Have you ever found yourself in a challenging situation where your insurance policy was unexpectedly canceled? It can be frustrating and overwhelming, especially when you rely on that coverage for peace of mind. In these moments, knowing how to effectively appeal for reinstatement can make all the difference. Join us as we explore a helpful letter template for insurance reinstatement appeals that can simplify your process and increase your chances of success!

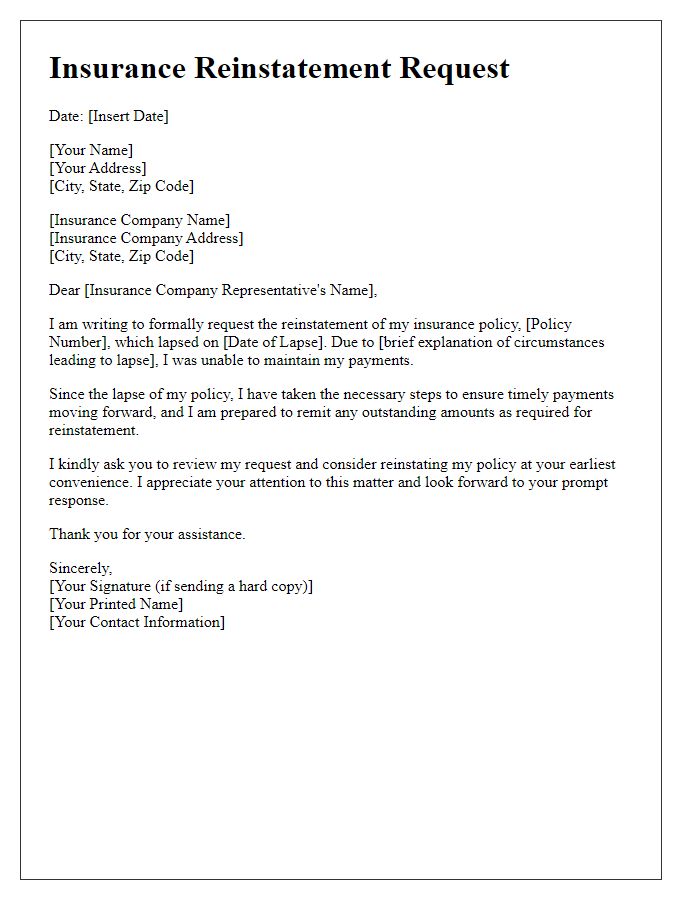

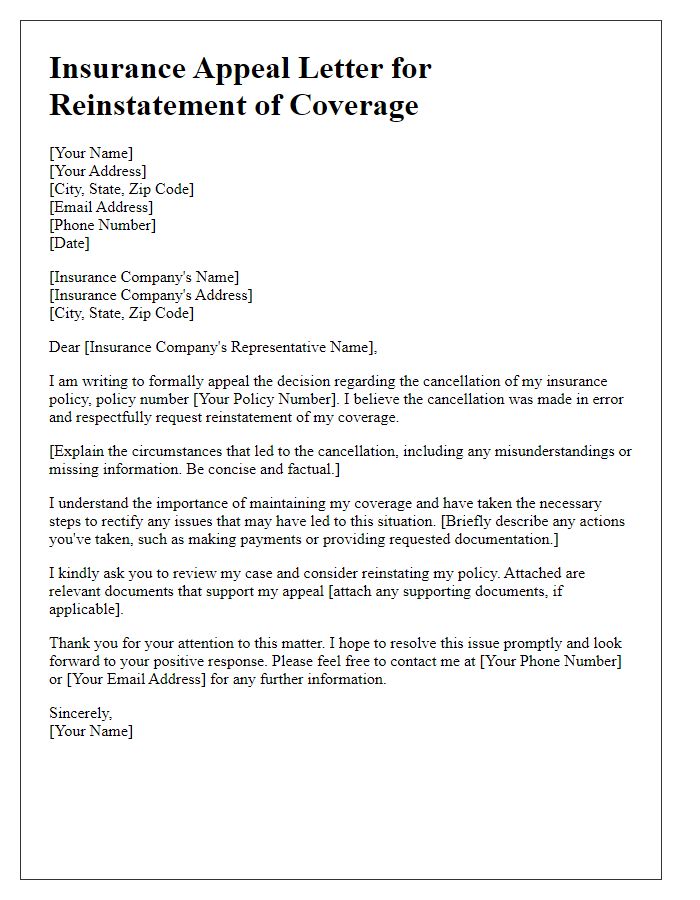

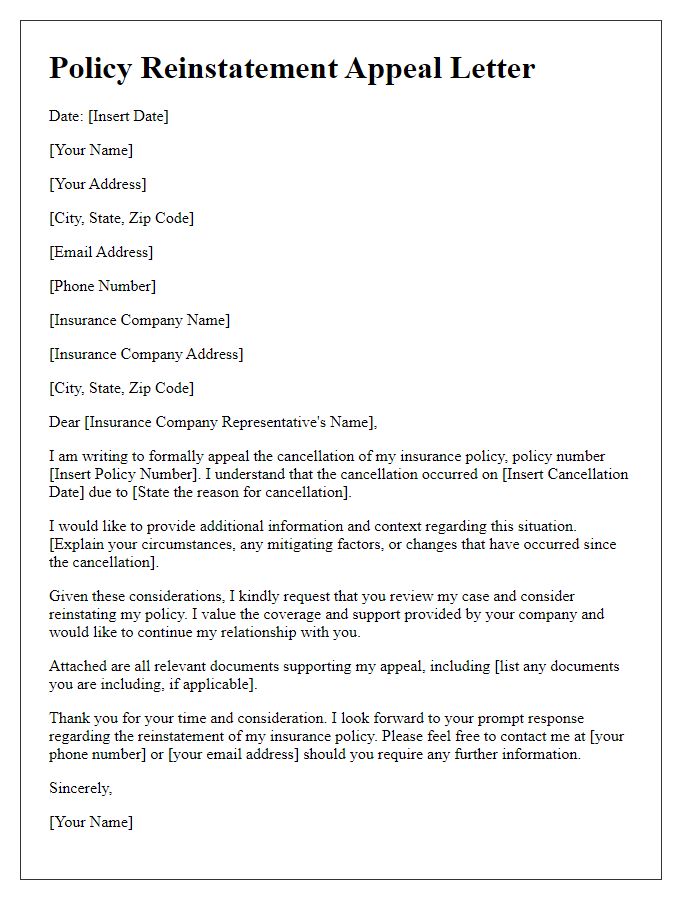

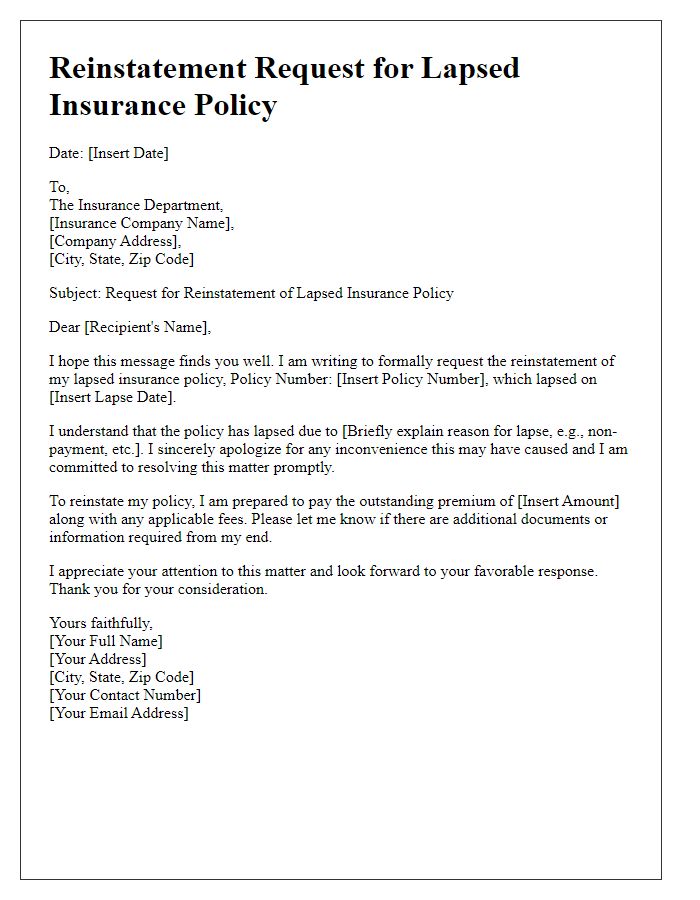

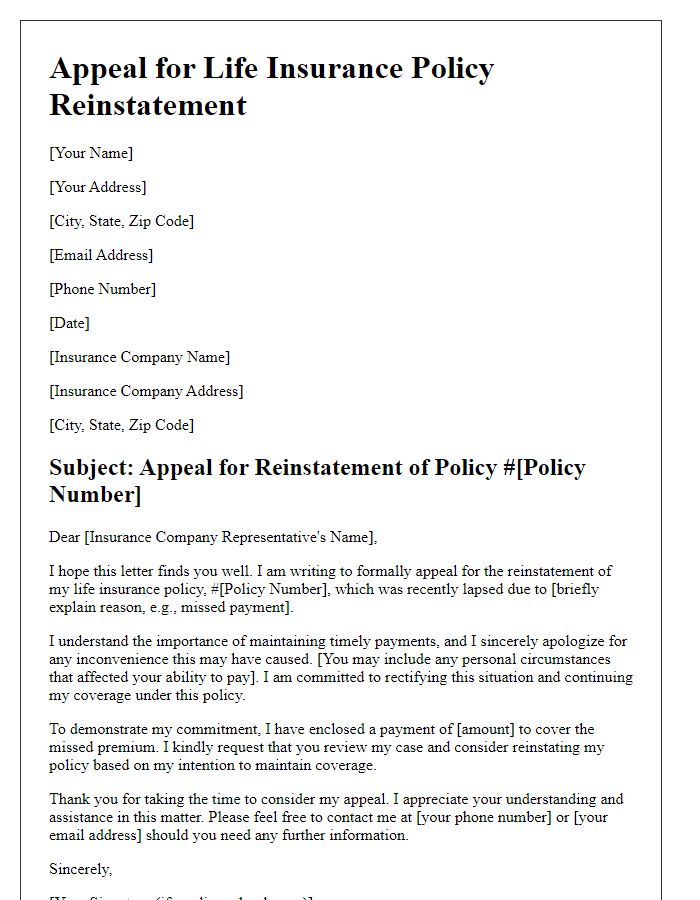

Policyholder information

Policyholders seeking insurance reinstatement must provide precise details, including their full name, policy number, and contact information. The policy number is essential for accurately identifying the account in question. Policyholders should include the date of the original policy issuance and the date of lapse to clarify the timeline of their coverage. Also, specifying the type of insurance--homeowners, auto, or health insurance--is necessary for processing appeals. Including reasons for lapse, whether due to non-payment, oversight, or financial hardship, can help the insurer evaluate the context of the appeal. Supporting documentation, such as payment records or financial statements, can strengthen the appeal case. Effective communication with the insurer can facilitate a smoother reinstatement process.

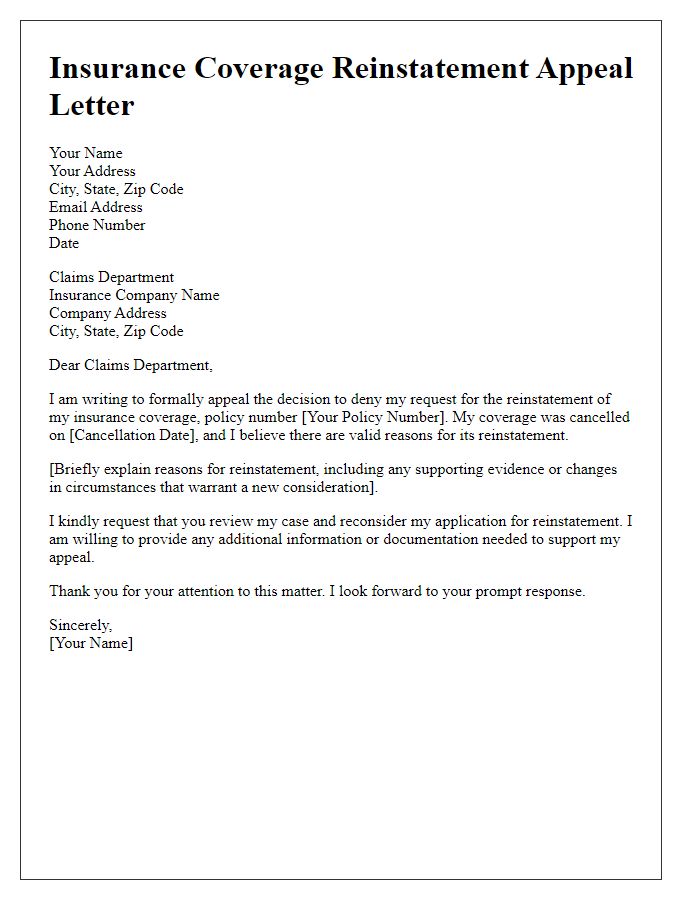

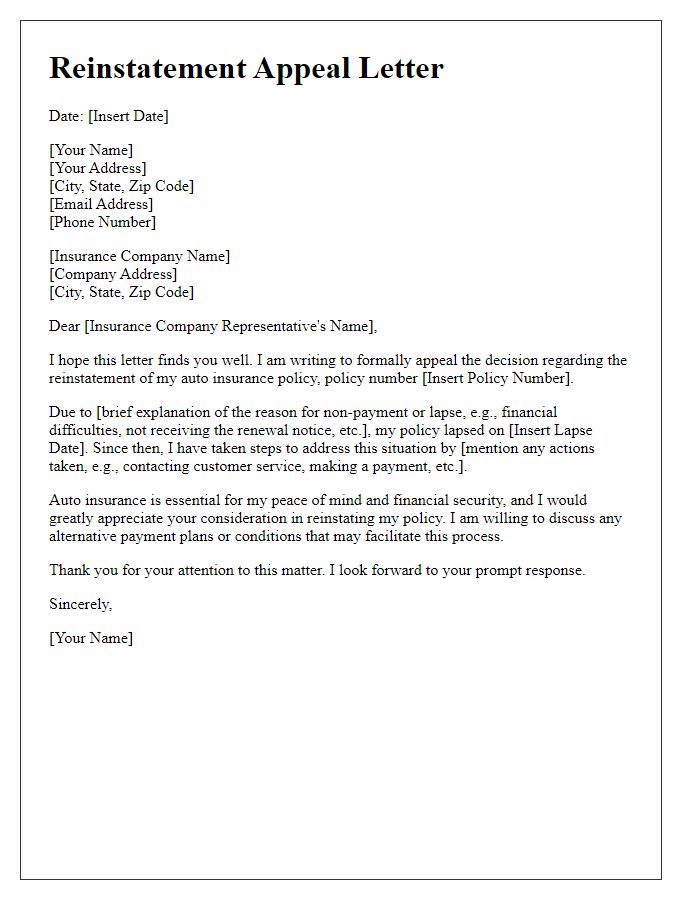

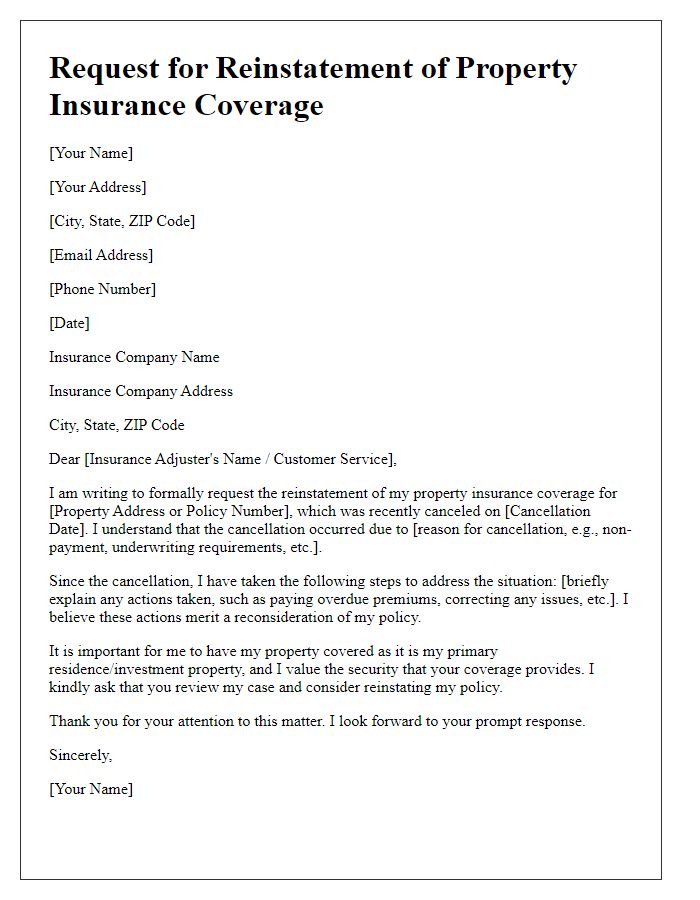

Policy details and lapse explanation

A policy lapse can occur for various reasons, including non-payment of premiums on health, auto, or life insurance policies. The policy number (e.g., 123456789), associated with the insured party (individual or business name), may have been affected by unexpected financial difficulties or billing errors. To appeal for reinstatement, it is crucial to provide a detailed explanation of these circumstances, including missed payments (e.g., due dates missed on January 15 and February 15), communication or correspondence with the insurance provider, and any relevant documentation proving intent to maintain coverage. Additionally, mentioning any changes in financial status or successful payments made post-lapse can reinforce the appeal, demonstrating commitment to reinstating the policy promptly.

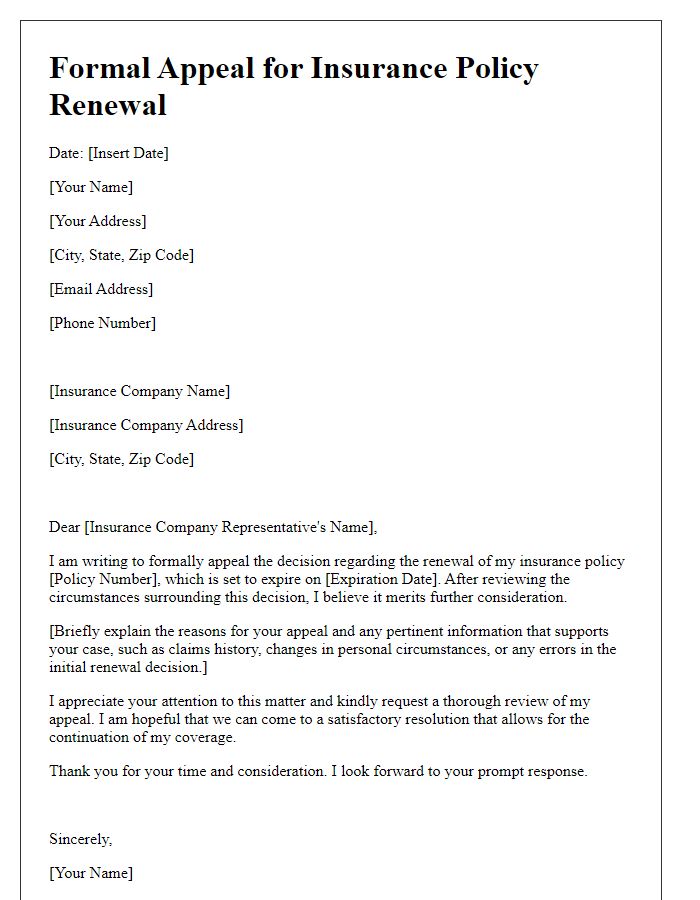

Reason for reinstatement request

An insurance reinstatement request often stems from circumstances such as financial hardship, lifestyle changes, or misunderstandings about policy terms. For instance, individuals may face unexpected medical expenses or job loss, impacting their ability to make timely premium payments. In cases where clients believed they had initiated a automatic payment plan but it failed due to a banking error, this could justify appeals for reinstatement. It is crucial to highlight any relevant documentation, like receipts or statements, demonstrating the effort made to maintain the policy. Notably, the appeals process often involves specific deadlines and forms, such as the reinstatement application, which should be submitted to the insurer's customer service department based in the primary office location for efficient processing.

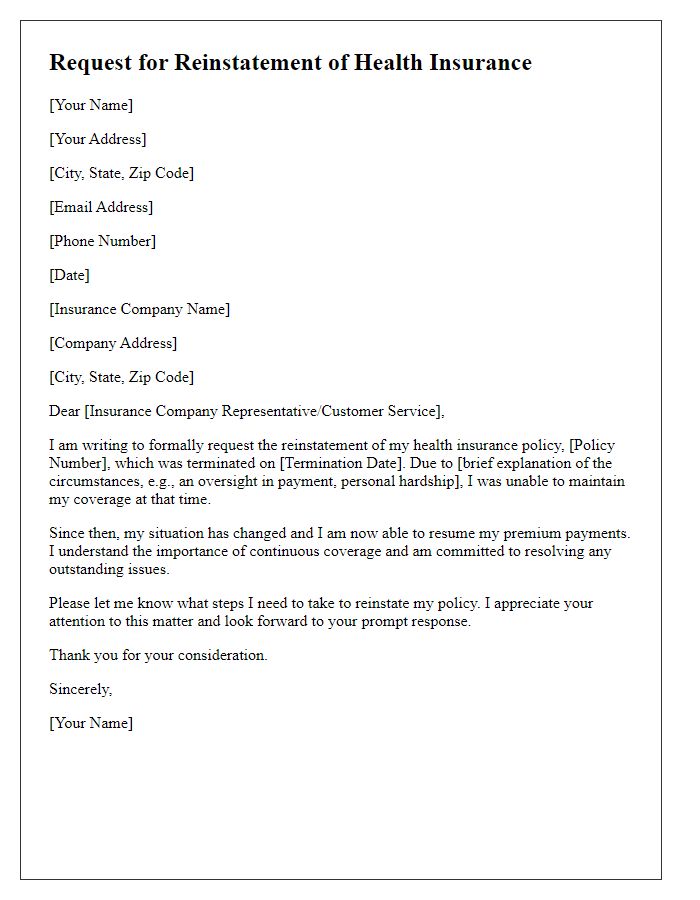

Evidence or documentation

Submitting evidence or documentation for an insurance reinstatement appeal requires careful attention to detail. Policy number (usually a combination of letters and numbers specific to each insured individual) must be clearly indicated, ensuring swift identification of the account. Include a detailed explanation of the circumstances surrounding the lapse, such as unexpected financial difficulties or medical emergencies that led to non-payment. Attach relevant documentation, like receipts of payment attempts or correspondence with the insurance provider, to establish credibility. Supporting documents may include medical records or bank statements demonstrating financial strain during the lapse period. All submissions should be organized and clearly labeled to facilitate the review process by the insurance company's appeals department.

Closing statement and contact information

In the final remark for an insurance reinstatement appeal, it is imperative to convey gratitude for the consideration given to the appeal. A clear expression of hope for a favorable resolution is essential, indicating readiness to provide additional information if necessary. Reiterate the policy number (specific digits) associated with the claim for ease of reference. Include complete contact details, including a phone number (specific format, e.g., (123) 456-7890) and a professional email address (example@example.com), ensuring that the insurance company can reach you promptly for any follow-up discussions or required clarifications.

Comments