Crafting an investment portfolio summary can seem daunting, but it's truly an opportunity to reflect on your financial journey and future goals. Whether you're a seasoned investor or just starting, understanding your portfolio's performance is key to making informed decisions. By breaking down your assets and examining their growth trends, you can better tailor your investment strategies to align with your objectives. Ready to dive deeper into how to create a compelling investment portfolio summary? Let's explore together!

Introduction and Objective Statement

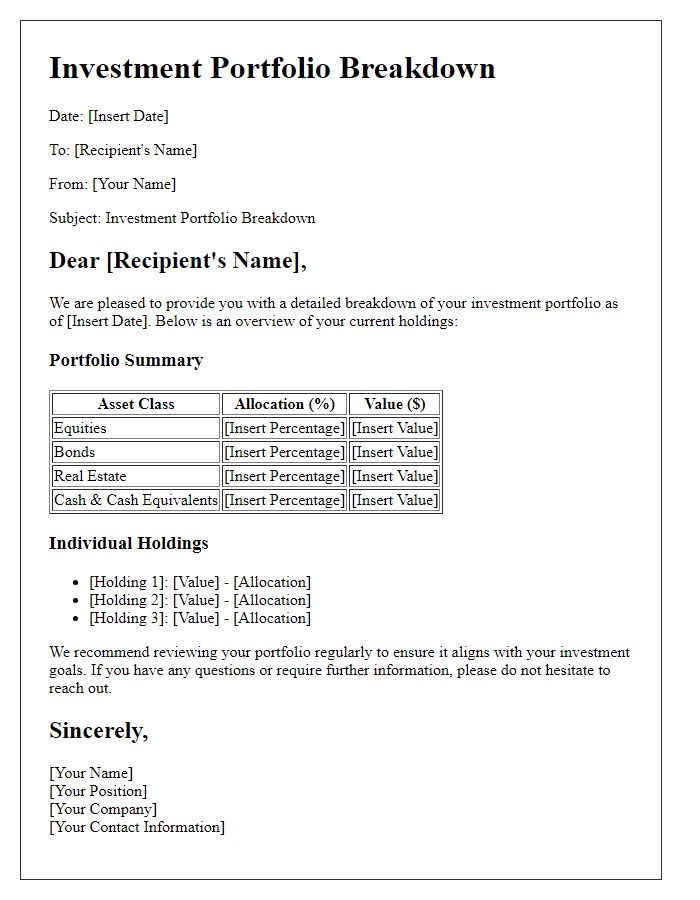

An investment portfolio summary serves as a key tool in assessing the performance and alignment of investment strategies with personal financial objectives. This summary provides an overview of asset allocation, focusing on diverse categories such as equities, bonds, real estate, and alternative investments. The objective statement outlines the financial goals, such as capital appreciation, income generation, or risk mitigation, guiding investment decisions. Additionally, it emphasizes the importance of regularly reviewing and adjusting the portfolio in line with market conditions and individual circumstances, ensuring optimal performance and alignment with long-term financial aspirations.

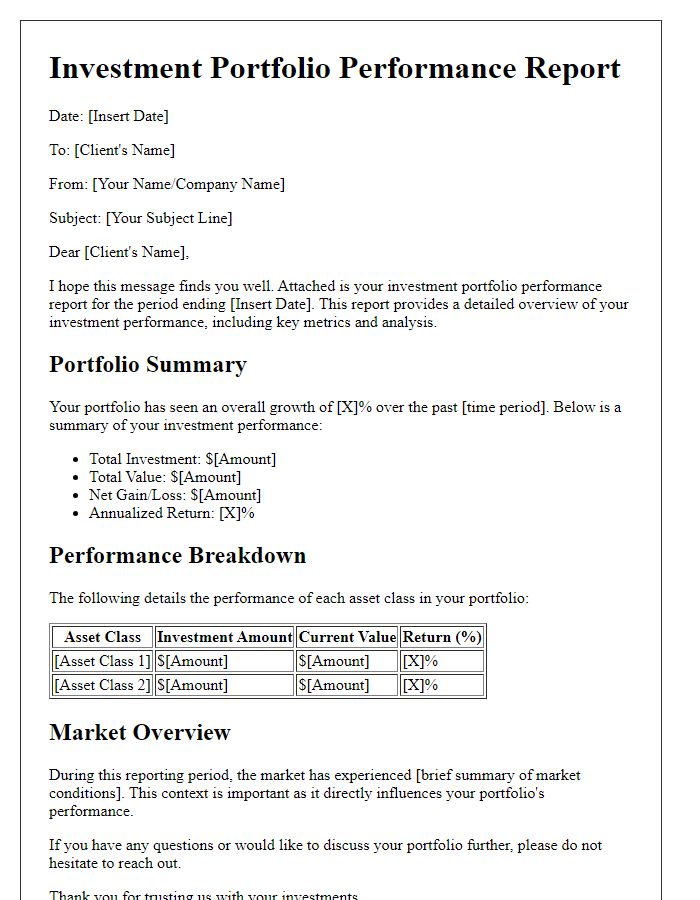

Portfolio Performance Summary

A portfolio performance summary illustrates the financial health and growth trajectory of an investment portfolio over a specific duration. Typically, it outlines cumulative returns, expressed as a percentage, indicating overall performance compared to benchmarks such as the S&P 500 index. Divided into asset classes, the summary may highlight allocations in equities (e.g., domestic and international stocks), fixed-income securities (e.g., government and corporate bonds), and alternative investments (e.g., real estate investment trusts). Key metrics like standard deviation, representing volatility, and the Sharpe ratio, measuring risk-adjusted returns, enhance the analysis. Additionally, it includes a comparison of initial capital investments made in specific months (like January 2023 or July 2023) against current market values. This comprehensive overview enables investors to assess decision-making effectiveness and align future strategies with market dynamics.

Asset Allocation Overview

An investment portfolio summary provides a comprehensive overview of the asset allocation strategy, detailing the distribution of investments across various categories. The primary asset classes typically include equities (stocks), fixed income (bonds), real estate (properties), and cash equivalent assets. For instance, a well-balanced portfolio might allocate 60% to equities, targeting growth through companies such as Apple and Microsoft, 30% to fixed income for stability and income, represented by U.S. Treasury bonds, and 10% in cash equivalents like money market funds for liquidity. Evaluating performance metrics, such as annualized return percentages or volatility measurements, adds context to the portfolio's effectiveness and risk profile. Monitoring economic indicators, including interest rates and inflation rates, also influences adjustments to the asset allocation strategy, ensuring alignment with market conditions and investment goals.

Market Conditions and Impact

Market conditions in 2023 reflect significant fluctuations due to geopolitical tensions and economic shifts. In the first quarter, the S&P 500 Index experienced a decline of approximately 5% largely due to rising inflation rates (averaging 6.5% year-over-year) and subsequent interest rate hikes by the Federal Reserve. Global events, such as the ongoing conflict in Eastern Europe and supply chain disruptions in Asia, have compounded market volatility. The tech sector, represented by the NASDAQ Composite, faced a notable downturn, dropping nearly 10% as companies like Apple and Amazon reported lower-than-expected earnings. Conversely, sectors such as energy and utilities showed resilience, with crude oil prices hovering around $85 per barrel despite global economic concerns. Investors are increasingly focusing on defensive strategies and diversifying portfolios to mitigate risks associated with these market conditions, emphasizing the need for a well-balanced investment approach in uncertain times.

Future Outlook and Strategy

The investment portfolio's future outlook emphasizes growth potential and diversification, focusing on sectors like technology, healthcare, and renewable energy. The technology sector, projected to grow at a compound annual growth rate (CAGR) of 8.5% through 2025, offers substantial opportunities driven by advancements in AI and machine learning. Healthcare investments, particularly in telehealth and biotechnology, are expected to expand due to rising healthcare demand and innovation, estimated to reach a $10 trillion global market by 2022. Renewable energy, shaped by global initiatives to combat climate change, presents strategic investments in solar and wind energy companies, with the International Energy Agency forecasting a 20% increase in renewable energy capacity by 2025. The strategy also includes rebalancing towards emerging markets, which are anticipated to outpace developed economies with a projected GDP growth of 4.4% by 2023, thus capturing growth from evolving consumer demographics and increased digital adoption. Regular performance reviews and adjustments will maintain alignment with overarching financial goals.

Comments