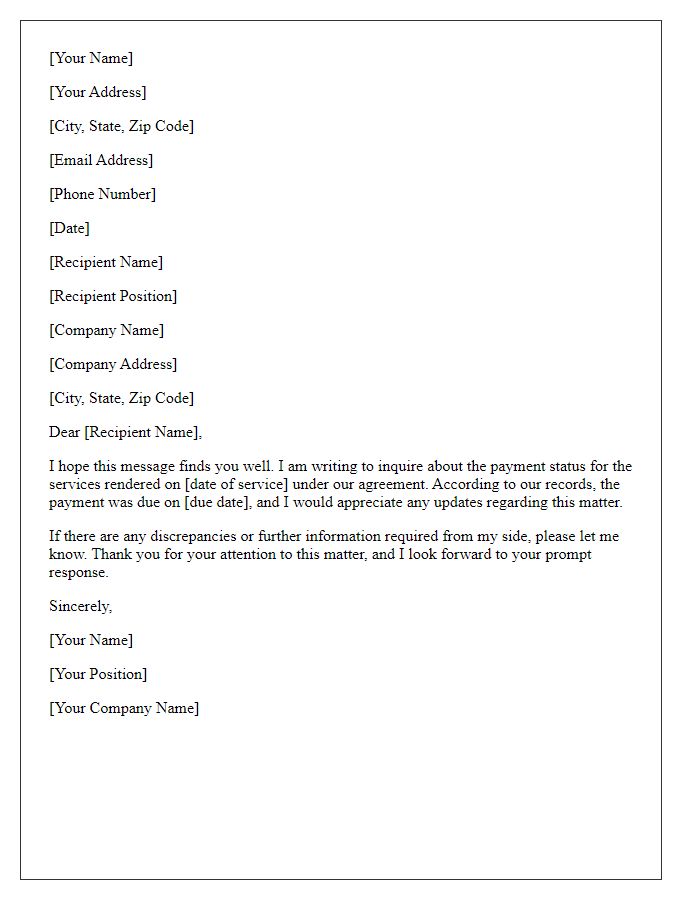

The process of requesting payment clarification can involve significant details regarding the financial transaction in question. Transaction numbers play a crucial role, facilitating the identification of specific payments made to companies, such as XYZ Corp. Dates of payment (e.g., October 1, 2023) should be specified to provide context and reference points for any discrepancies. In addition, the invoicing details, including invoice number (e.g., Invoice #12345), and the amount due (such as $1,250) can provide clarity. Addressing issues related to payment methods, such as credit card transactions or bank wire transfers, can be essential for understanding delays or errors. Clear communication is vital in ensuring that all parties involved have a comprehensive understanding of the financial obligations and statuses.

Introduction: State the purpose of the letter and reference specific payment details.

A payment clarification request typically centers around discrepancies or uncertainties regarding transactions such as invoices or contracts. Company XYZ, located at 123 Business Avenue, serves as a reminder regarding Invoice #4567 issued on August 15, 2023, amounting to $2,000. The payment was originally due on September 15, 2023, but as of October 1, 2023, it remains unresolved. Additionally, Reference #7890, related to the service agreement for consulting services, requires further explanation for the variation in charges. Specific details include payment methods and dates to resolve outstanding issues promptly, ensuring both parties maintain clear financial records and understanding regarding obligations.

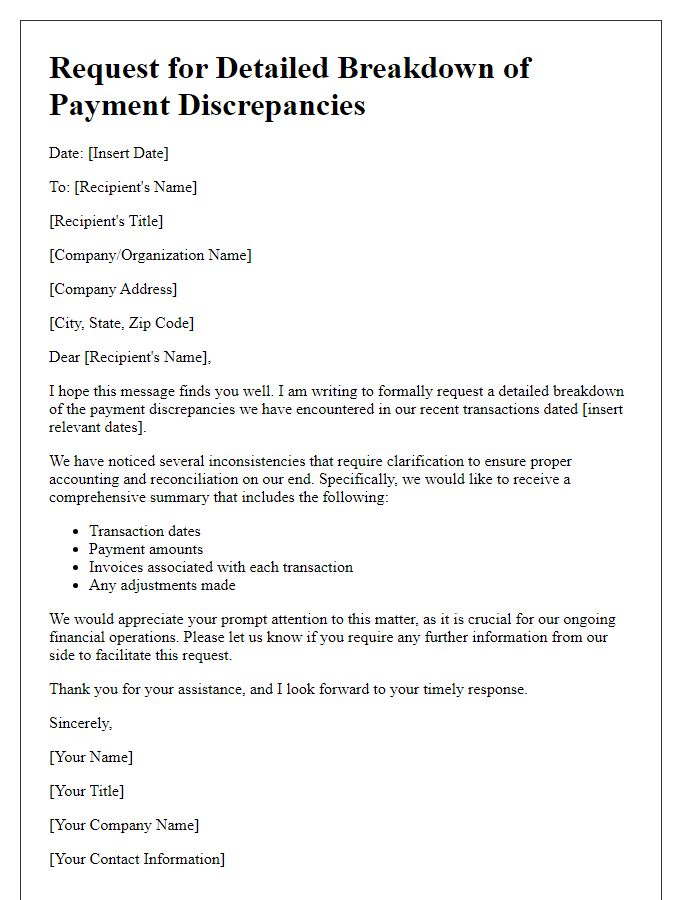

Details: List any discrepancies or unclear aspects of the payment.

Anomalies in payment processing can create confusion, especially in transactions exceeding $1,000, involving multiple invoices or services. Discrepancies such as missing entries for specific charges related to recent projects, incorrect amounts reflecting services rendered on March 15, 2023, or unclear deductions can lead to miscommunication. Detailed breakdowns from the payment statement are essential to clarify amounts owed, especially when payment terms involve 30-day net and late fees may apply. Additionally, items listed without corresponding purchase orders or mismatched dates can significantly complicate reconciliation. Keeping accurate records enables effective discussion of these issues with the accounts payable department for resolution.

Closing: Request for clarification, provide contact information, and a polite closing statement.

Clear payment terms are essential for maintaining smooth business operations. Outstanding invoices (often exceeding 30 days) cause disruptions in cash flow management. Clients, such as those in the service industry, might encounter misunderstanding regarding specific charges, leading to payment delays. Accurate documentation, including service terms and itemized bills, is crucial for transparency. Providing direct contact information (such as a dedicated accounts payable email or phone number) encourages prompt resolution of payment disputes. A courteous closing statement reinforces professionalism, fostering positive client relationships.

Letter Template For Requesting Payment Clarification. Samples

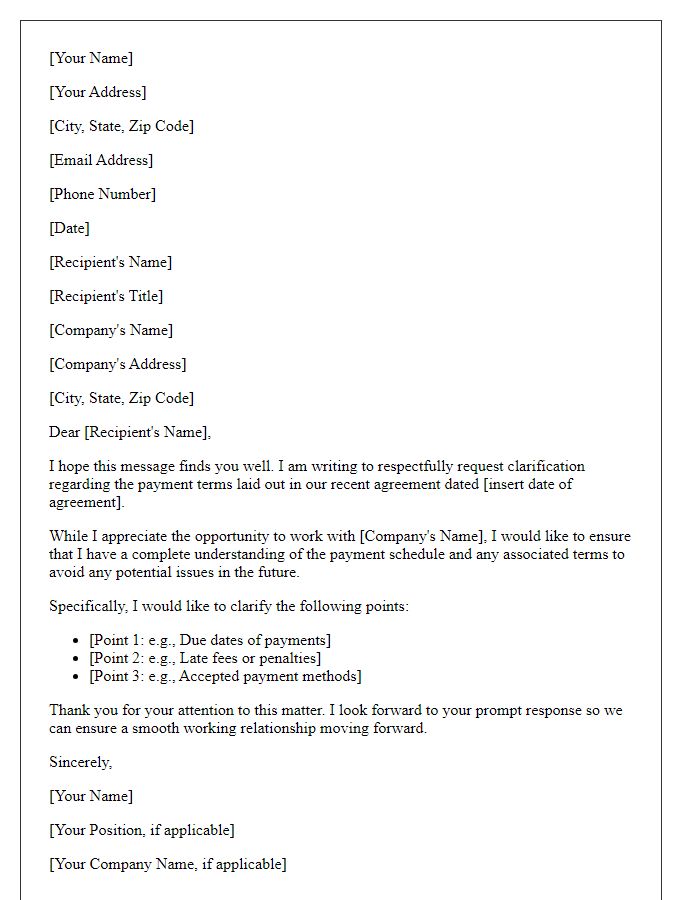

Letter template of payment clarification request for outstanding invoice.

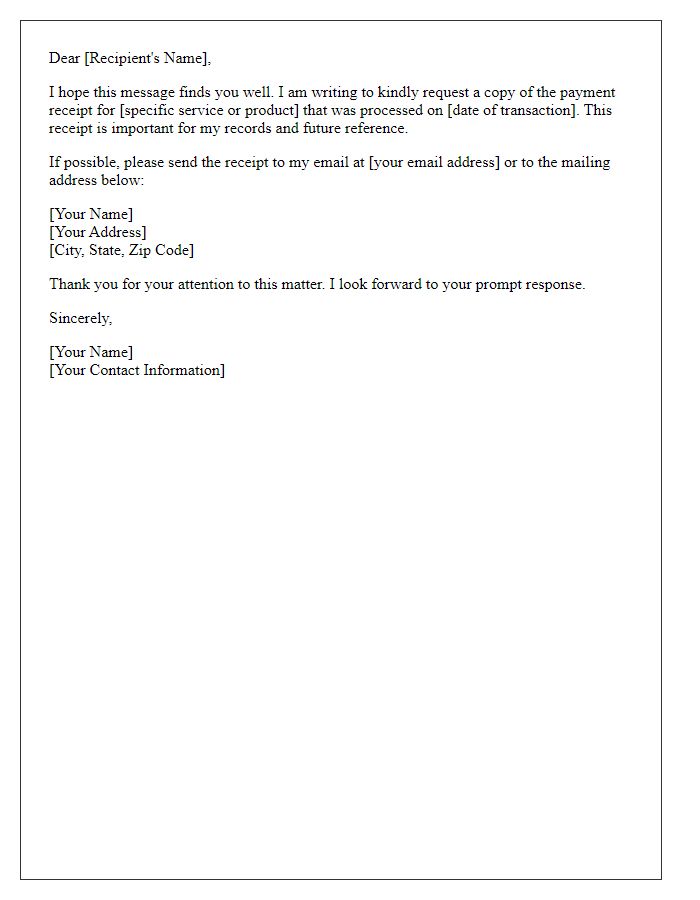

Letter template of inquiry regarding payment status for services rendered.

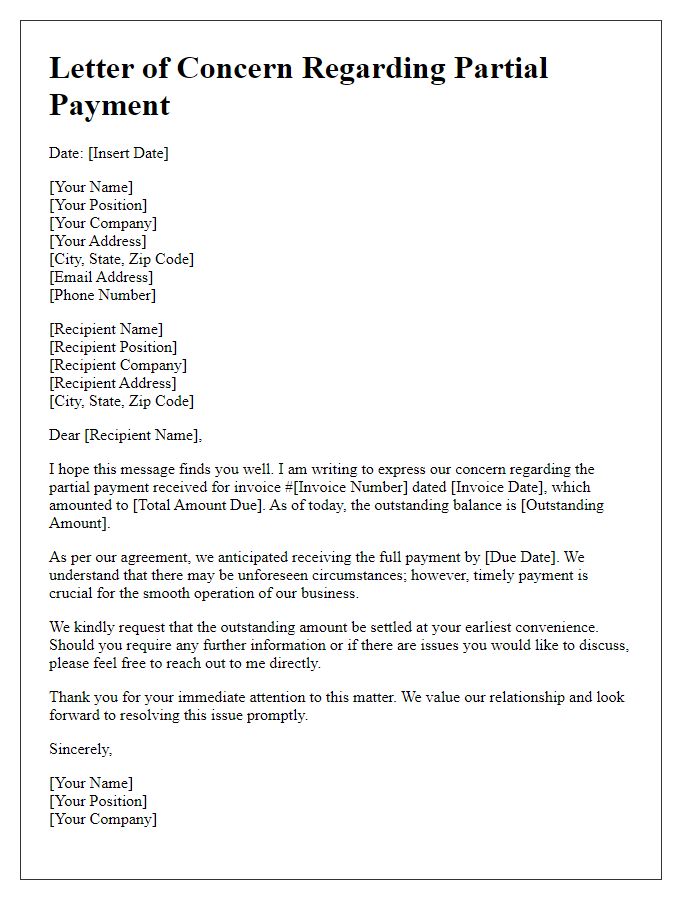

Letter template of request for detailed breakdown of payment discrepancies.

Comments