Have you ever found yourself juggling multiple invoices and struggling to keep track of payments? It can be a daunting task, but we've got you covered with a simple letter template designed to make summarizing multiple invoices a breeze. This user-friendly format allows you to present all your billing information in a clear and concise way, ensuring nothing slips through the cracks. Curious to learn more about how to streamline your invoicing process? Keep reading!

Clear Header and Company Information

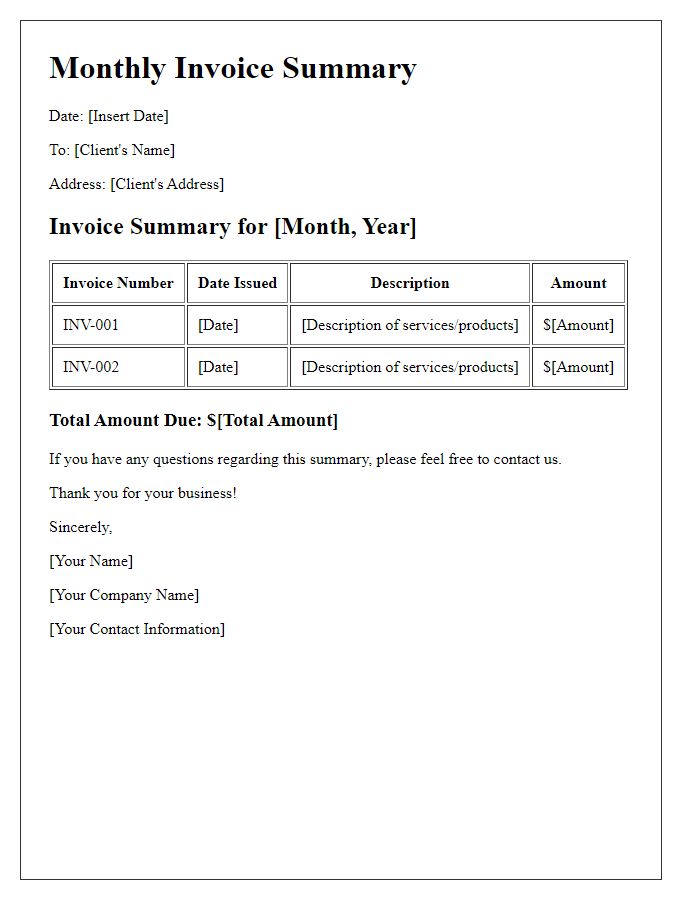

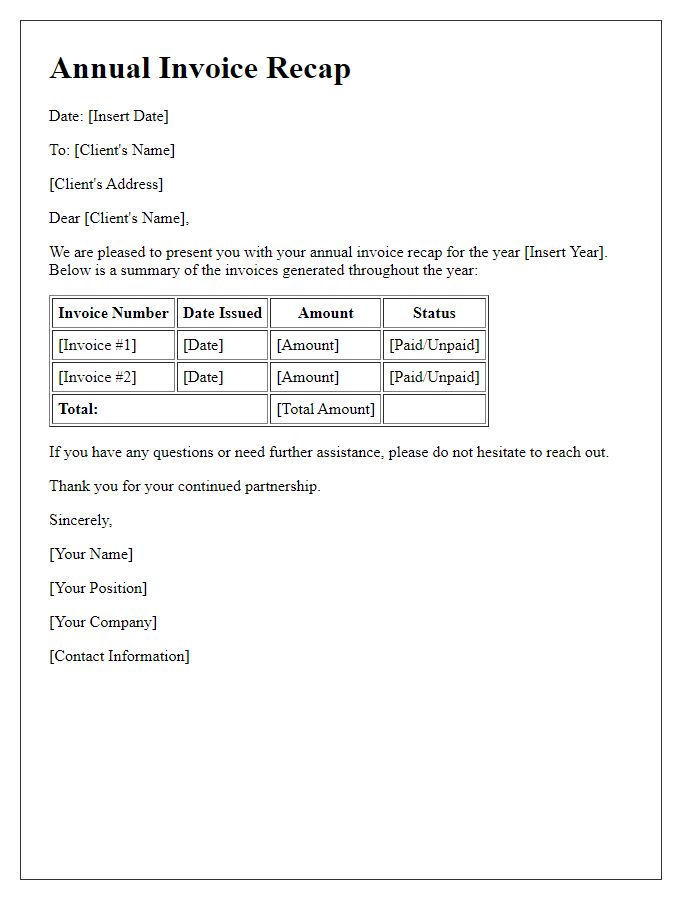

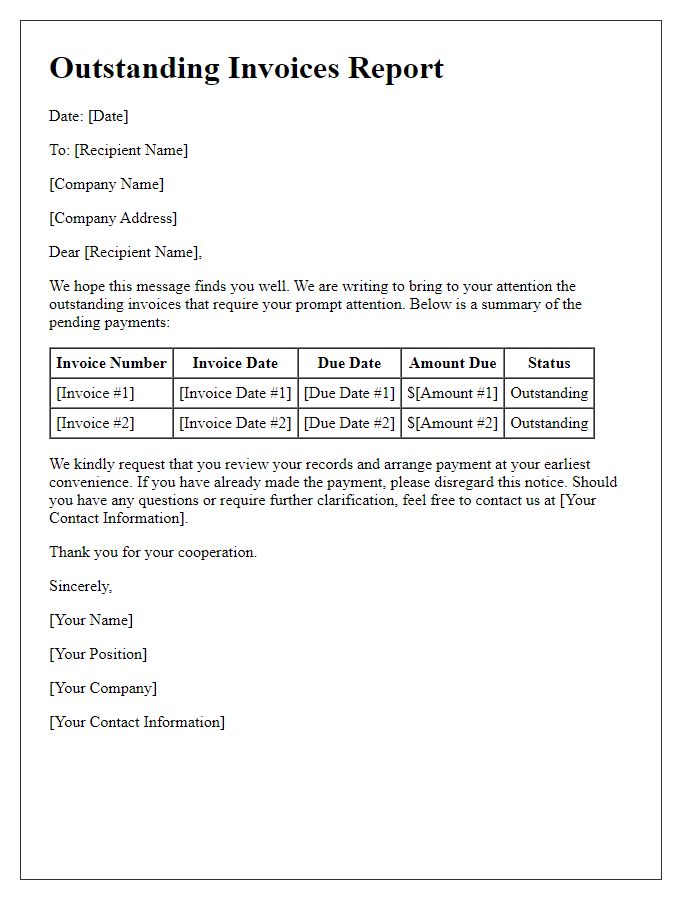

A multiple invoice summary provides a concise overview of various transactions related to a customer or project. The header should prominently display the company name, legal entity details, and contact information, including address and phone number (e.g., 123 Business Rd, Suite 456, City, State, ZIP, +1 (555) 123-4567). Following the header, the summary should present invoice details, such as invoice numbers (e.g., INV-001, INV-002), dates of issue (e.g., October 1, 2023, October 15, 2023), due dates, amounts billed, and status (paid or outstanding). Clear organization of information, potentially using tables or bullet points, enhances readability and simplifies tracking of financial transactions for customers and accounting departments alike.

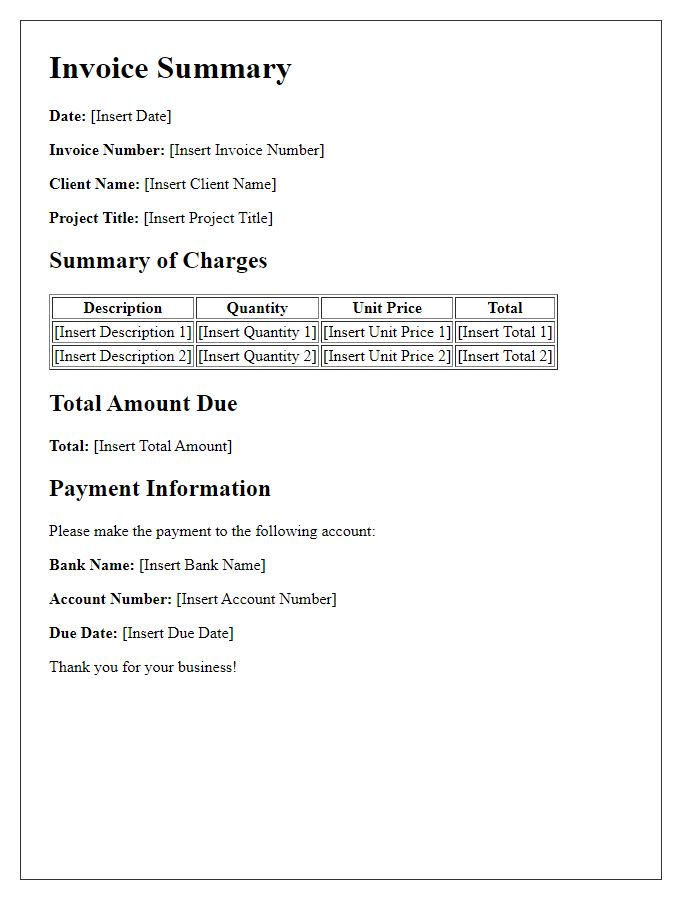

Client Details and Contact Information

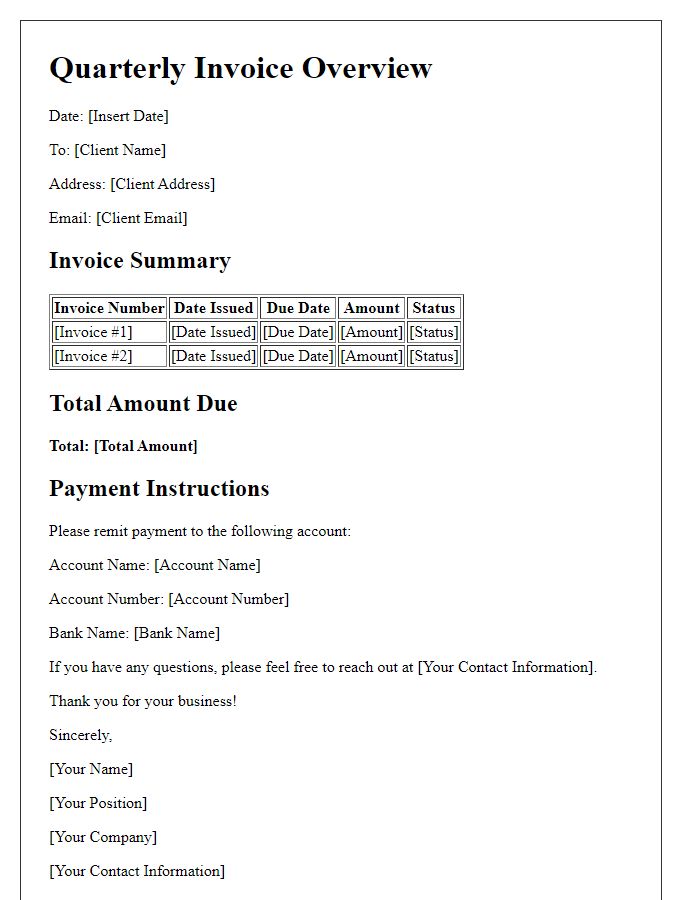

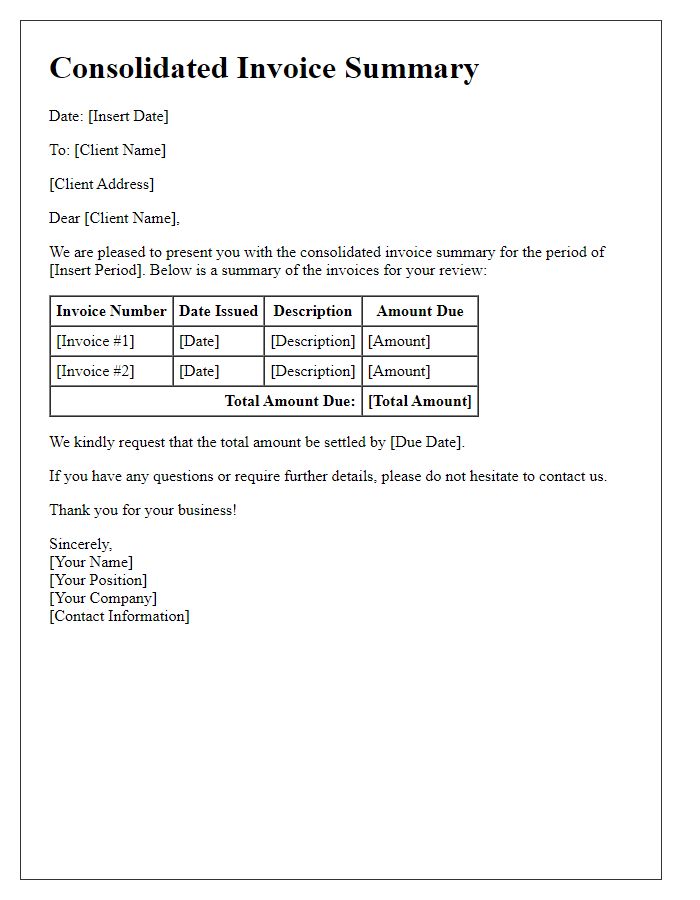

A comprehensive overview of multiple invoices is essential for efficient financial management. The summarized document lists key elements such as invoice numbers, total amounts, due dates, and services rendered for each invoice, allowing for easy reference. Detailed client information, including the business name, contact person, telephone number, email address, and physical address, helps to maintain clear communication channels. Including the date of the summary ensures all parties are aware of the latest updates. Additionally, a breakdown of payment history provides insights into outstanding balances and recent transactions, fostering transparency in client relations.

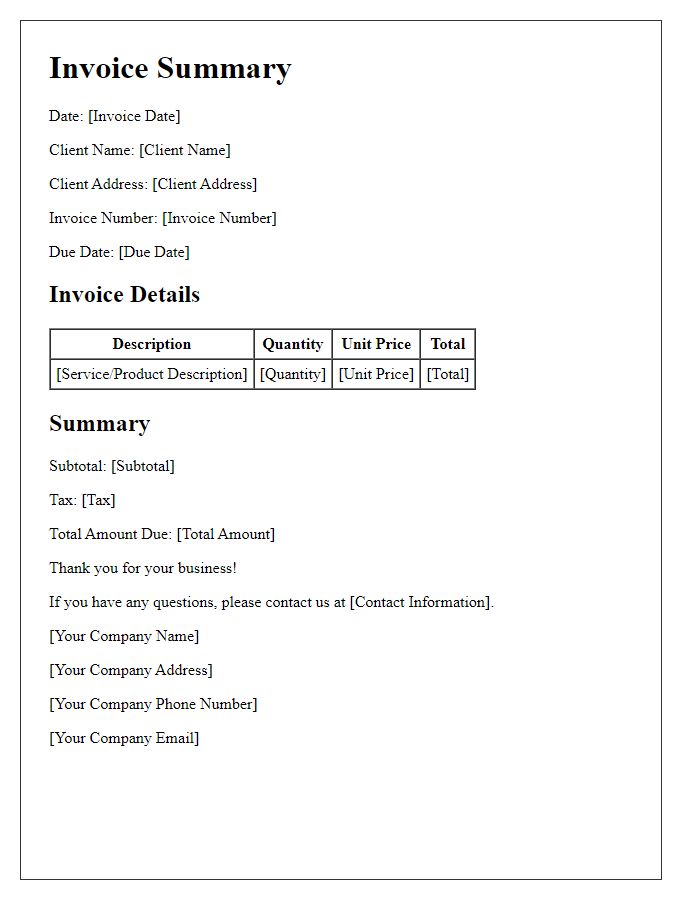

Invoice Summary with Itemized List

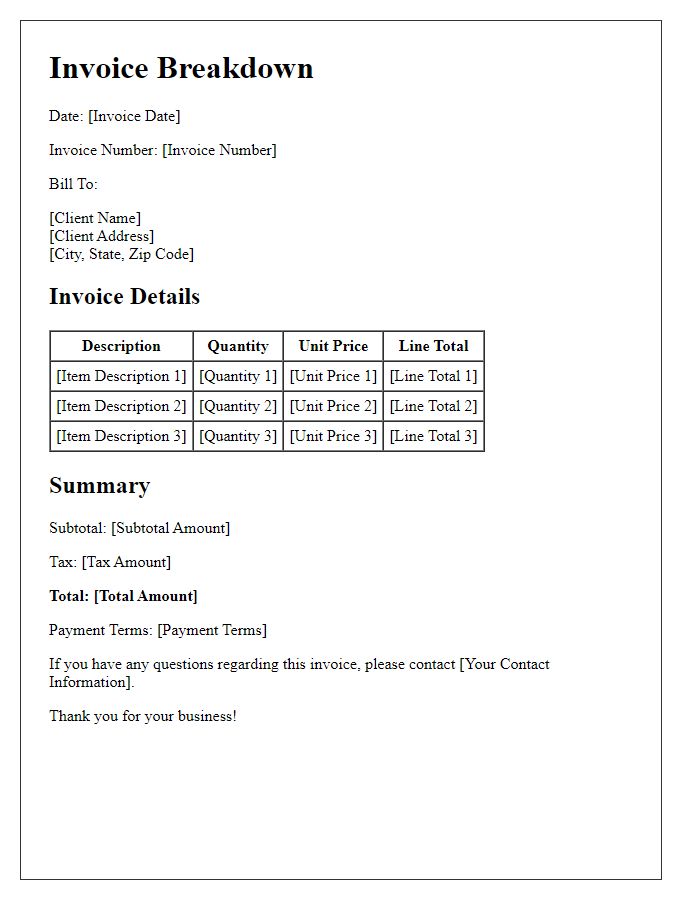

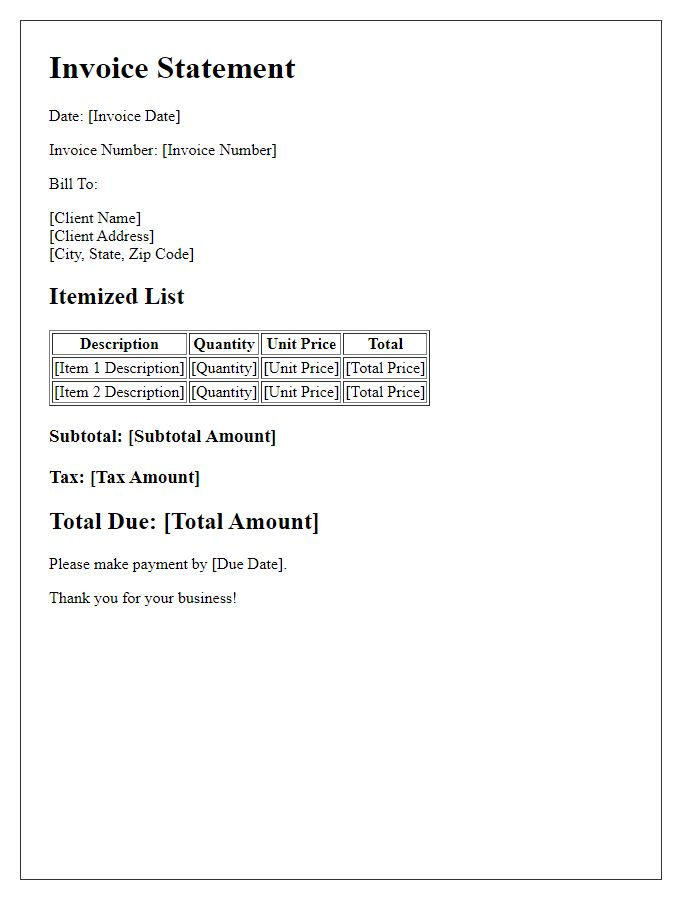

An invoice summary provides a comprehensive overview of the billed items and total amounts due, essential for maintaining financial clarity. Each item listed in the summary includes the item description, quantity, unit price, and total cost, allowing for easy verification of charges. For instance, a summary might detail service fees for consulting, determined by hourly rates, along with product costs such as office supplies, with quantities and item prices clearly outlined. This structured format aids both businesses and clients in understanding the financial transaction, enhancing transparency and accountability in billing processes. Clear identification of invoice numbers and due dates is vital for timely payment and record-keeping purposes.

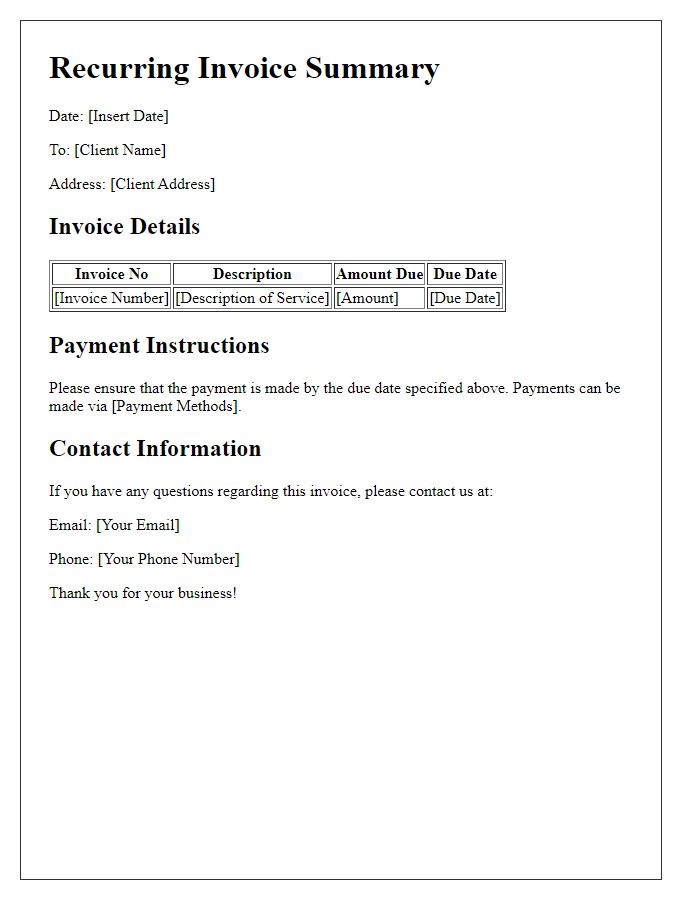

Payment Terms and Deadlines

An overview of payment terms and deadlines is essential for maintaining financial organization. Each invoice outlines specific payment terms, which typically include a net payment period (commonly 30 days from the invoice date) and details regarding early payment discounts, late fees, or penalties for overdue payments. Accurate records must indicate invoice numbers, totals, and due dates, ensuring clarity between both the issuer (such as a business or service provider) and the recipient (such as a client or customer). Additionally, clear communication of accepted payment methods, whether through bank transfer, credit card, or other means, assists in streamlining the payment process and ensuring timely transactions.

Contact Information for Queries and Disputes

In the context of invoicing, accurate contact information is vital for resolving queries and disputes related to billing items. Providing a thorough summary of multiple invoices can streamline communication and enhance clarity for both parties involved. Key details include a focal point of contact, typically the accounts receivable manager or financial officer, including their direct phone number (preferably a local or toll-free line) and email address for prompt responses. Invoking office hours, such as Monday to Friday from 9 AM to 5 PM, can further guide clients on the best times to reach out. Additionally, clearly stating a dispute resolution process enhances understanding and ensures timely resolutions. This outline fosters transparent communication between service providers and clients, promoting a smoother financial transaction experience.

Comments