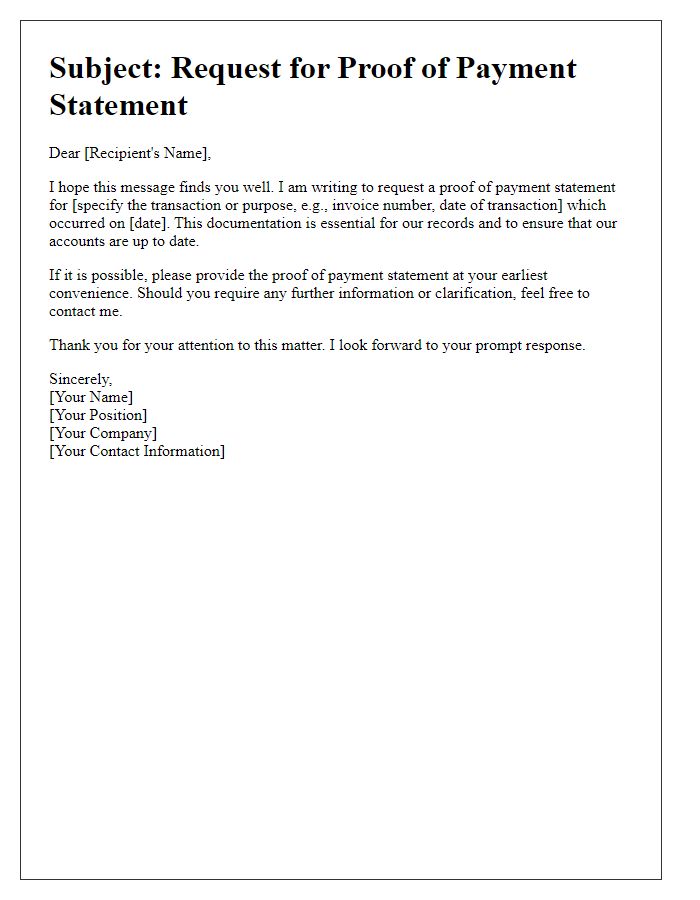

Hey there! We've all been in a situation where we need to confirm a payment, whether for personal records or to keep our finances in check. A well-crafted letter can make all the difference when reaching out for that proof of payment you need. If you're curious about how to effectively request a payment proof copy, stick around to learn some handy tips and templates!

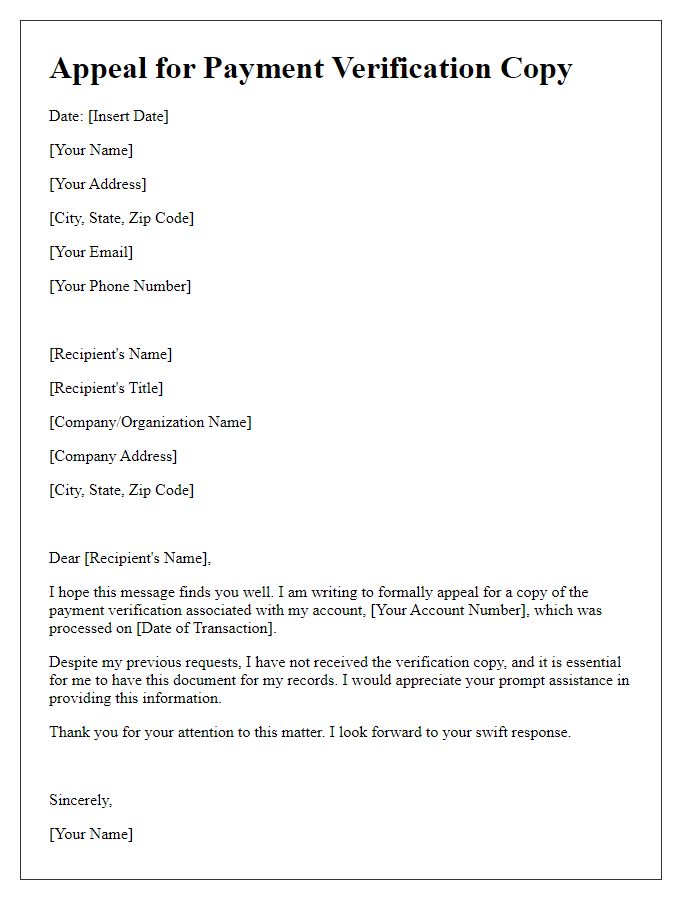

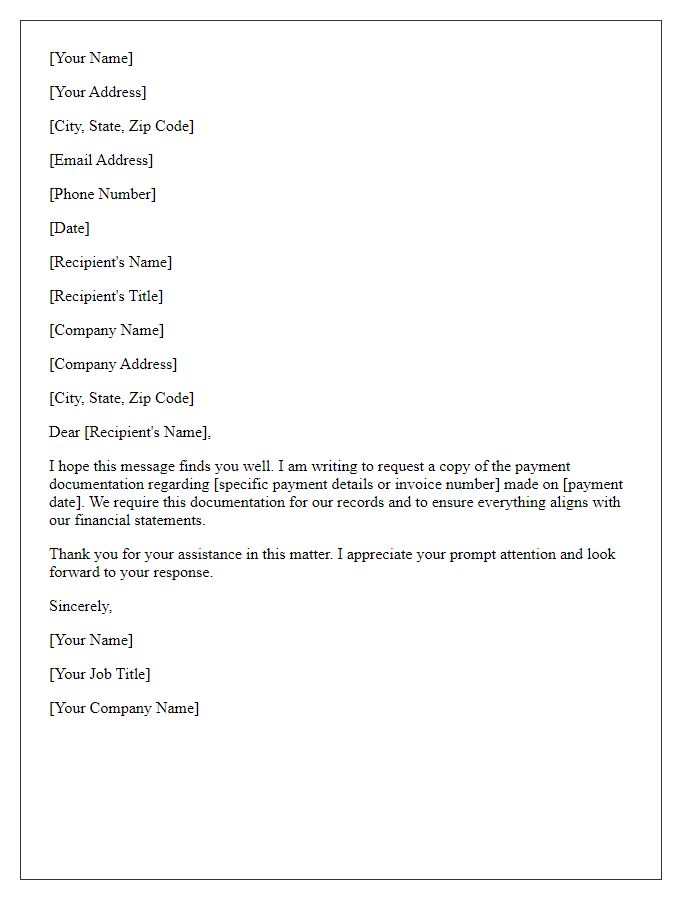

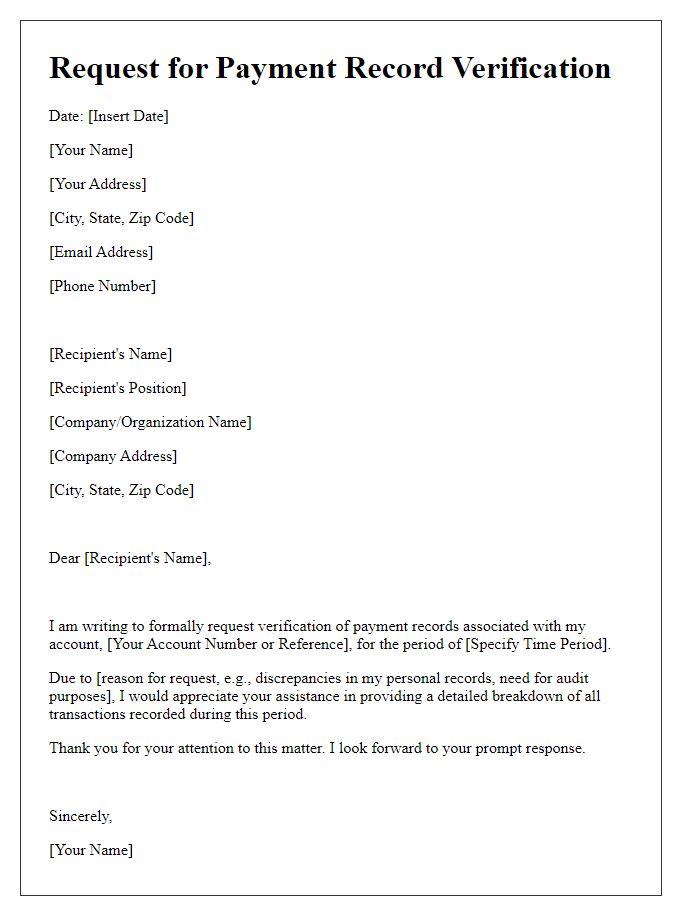

Recipient's full name and address

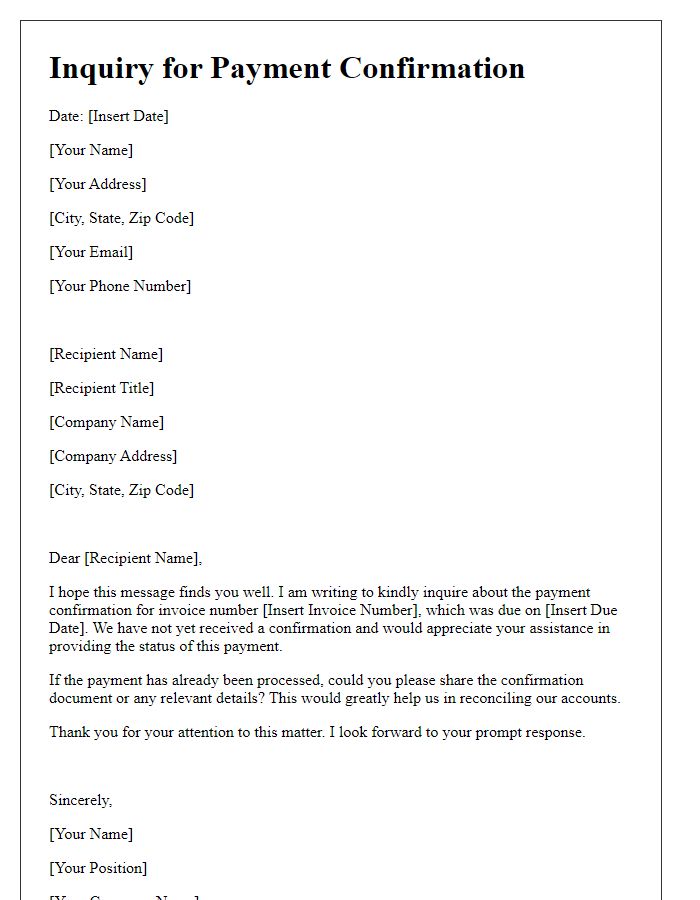

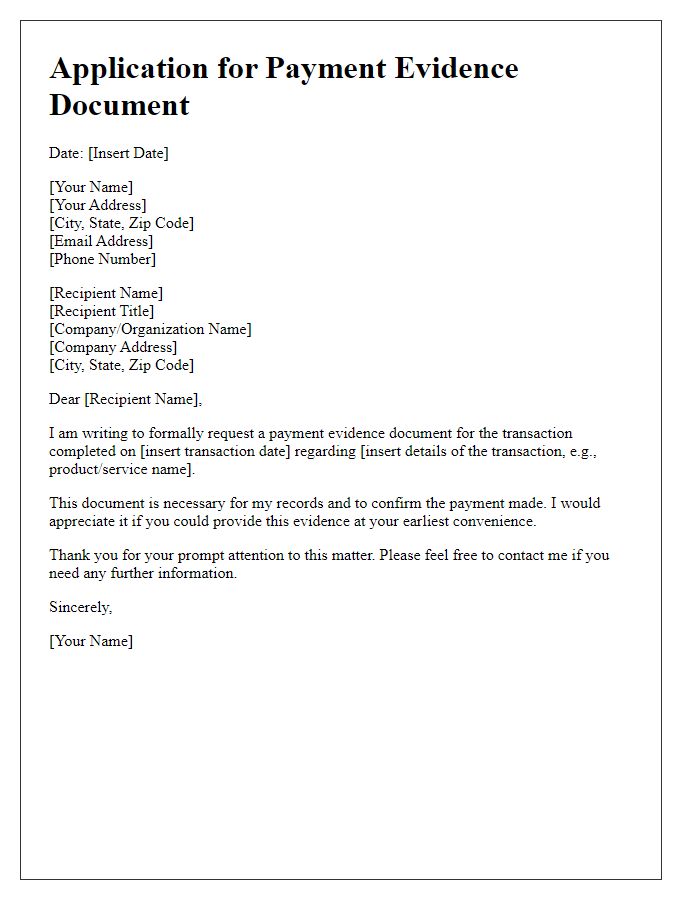

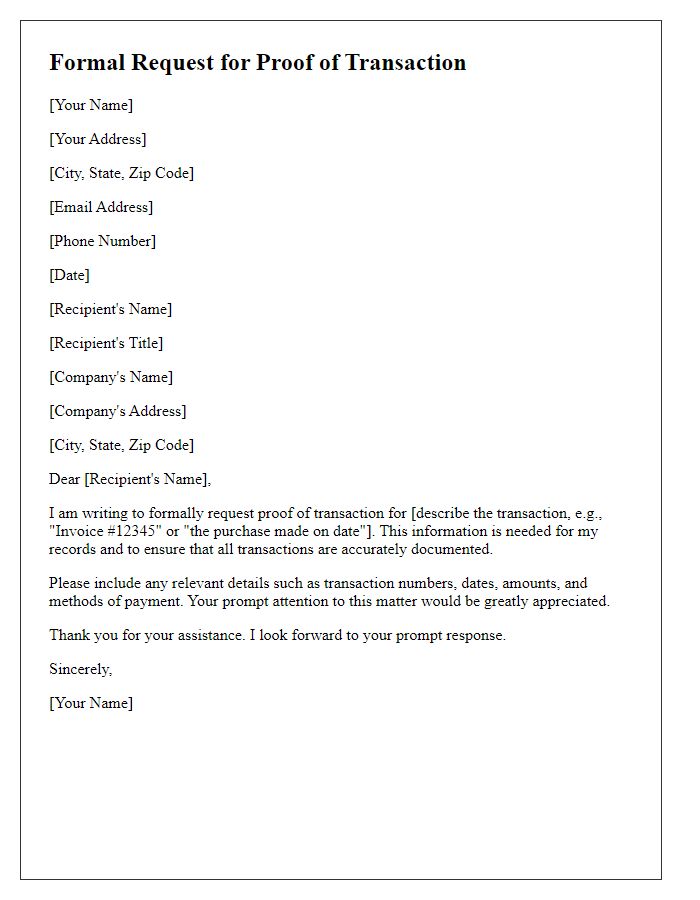

To ensure successful communication, it is essential to request a copy of payment proof, such as receipts, invoices, or transaction confirmations. This documentation serves as essential evidence for any financial transaction, particularly within the realms of business accounts or tax filings. For instance, in a corporate setting like an invoice/payment sent from a business to a partner (e.g., Company XYZ, 123 Business Lane), a proper record of payments can aid in transparency and prevent disputes. Additionally, these records may include details like transaction dates, payment amounts, and payment methods, providing a comprehensive overview of financial exchanges. Requesting such proof ensures clarity and security in financial dealings, especially when significant sums are involved or when auditing may occur.

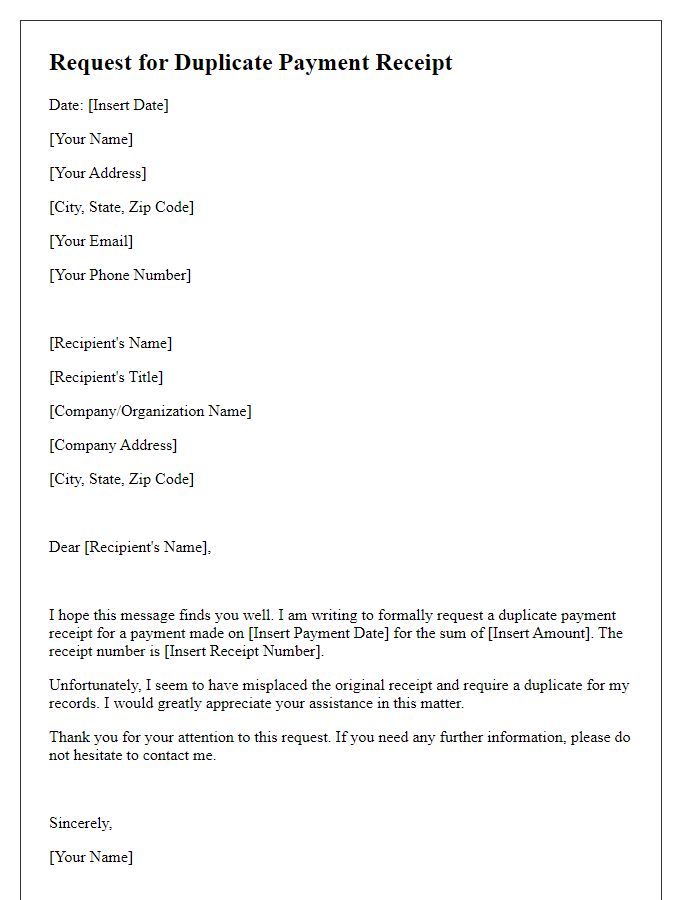

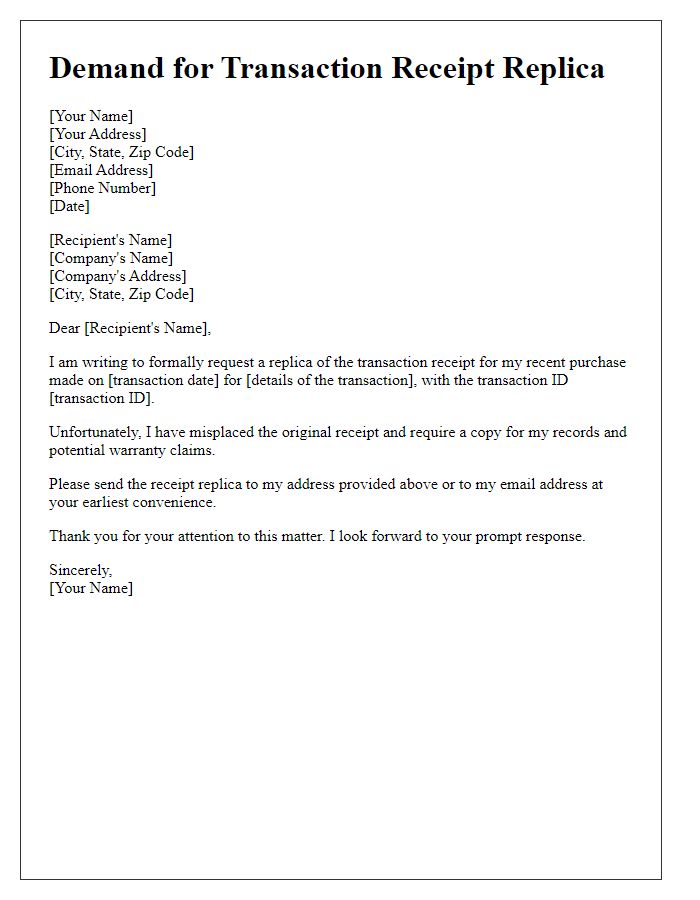

Subject line: Request for Payment Proof Copy

A request for a payment proof copy typically involves details such as date and transaction number for reference. Payment proof, a critical financial document, verifies completion of a monetary transaction, aiding in record-keeping. Businesses often require this document to reconcile accounts. When requesting a payment proof copy, include specifics like payment method, transaction amount, and relevant dates to ensure prompt processing. Clear communication enhances efficiency in obtaining necessary financial documentation, and prevents potential disputes between parties involved in the transaction.

Clear explanation of the request

In the accounting process, requesting payment proof copy is essential for maintaining accurate financial records. Businesses often require documentation such as receipts or bank transfer confirmations to confirm transactions. For instance, a company may seek a payment proof copy from a vendor after a purchase made on March 15, 2023, for office supplies worth $1,200. This proof serves as a verification method for accounting audits and tax-related activities. Any discrepancies in financial statements can lead to complications, hence the importance of obtaining these documents to ensure transparency and accuracy in financial dealings.

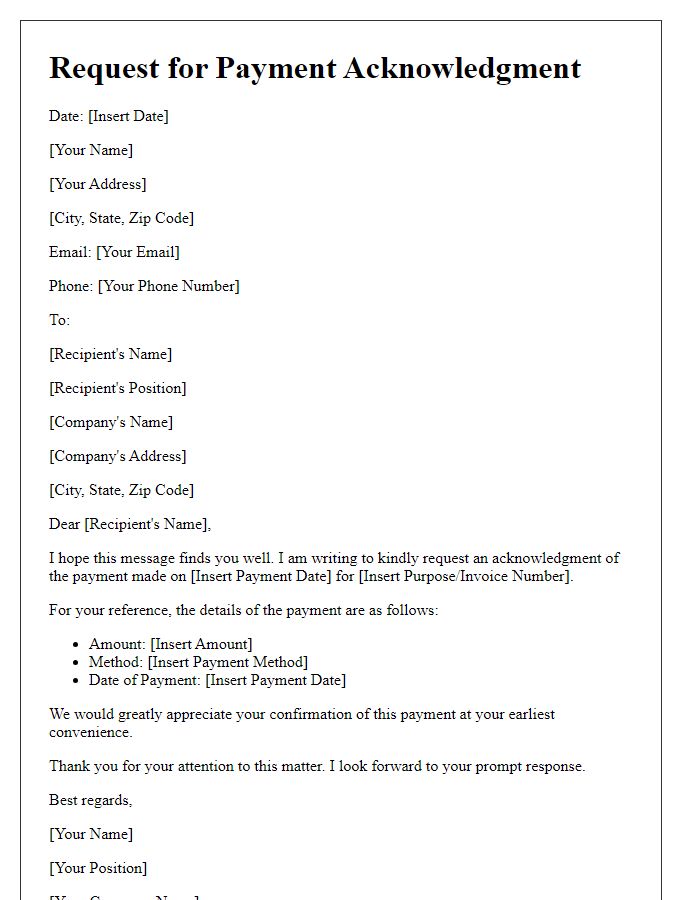

Payment details (amount, date, transaction ID)

The request for a payment proof copy is important for record verification. Payment details must include the total amount (specifying currency, such as USD), the exact date of the transaction (noting any time zones), and the unique transaction ID (which allows for tracking in the payment system). This documentation is useful for reconciliation purposes within financial systems, ensuring all accounts are accurately maintained. Providing these details can expedite the process when contacting institutions like banks or payment processors. Prompt action may lead to faster resolution of any discrepancies that arise.

Contact information for follow-up communication

Requesting a payment proof copy is essential for verifying transaction details. Beneficial for both parties, this document serves as evidence of completed financial exchanges. For instance, payments processed via online platforms like PayPal or bank transfers should include unique identifiers such as transaction numbers. This aids in tracking and ensures clarity in financial records. Always include your contact information, such as email addresses or phone numbers, for follow-up communication regarding the request. This facilitates a smooth resolution and provides an avenue for clarification of any discrepancies or additional inquiries related to the payment.

Comments