Are you looking to update the beneficiary on your investment account? It's crucial to ensure that your assets are directed according to your wishes, and the process can be surprisingly straightforward! In this article, we'll walk you through the necessary steps and provide helpful tips to make the transition effortless. So, let's dive in and explore everything you need to know about beneficiary updates!

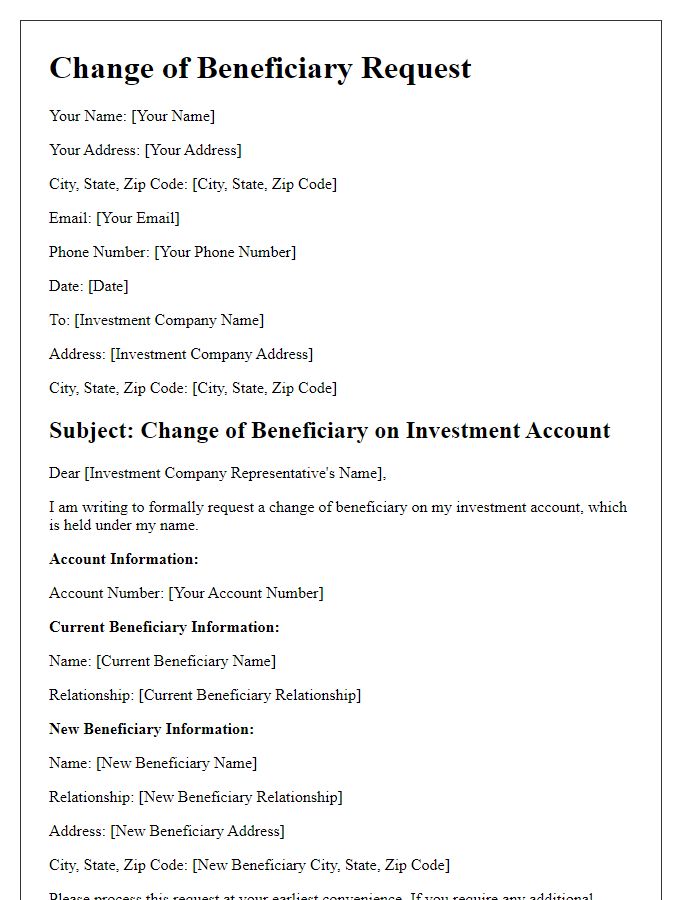

Account Holder Information

An investment account beneficiary update involves essential details like the account holder's name, financial institution, and account number. Including a precise date (e.g., March 7, 2024) indicates when the update is requested. The financial institution, such as Fidelity Investments or Charles Schwab, often requires specific instructions regarding the new beneficiary. Clear identification of beneficiaries including their full names, social security numbers, and birth dates ensures accuracy. Relevant tax implications may arise from beneficiary changes, primarily concerning estate taxes or gift taxes based on jurisdiction. Consistent communication with investment firms ensures compliance with regulatory requirements and smooth updates.

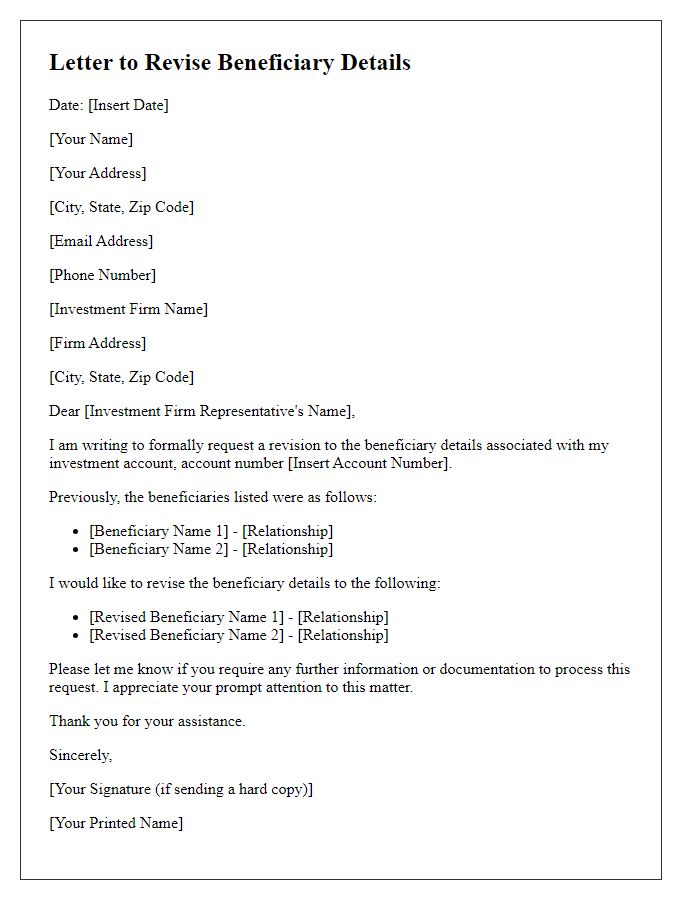

Current Beneficiary Details

Beneficiary details for investment accounts such as savings, retirement, or trust accounts are crucial for estate planning. Current beneficiaries may include individuals or entities like family members, charities, or trusts. For instance, a beneficiary could be a spouse, child, or a specific charity, which might significantly influence the allocation of assets valued at thousands or millions of dollars upon account holder's passing. Keeping these details updated ensures that your intended heirs receive their rightful share without delays. Additionally, verification of social security numbers, birth dates, and contact information of beneficiaries can prevent legal complications in the future.

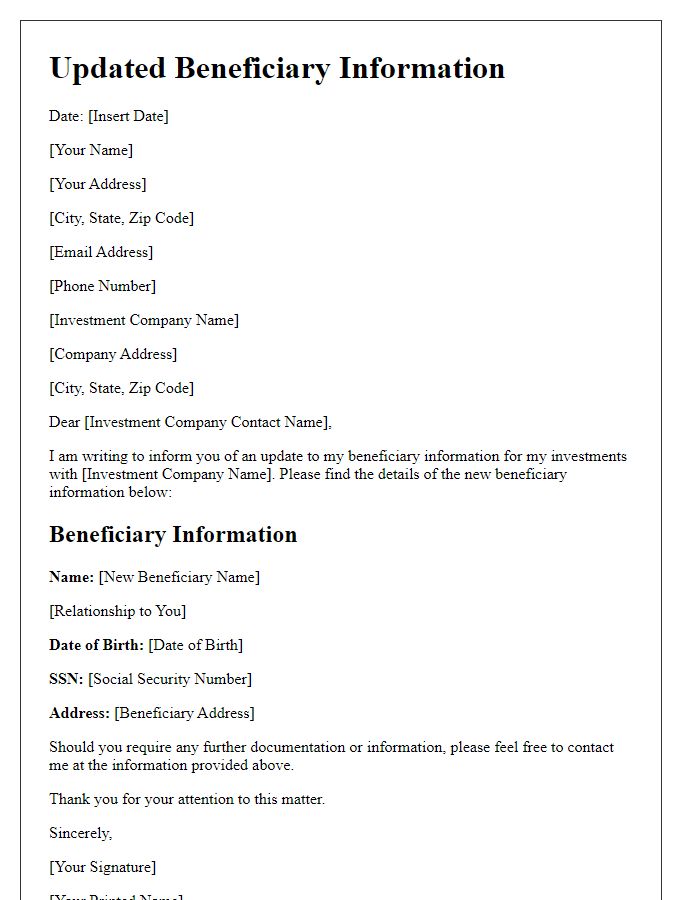

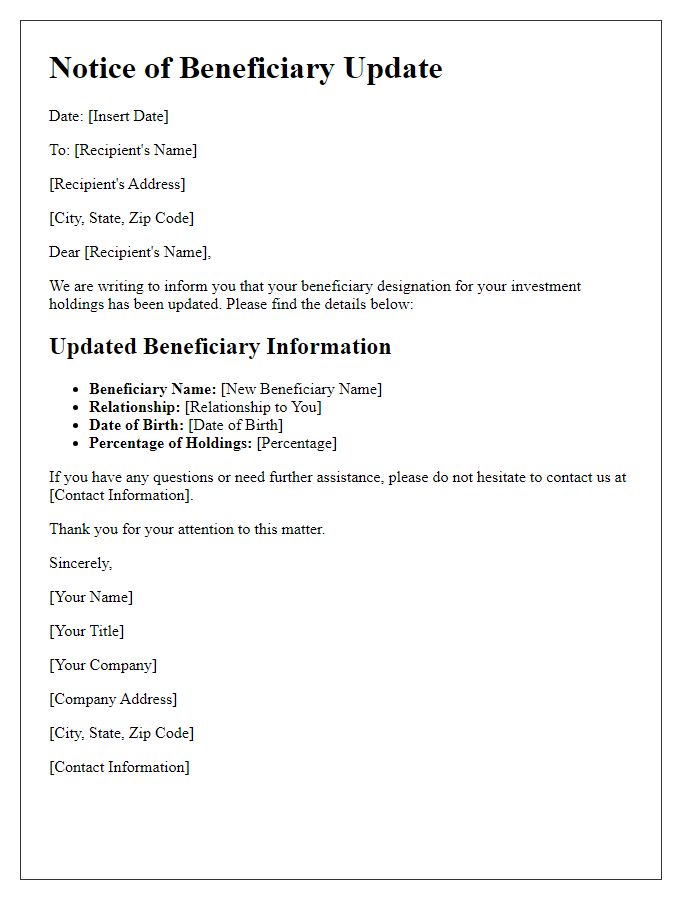

New Beneficiary Information

Updating beneficiary information for an investment account is a critical step in ensuring the proper allocation of assets after an individual's passing. Important details include the new beneficiary's full name, relationship to the account holder, and Social Security number for identification. Providing a permanent address is essential for future communication, and an updated contact number can facilitate any necessary discussions regarding the account. Additionally, specifying the percentage of the account allocated to each beneficiary is crucial to avoid any confusion. Institutions may require this information to be submitted on official forms, adhering to regulations and ensuring legal validity. Regular updates can help safeguard against outdated information impacting heirs.

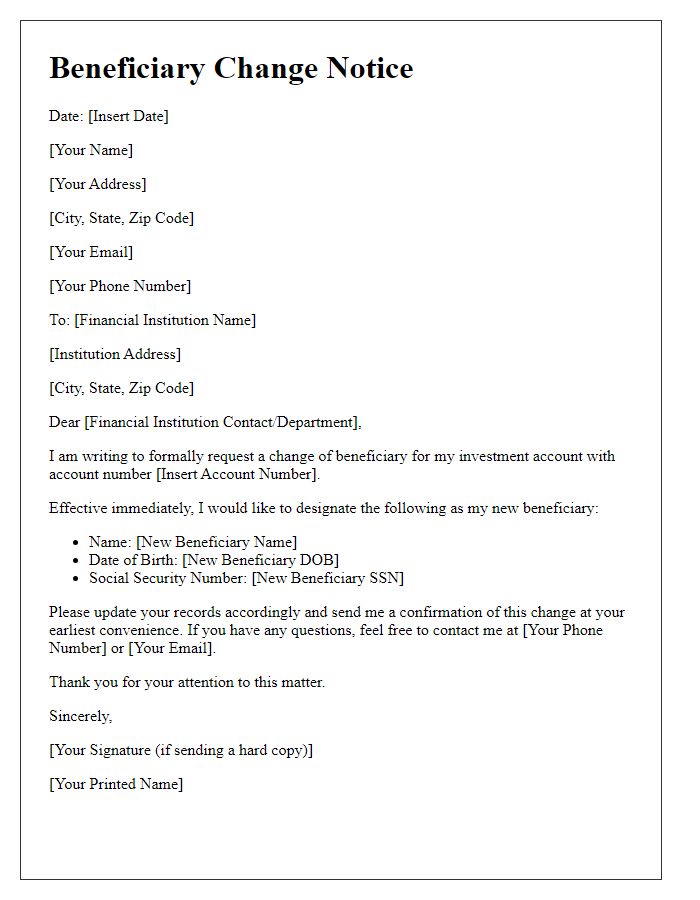

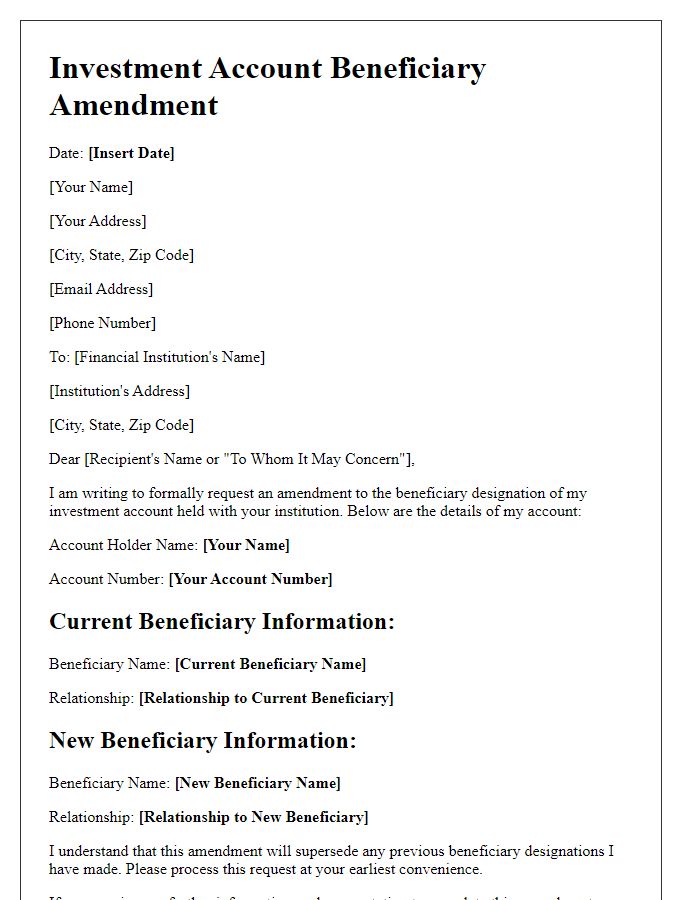

Authorization and Consent

To update a beneficiary on an investment account, it is essential to provide clear authorization and consent. This includes specifying the investment account type, such as a brokerage account or retirement fund (like an IRA), along with the account number for identification. The concerned financial institution, like Fidelity Investments or Charles Schwab, requires the current beneficiary's full legal name, relationship to the account holder, and Social Security Number. The new beneficiary's details must also be included, with similar information provided to ensure proper documentation. Additionally, the language should state that the account holder is revoking any previous beneficiary designations and confirming understanding of the implications, which may include potential tax consequences and distribution policies upon the account holder's passing. Finally, signing and dating the document reinforces the account holder's intent and consent, complying with financial regulations.

Contact Information for Follow-Up

Updating the beneficiary information for an investment account can ensure that asset distribution aligns with personal intentions and estate planning. It is essential to have accurate details for beneficiaries, such as full names, Social Security numbers, and contact information including phone numbers and email addresses. Additionally, documentation regarding the relationship to the account holder, such as spouse, child, or trust, should be organized to facilitate smooth processing by the financial institution. This information allows financial advisors and estate executors to follow up effectively, ensuring that all parties are informed regarding beneficiary designations and that the estate settlement process proceeds without complications. A designated point of contact (like a primary financial advisor) should always be available to answer questions or provide clarity as it relates to the investment account policies and beneficiary updates.

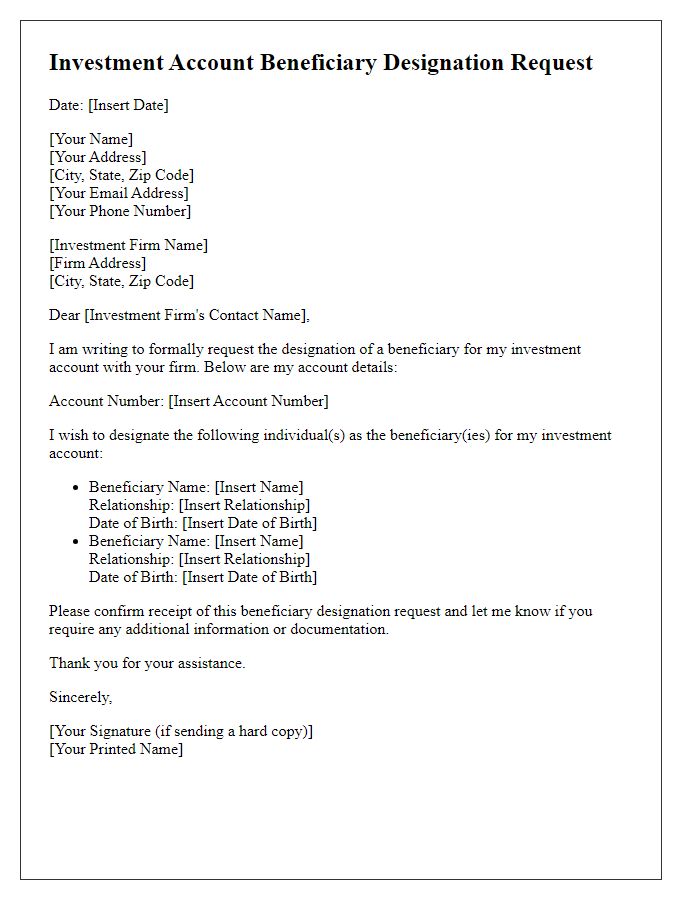

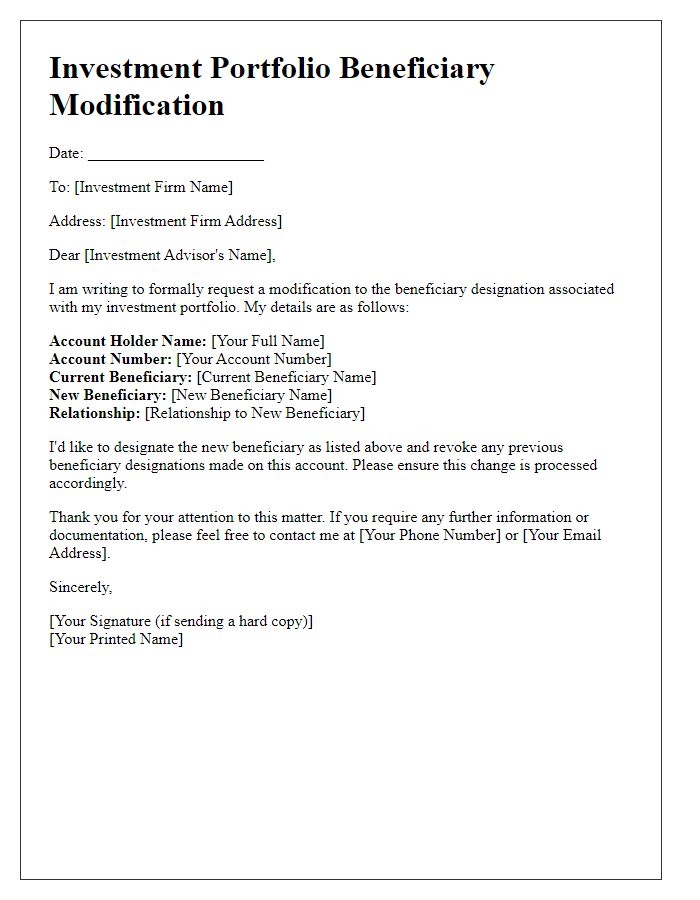

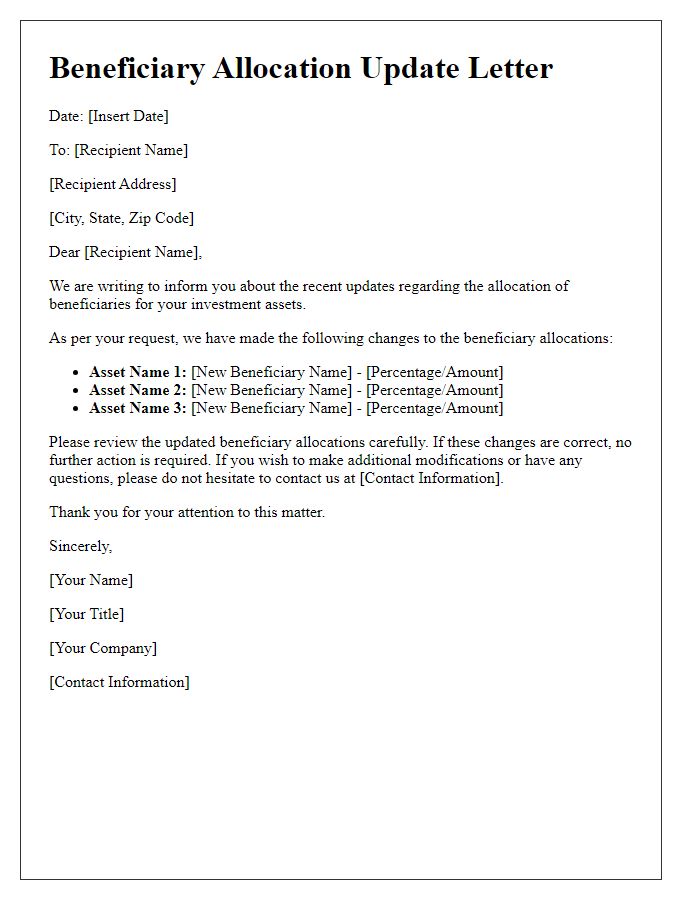

Letter Template For Investment Account Beneficiary Update Samples

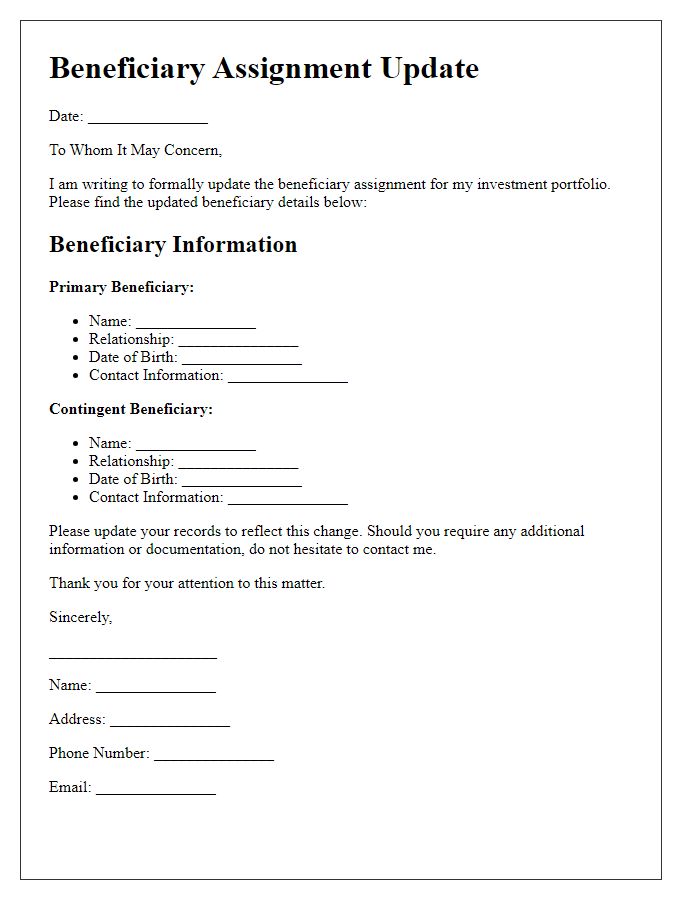

Letter template of beneficiary assignment update for investment portfolio

Comments