Hey there! We all know that managing invoices can sometimes slip through the cracks, and that's totally understandable. If you've recently found yourself in the position of needing a gentle nudge to remind someone about an overdue invoice, you're in the right place. Stick around as we explore a friendly yet effective template to help you smoothly communicate with your clients and get back on track!

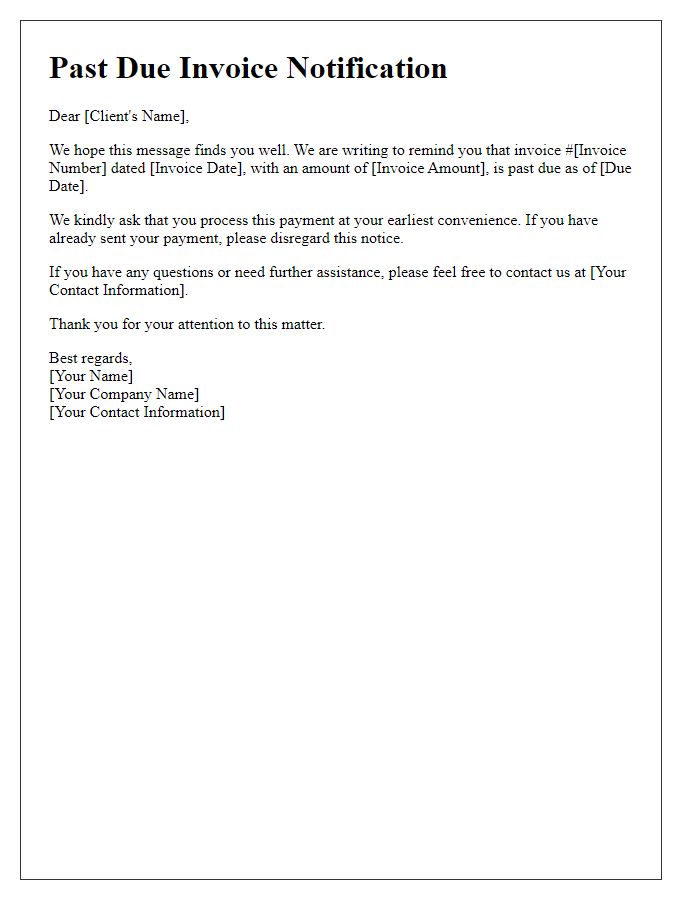

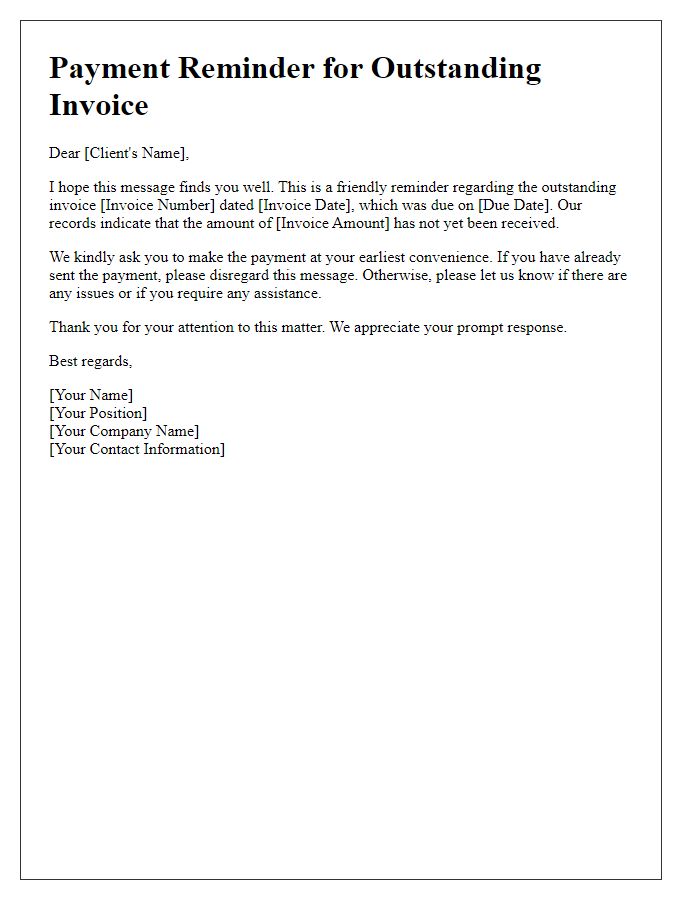

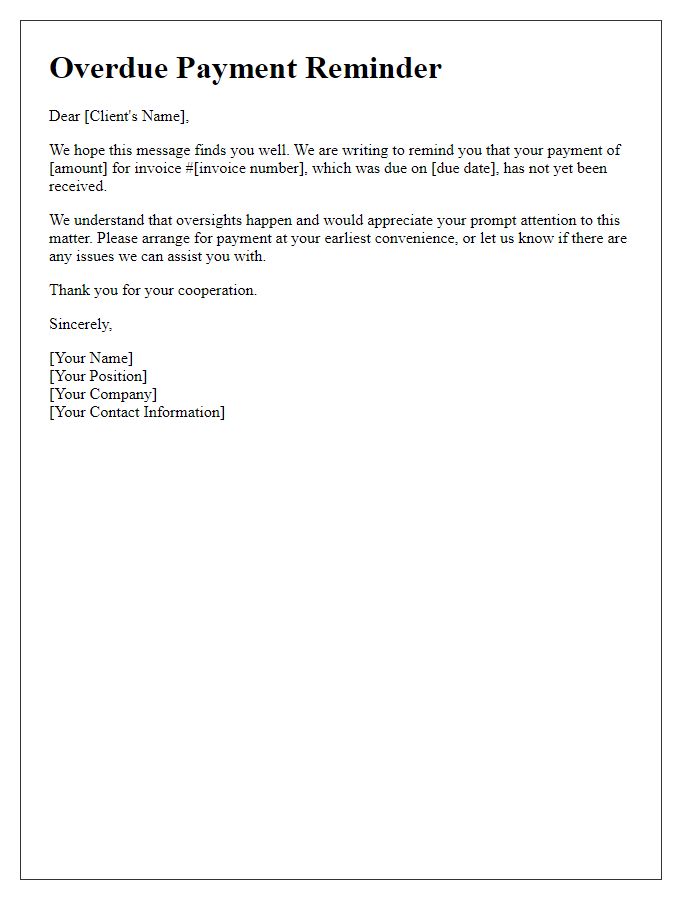

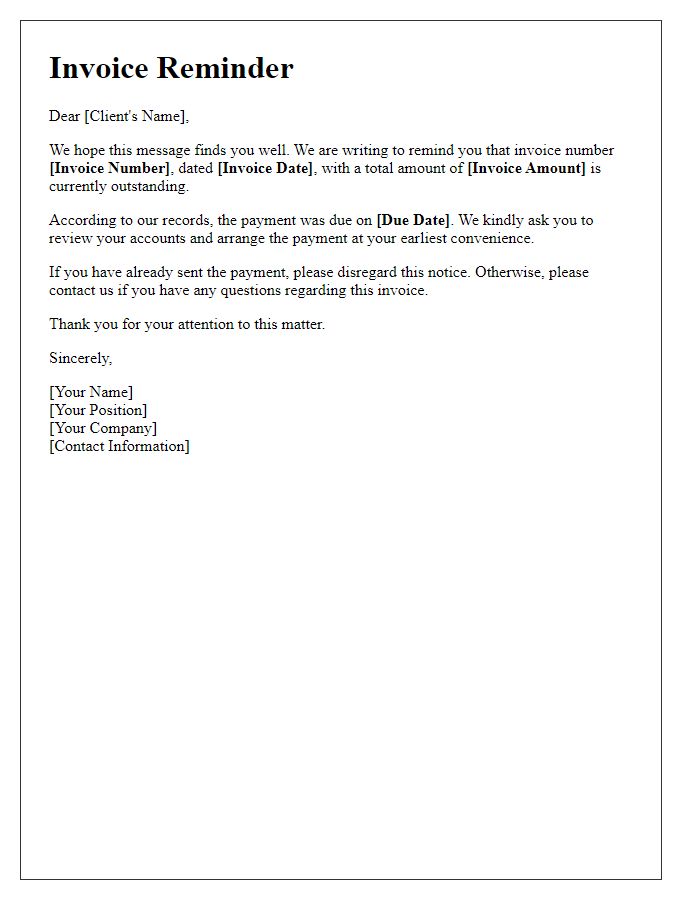

Polite and professional tone

An overdue invoice can disrupt cash flow and hinder financial stability for businesses. Maintaining a polite and professional tone in reminders is crucial for preserving relationships with clients while ensuring timely payments. For instance, a reminder sent 30 days after the due date can highlight the original due date and the outstanding amount, fostering transparency. It is advisable to reference the specific invoice number, along with a clear statement of the payment terms outlined in the agreement. Reinforcing the value of the services rendered can also encourage prompt payment, especially in industries like construction, where prompt cash flow is vital for ongoing projects. This approach not only serves as a reminder but also strengthens client rapport.

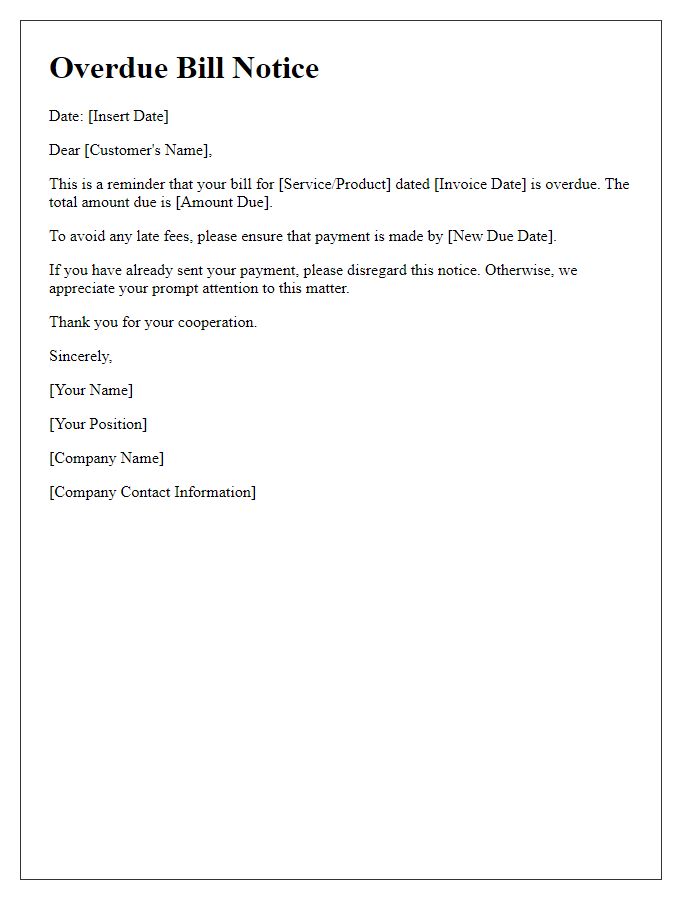

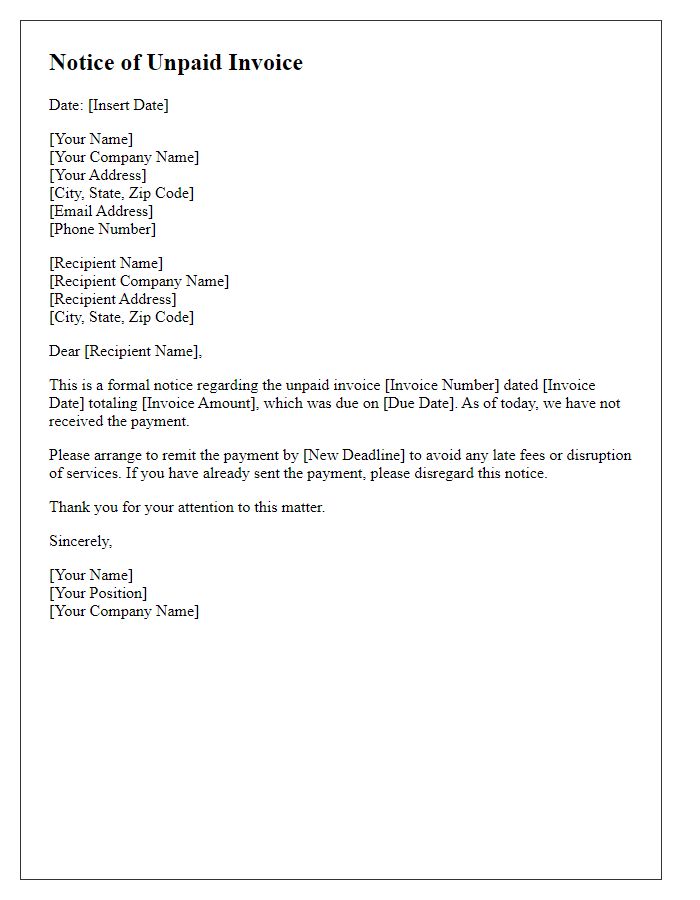

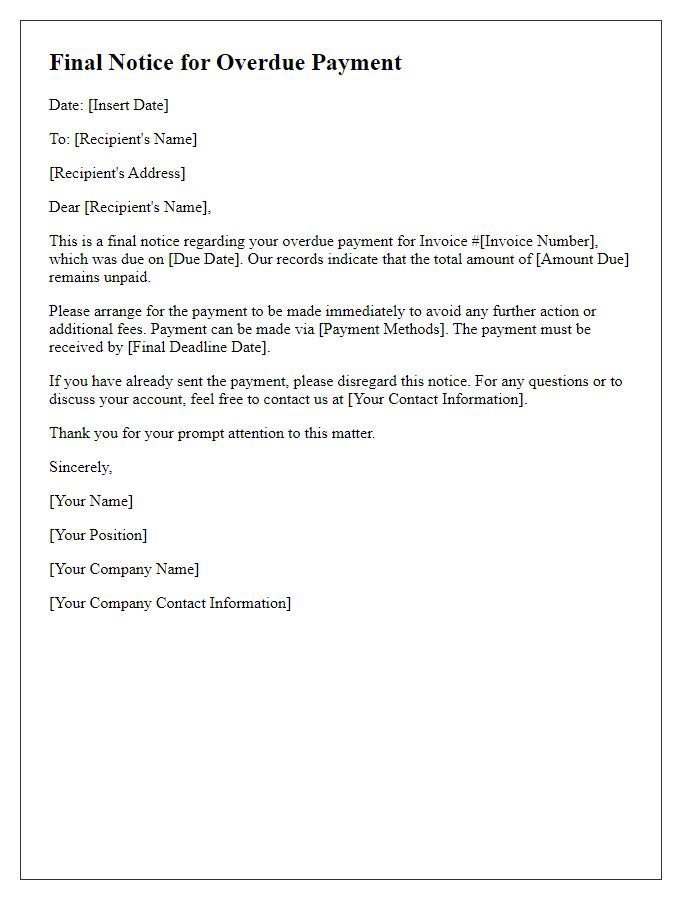

Clear mention of overdue amount and due date

Outstanding invoices can significantly impact cash flow for businesses, often leading to financial strain. An overdue amount of $1,500, with a due date of September 30, 2023, may require immediate attention to avoid late fees or disruptions in service. Regular reminders about overdue invoices help maintain positive relationships between vendors and clients, ensuring timely payments. A structured approach, detailing the overdue amount alongside clear due dates, can enhance communication and prompt repayment while minimizing confusion or disputes regarding outstanding payments. Implementing such reminders can foster better financial management practices, benefiting both parties involved.

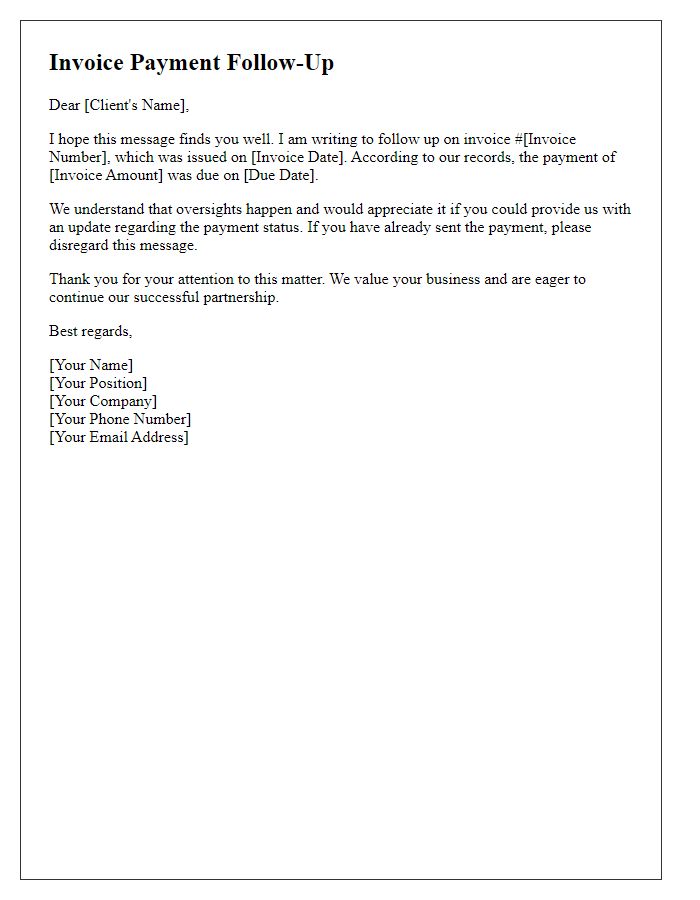

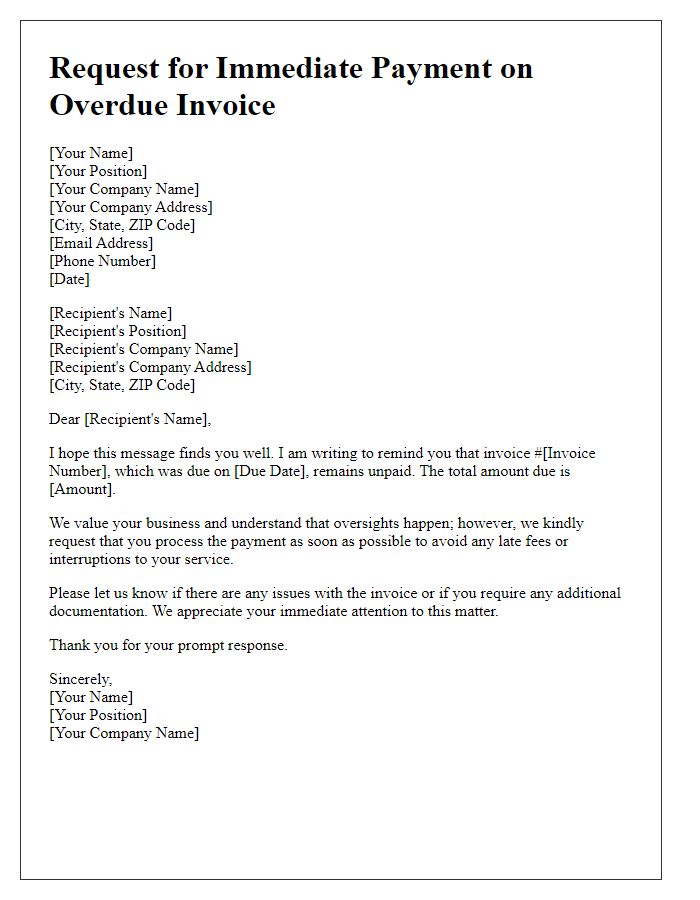

Invoice details, including reference numbers

An overdue invoice reminder should contain specific details such as the invoice number (for example, INV-12345), the due date (for instance, October 15, 2023), and the total amount due ($500). Additionally, it should mention payment terms agreed upon (30 days net). Including a brief description of services rendered, like web development services from Company XYZ, can help clarify the context. Contact information for addressing queries, including the accounts department's email (accounts@companyxyz.com), should also be provided to facilitate communication.

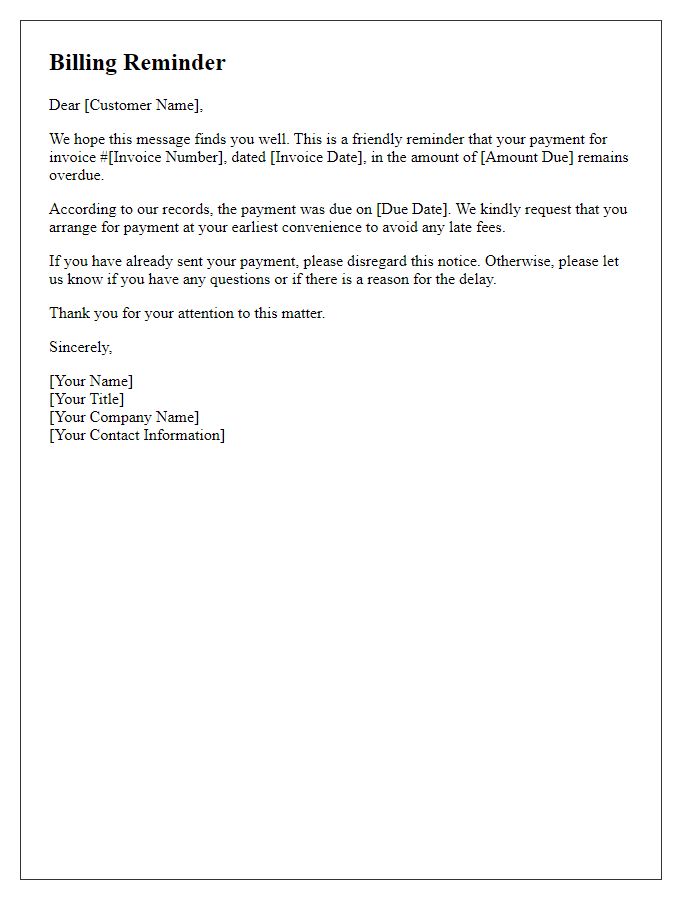

Payment options and instructions

Overdue invoices can disrupt cash flow for businesses, especially small enterprises. It is essential to remind clients promptly about payments due (usually within 30 days) to maintain financial stability. Payment options typically include credit card transactions, bank transfers, or online payment platforms such as PayPal. Clear instructions should accompany reminders, detailing how to access payment portals, the necessary banking details, or the payment services required. Highlight the importance of timely payments to avoid late fees (often 1.5% monthly) or service interruptions, ensuring clients remain informed about their account status and obligations.

Contact information for support or queries

Businesses often experience challenges with overdue invoices, impacting cash flow and operational efficiency. Overdue invoices, typically defined as payments not received within 30 days of the due date, can lead to misunderstandings between service providers and clients. Clear communication is essential for resolving these issues. Providing contact information for support or queries, such as a designated email address or phone number, allows customers to address concerns promptly. In addition, establishing a timeline for payment follow-ups can enhance the collections process, making it smoother for both parties involved. Utilizing polite yet firm language in reminder communications can foster positive client relationships while emphasizing the importance of timely payments.

Comments