Are you looking to simplify your investment account tax statement request? Understanding how to draft a clear and concise letter can make the process less daunting. By following a structured template, you can ensure that all necessary information is included, which will help expedite your request. Let's explore the essential components and tips for writing your own effective letterâkeep reading to discover more!

Account Holder Information

The request for an investment account tax statement typically begins with the account holder's information, including full name, address, contact number, and account number. This data ensures proper identification and management of the account, especially for tax reporting purposes. In many cases, the tax statement covers various transactions throughout the year, such as dividends, capital gains, and interest earned, which are required for accurate tax filings. Each financial institution may have specific guidelines for submitting these requests, including required forms or identification verification. Timely receipt of this statement is crucial, often needed before the tax filing deadline of April 15 in the United States.

Account Number and Details

Investors often need to request tax statements for their investment accounts, such as those related to mutual funds or brokerage accounts. Tax statements, like Form 1099 for U.S. taxpayers, provide crucial information about capital gains or losses, dividends, and other earnings. These statements are typically needed for accurate tax reporting during the annual tax season, specifically by April 15th in the U.S. Providing the specific account number, such as 123456789, and relevant personal details can streamline the request process. Accurate information ensures timely delivery and helps avoid potential tax filing delays or issues with the Internal Revenue Service (IRS).

Request for Tax Statement

The process of acquiring an investment account tax statement is vital for accurate financial reporting and compliance during tax season, typically experienced in early April in the United States. Financial institutions, like Vanguard or Fidelity, usually issue these statements that summarize tax-related information concerning capital gains, dividends, and interest accrued over the previous year, essential for individual tax filings. Investors should ensure they have adequate identification details, such as account numbers and personal identification information, ready for submission when requesting this document. Online platforms may offer a streamlined request process, but contacting customer service directly may sometimes facilitate immediate assistance, especially for complex accounts involving multiple investment vehicles.

Contact Information for Follow-up

The request for an investment account tax statement is a vital procedure for investors seeking clarity on their financial standings for the preceding tax year. This tax statement, typically issued by financial institutions like Fidelity Investments or Charles Schwab, includes comprehensive details about dividends received, interest earnings, and capital gains or losses, which are essential for accurate tax filing. Investors should ensure they provide accurate personal information such as Social Security Number and specific account numbers to facilitate a smooth request process. Following up through designated contact methods, such as customer service lines or secure messaging within online banking platforms, will ensure timely assistance and prompt delivery of the requested documents. It is advisable to keep a record of any correspondence, including dates and names of representatives spoken with, for future reference.

Signature and Date

The request for an investment account tax statement requires a formal communication approach. The investment account (e.g., IRA, 401(k), brokerage account) should be mentioned with specific details like account number to ensure proper identification. Tax statements typically include crucial data such as dividends earned, capital gains incurred, and any relevant deductions for the tax year, often by April 15th, making timing essential. The signature at the end (dated for legal purposes) confirms the account holder's authorization for the request. Note: Ensure that the communication is directed to the appropriate financial institution, such as Charles Schwab, Fidelity Investments, or others, which may have distinct procedures for retrieving such documents.

Letter Template For Investment Account Tax Statement Request Samples

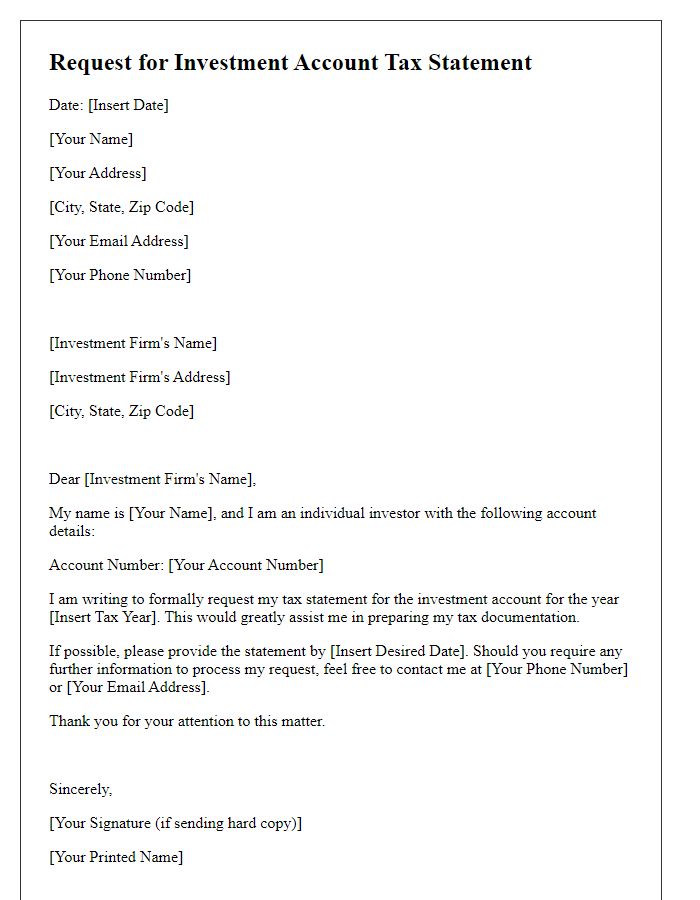

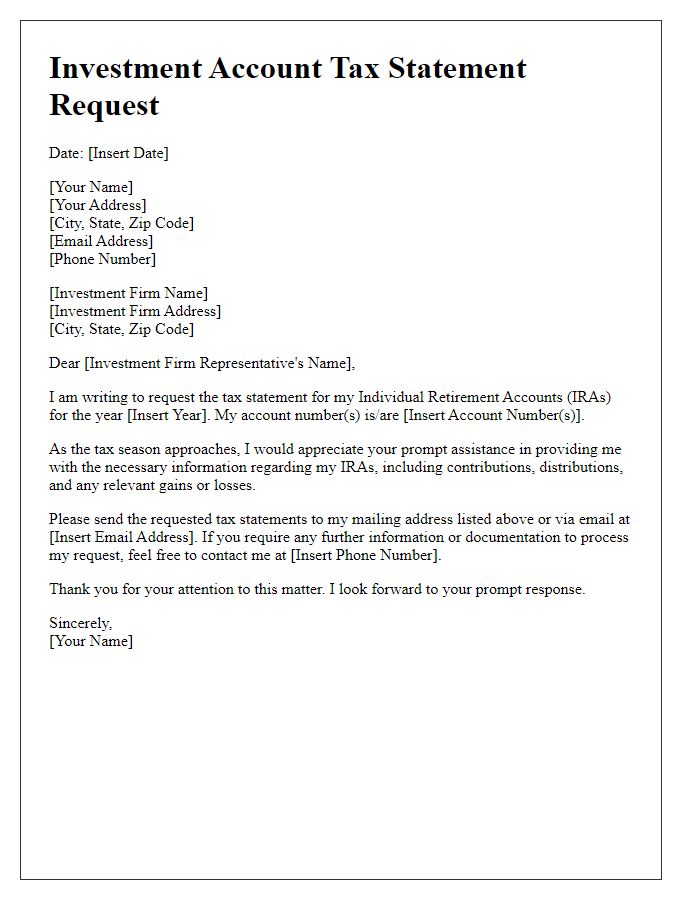

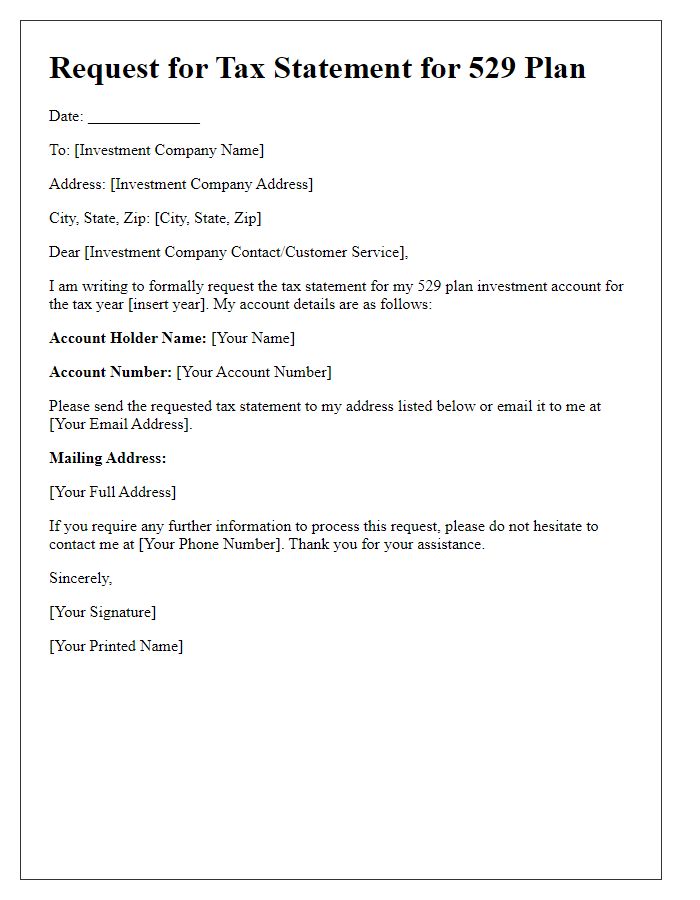

Letter template of investment account tax statement request for individual investors.

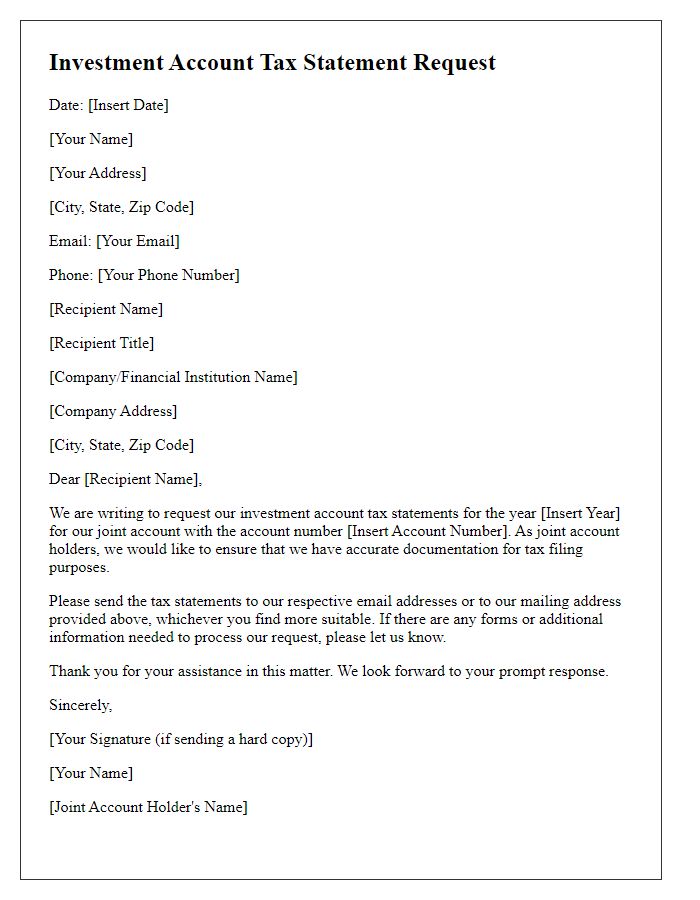

Letter template of investment account tax statement request for joint account holders.

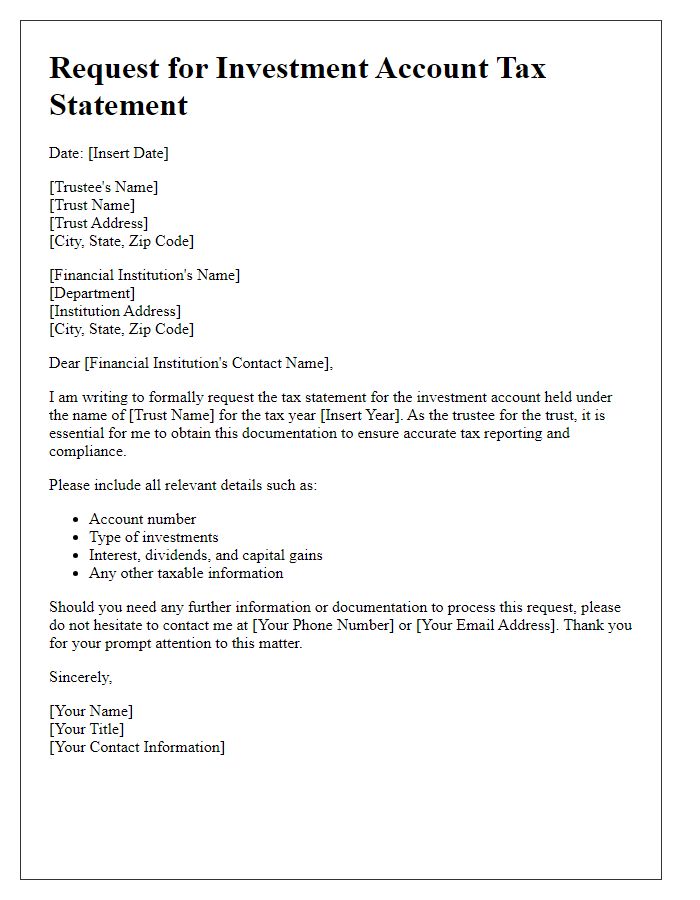

Letter template of investment account tax statement request for trust accounts.

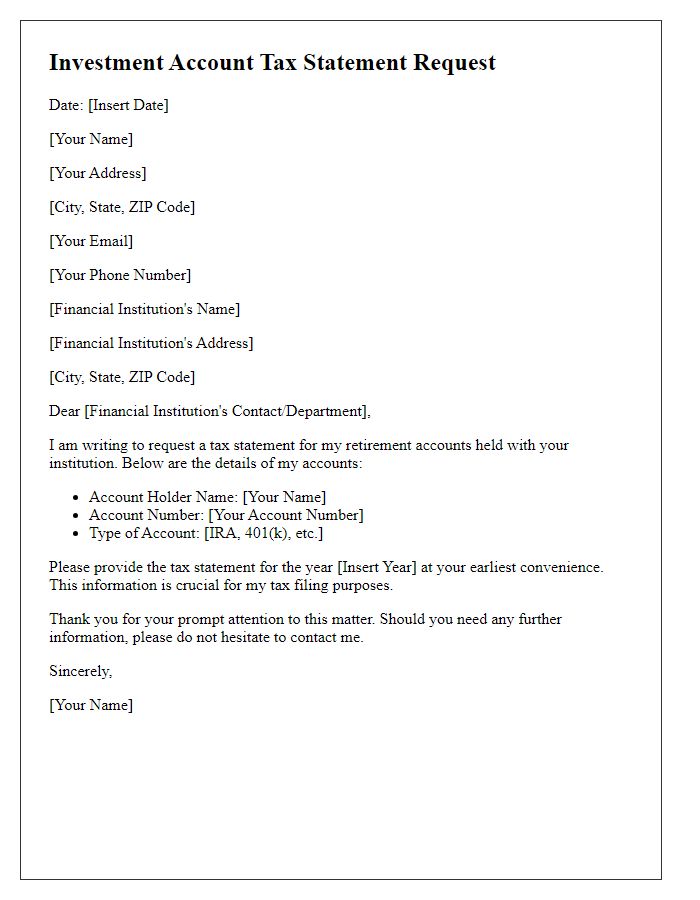

Letter template of investment account tax statement request for retirement accounts.

Letter template of investment account tax statement request for corporate accounts.

Letter template of investment account tax statement request for tax-exempt entities.

Letter template of investment account tax statement request for estate accounts.

Letter template of investment account tax statement request for self-directed accounts.

Comments