Are you curious about how to effectively communicate your investment performance review? Crafting a well-structured letter can make all the difference in conveying your financial insights. In this article, we'll explore essential components to include in your review letter, ensuring it reflects your professionalism and clarity. So, let's dive in and discover the best practices for writing an impactful investment performance review letter!

Personalized Greeting

Investment performance reviews provide detailed insights into portfolio results, highlighting key metrics such as return on investment (ROI), asset allocation breakdowns, and market comparisons. Annual reports often emphasize performance against benchmarks like the S&P 500 or Dow Jones Industrial Average, enabling investors to gauge progress. Additionally, individual investment profiles include risk assessments and diversification strategies correlating with specific goals. Important events, including market volatility due to geopolitical factors or economic downturns, are also analyzed, affecting overall returns. Understanding these elements empowers investors to make informed decisions, aligning future strategies with long-term objectives.

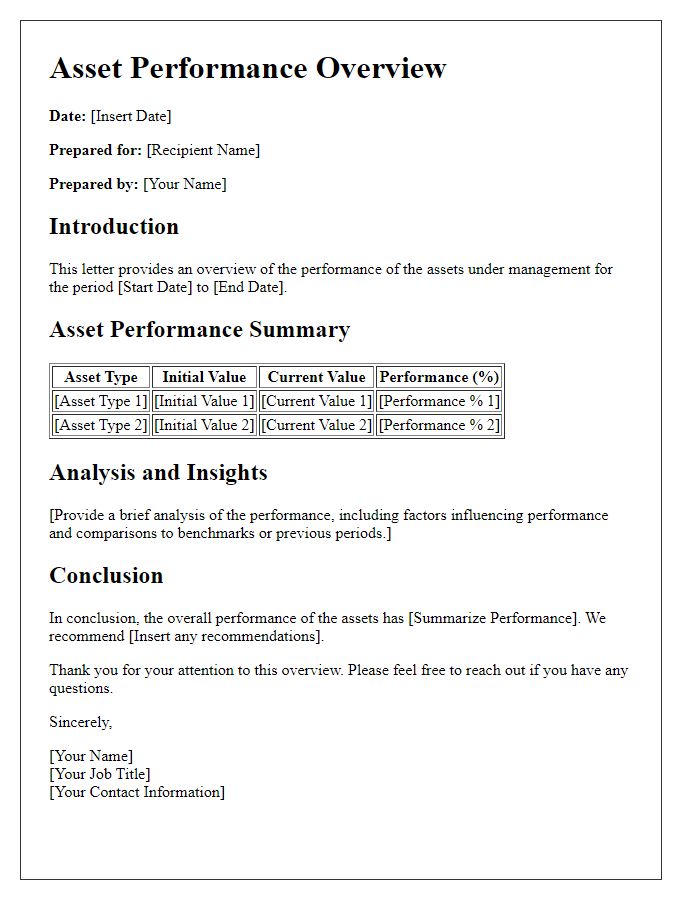

Summary of Portfolio Performance

The summary of portfolio performance reveals significant trends in asset allocation and return on investment metrics over the last fiscal quarter. Equities represent a substantial portion, approximating 60% of the total portfolio, contributing to a year-to-date gain exceeding 15%. The technology sector, including companies like Apple and Nvidia, experienced remarkable growth due to increased consumer demand for electronics and software solutions. Bonds, constituting around 30% of the portfolio, provided stability with an approximate yield of 2.5%, mitigating overall risk. Real estate investments (REITs), comprising 10% of the portfolio, displayed resilience despite market fluctuations, yielding a modest return of 5%. The diversified approach, focusing on large-cap stocks and steady income-generating assets, has positioned the portfolio favorably against benchmarks such as the S&P 500, which returned 12% during the same timeframe. Continuous monitoring of macroeconomic indicators, such as inflation rates and interest rates set by the Federal Reserve, will be crucial for future performance optimization.

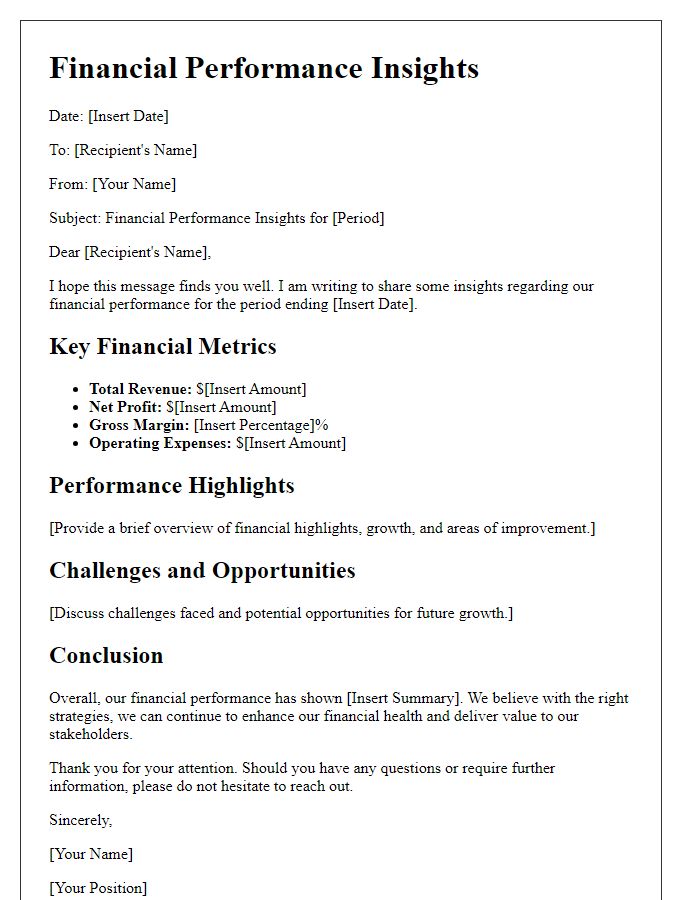

Benchmark Comparisons

Investment performance analysis often includes comparisons against established benchmarks to gauge effectiveness. Common benchmarks, such as the S&P 500 Index, represent large-cap investment returns in the United States, offering investors a standard for tracking performance. Year-over-year comparisons, especially over five or ten-year periods, provide insights into how specific portfolios align with these benchmarks. Returns may fluctuate; for instance, in 2021, the S&P 500 achieved a return of over 20%, while sector-specific funds like technology or healthcare often exceed this average. Detailed metrics, such as alpha (a measure of active return above the benchmark) and beta (a measure of volatility relative to the market), illustrate the risk-adjusted performance of investments, enabling better strategic decision-making for future allocations. Understanding these comparisons is crucial for assessing overall portfolio health and identifying areas for improvement in asset management strategies.

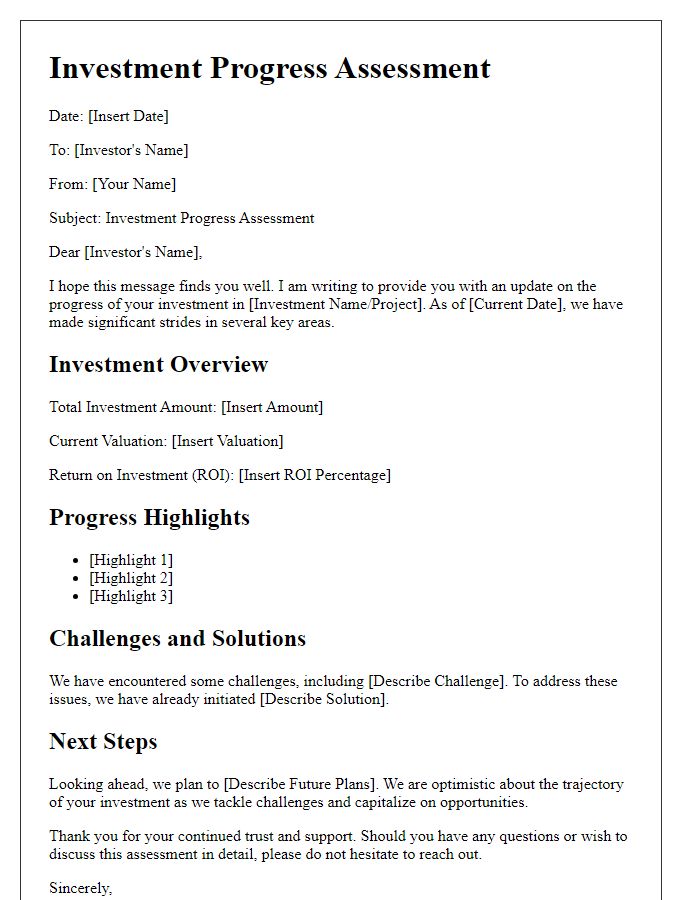

Key Insights and Analysis

Investment performance reviews provide essential insights into portfolio management, allowing investors to assess capital growth over specified periods. Analyzing trends, such as annualized return rates which may range from 5% to 15%, helps identify successful funds and asset classes. Comparing performance against benchmarks, like the S&P 500 index or bond indices, offers a standard for evaluation. Key metrics, including Sharpe Ratio (risk-adjusted return) and alpha (excess return above benchmark), are critical for understanding risk versus performance. Geographic allocation, particularly in emerging markets such as Southeast Asia or Latin America, could influence returns due to socio-economic factors. Regular reviews and adjustments can optimize long-term growth, mitigating risks associated with market volatility or economic downturns.

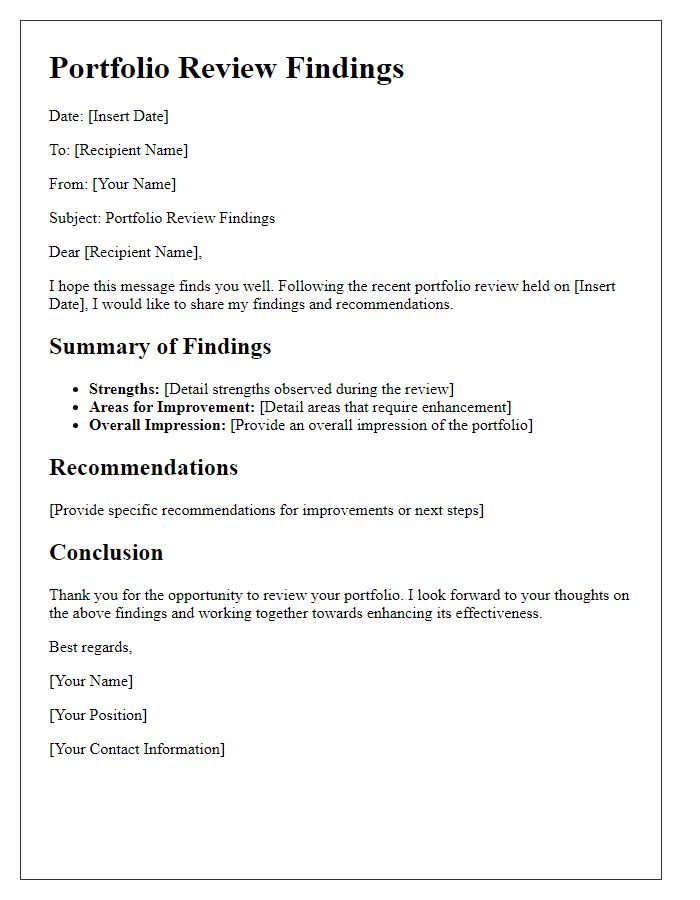

Future Investment Strategy

In assessing the future investment strategy, it is essential to consider various factors that influence market dynamics and individual asset performance. Current economic indicators, such as inflation rates in the United States (approximately 3.7% in October 2023) and unemployment rates (holding steady at 4.2% in the same month), provide insight into potential shifts in investment landscapes. Furthermore, global events, including geopolitical tensions and their impact on oil prices (hovering around $85 per barrel), necessitate a diversified approach to mitigate risks. Emerging markets, particularly in Asia, show promising growth rates, with countries like India projected to expand by 6.3% in 2024, suggesting a strategic allocation towards equities in these regions. Implementing sustainable investments, particularly in renewable energy, could align with both ethical considerations and potential long-term gains, as sectors like solar and wind energy continue to attract significant capital inflows. Regular performance evaluations and adjustments based on these evolving trends will ensure a robust investment approach capable of navigating future uncertainties.

Comments