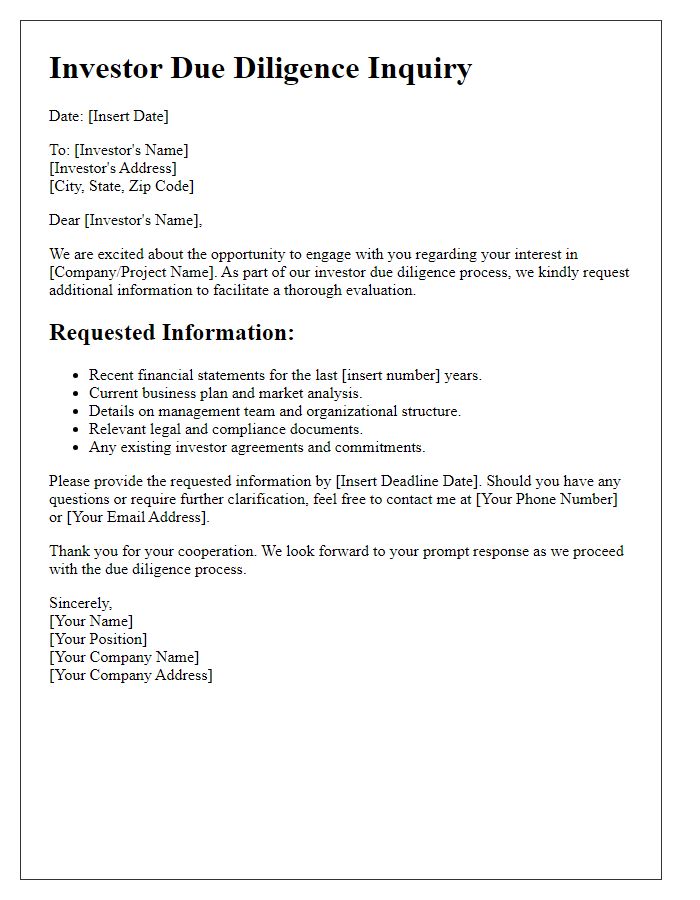

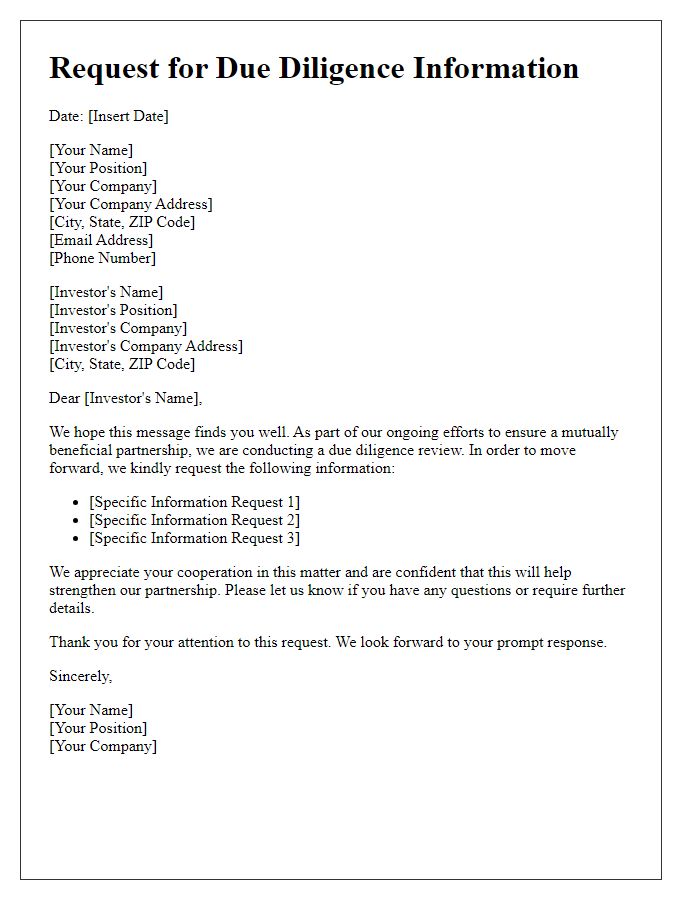

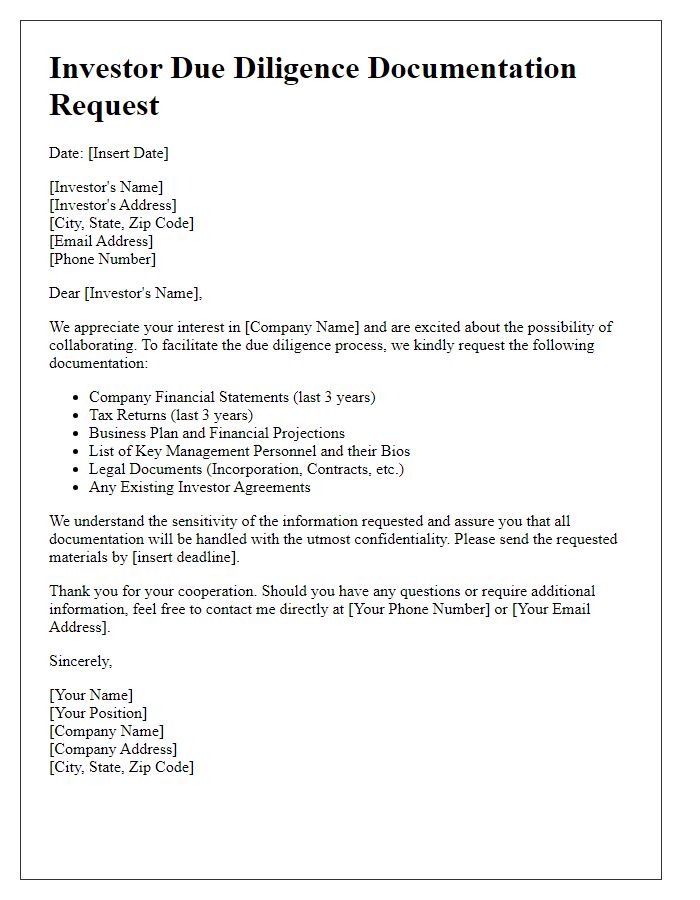

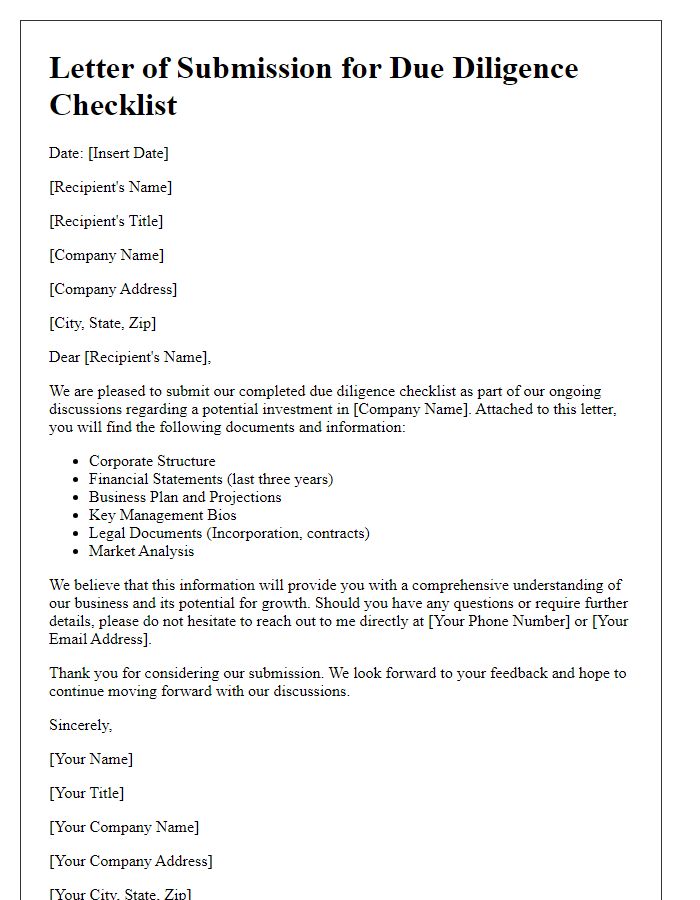

When it comes to securing investment, one of the most critical steps is the due diligence process. This is where we uncover the details that potential investors need to make informed decisions, ensuring transparency and building trust. Writing a letter to request this information can be straightforward yet effective, helping to streamline the process for everyone involved. If you're looking for a helpful template to get started on your own request, keep reading for valuable insights!

Company Overview

The comprehensive company overview serves as a crucial component in investor due diligence processes, offering insight into the business's structure, operations, and market presence. Founded in 2015, SkyTech Innovations operates within the technology sector, specifically focusing on cloud computing and artificial intelligence services. The organization, headquartered in San Francisco, California, employs over 200 professionals and has reported a revenue growth of 30% year-over-year, indicating scalability and market demand. Key products include the SkyCloud platform, enabling secure data storage solutions, and AI-driven analytics tools designed to enhance business decision-making for over 1,000 clients globally. Recent partnerships with Fortune 500 companies further support the company's credibility and potential for expansion in emerging markets, notably in Southeast Asia. Additionally, upcoming product launches set for Q2 2024 are anticipated to broaden the service portfolio and drive further revenue growth.

Financial Performance

An accurate financial performance analysis offers insight into a company's stability and growth potential, essential for investor due diligence. Key metrics include revenue figures, which reflect the total income generated, and profit margins, indicating the efficiency in converting sales into actual profit. Balanced financial statements, such as the balance sheet and cash flow statement, highlight the company's assets, liabilities, and cash movements over specific periods. Historical performance, demonstrated through year-over-year revenue growth rates and earnings before interest, taxes, depreciation, and amortization (EBITDA), enhances understanding of trends and profitability. External factors, including market conditions and economic indicators such as inflation rates or interest rates, can also influence financial outcomes and investment viability.

Market Position

The market position of a company is critical in understanding its competitive landscape and potential for growth. Research shows that X Company, operating in the technology sector, ranks within the top five players in its niche market, valued at approximately $5 billion. Key competitors include Y Corp and Z Ltd., with market shares of 20% and 15% respectively. The company has a unique selling proposition, emphasizing innovative solutions in artificial intelligence, which has attracted partnerships with over 50 enterprises, boosting its credibility. Recent trends indicate an annual growth rate of 12% in the sector, driven by increasing demand for automation. Geographic presence spans North America and Europe, where consumer adoption is rising rapidly. Understanding these dynamics is essential for assessing overall investment risks and opportunities.

Management and Governance

Management and governance structures play a crucial role in determining the stability and growth prospects of any business entity. Clear delineation of responsibilities among executive team members, such as Chief Executive Officer (CEO) and Chief Financial Officer (CFO), influences strategic direction and financial health. Board composition, including independent directors versus executive directors, can impact decision-making processes and overall corporate accountability. Established committees, such as the Audit and Compensation Committee, ensure compliance with regulations and align executive compensation with company performance. Moreover, adherence to frameworks such as the Sarbanes-Oxley Act enhances transparency and mitigates risks associated with financial reporting. Robust risk management strategies, along with clearly defined policies, are essential to uphold integrity and trust with stakeholders, particularly in fast-moving sectors like technology or finance.

Risk Factors

Investors must thoroughly analyze risk factors associated with potential investments to make informed decisions. Risks such as market volatility, regulatory changes, and financial instability can significantly impact investment outcomes. For instance, market volatility (fluctuations exceeding 20% within a year) may disrupt stock prices in sectors like technology or energy. Regulatory changes, particularly in industries such as pharmaceuticals and finance, can result in compliance costs or limit operational capabilities. Additionally, financial instability, marked by indicators like negative cash flow or debt levels exceeding 30% of total assets, can jeopardize a company's sustainability. Understanding these risk factors is essential for assessing the long-term viability of investments and protecting capital.

Comments