Hello, dear reader! We all know how crucial it is to stay informed about our investments, especially when it comes to systematic investment plans (SIPs). Whether you're a seasoned investor or just starting out, understanding the nuances of your SIP can help you make smarter financial decisions. So, grab a cup of coffee, and let's delve into the latest updates and strategies that can enhance your investment journey!

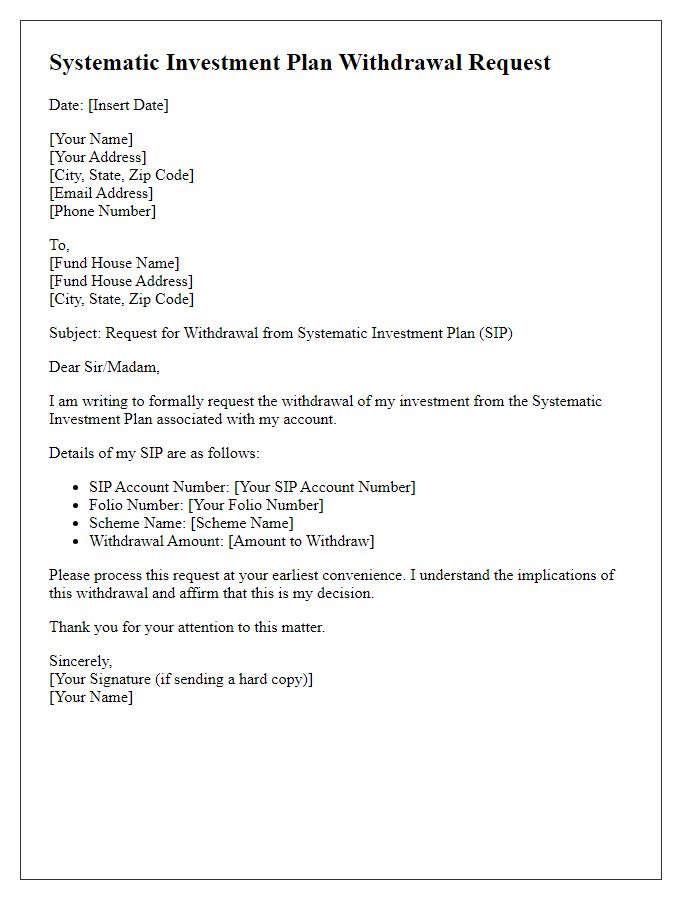

Personal Identification Details

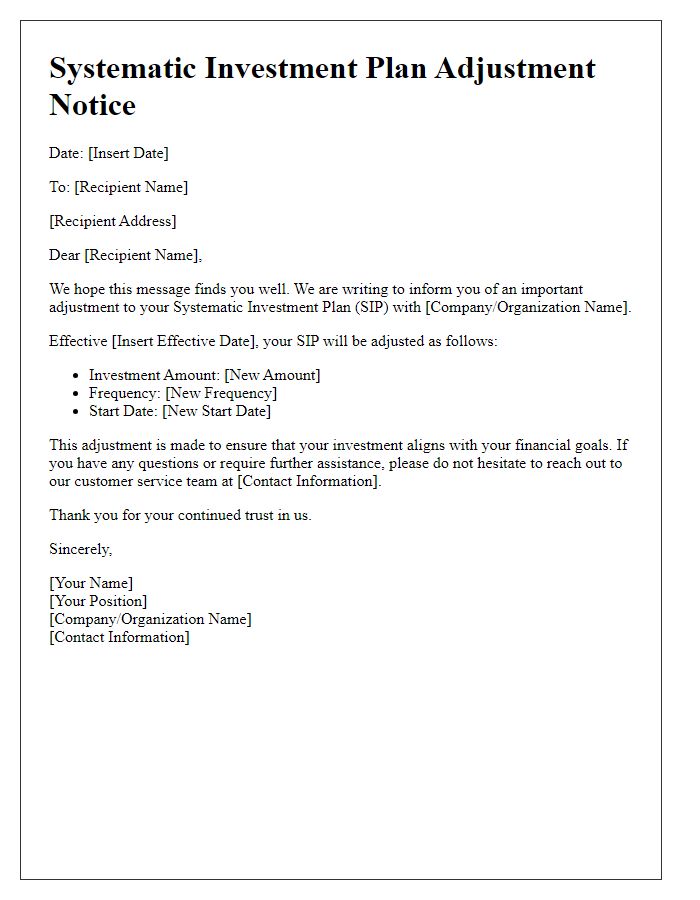

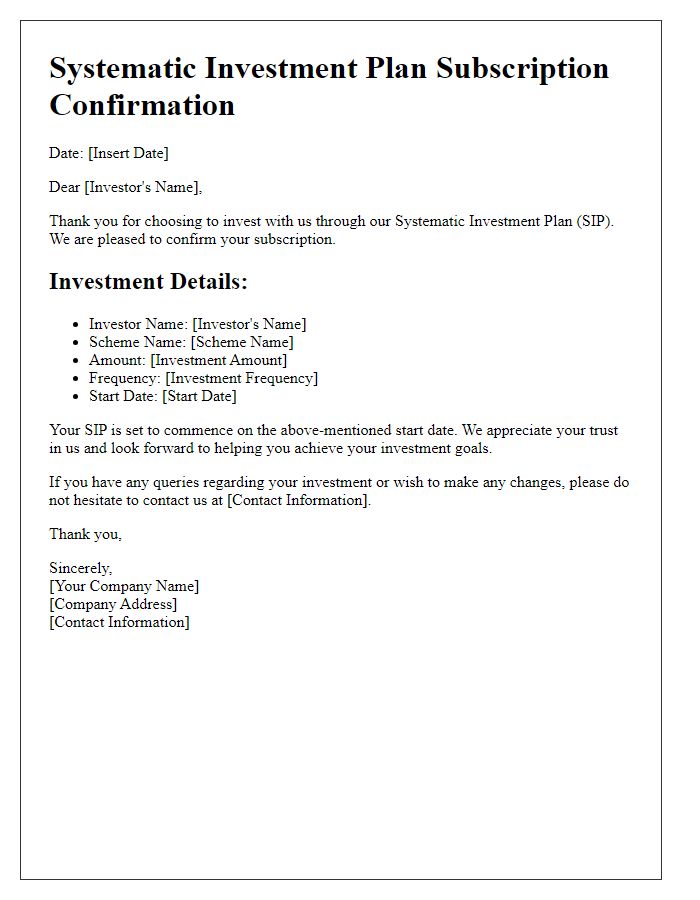

A systematic investment plan (SIP) update involves tracking the performance and contributions of individual investments, usually within mutual funds. Key details about personal identification, such as full name, unique identification number (like a Social Security Number), and contact information, play crucial roles in financial management. This includes specifying investment accounts related to financial institutions, such as banks or mutual funds. Timely updates may be necessary to reflect changes in personal circumstances, such as a change of address or contact number, targeting seamless communication and ensuring accurate records. Understanding SIP performance, often expressed in percentages and growth rates, is vital for effective portfolio management and achieving long-term financial goals. Regular monitoring can lead to adjustments in strategy, ensuring alignment with personal investment objectives, such as retirement savings or child education funds.

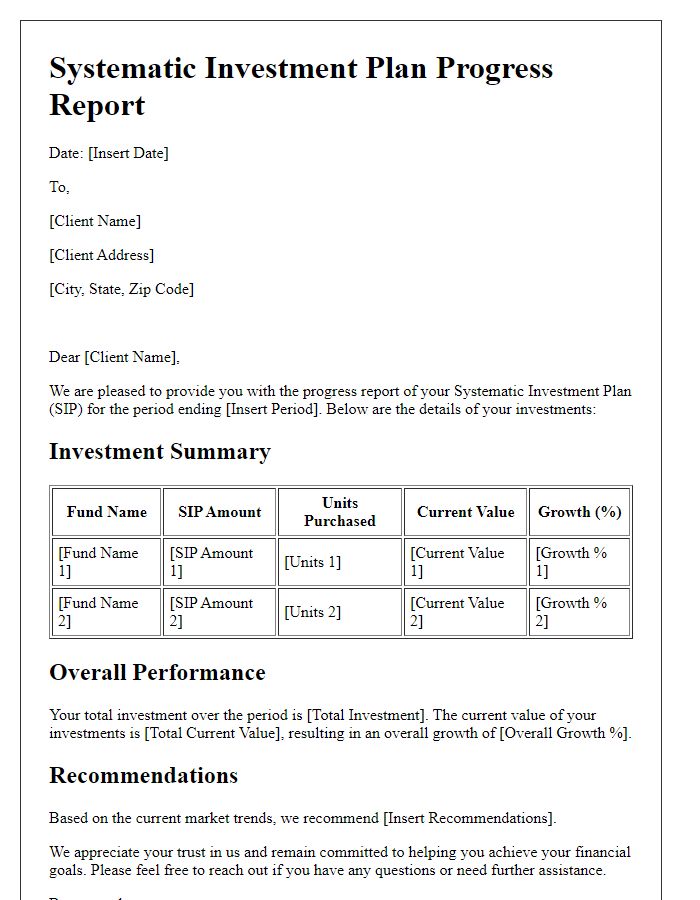

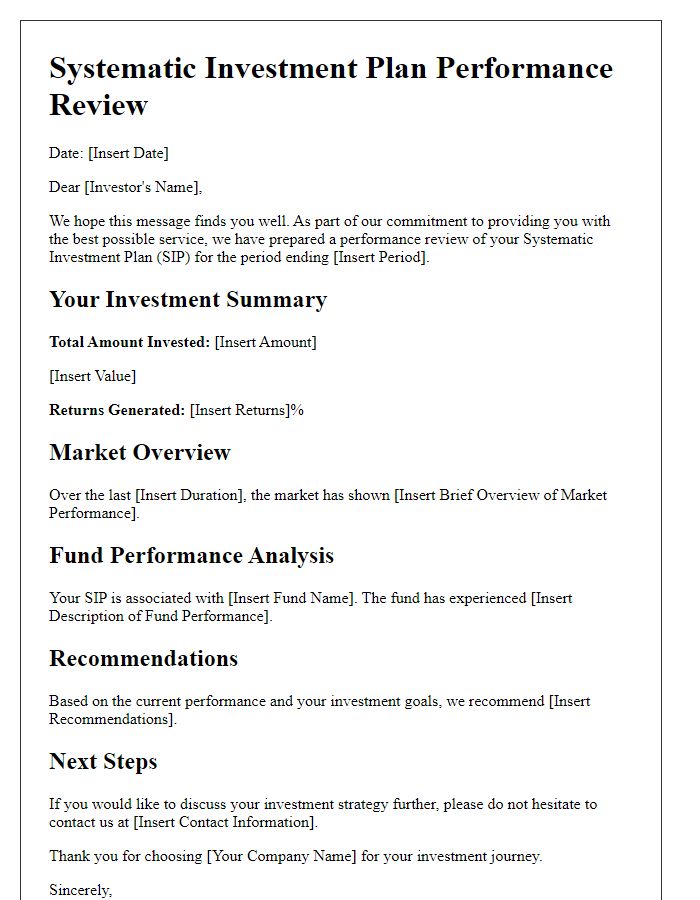

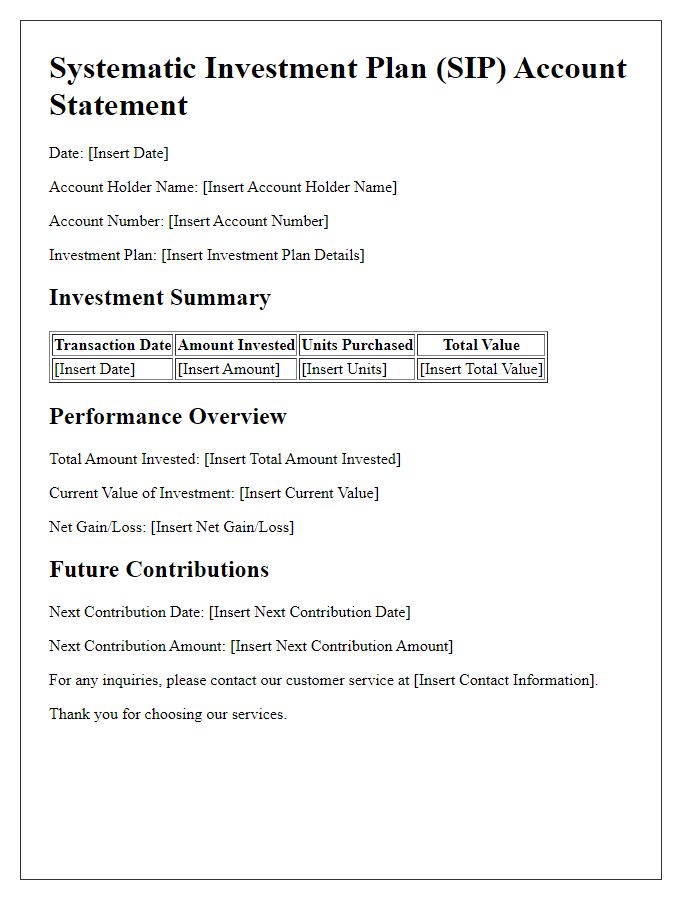

Investment Account Information

The Investment Account Information report provides essential updates on systematic investment plans (SIPs) for investors. This report includes details such as the total investment amount, specific mutual funds or stocks involved, and the performance metrics over quarterly periods. As of October 2023, the average annual return rate for these investments has been closely monitored, revealing trends and fluctuations that affect overall portfolio value. The current market conditions, influenced by economic indicators like inflation (currently at 3.7% in the United States) and interest rates (minimum 4.5% as set by the Federal Reserve), play a significant role in the investment landscape. Additionally, the report emphasizes the importance of rebalancing strategies and tax implications for long-term gains, ensuring that investors are well-informed about their financial journey.

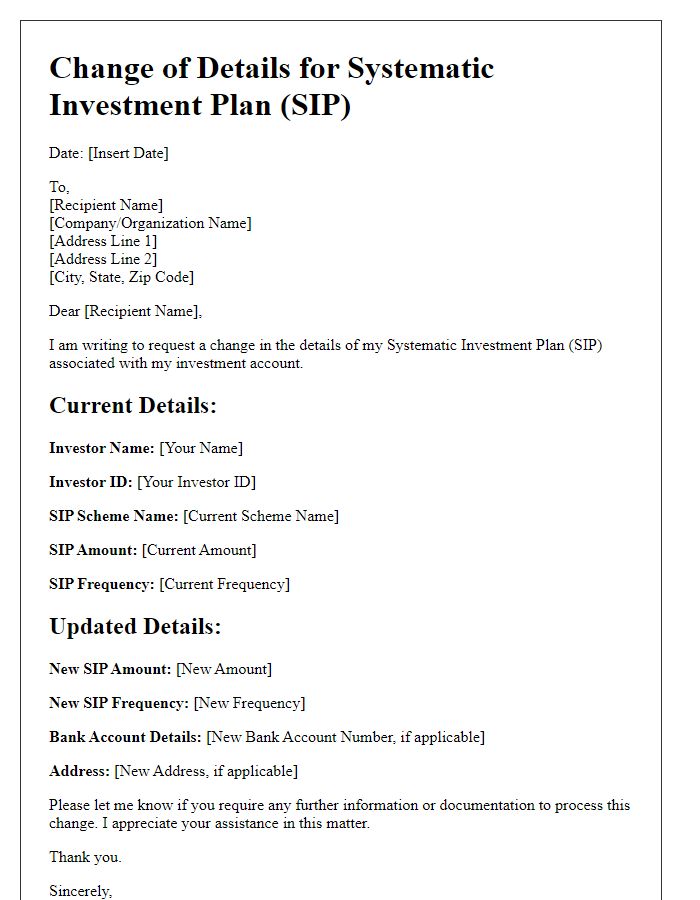

Updated Investment Objectives

An updated investment objective can significantly refine financial strategies within a systematic investment plan (SIP), which is a method of investing a fixed sum in mutual funds throughout specified intervals. This adjustment can reflect changes in factors such as risk tolerance, life events like marriage or retirement, or market conditions affecting financial goals, such as rising inflation rates or shifts in economic indicators. It is crucial to reassess investment horizons, ensuring alignment with both short-term requirements (e.g., purchasing a home) and long-term aspirations (such as funding children's education). Communicating these nuances in investment objectives can enhance clarity and effectiveness, helping to optimize aggregate portfolio performance over time.

Signature and Date for Authorization

Systematic Investment Plans (SIPs) play a crucial role in wealth management, allowing investors to contribute a fixed amount regularly into mutual funds, typically on a monthly basis. This investment strategy promotes disciplined savings, enabling individuals to harness the power of compounding over time, especially in volatile markets. For instance, an investor committing Rs5,000 monthly in an equity mutual fund could see substantial growth over several years, influenced by market performance and economic factors such as inflation or interest rates. Notably, SIPs in mutual funds registered under the Securities and Exchange Board of India (SEBI) guidelines offer additional security and transparency, with performance metrics available for review. To process updates for SIPs, proper authorization is vital, requiring signature and date from the investor to confirm adjustments in investment amounts or frequency.

Contact Information for Queries

For any inquiries regarding your systematic investment plan (SIP) update, please reach out directly to our customer service team. You can contact us via phone at +1-800-555-0142, available Monday to Friday from 9 AM to 6 PM (EST). Alternatively, you may send an email to support@investmentfirm.com for assistance. Our dedicated representatives will promptly address your concerns. Please have your SIP account number ready to facilitate a quicker resolution.

Comments