Are you curious about increasing your credit limit but unsure where to start? Whether you're planning a big purchase or just looking to improve your financial flexibility, understanding how to approach a credit limit inquiry can be crucial. In this article, we'll walk you through a simple letter template that you can use to make your request to your financial institution. So, let's dive in and discover how to craft the perfect inquiry letter!

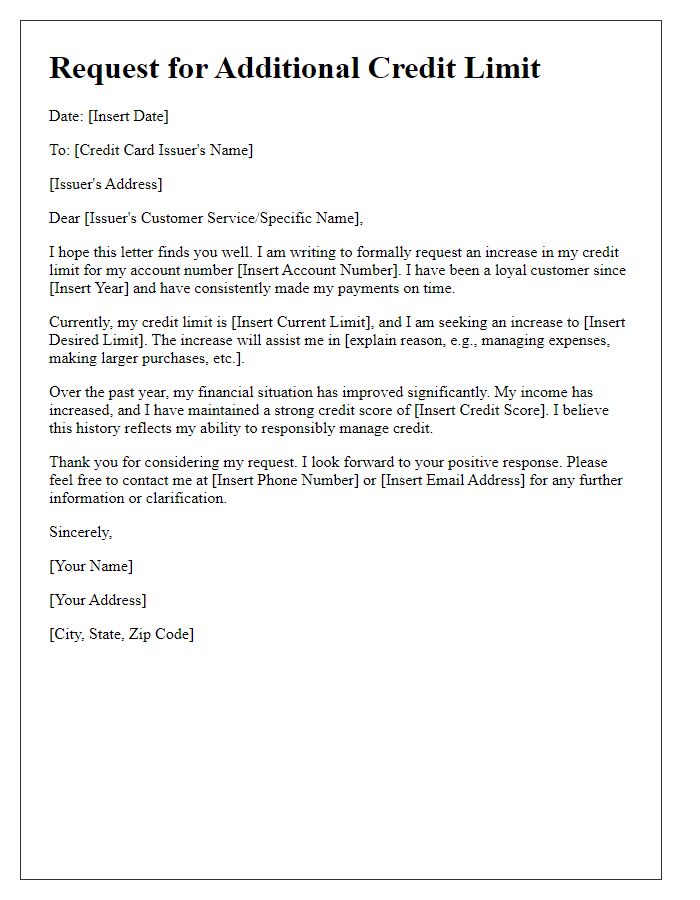

Clear Subject Line

Credit limit inquiries can significantly impact a cardholder's financial management. A high credit limit may enhance purchasing power, making it easier to cover unexpected expenses. Many financial institutions, including banks and credit unions, assess creditworthiness based on factors such as credit score, income, and payment history before approving limit increases. Potential borrowers should be aware that a credit inquiry may temporarily affect their credit score. For instance, a hard inquiry can reduce a score by a few points but typically rebounds within a few months. Establishing a good relationship with the lender can improve chances of receiving favorable terms.

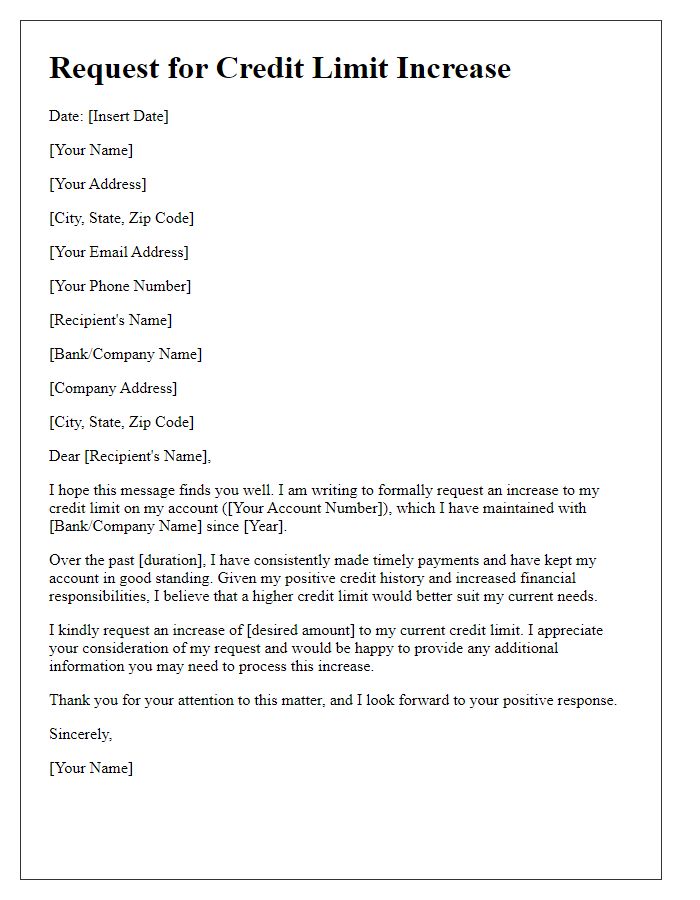

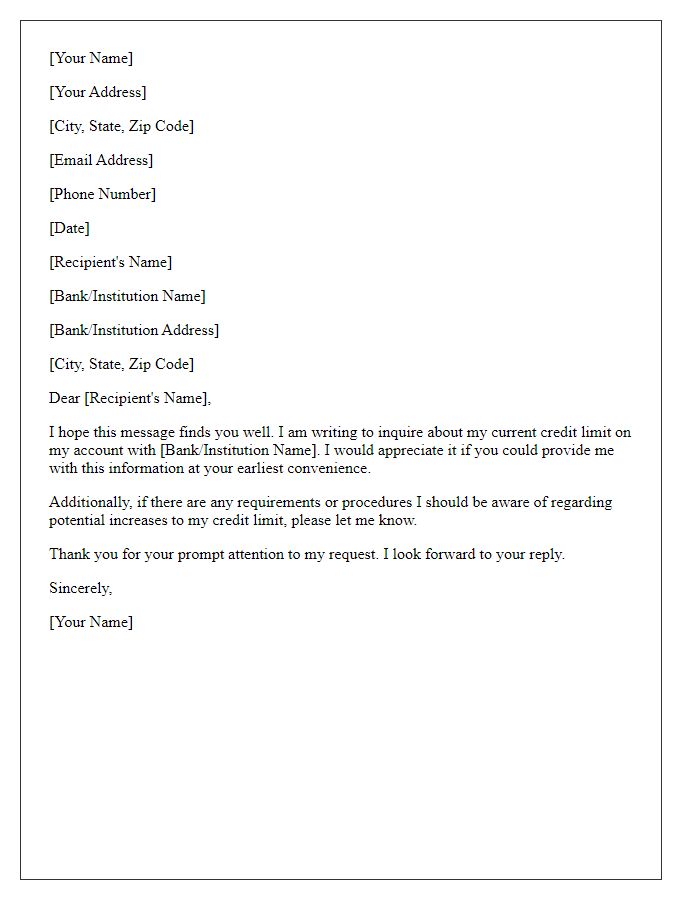

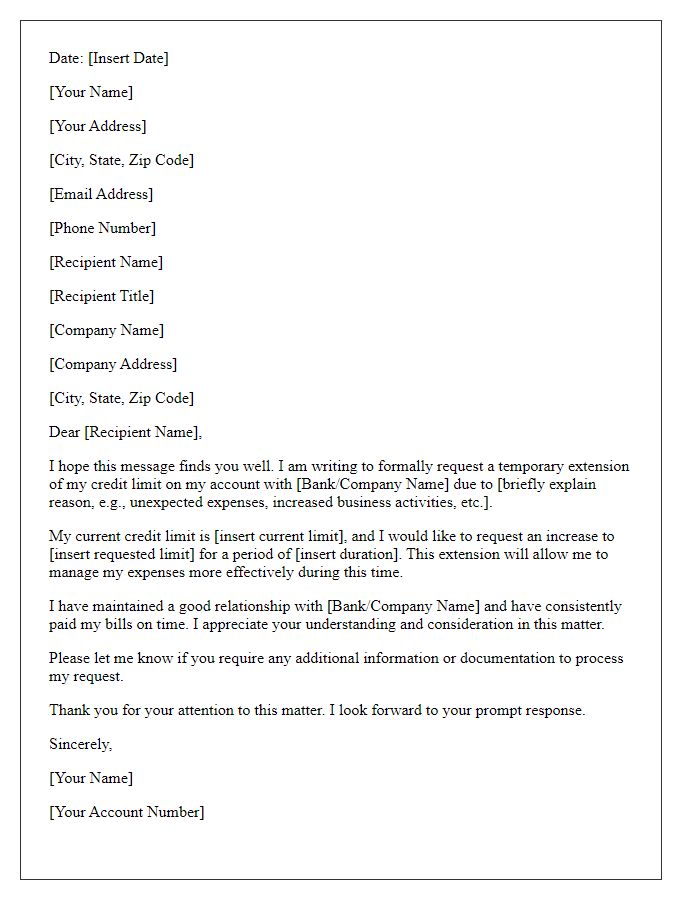

Accurate Personal Information

Accurate personal information is crucial for a successful credit limit inquiry. Financial institutions like banks and credit card companies require up-to-date details, including full name, social security number, and current address, to verify identity and assess creditworthiness. Inaccuracies can lead to delays or denial of requested credit limits. Loan applications typically necessitate phone numbers and employment information for additional verification. Furthermore, maintaining current information, especially after significant life events such as marriage or relocation, is essential to avoid complications in financial transactions and strengthen credit profiles.

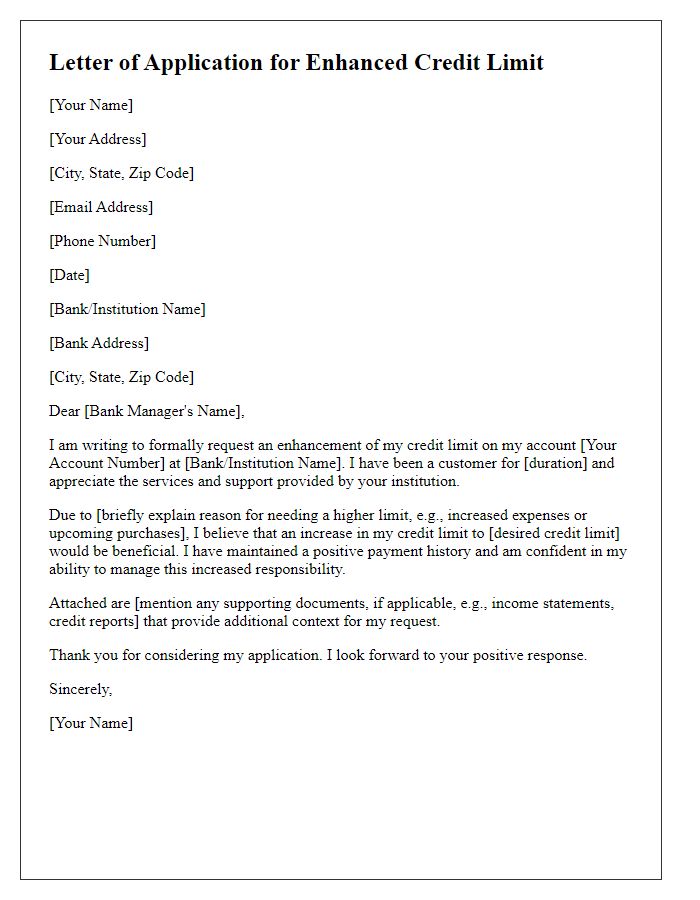

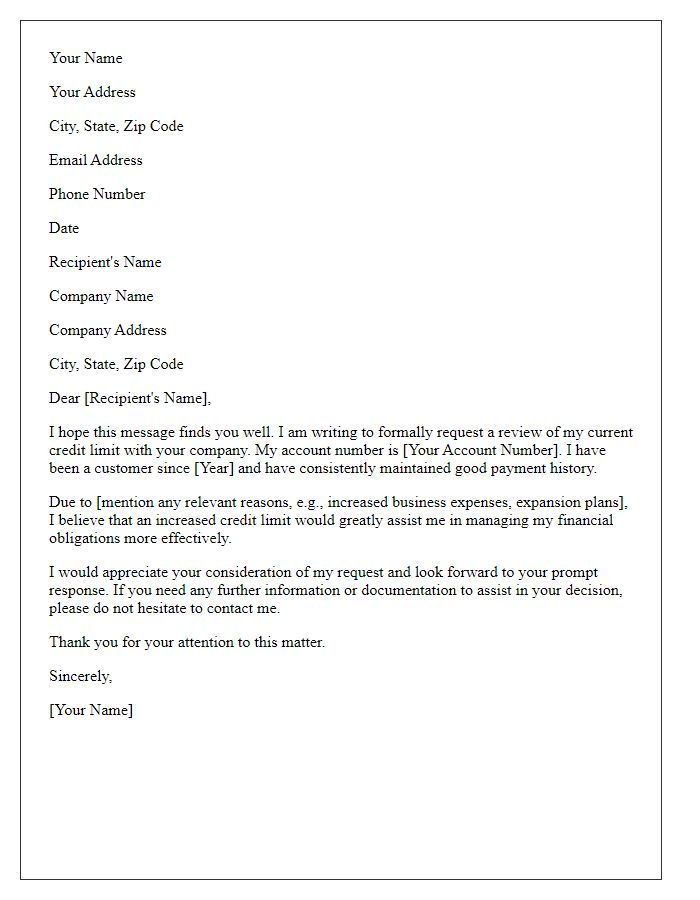

Reason for Inquiry

A credit limit inquiry typically arises from various financial situations, such as applying for a new credit card or seeking an increase in the existing credit line with a financial institution like a bank or credit union. Consumers may request this adjustment to accommodate larger purchases, enhance their buying power for significant expenses like home renovations or travel, or improve credit utilization ratios for better credit scores. Additionally, frequent inquiries may indicate potential changes in financial stability, prompting lenders to evaluate the applicant's creditworthiness and determine the appropriate credit limit. Institutions assess factors including income levels, payment history, and outstanding debts during this process, ultimately influencing their decision regarding the requested credit limit.

Financial Information

Financial information plays a critical role in determining credit limits for consumers. Lenders assess various factors, including credit scores, which range from 300 to 850, and outstanding debts such as loans or credit card balances. Payment history, comprising on-time payments for at least the past 24 months, significantly influences creditworthiness. Income levels, documented through recent pay stubs or tax returns, help lenders gauge an applicant's ability to repay debts. Additionally, debt-to-income ratios, ideally maintained under 36%, provide insight into financial stability. Understanding these components is essential for consumers seeking adjustments to their credit limits.

Polite Closing and Contact Details

Credit limit inquiries can significantly impact a customer's spending capabilities. A polite closing statement is essential for leaving a positive impression, thanking the recipient for their attention to the request. Including contact details is crucial for facilitating further communication, providing a direct line through a phone number (10-digit format) or an email address (e.g., example@email.com). These details ensure that any follow-up questions can be addressed promptly, enhancing customer service and satisfaction.

Comments