Are you considering a change in your investment portfolio allocation? It's a pivotal decision that can significantly impact your financial future. Understanding the nuances of your options and how they align with your goals is essential for making informed choices. Join me as we delve deeper into the factors to consider and explore the best strategies for reallocating your investments!

Purpose Statement

Investment portfolio allocations require meticulous planning to align with risk tolerance and financial goals. For instance, reallocating assets may involve adjusting the percentage of equities, bonds, and alternative investments to optimize returns. Factors influencing these changes could include market volatility, economic indicators such as inflation rates, or shifts in personal circumstances like a job change. An effective purpose statement articulates these intent-driven adjustments, ensuring clarity on objectives such as capital growth, income generation, or preservation of wealth across a diversified portfolio, ideally suited for navigating fluctuations in global markets.

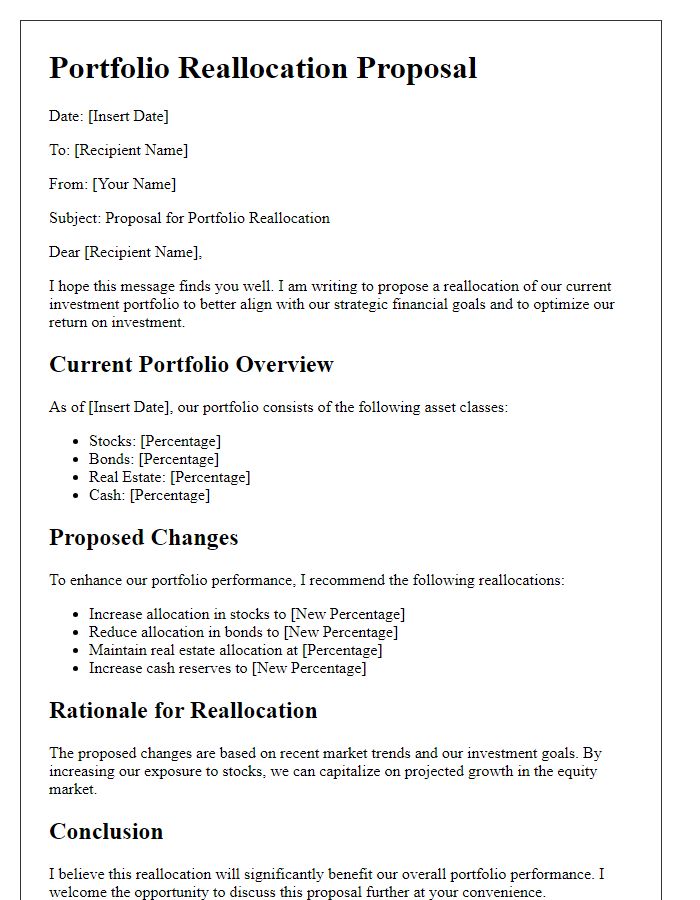

Current Portfolio Overview

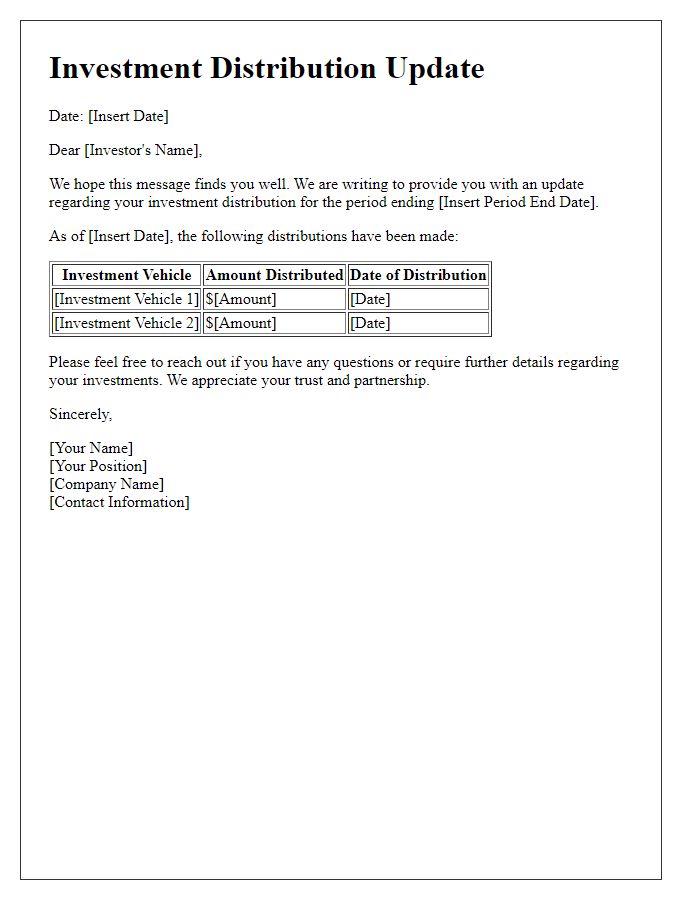

Current portfolio allocation demonstrates a diversified mix across various asset classes, including equities, fixed income, and alternative investments. The total equities allocation comprises approximately 60% of the overall portfolio value, with notable investments in technology companies such as Apple (AAPL) and Microsoft (MSFT), which contribute significant growth potential. The fixed income segment, representing about 30%, consists primarily of U.S. Treasury Bonds and corporate bonds, providing stability and income generation. Alternative investments, making up the remaining 10%, include positions in real estate investment trusts (REITs) and commodities like gold, helping to hedge against inflation. The overall portfolio performance aligns with a moderate risk tolerance, yielding a year-to-date return of approximately 7%, while maintaining a balanced approach to risk and reward.

Desired Allocation Adjustment

Investment portfolio allocation adjustments can significantly impact overall returns and risk management strategies. Diversifying investments across various asset classes, including stocks, bonds, and real estate, is essential for optimizing performance. For instance, increasing allocation to emerging markets, such as Brazil or India, can provide growth opportunities, potentially yielding returns exceeding 15% annually during economic upswings. Conversely, reallocating funds to fixed-income securities, like U.S. Treasury bonds, offers stability and income generation, particularly during market volatility. Assessing risk tolerance, market conditions, and personal financial goals are crucial before making any changes to ensure the adjusted portfolio aligns with long-term investment objectives.

Rationale for Change

Investment portfolio allocation change can significantly impact overall financial health. A shift in market conditions, such as increased inflation rates of 6% or changes in interest rates set by the Federal Reserve, can necessitate reevaluation. Diversification strategies may require adjustments, especially following a downturn in specific sectors like technology, which experienced a 25% decline in 2022. Incorporating emerging markets, for instance, could capitalize on growth potential, particularly in Asia, where GDP growth rates are projected to exceed 5% in 2023. Additionally, reallocating funds from underperforming assets to bonds with higher yield prospects can enhance stability and yield a more favorable risk-return profile.

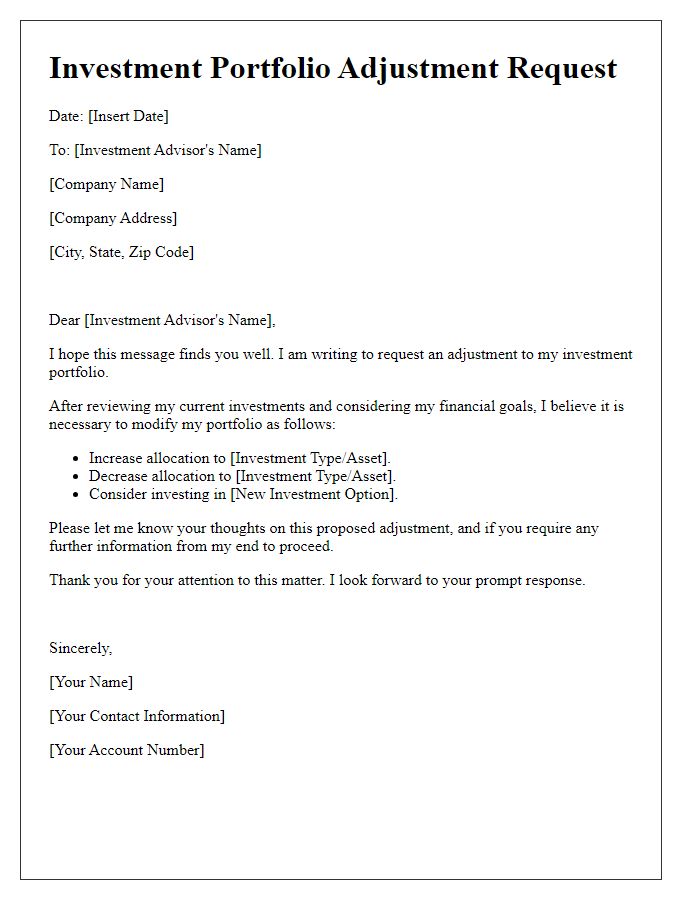

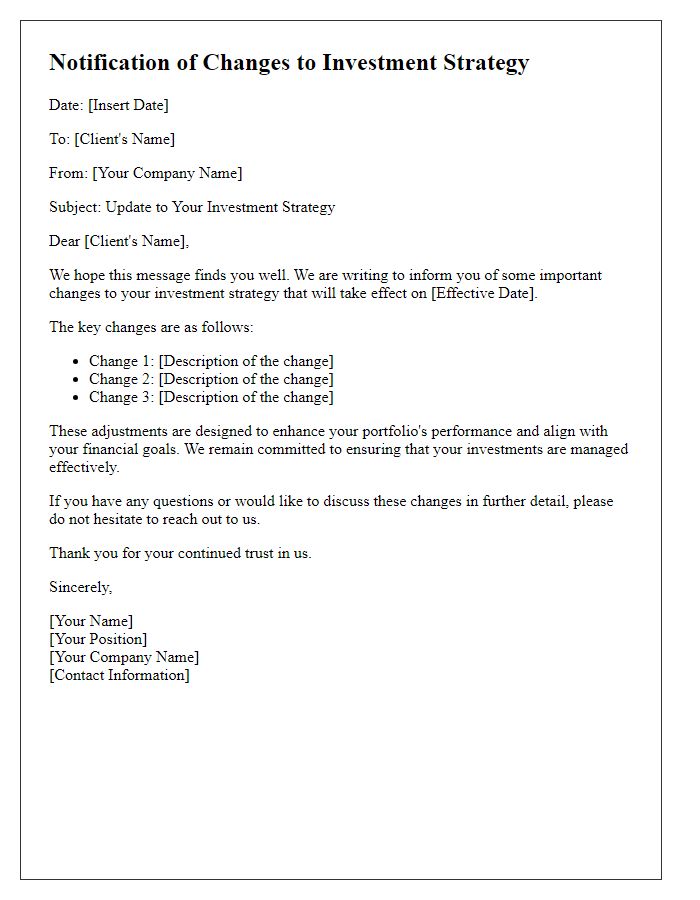

Call-to-Action and Contact Information

Modification of an investment portfolio requires careful consideration of asset allocation strategies to optimize financial growth. Investment portfolios, typically composed of various asset classes such as stocks, bonds, and cash equivalents, may need adjustments based on market trends or personal financial goals. Recent data indicates that equities, especially in technology sectors, have shown significant growth potential, while bond yields have been comparatively low. Contact your financial advisor for an in-depth analysis of your current allocation, ensuring alignment with your risk tolerance and investment horizon. Reviewing options such as diversifying into emerging markets or alternative investments can be beneficial. Take proactive steps today to reassess your portfolio for better performance and peace of mind in the ever-changing financial landscape.

Comments