Are you curious about how behavioral factors impact investment decisions? In today's fast-paced financial world, understanding investor psychology is just as important as analyzing market trends. By conducting a thorough behavioral risk assessment, we can uncover the nuances of decision-making that may influence your portfolio. Dive into this article to explore the strategies that can help you manage these risks effectively and elevate your investment game.

Investor's Risk Tolerance Level

Investor risk tolerance levels can be categorized into three main groups: conservative, moderate, and aggressive. Conservative investors prioritize capital preservation, typically favoring low-risk investments such as bonds or money market funds. Moderate investors seek a balanced approach, often allocating funds across a mix of equities and fixed-income securities with a long-term growth perspective. Aggressive investors, on the other hand, pursue high-risk opportunities, favoring stocks, real estate, or alternative investments, aiming for substantial returns despite the potential for significant losses. Understanding these categories can aid financial advisors in crafting tailored investment strategies that align with individual goals and comfort with market volatility. Additionally, market trends, economic indicators, and personal financial situations significantly influence an investor's risk tolerance.

Investment Time Horizon

Investment time horizon is a crucial factor in assessing investor behavioral risks, influencing decision-making processes. Typically categorized into short-term (under three years), medium-term (three to ten years), and long-term (over ten years), these horizons impact asset allocation strategies and risk tolerance levels. Investors with shorter horizons, such as those planning a life event like buying a house in two years, may prefer less volatile investments like bonds or cash equivalents for stability. In contrast, long-term investors, potentially saving for retirement or education over twenty years, might accept higher volatility through stocks to capture growth potential. Understanding individual timelines helps tailor risk assessments, identify emotional responses to market fluctuations, and recognize potential biases that could lead to premature investment decisions.

Diversification Strategies

Investors often address behavioral risk through diversification strategies, which involves spreading investments across various asset classes to mitigate potential losses. This approach minimizes the impact of market volatility on an investor's overall portfolio. For instance, a well-diversified portfolio might include equities from sectors like technology, healthcare, and energy, alongside fixed-income securities such as government bonds and corporate bonds. Geographic diversification is also essential; investing in emerging markets (like India or Brazil) and developed markets (like the USA or Germany) can reduce exposure to regional economic downturns. Additionally, incorporating alternative investments, such as real estate or commodities like gold, can further balance risks during market fluctuations. Employing a mix of these strategies enables investors to manage emotional biases often leading to impulsive decisions during market turbulence.

Economic and Market Conditions

Economic and market conditions significantly impact investor behavior, influencing decisions related to asset allocation and risk tolerance. Factors such as inflation rates (currently around 6% in the U.S.), interest rates (set by the Federal Reserve), and stock market volatility (the S&P 500 experiencing swings of 2% to 3% in recent months) play a crucial role in shaping investor sentiment. Additionally, geopolitical events, such as the ongoing tensions in Eastern Europe, can create uncertainty in markets, leading to more conservative investment strategies among individuals. Understanding these conditions helps in assessing behavioral risks, as investors might react differently based on their psychological profiles and the prevailing economic climate. Market indices, such as the Dow Jones Industrial Average, exhibit fluctuations that often correlate with shifts in economic indicators, further underscoring the need for a comprehensive assessment of investor behavior amid changing conditions.

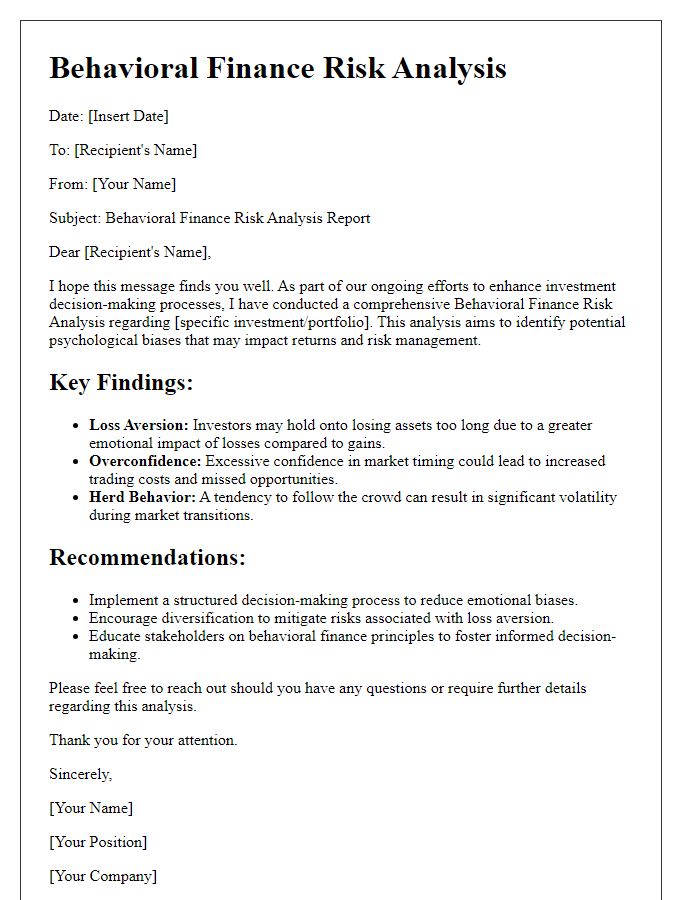

Psychological and Emotional Factors

Investor behavioral risk assessment focuses on various psychological and emotional factors impacting decision-making in financial investments. Overconfidence, a cognitive bias, leads investors, particularly novice ones, to overestimate their knowledge and predictive abilities, increasing risks, especially during volatile market conditions. Loss aversion causes investors to prefer avoiding losses over acquiring equivalent gains, resulting in suboptimal selling strategies during downturns. Anchoring, the tendency to rely heavily on initial information, influences investors' perception of asset value, potentially leading to poor investment choices. Additionally, herd behavior, prompted by social dynamics, results in following the crowd rather than independent analysis, often exacerbating market bubbles or crashes. Lastly, emotional investing, driven by fear and greed, significantly impacts an investor's ability to make rational decisions, highlighting the need for effective risk management strategies.

Comments