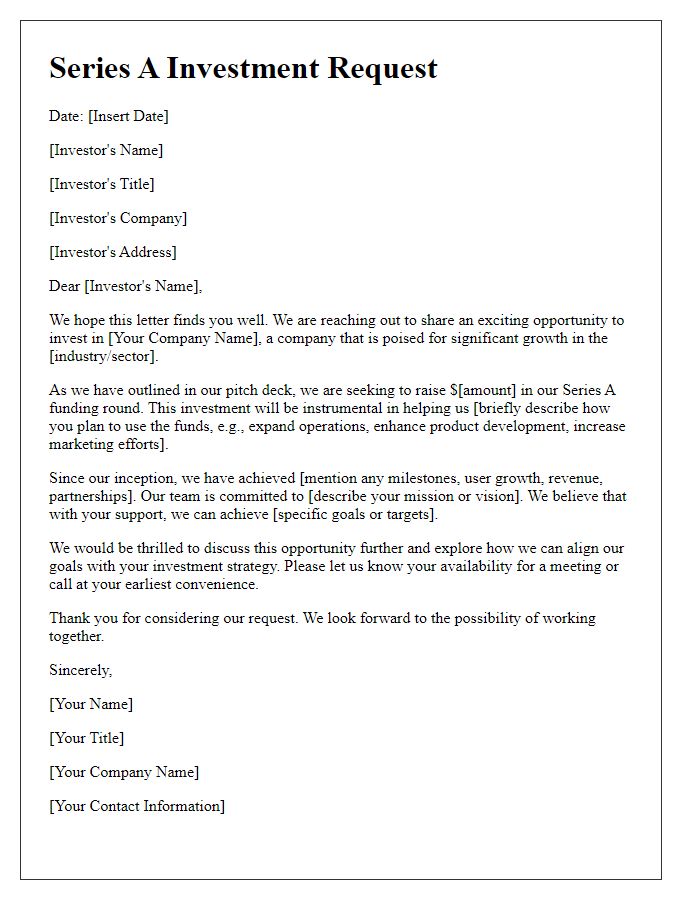

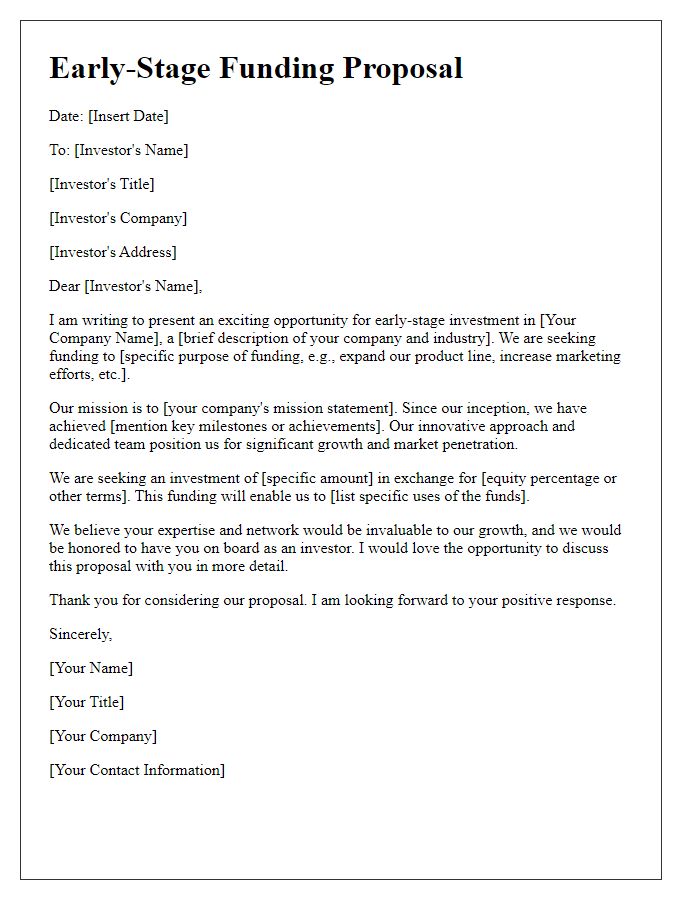

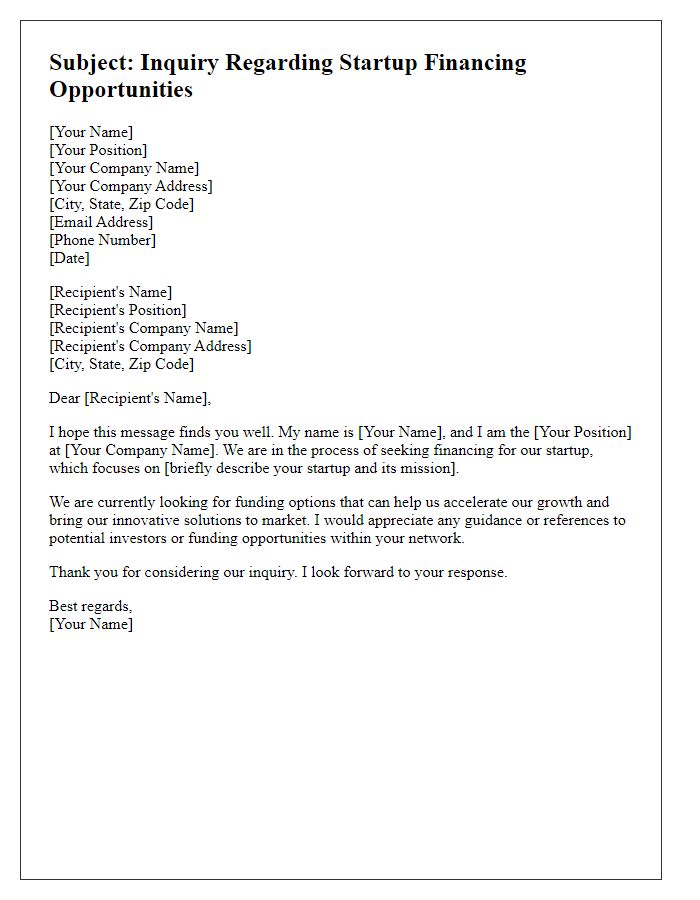

Are you ready to take your startup to the next level? Crafting a compelling letter for Series A funding can be the key to unlocking significant investment opportunities. In this article, we'll share a concise and effective letter template that will not only highlight your business's potential but also resonate with potential investors. So, let's dive in and help you create a winning proposal!

Executive Summary

A Series A funding proposal aims to secure investment for the growth phase of a startup or business. This stage typically occurs after a successful seed round, where initial capital is raised for product development and market entry. Specifically, a Series A round focuses on scaling the business model, enhancing customer acquisition strategies, and expanding the team. Investors are presented with detailed insights into the company's market traction, revenue model, and future projections. Key metrics include user engagement, customer retention rates, and revenue growth percentages, which are crucial for demonstrating potential return on investment. The summary should also highlight the competitive landscape, identifying key players in the industry and the startup's unique value proposition. Understanding passive and active fundraising methods, market conditions, and investor sentiment is critical in crafting a compelling pitch to capture attention and ensure successful fundraising outcomes.

Market Opportunity

The global electric vehicle (EV) market, projected to reach $802.81 billion by 2027, presents a significant opportunity for innovative companies. Growth rates are expected to accelerate, with a compound annual growth rate (CAGR) of 22.6% from 2020 to 2027. Urban centers like San Francisco and Amsterdam are leading the charge towards sustainable transportation, with initiatives aimed at reducing carbon emissions by 30% within the next decade. Consumers increasingly prioritize eco-friendly alternatives, with surveys indicating that over 50% of potential car buyers express interest in electric options. The transition aligns with supportive governmental policies, including incentives and subsidies targeting clean energy solutions. These factors create a fertile landscape for investment and innovation in the EV sector, making Series A funding crucial for businesses poised to capitalize on this booming market.

Revenue Model

A well-structured revenue model is critical for startups seeking Series A funding, demonstrating how the business generates income. The model often includes diverse streams such as subscription fees, which can average around $10 to $50 per user monthly, depending on the industry, product sales with margins of 50% to 70% for software applications, and transaction fees averaging between 2% to 5% for marketplace platforms. Companies can also leverage advertising revenue, with online platforms earning around $3 to $10 per 1,000 impressions, alongside affiliate marketing partnerships that provide commissions averaging 5% to 30% of sales referred to third-party vendors. Predictable revenue generation is essential for establishing traction, as noted in investor surveys indicating startups achieving a minimum of $1 million in ARR (Annual Recurring Revenue) are significantly more likely to secure funding. Accurate financial forecasting, based on current growth rates and market analysis, should accompany the revenue model to illustrate scalability and long-term sustainability, showcasing the potential for originations and customer retention strategies in a competitive landscape.

Competitive Analysis

In the competitive landscape of mobile payment solutions, various players such as Square, PayPal, and Stripe lead with innovative platforms that cater to both small businesses and large enterprises. Square's unique point-of-sale systems dominate retail markets, while PayPal offers vast user familiarity with its digital wallet service. Stripe, serving over 120 countries, excels in e-commerce integration with its advanced APIs and fraud prevention features. Market analysis highlights that in 2022, the global mobile payment market reached approximately $1 trillion and is projected to grow at a CAGR of 23.8% through 2028, indicating a rapidly expanding user base. Strategic positioning in this segment requires a clear differentiation through features such as user experience, security measures, and transaction fees, which can significantly influence customer acquisition and retention rates. Furthermore, emerging technologies like blockchain and biometric authentication present new challenges and opportunities, emphasizing the need for continuous innovation in service offerings.

Financial Projections

Financial projections are critical for understanding the potential growth and viability of a startup. For instance, a technology company focused on SaaS solutions might forecast revenues of $1 million in year one, escalating to $5 million by year three as it captures a larger market share. Key metrics include customer acquisition cost (CAC) projected at $200, with a lifetime value (LTV) of $1,200 per user. Operating expenses could rise from $500,000 in year one to $2 million by year three, primarily driven by increased marketing efforts and talent acquisition. Profit margins are expected to improve over time, moving from 20% in year one to 40% in year three, reflecting operational efficiencies achieved through scaling. Financial forecasting software, like QuickBooks or Excel, will ensure accurate tracking and can provide pivot tables for scenario analysis. Furthermore, significant funding milestones may include reaching break-even within 24 months, thereby attracting interest from venture capitalists looking for sustainable growth opportunities.

Comments