Are you considering starting a home-based business but unsure where to begin? Declaring your business can feel like a daunting task, but it doesn't have to be. With the right guidance, you can navigate the necessary steps to ensure you're compliant and protected. Ready to learn how to declare your home-based business effectively? Let's dive into the details!

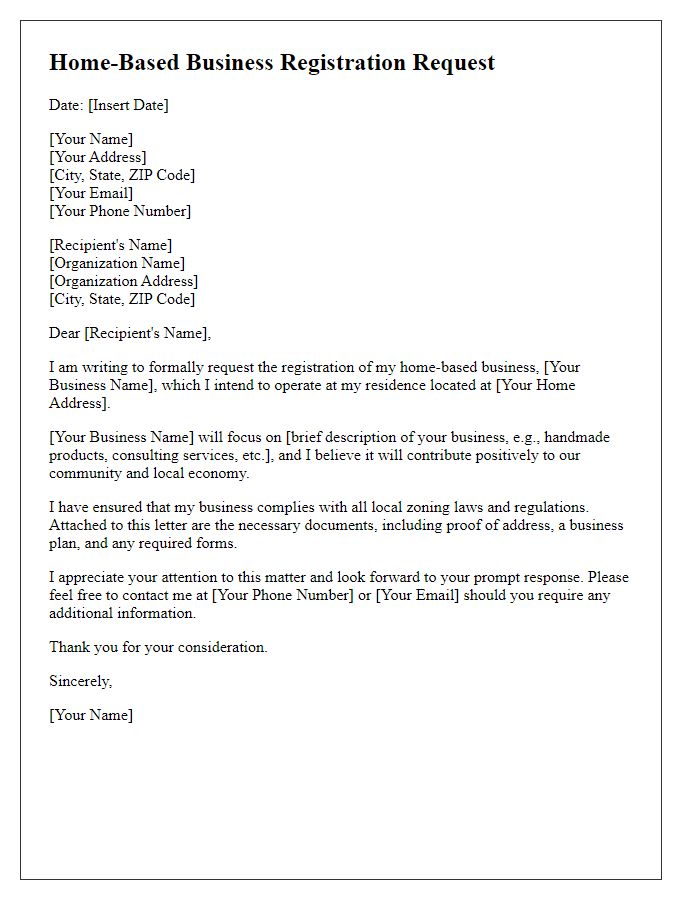

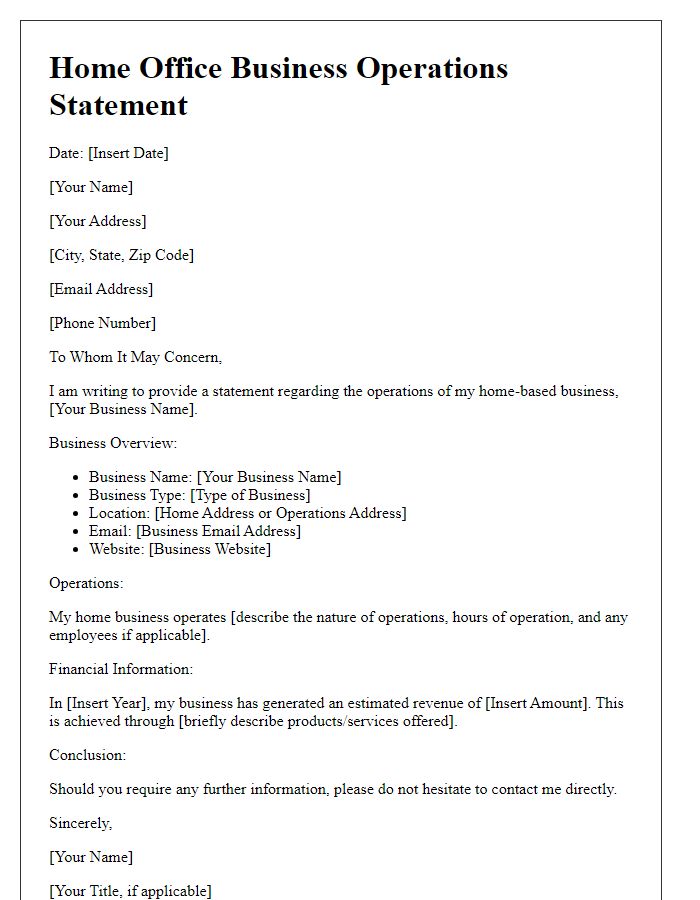

Business Name and Owner Information

A home-based business operates within the confines of a residential property, often providing services or products directly from home. Business owners, typically entrepreneurs, leverage their personal space to run operations, manage inventory, and engage with clients. This model can include various industries, such as e-commerce, consultancy, or arts and crafts. Proper registration with local authorities is essential to ensure compliance with zoning laws and tax regulations. The business name serves as the brand identifier, often crafted to reflect the unique offerings or ethos. Owner information, including names, contact details, and relevant experience or expertise, plays a crucial role in establishing credibility and attracting customers.

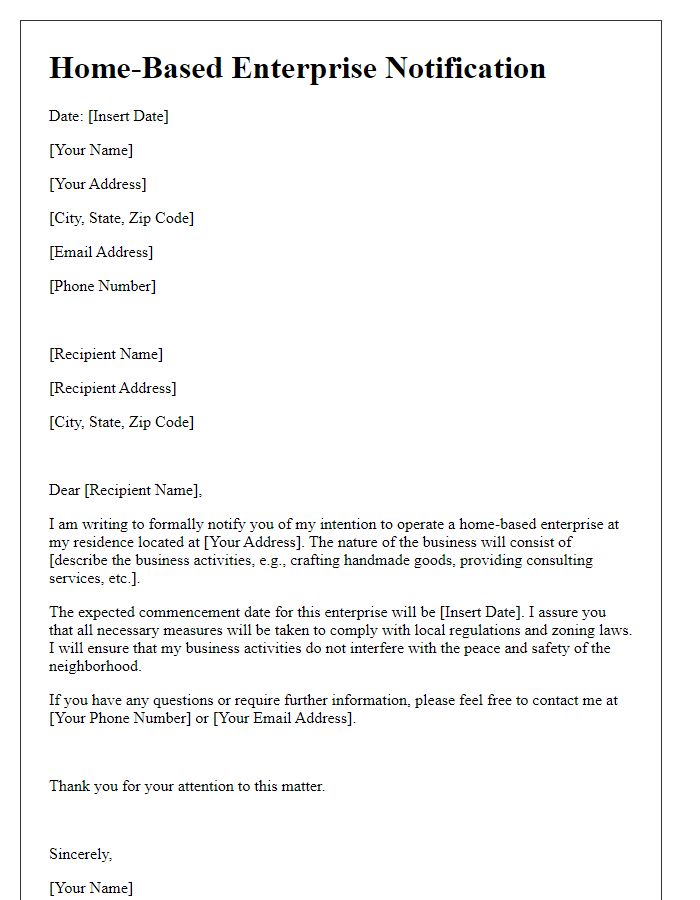

Business Address and Contact Details

A home-based business declaration requires clear information regarding the business address and contact details to establish legitimacy and enhance communication. The business address, usually the physical location where operations take place, must include the street number, street name, city, state, and postal code to ensure proper identification. Including contact details is essential; this should encompass a dedicated business phone number, an email address associated with the business domain, and possibly a website URL if applicable. This information facilitates ease of contact for clients, vendors, and regulatory bodies and promotes professionalism in business dealings.

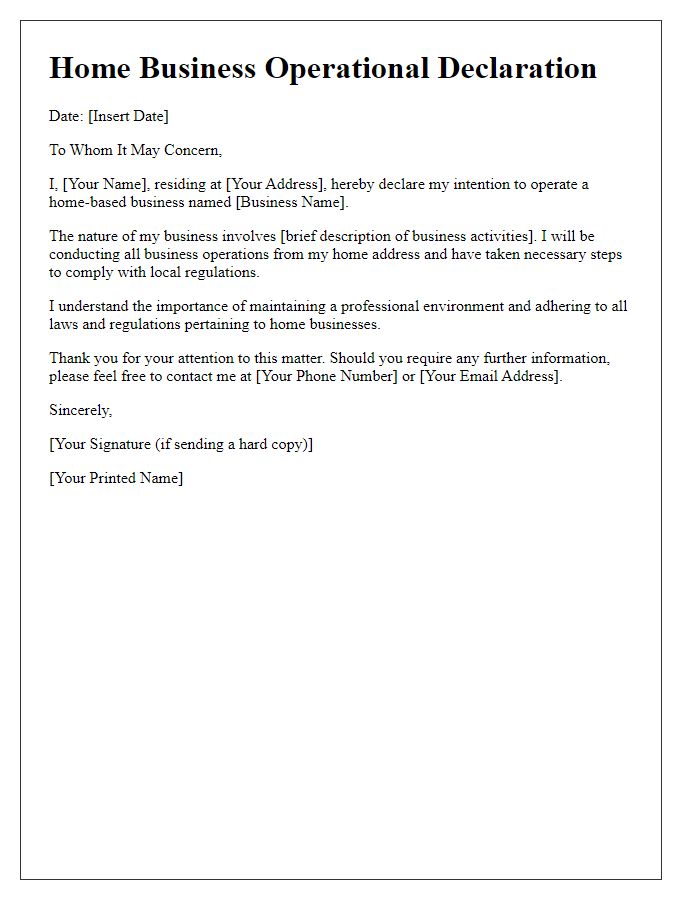

Nature and Description of Business

Home-based businesses, such as e-commerce stores and freelance services, thrive in modern economies, leveraging digital platforms for operations. An e-commerce store focuses on selling products directly to consumers, utilizing websites like Shopify or Etsy, often targeting niche markets. Freelance services encompass various industries, including graphic design, writing, and virtual assistance, enabling professionals to submit proposals and collaborate remotely. These businesses benefit from lower overhead costs due to lack of physical storefronts, attracting entrepreneurs interested in flexibility and work-life balance. The effectiveness of home-based businesses relies heavily on branding strategies and digital marketing techniques, utilizing social media platforms like Instagram and Facebook for increased visibility.

Compliance with Local Regulations

Home-based businesses must ensure full compliance with local regulations to operate legally and effectively. In municipalities like San Francisco or Austin, zoning laws dictate the types of activities permissible within residential areas. Permit requirements can vary significantly; some areas may require a business license, while others may not. Furthermore, adhering to health and safety standards, especially for businesses involving food preparation, is critical. Regular inspections, as mandated by local health departments, ensure sanitary conditions. Noise ordinances may also impact operations, limiting activities during specific hours to minimize disruption to neighbors. By understanding and following these regulations, home-based entrepreneurs can contribute positively to their communities while minimizing the risk of fines or legal complications.

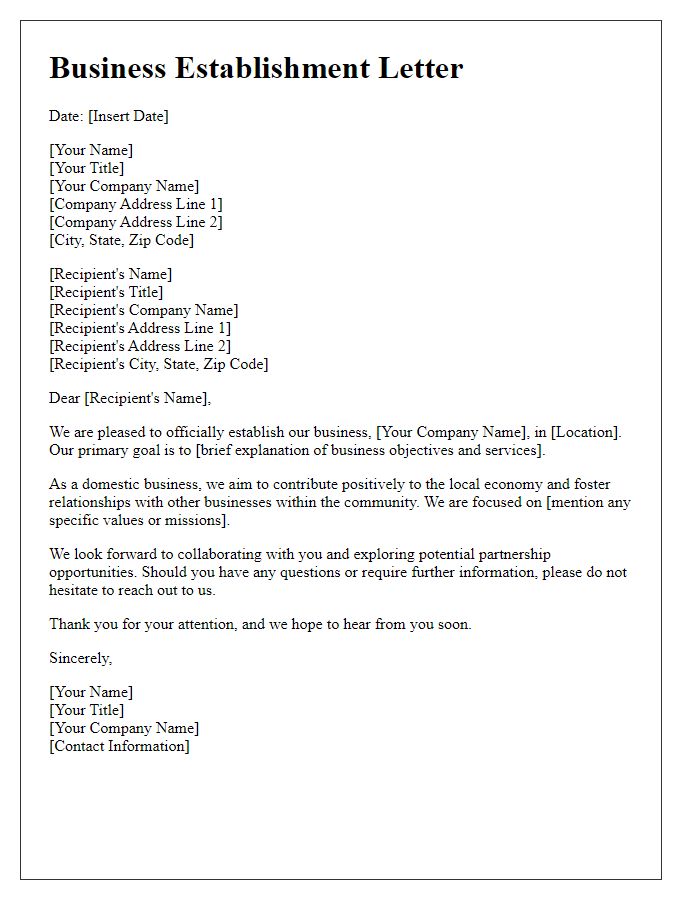

Signature and Date

Home-based businesses often begin with a formal declaration to establish legitimacy. A business owner typically includes their name, business name, and address, detailing the nature of the activities conducted from the residence. Essential components may involve a declaration of adherence to local regulations, zoning laws, and permits required for operation, which can vary significantly by city or municipality. A signature line is crucial for personal acknowledgment, alongside a date indicating when the declaration becomes effective. Ensuring the document's details align with state and local business laws enhances credibility and can facilitate interactions with potential clients and partners.

Comments