Are you ready to make a significant leap in your business journey? Capital investment commitments can be a game changer, driving growth and unlocking new opportunities. In this article, we'll guide you through the essential elements of crafting a compelling letter that confirms your investment intent. So, let's dive in and explore how you can secure that vital commitment!

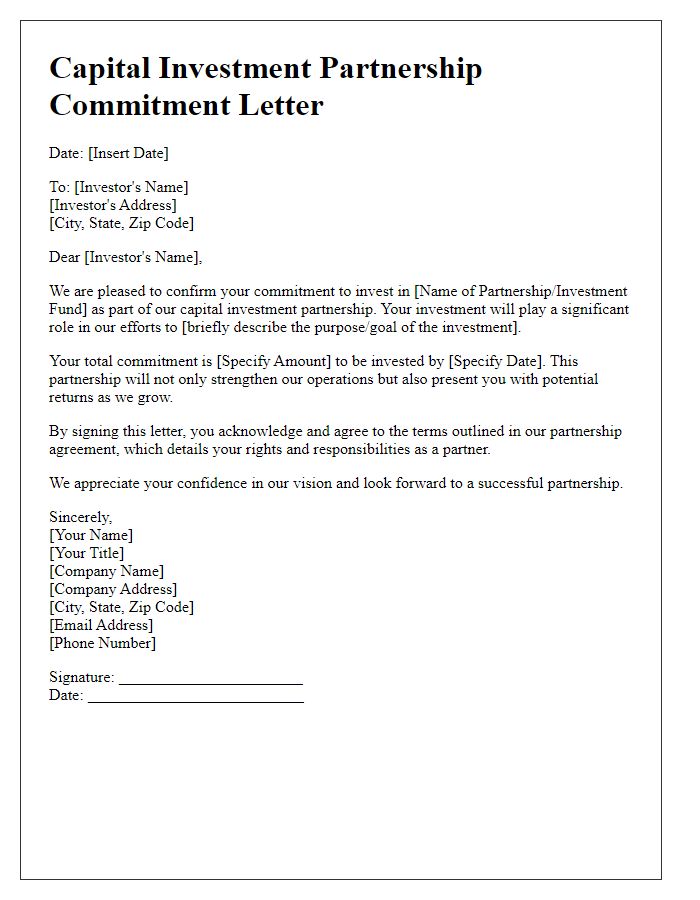

Clear identification of parties involved

In capital investment scenarios, both investors and recipients play pivotal roles. Investors, such as venture capital firms or individual angel investors, typically provide essential funding, which can range from thousands to millions of dollars, supporting startups or established companies. Recipients include organizations or entrepreneurs, within industries like technology, healthcare, or renewable energy, seeking financial assistance to scale operations, develop products, or expand market presence. Precise identification of these parties ensures clarity, promotes trust, and establishes accountability in the investment agreement, which is crucial for fostering long-term partnerships and successful financial outcomes.

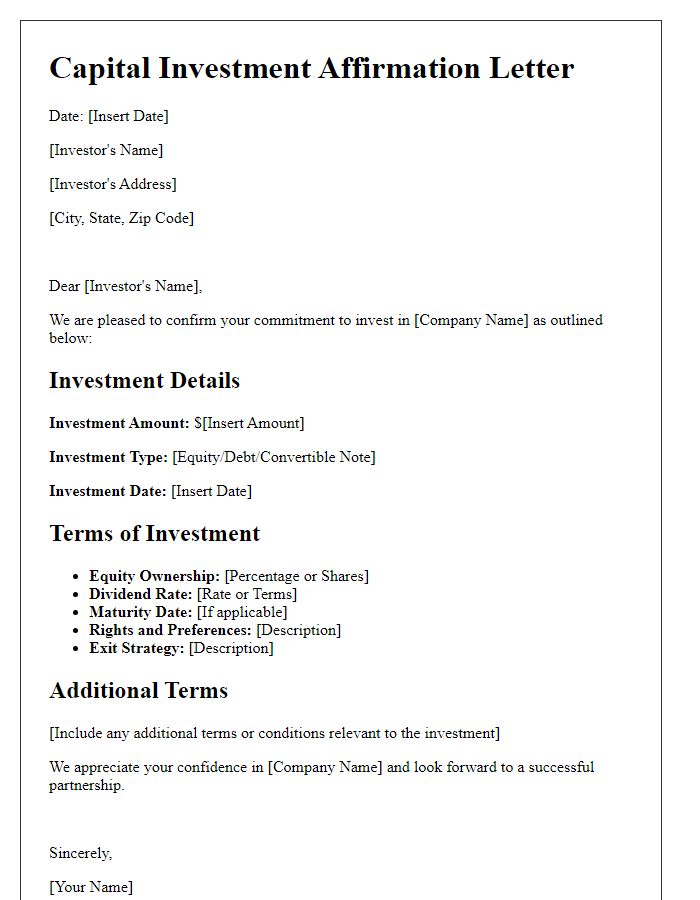

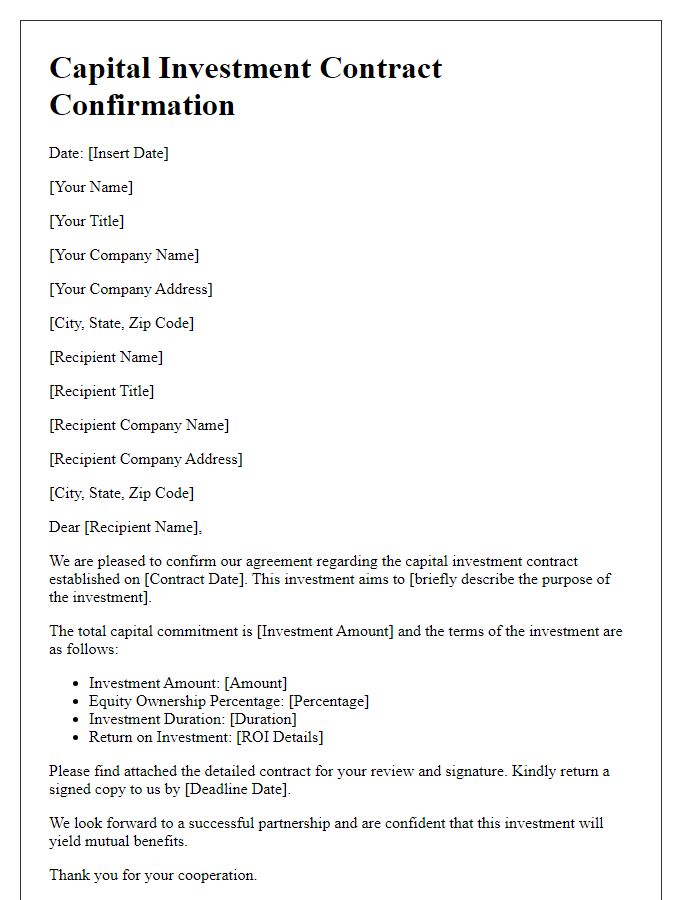

Detailed description of investment terms

A capital investment commitment confirmation outlines the specific terms of an investment agreement between an investor and a business entity. The investment amount, typically specified in currency denominations such as USD or EUR, may range from thousands to millions of dollars. The duration of the investment commitment can span several months or years, often stated as a fixed term, such as three to five years. Interest rates, if applicable, could be fixed or variable, dependent on market conditions. Voting rights attached to the investment may grant investors influence over key business decisions. Financial projections, including expected return on investment (ROI) based on projected revenue growth of the business, provide clarity on the potential financial outcomes. Exit strategies, such as initial public offerings (IPOs) or acquisition possibilities, detail how investors can realize their investment gains. All terms are typically subject to legal review to ensure compliance with regulations and to protect both parties' interests.

Commitment duration and timeline

Capital investment commitment confirmation involves detailed aspects such as the duration and timeline of the financial engagement. Typically, a commitment duration spans five to ten years, aligning with the strategic objectives of the investment project. Timelines often include key milestones such as initial funding disbursement, project implementation phases, and projected return-on-investment reviews, typically occurring bi-annually or annually. A comprehensive overview ensures clarity for stakeholders, detailing the involvement of various entities like venture capital firms or private equity investors and specifying the expected outcomes, thus fostering transparency and accountability in the commitment process.

Clauses for legal compliance and regulations

Capital investment commitments require adherence to specific legal compliance regulations. These regulations, often dictated by governing bodies such as the Securities and Exchange Commission (SEC) in the United States, ensure transparency and protect investors. The commitment may include clauses that stipulate adherence to the Sarbanes-Oxley Act (SOX), which enhances corporate governance and accountability. Furthermore, compliance with the Investment Company Act and federal and state securities laws is crucial, ensuring that all communications regarding investment terms meet regulatory standards. Legal counsel should review all documents to mitigate risks associated with non-compliance, which can result in significant penalties or litigation. Each commitment may also require disclosure of material facts, providing investors with essential information to make informed decisions.

Contact information for further communication

The capital investment commitment confirmation outlines the details of significant investments made by investors in various ventures, typically involving amounts exceeding $100,000. This document is crucial for ensuring clarity between stakeholders, fostering trust in business partnerships. Key elements often include specific terms and conditions regarding the investment, projected timelines for returns, and potential risks associated with the venture. Party names, such as the investing entity and the recipient business, are also emphasized. For further communication, individuals may provide contact information, including phone numbers, email addresses, and mailing addresses, facilitating direct discussions about the progress and performance of the investment.

Comments