Are you feeling overwhelmed by insurance policy fees? You're not alone, as countless individuals find themselves searching for ways to alleviate these financial burdens. In this article, we'll explore a simple yet effective letter template that you can use to request a waiver for your insurance policy fees. So, grab a cup of coffee and let's dive in to discover how you can potentially save money and gain peace of mind!

Accurate Policy Details

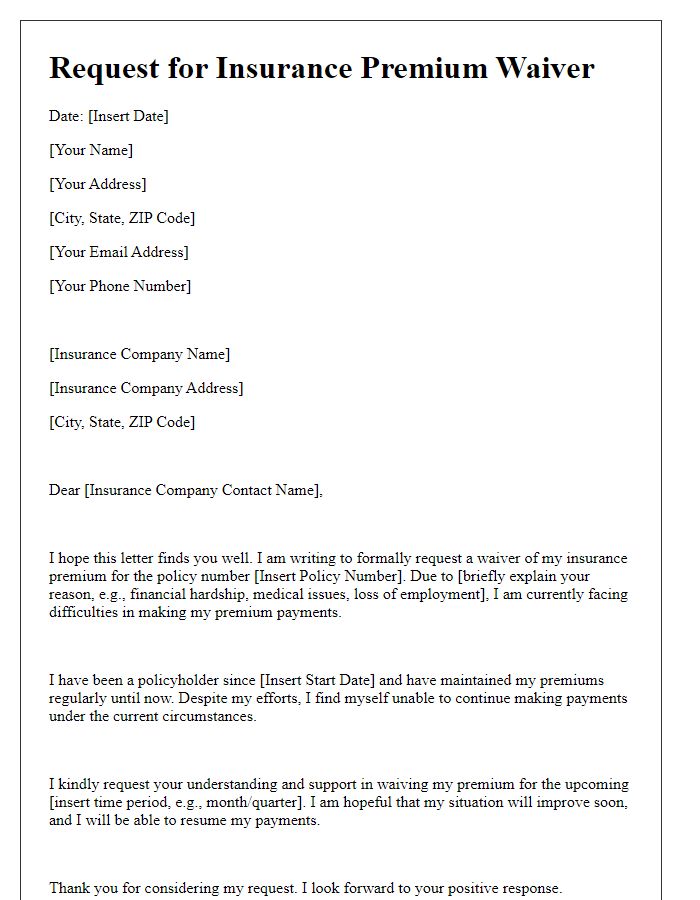

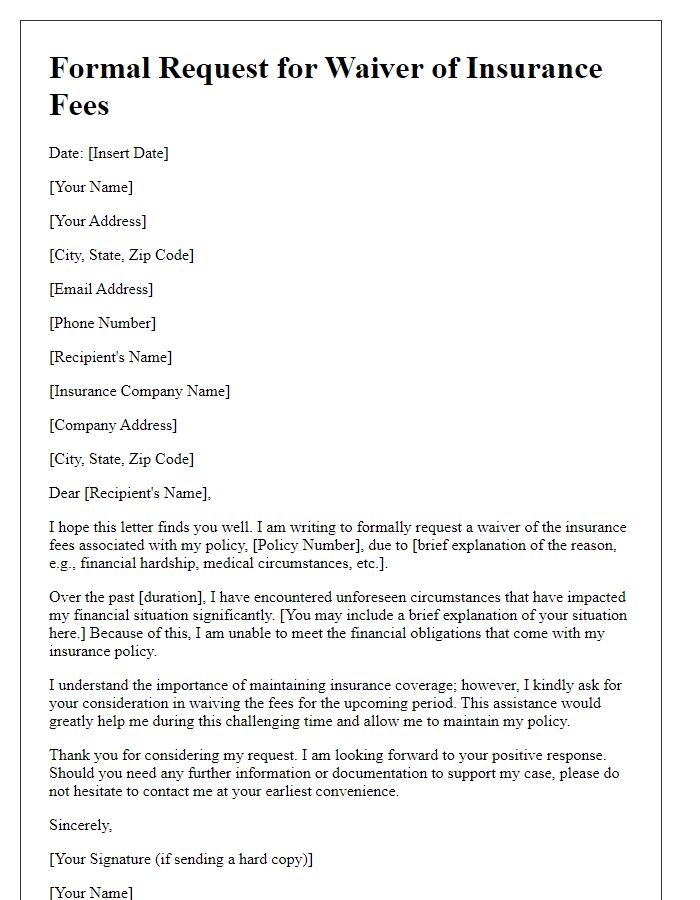

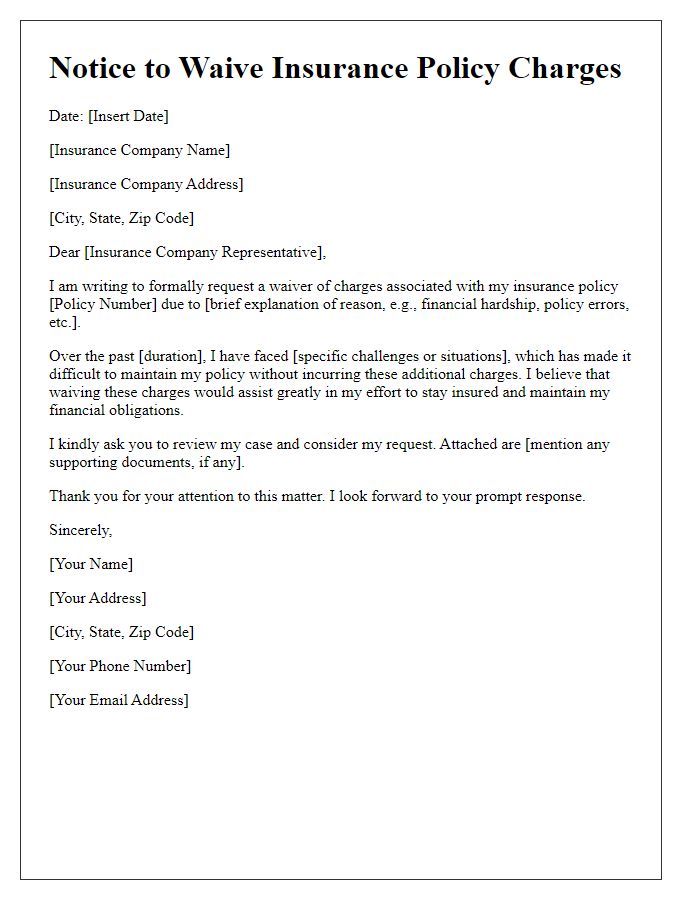

An insurance policy fee waiver request requires precise details to ensure proper processing. The policy number, typically a string of alphanumeric characters unique to each client, identifies the specific agreement with the insurance provider. Having the insured party's full name, reflecting the individual or entity responsible for the policy, is essential for accurate record-keeping. Including the date of the policy's inception, such as January 1, 2020, indicates the duration of coverage, which may influence the waiver decision. The coverage type, which could include health insurance, auto insurance, or home insurance, further clarifies the context. Lastly, outlining the reason for the waiver request, such as financial hardship due to the COVID-19 pandemic, or unexpected medical expenses, provides necessary justification for consideration by the insurance company's customer service team.

Personal Identification Information

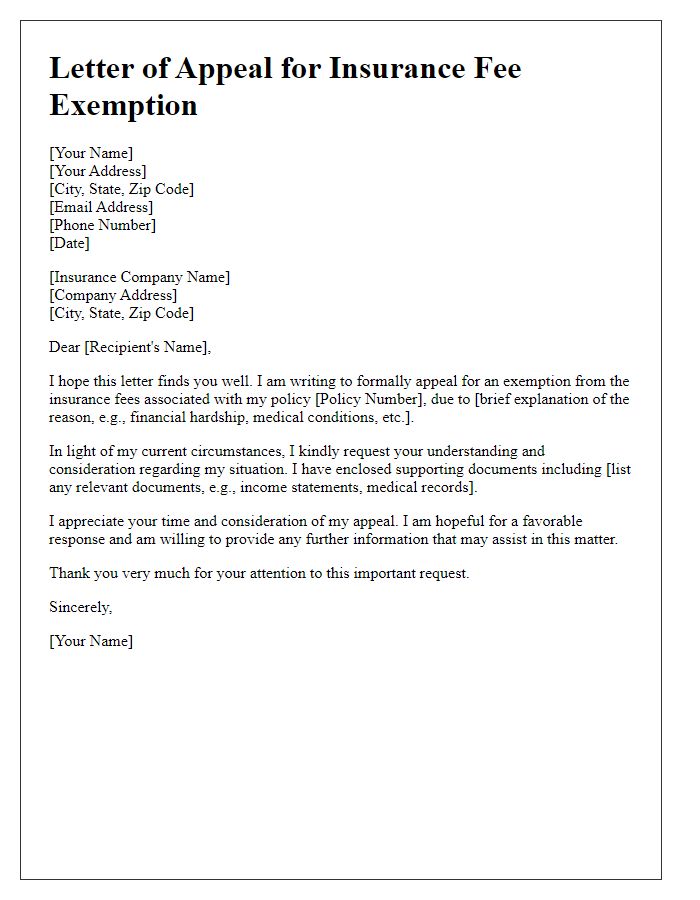

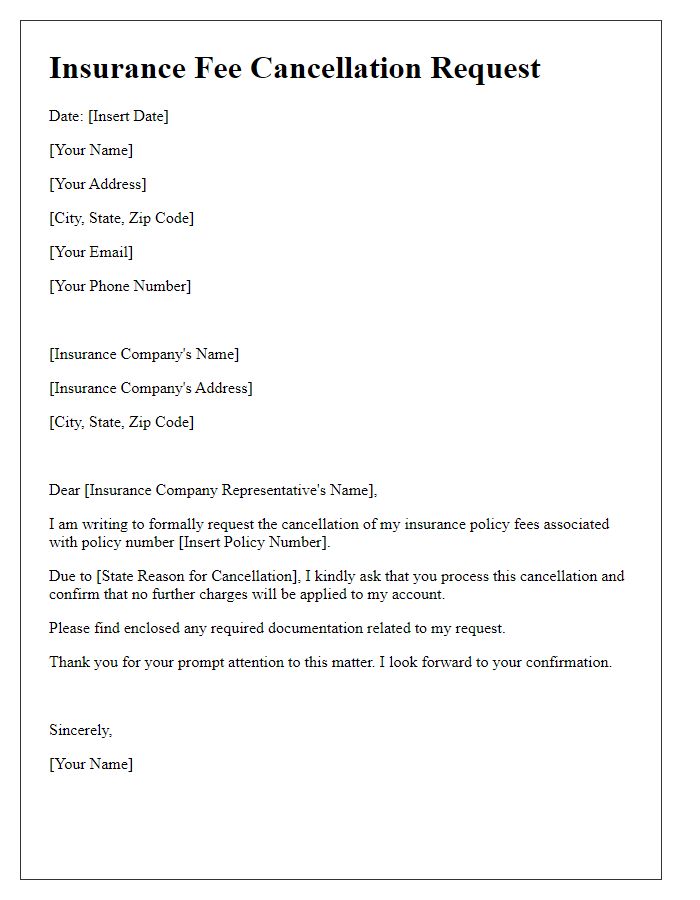

Insurance policy fee waivers provide significant relief for policyholders facing financial hardships. Clients, typically individuals or families, can apply for these waivers under specific eligibility criteria established by their insurance provider. Common requirements may include proof of unemployment, disability documentation, or other financial difficulties. The waiver process usually necessitates personal identification information, such as Social Security numbers and policy numbers, to validate claims and maintain accurate records. Different insurance companies, including prominent ones like State Farm and Allstate, may have varying approaches to processing these requests, impacting approval timelines and documentation needed. Understanding the policy terms and necessary steps for the fee waiver application can greatly assist policyholders in navigating potential financial pressures while ensuring compliance with insurance regulations.

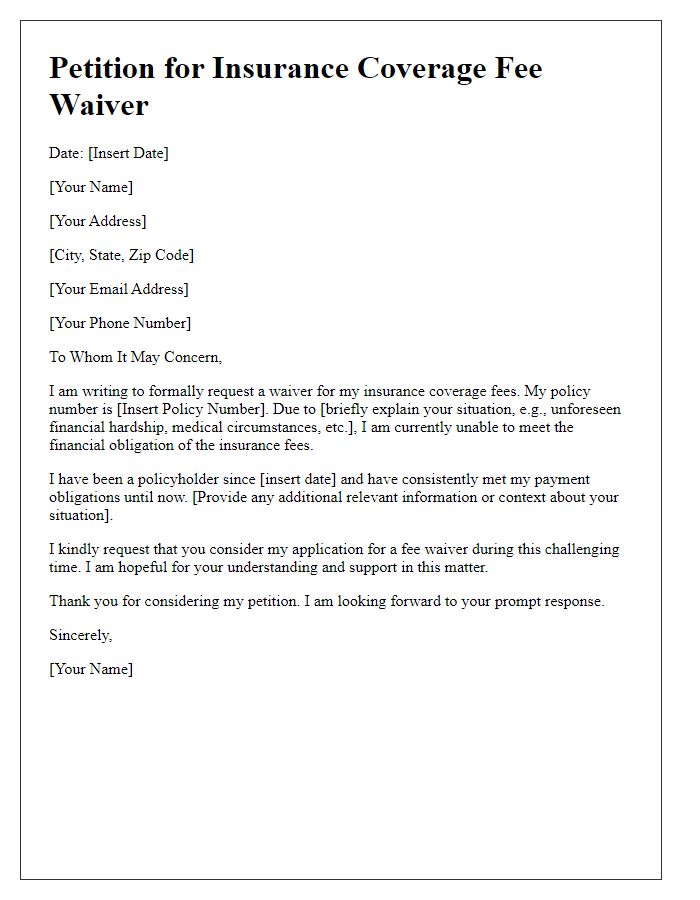

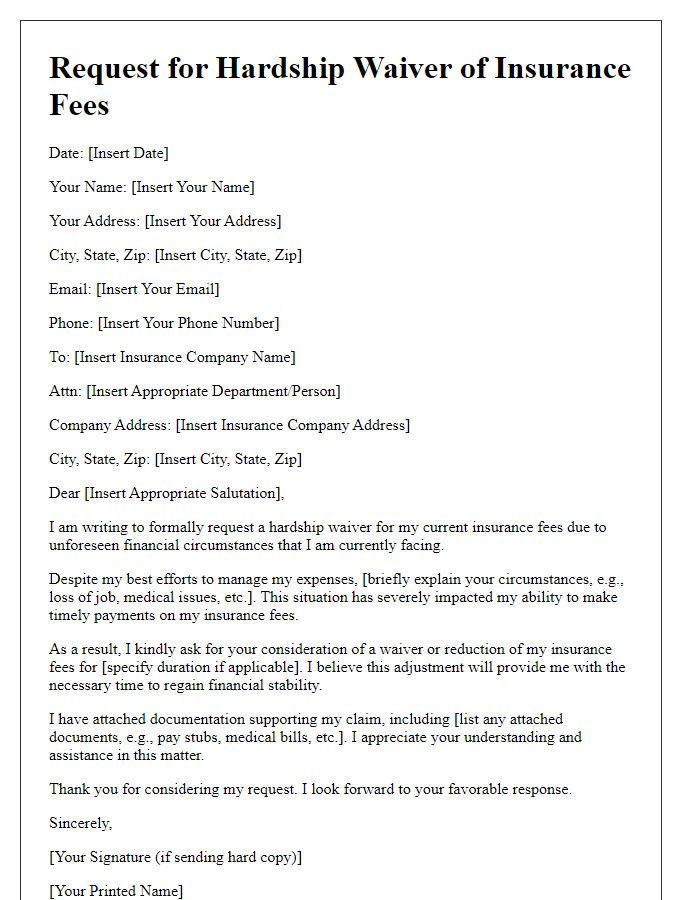

Reason for Waiver Request

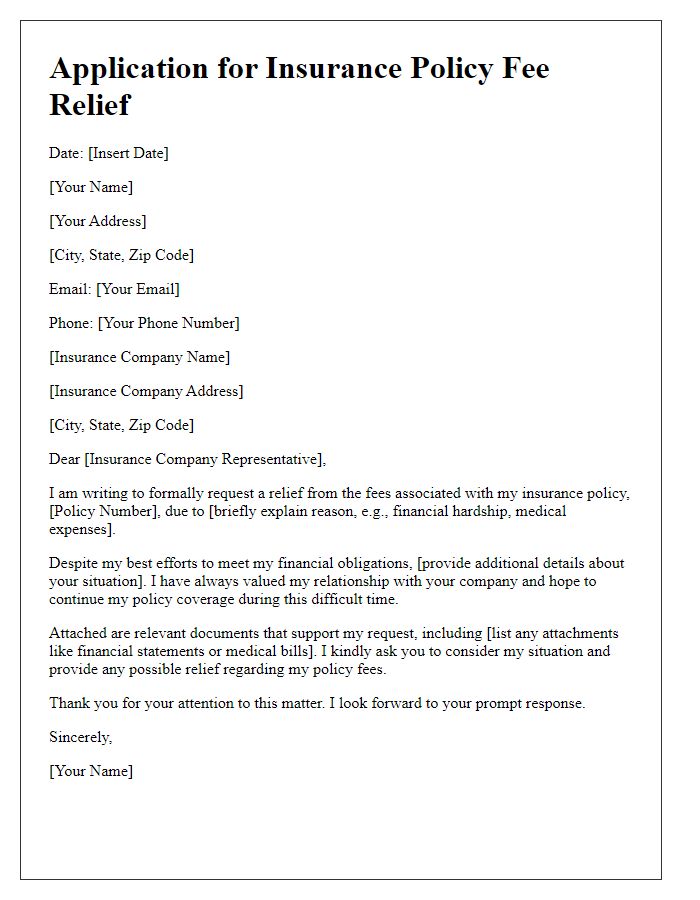

Insurance policy fee waiver requests often arise due to financial hardship or unforeseen circumstances. A significant change in personal circumstances, such as loss of employment or medical emergencies, may necessitate a waiver. In cases where policyholders face extreme challenges, such as natural disasters like hurricanes or wildfires, insurers often have provisions for such waivers. Additionally, humanitarian events, such as the COVID-19 pandemic, have commonly prompted fee waivers to alleviate economic distress for policyholders facing income loss. Documentation, including pay stubs or medical bills, might be required to substantiate the request, thus providing context for the waiver's necessity.

Supporting Documentation

Submitting supporting documentation for an insurance policy fee waiver involves providing essential details that validate the request. Documentation such as proof of income, bank statements, or medical records may be required, depending on the policy provider's guidelines. For example, if seeking a fee waiver due to financial hardship, income verification could include recent pay stubs, demonstrating the total income level, which may fall below a specified threshold set by the insurer. Furthermore, in the case of medical emergencies, hospital discharge papers detailing treatment dates and costs can substantiate the request. Each document should be clearly labeled and organized chronologically to facilitate the review process by the insurance company.

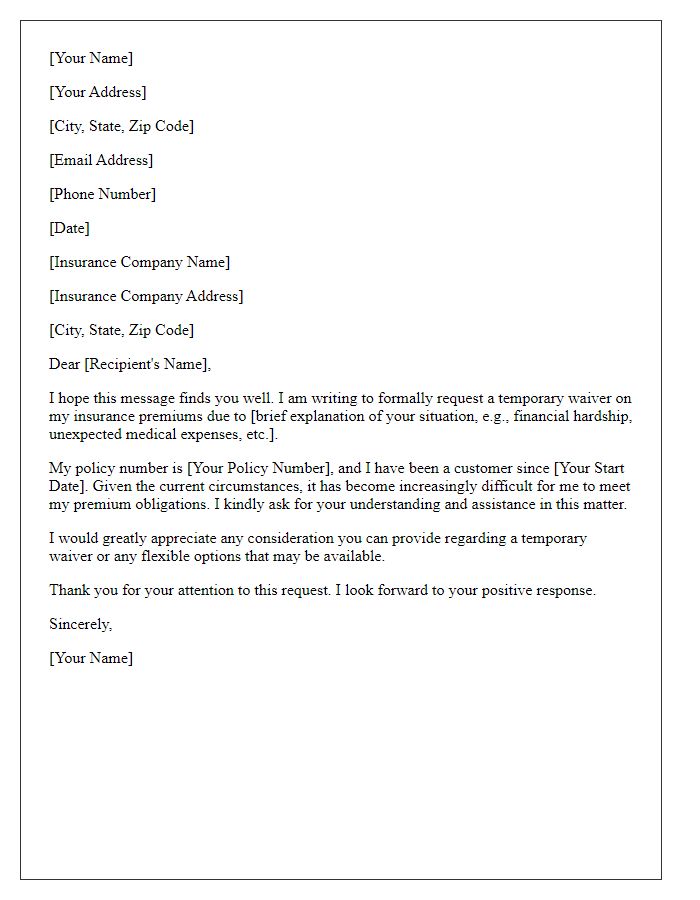

Contact Information

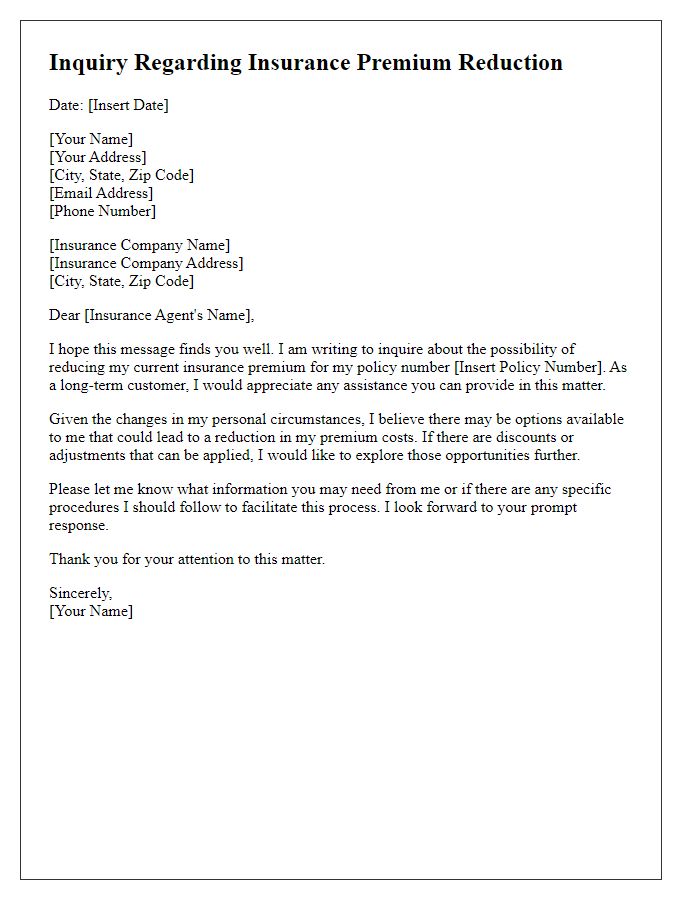

A fee waiver for an insurance policy can significantly impact policyholders, especially those facing financial hardship. Policyholders, often under undue stress, may seek relief from monthly premium payments, which average around $100 for standard coverage plans. Many insurance companies, such as Allstate or State Farm, have specific criteria that must be met to qualify for a fee waiver. Documentation like proof of income reduction, medical bills, or unemployment records--sometimes totaling thousands of dollars--might be necessary. This process involves contacting customer service departments, which may be located in regional offices across the United States, often resulting in lengthy wait times. Understanding these requirements helps individuals navigate their options, ensuring they receive timely assistance during challenging times.

Comments