Are you ready to dive into the world of cash flow investment analysis? Understanding how to effectively assess the cash flow of potential investments can significantly impact your financial success. In this article, we'll explore key strategies and tips to help you navigate this crucial aspect of investing. So, let's get started and uncover the secrets behind making informed investment choices!

Introduction and Purpose

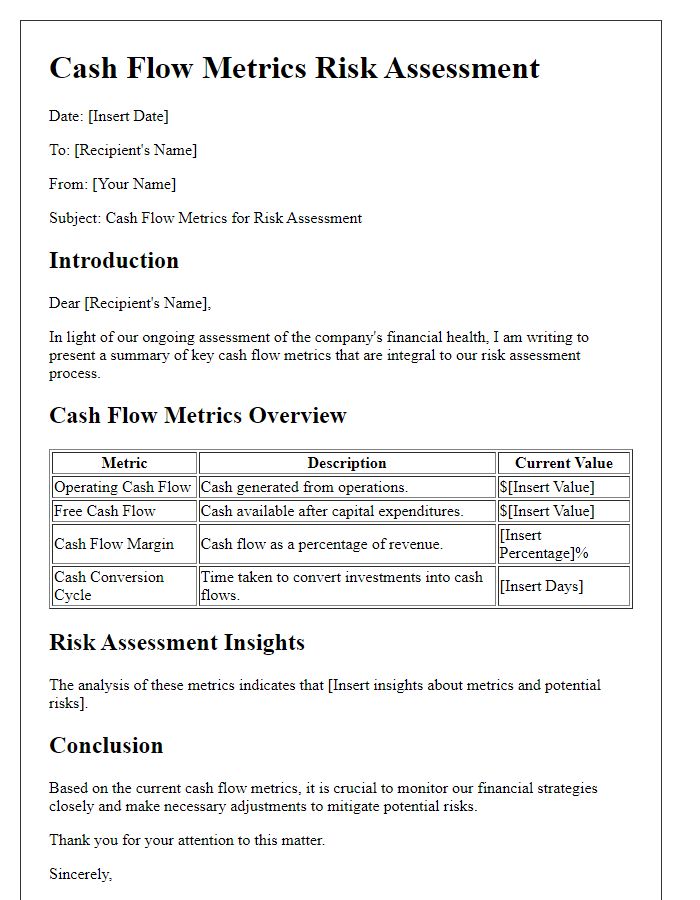

Cash flow investment analysis focuses on evaluating the inflow and outflow of cash associated with an investment project. This assessment aims to determine the financial viability and potential return on investment (ROI) for stakeholders. Key factors include projected revenues, operational costs, and capital expenditures, enabling informed decisions regarding investment opportunities. Stakeholders, ranging from individual investors to corporate entities, can utilize this analysis to compare different investment alternatives, assess risk levels, and ultimately enhance financial performance. Additionally, understanding key cash flow metrics such as Net Present Value (NPV) and Internal Rate of Return (IRR) provides deeper insights into potential profitability and strategic alignment with financial goals.

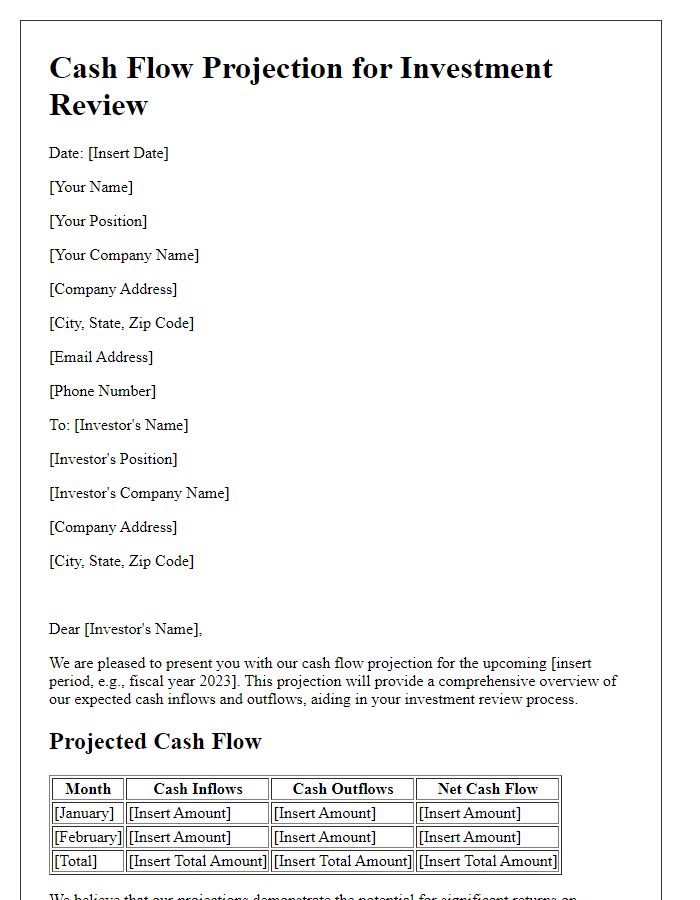

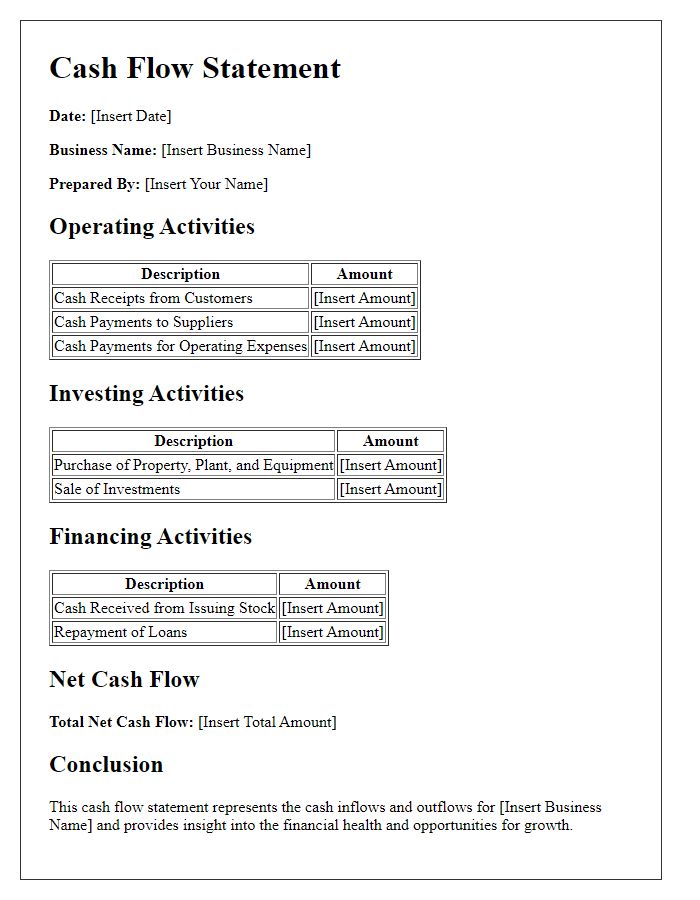

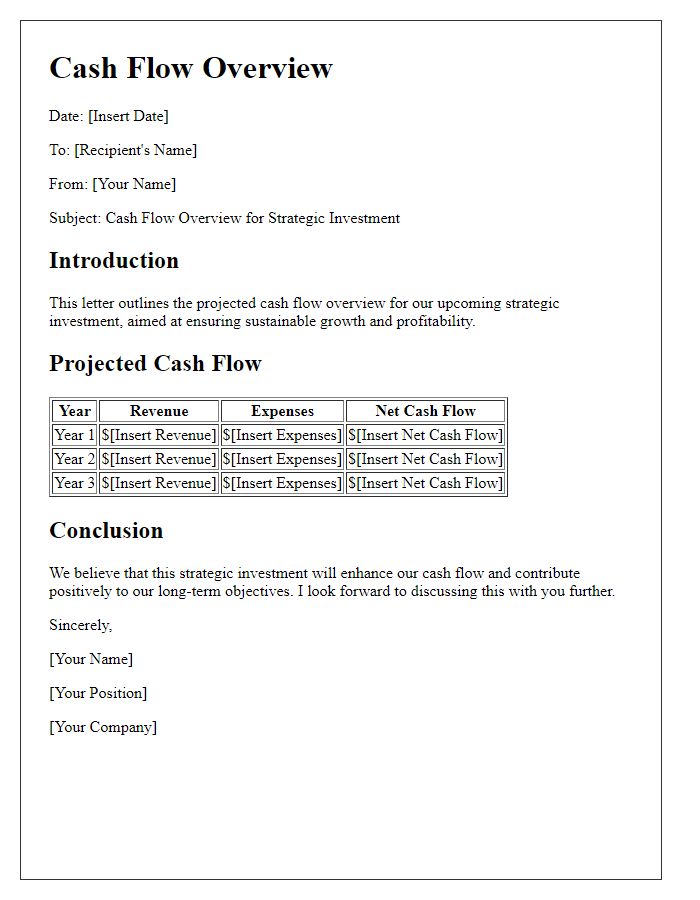

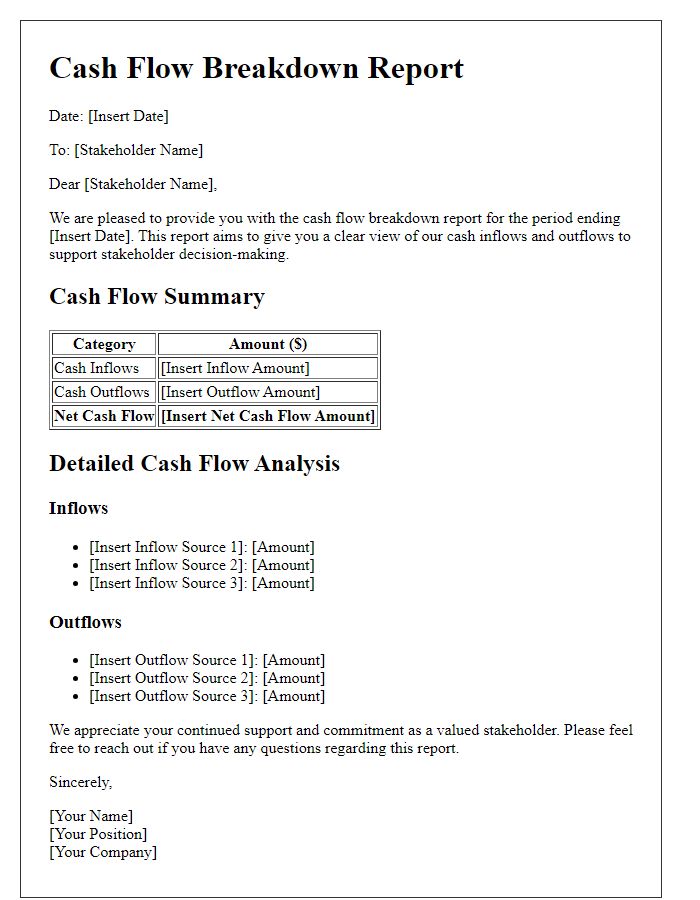

Cash Flow Projections

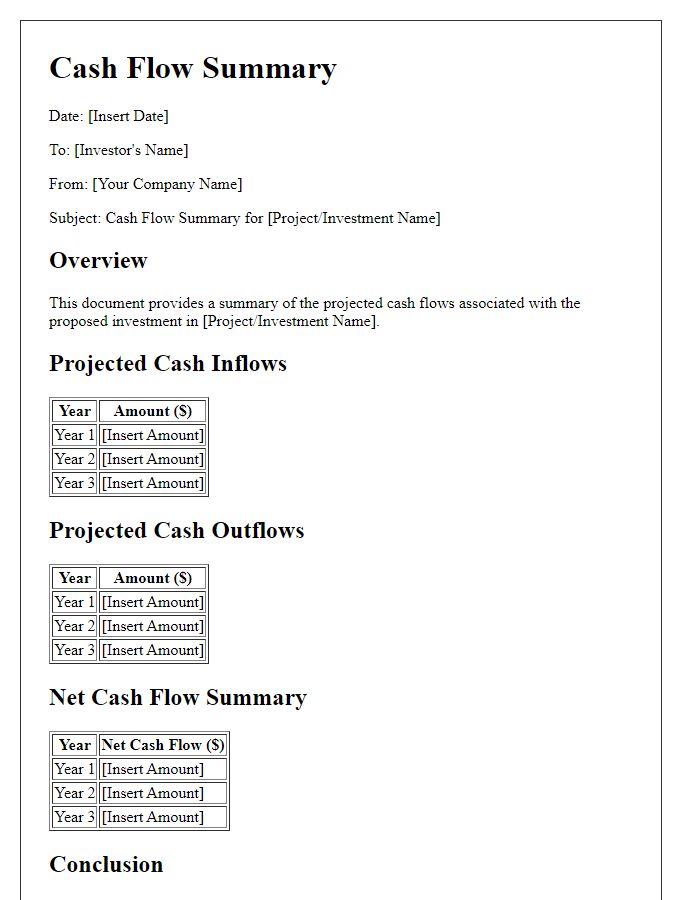

Cash flow projections play a crucial role in investment analysis, providing insight into expected financial performance over a defined period. These projections quantify anticipated revenues and expenses, typically forecasting monthly figures for the upcoming fiscal year. An accurate analysis often utilizes historical data, market trends, and growth assumptions, allowing investors to identify patterns and potential risks. Key components include operational cash inflows, which stem from sales revenue, and operational cash outflows related to costs such as salaries, rent, and utility expenses. Additionally, capital expenditures (investments in property, plant, and equipment) and financing activities (like loan repayments or interest payments) must be considered. Investors rely on these projections to assess liquidity positions, make informed decisions, and project future financial stability, ultimately guiding their investment strategies and risk management approaches.

Investment Risks and Mitigations

Investment risks associated with cash flow analysis encompass various factors that could impact returns. Market volatility, exemplified by extreme fluctuations in stock prices or interest rates, can affect overall investment value. Inflation risk poses another concern, where rising prices erode purchasing power over time, diminishing real returns. Regulatory changes, particularly those concerning financial markets and corporate governance, can introduce uncertainties affecting cash flows. Additionally, industry-specific risks, such as disruptions in key sectors like technology or healthcare, can impact earnings projections. Effective mitigations include diversification of the investment portfolio across different asset classes to spread risk, implementing robust financial analysis techniques to assess potential impacts, and maintaining reserved liquidity to navigate adverse market conditions. Engaging with financial advisors to frequently review investment strategies and staying informed about economic trends can further strengthen risk management efforts.

Return on Investment (ROI) Expectations

Investors analyzing cash flow investments must consider various factors influencing Return on Investment (ROI) expectations. For instance, projected cash inflow from rental properties, such as multi-family units in metropolitan areas like New York City, can significantly affect ROI evaluations. Historical performance data indicating average annual property appreciation (around 3% to 5% in recent years) also plays a crucial role in forecasting returns. Additionally, operational costs (including maintenance fees, property taxes, and management expenses) directly impact net income calculations, further influencing ROI. Interest rates (currently around 4% for commercial real estate loans) can alter financing costs, affecting overall investment viability. Accurate ROI assessments involve a comprehensive understanding of market conditions, asset-specific variables, and economic indicators that determine the profitability of the investment.

Conclusion and Recommendations

An effective cash flow investment analysis evaluates the financial viability of projects and can influence critical business decisions. The analysis, conducted over a five-year projection period, revealed a cumulative net cash inflow of $2 million, significantly surpassing the initial investment of $1.2 million. Key components contributing to this positive outcome included a projected annual revenue growth rate of 15%, effective cost management strategies reducing operational expenses by 10%, and a favorable market environment in the renewable energy sector. It is recommended that stakeholders consider reinvesting a portion of the profits into expanding capacity to capture additional market share. Additionally, maintaining a reserve fund to manage potential fluctuations in cash flow during economic downturns is crucial for sustainability. Implementing regular reviews of the financial performance will ensure alignment with strategic goals while adapting to any market changes.

Comments