Are you looking to navigate the exciting world of technology venture investment? Whether you're a seasoned investor or a newcomer eager to learn, understanding the nuances of this dynamic field is essential. With innovations emerging daily, now is the perfect time to explore the opportunities that lie ahead. Join us as we delve deeper into the essentials of technology venture investment and discover strategies to enhance your portfolio!

Executive Summary

A technology venture investment executive summary provides a concise overview of the business opportunity, outlining critical aspects such as market potential, innovative product features, team expertise, and financial projections. This summary highlights the unique selling proposition of the technology, emphasizing its scalability and competitive advantage within the industry. Key metrics include projected revenue growth rates, market share objectives, and key performance indicators (KPIs) essential for measuring success. The target market, exemplified by statistics from industry reports (e.g., projected to reach $500 billion globally by 2025), supports the investment rationale. The investment ask, detailing funding requirements and intended use of funds, sets the stage for potential investors to understand the financial backing needed for launch and expansion phases.

Market Opportunity

The technology sector presents a significant market opportunity, particularly within emerging fields like artificial intelligence (AI), cloud computing, and blockchain. In 2023, the global AI market is projected to reach approximately $190 billion, driven by advancements in machine learning and natural language processing. The cloud computing market, estimated to grow from $368 billion in 2022, is anticipated to exceed $832 billion by 2025, showcasing a compound annual growth rate (CAGR) of 17.5%. Blockchain technology, extending beyond cryptocurrencies, has garnered attention for its applications in supply chain management and secure transactions, with investment projections reaching $57 billion by 2025. These trends are underpinned by increasing digital transformation across industries, where businesses are integrating technology to enhance efficiency and customer experiences. Major tech hubs such as Silicon Valley and Beijing are nurturing innovation, fostering startups that are poised to capture a considerable share of these expanding markets.

Solution and Technology

Innovative technology solutions are transforming industries such as healthcare and finance, emphasizing data-driven approaches. Advanced algorithms, powered by machine learning, analyze vast datasets to improve decision-making and operational efficiency. For instance, telemedicine platforms support remote patient monitoring, enabling healthcare access for millions globally, especially in underserved regions. Blockchain technology enhances security and transparency in financial transactions, with specific applications such as smart contracts simplifying agreement processes. This sector also witnesses the rise of artificial intelligence, automating customer service through chatbots, improving user experience dramatically. These technological advancements present overwhelming opportunities for venture investment, fostering growth and revolutionizing traditional practices.

Business Model

The business model for a technology venture encompasses a systematic approach to generating revenue while delivering value through innovative products. Key components include target market segmentation, which identifies specific user demographics ranging from millennials to corporate clients, and revenue streams such as subscription-based services (for example, SaaS in cloud computing) and one-time sales in hardware. Cost structures outline fixed expenses, including research and development costs, as well as variable expenses related to customer service. The distribution channels, such as e-commerce platforms like Amazon and direct sales through tech expos, play a crucial role in reaching customers. Competitive differentiation relies heavily on unique selling propositions, such as superior user experience or advanced technology integrations. Strategic partnerships, like collaborations with software firms or telecom providers, further enhance market reach and operational efficiency. Continuous adaptability to emerging trends, such as artificial intelligence and blockchain technology, ensures sustained relevance and growth in a dynamic tech landscape.

Financial Projections

Financial projections serve as a crucial roadmap for technology ventures, outlining expected revenue, expenses, and profitability over a specified period, typically three to five years. These projections include key metrics such as projected earnings before interest, taxes, depreciation, and amortization (EBITDA), gross margin percentages, and net profit margins, offering insights into the venture's financial health. Strategic assumptions are integral, reflecting market trends, competitive landscapes, and potential customer acquisition rates within the technology sector. Each year's financial forecast is often broken down by quarter, providing detailed visibility into expected cash flow, working capital requirements, and necessary funding rounds. Furthermore, sensitivity analyses are performed to assess potential risks associated with varying operational scenarios, enhancing the venture's resilience against market fluctuations, especially in rapidly evolving technology markets like artificial intelligence and cloud computing.

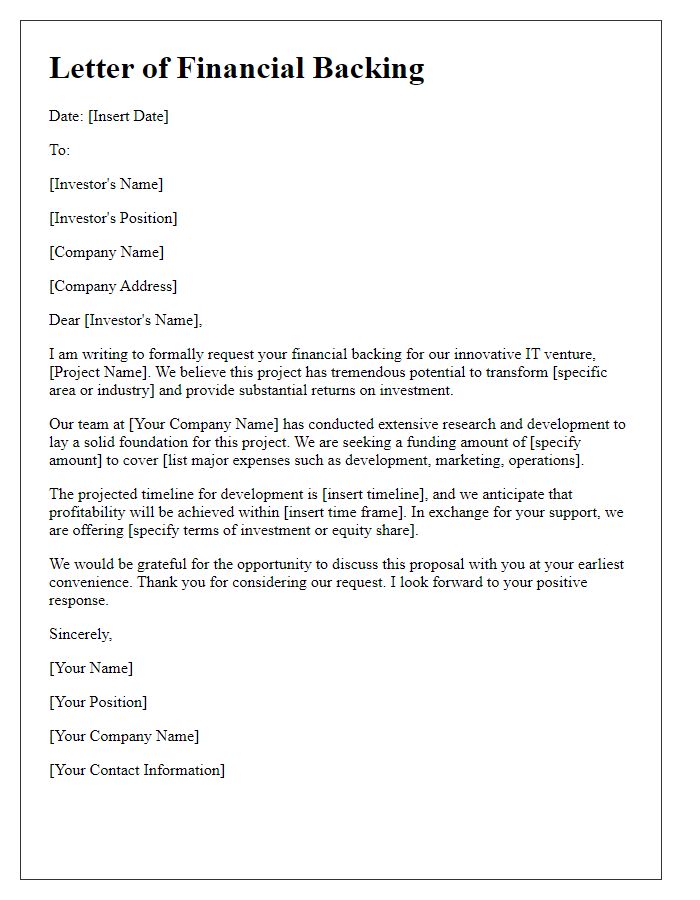

Letter Template For Technology Venture Investment Samples

Letter template of invitation to discuss technology investment opportunities

Comments