Writing a letter to request payment reconciliation may seem daunting, but it can be a straightforward process when you know how to approach it. Whether you're a business owner managing accounts or an individual examining a financial discrepancy, clear communication is key. In this article, we'll guide you through the essential components of crafting an effective request, ensuring your message is both professional and persuasive. Ready to simplify your payment reconciliation process? Read on!

Clear Subject Line

Overdue accounts, specifically the outstanding invoices (notably invoices #12345 and #67890) from the Q1 of 2023, require immediate attention for payment reconciliation. The total amount owed is $10,500, which includes services rendered by the accounting firm, Smith & Co., and materials supplied by Green Supply Co. It's crucial to address discrepancies identified in the payment records, particularly concerning transaction dates and amounts. The deadline for this reconciliation is October 30, 2023, to avoid late fees and maintain a positive business relationship. Prompt actions concerning this matter will help ensure accuracy in financial reporting and operational continuity.

Polite Salutation

Persistent delays in payment reconciliation can significantly impact financial health. In corporate environments such as accounts payable, timely alignment of payment records is crucial for maintaining accurate financial statements. Discrepancies in invoices and receipts can lead to cash flow issues, especially for small businesses relying on consistent revenue streams. Establishing a clear timeline for reconciliation promotes transparency and efficiency. Important dates should be documented, along with relevant invoice numbers and amounts due, to ensure all parties are aligned. Regular follow-ups can enhance communication and facilitate quicker resolutions.

Detailed Account Statement

A detailed account statement provides an overview of financial activity, including transactions between two parties. This statement often includes key data such as dates, transaction types, amounts, and balances, facilitating effective payment reconciliation. For businesses, maintaining accurate account statements is critical for cash flow management, particularly for companies in sectors like finance or retail. The process typically involves examining invoice details, payment receipts, and any outstanding balances to ensure clarity and accuracy. Regularly updating this financial document helps mitigate discrepancies and ensures timely payments, vital for maintaining positive supplier and client relationships.

Specific Discrepancy Explanation

Inaccurate payment records can lead to significant discrepancies in financial statements, affecting operational liquidity. A review of monthly statements (for example, January 2023) indicated a $5,000 discrepancy between received payments and reported income, highlighting a recurring issue. The financial report dated February 28, 2023, shows that several invoices, particularly Invoice #14527 dated January 15, 2023, with a total of $3,200, were not accurately reflected in the accounts payable ledger. Furthermore, the payment received on February 20, 2023, towards Invoice #14527 is recorded incorrectly. Immediate resolution of these discrepancies is vital for maintaining accurate financial tracking and ensuring compliance with accounting standards.

Request for Prompt Resolution

Businesses often require prompt payment reconciliation to ensure accurate financial records. Invoices for services rendered, such as those from suppliers or contractors, may need thorough comparison against payments received. Discrepancies, such as underpayments or overpayments, can cause cash flow issues and affect budgeting. Timely communication with accounts payable departments is essential to resolve outstanding amounts. Documentation, including original invoices, payment confirmations, and transaction records, should accompany requests to expedite the reconciliation process and maintain financial integrity. Consistent follow-up on outstanding payments helps to establish good relationships with stakeholders.

Letter Template For Requesting Payment Reconciliation. Samples

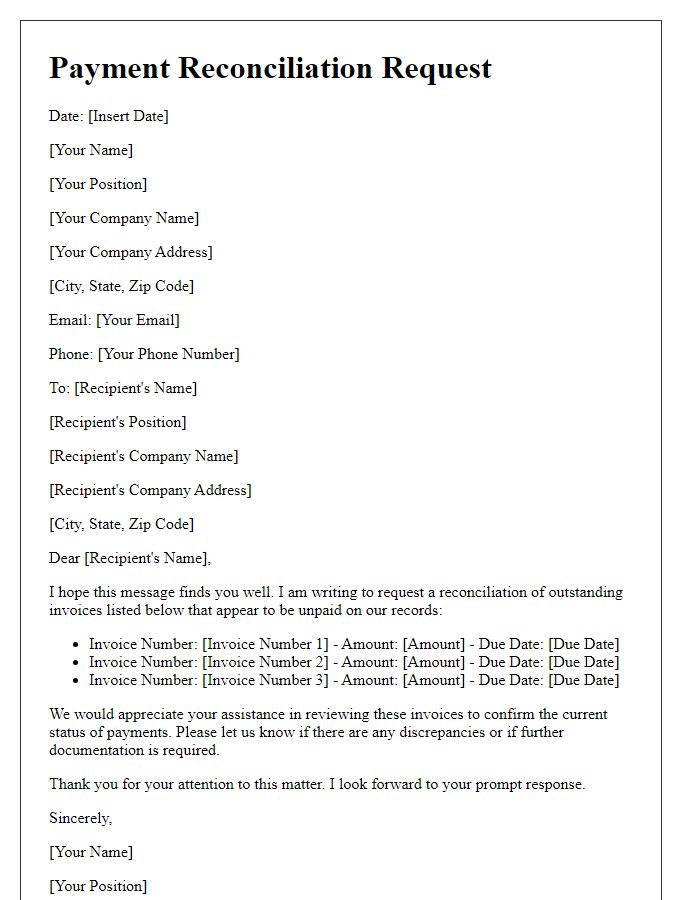

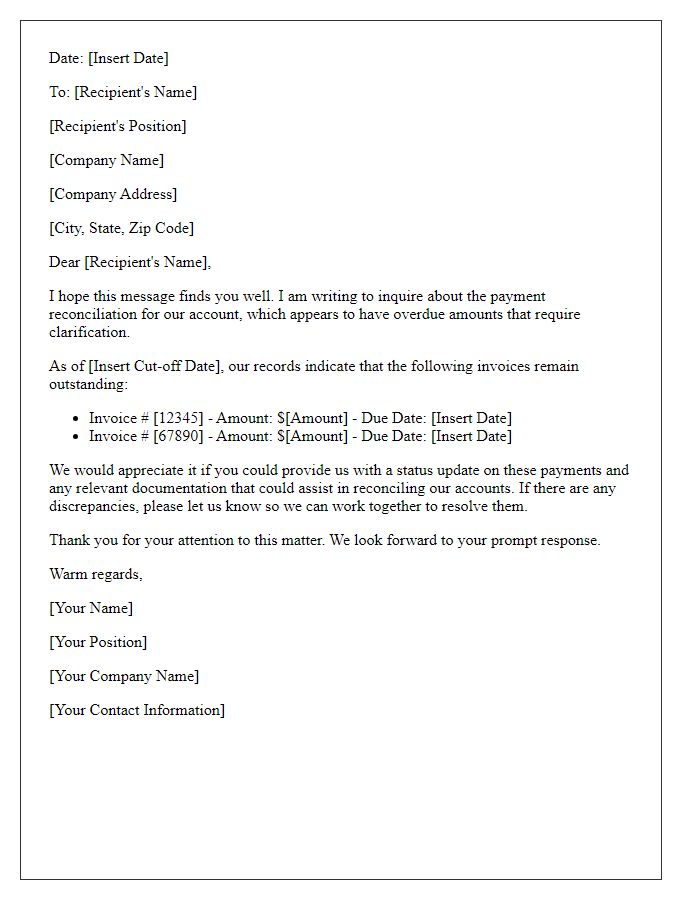

Letter template of payment reconciliation request for outstanding invoices.

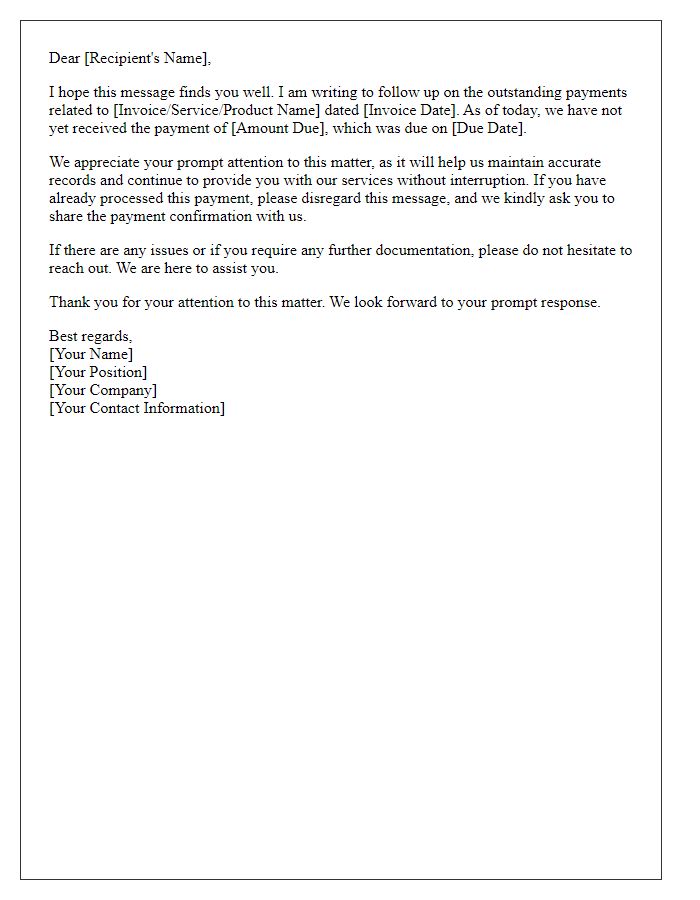

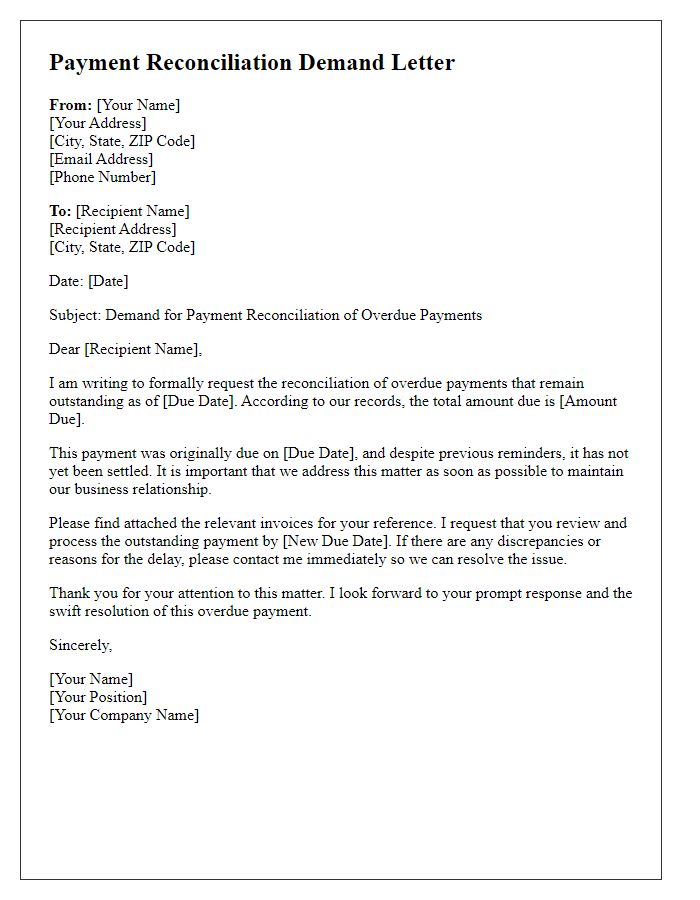

Letter template of payment reconciliation follow-up for unsettled payments.

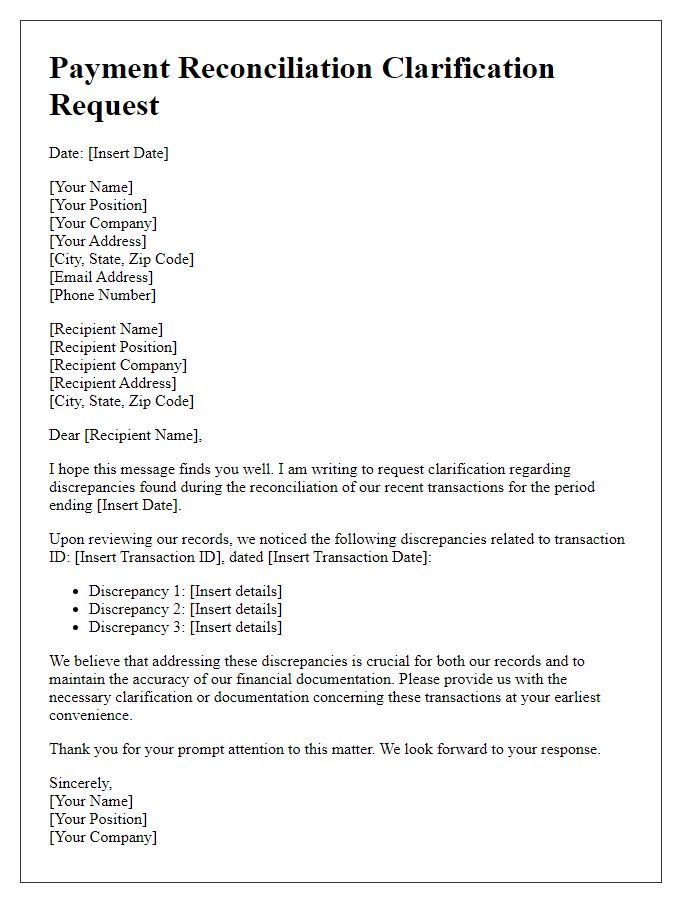

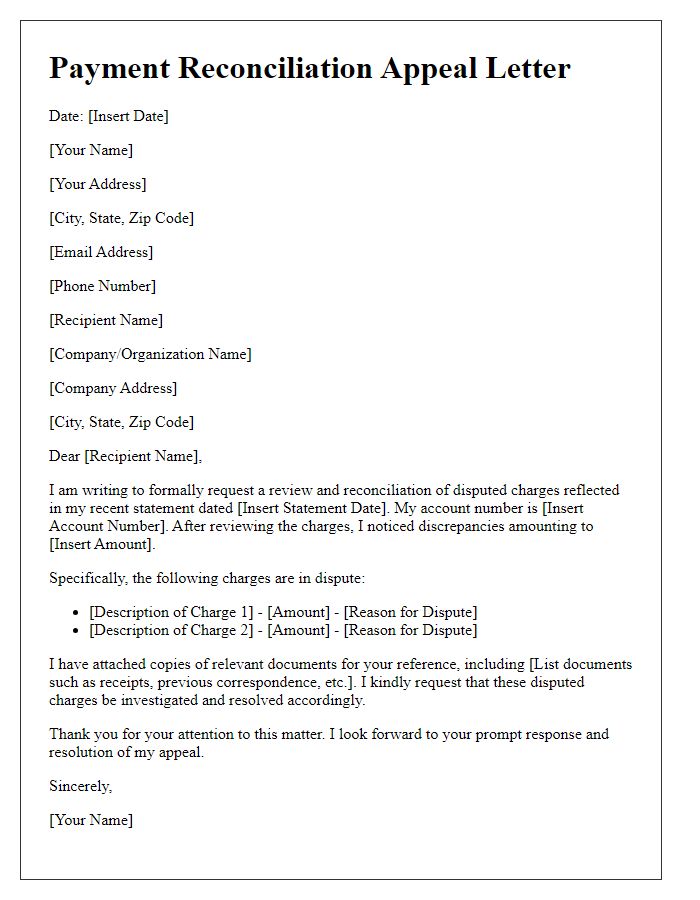

Letter template of payment reconciliation clarification request for transaction discrepancies.

Letter template of payment reconciliation notification for account review.

Letter template of payment reconciliation documentation request for audit purposes.

Letter template of payment reconciliation summary request for account balance.

Letter template of payment reconciliation communication for fiscal year closure.

Comments