Are you facing the uncomfortable task of addressing unpaid bills? It's never easy to send a payment reminder, but clear communication can help maintain a positive relationship with your clients. In this article, we'll explore effective letter templates for warning about delinquent payments, ensuring your tone remains professional yet approachable. Keep reading to discover how to craft the perfect message that encourages timely payment while preserving goodwill!

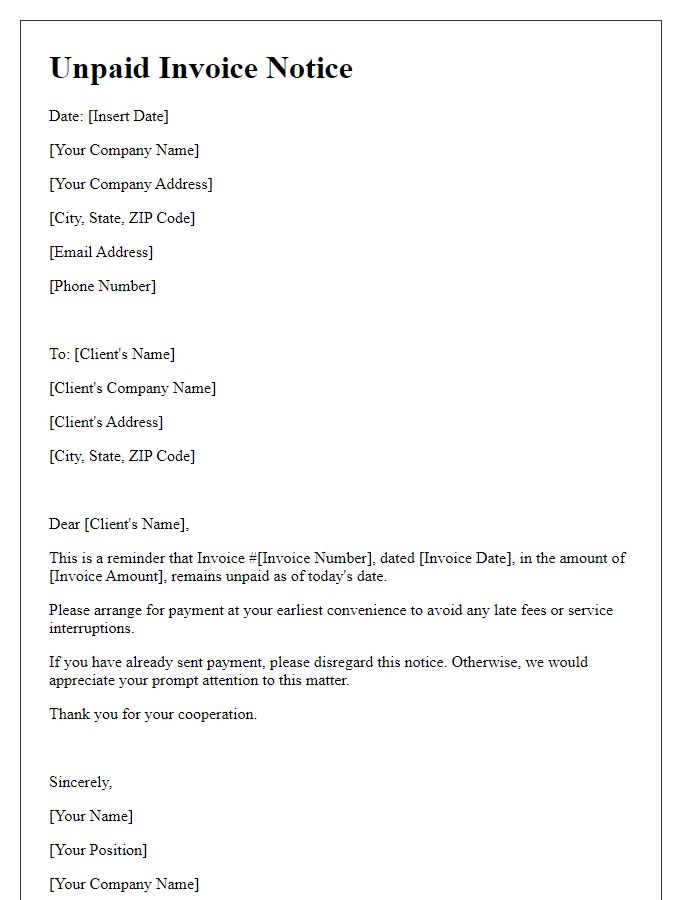

Formal tone and clear language

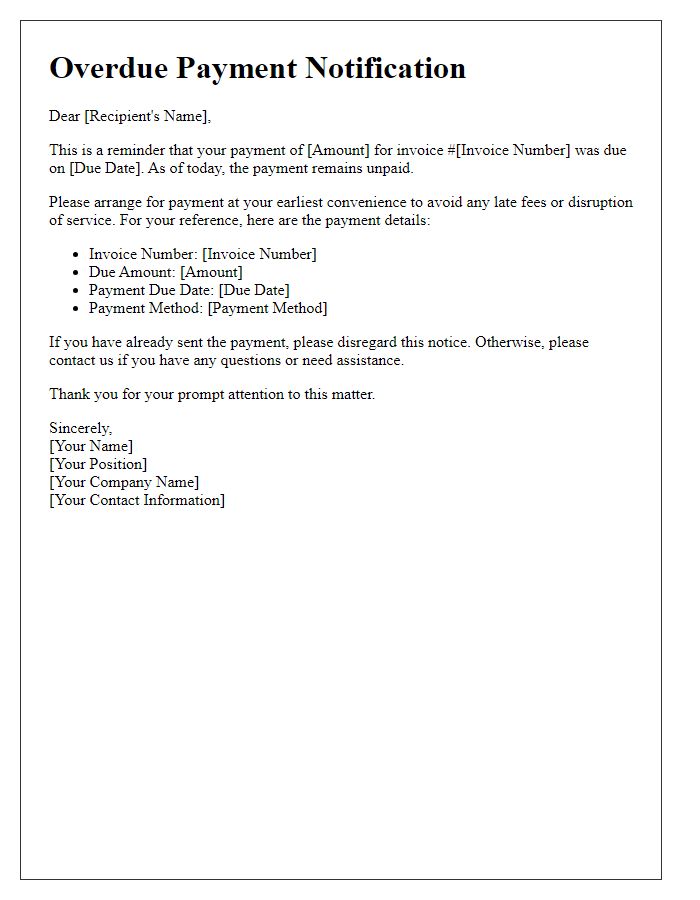

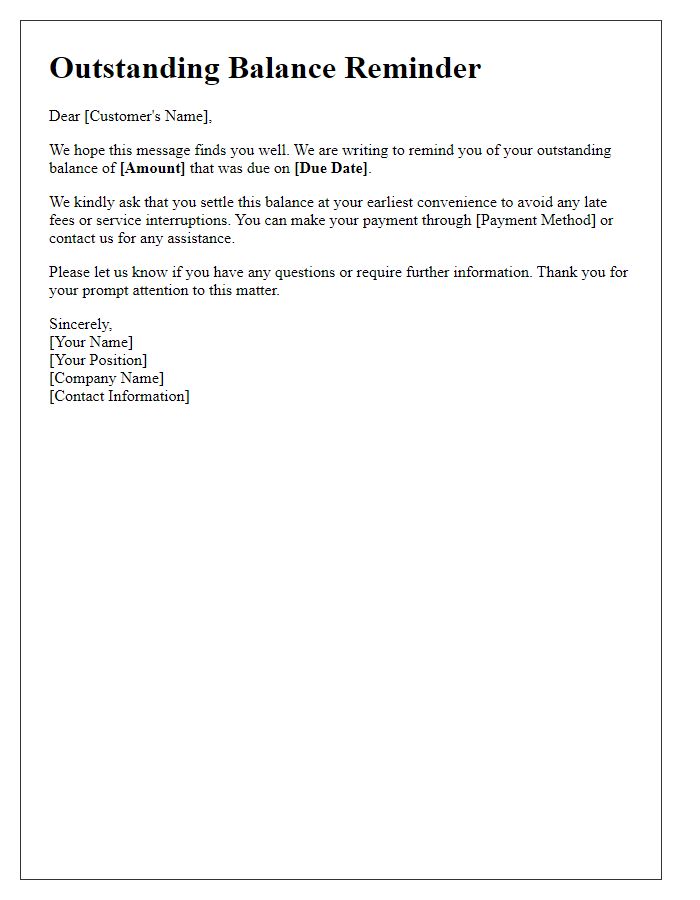

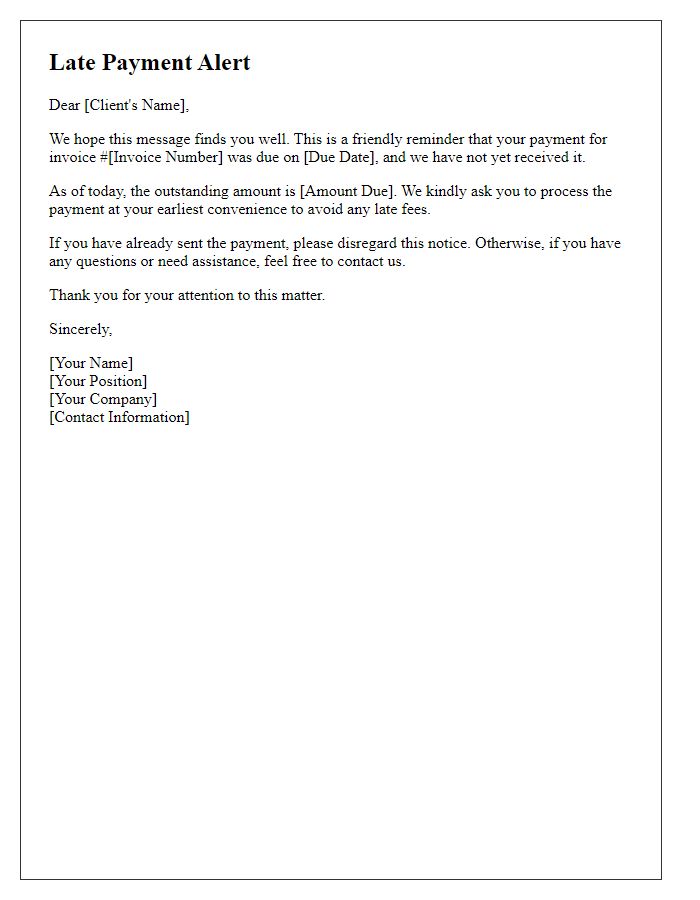

Past due accounts can incur significant penalties for businesses. Payment reminders should include specific details such as invoice number, original due date, and outstanding amount. Being concise yet firm ensures transparency and encourages prompt resolution. The sender's contact information alongside the company's name ensures recipients can quickly clarify discrepancies. Timely follow-ups can mitigate potential issues, maintaining healthy cash flow. Documentation of communications regarding delinquent payments strengthens the case for future collection efforts.

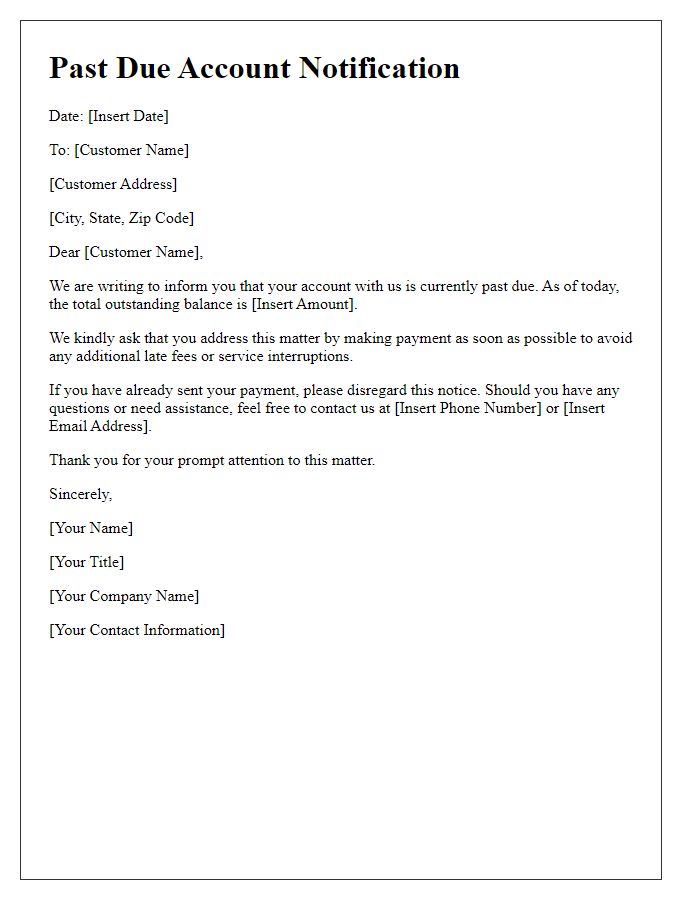

Specific details of the overdue amount

Overdue payments can significantly impact financial stability, particularly when they pertain to accounts receivable for businesses. As of October 2023, a typical overdue amount might exceed $1,000, which could involve penalties and interest rates of up to 10% per annum depending on the agreement terms. The timeline shows that a payment due on September 1 has now been overdue for over 30 days, significantly straining cash flow. Clients or customers located in regions such as California or New York may encounter additional local laws governing collection practices. Timely communication regarding these overdue amounts is crucial for maintaining positive relationships while also ensuring the organization's financial health remains intact.

Mention of due date and payment terms

A delinquent payment warning can highlight the importance of timely payments associated with invoices. Bills issued on or before September 1, 2023, typically require payment within 30 days to avoid penalties. The due date for these invoices is strictly set for October 1, 2023. Failure to meet this deadline may result in late fees of 1.5% per month on the outstanding amount. It's crucial for clients to adhere to these payment terms to maintain good standing and avoid further collection actions. Regular reminders can help ensure awareness and compliance with the established payment schedule.

Consequences of continued non-payment

Delinquent payments can lead to severe financial consequences for individuals and businesses alike. For instance, prolonged non-payment (typically after 30 days) can result in late fees, which may reach up to 25% of the total owed amount. Credit scores can plummet (a potential decrease of 100 points) due to negative payment history, significantly impacting future borrowing capabilities. Additionally, utilities such as electricity and water may face disconnection, causing disruptions in daily life. In extreme cases, legal action (including lawsuits or garnishments) can occur, leading to additional costs and financial strain. Creditors may also resort to collection agencies, resulting in persistent calls and further damage to credit standings. Timely resolution of outstanding balances is crucial to avoid these escalating repercussions.

Contact information for assistance

Delinquent payments can significantly impact credit scores and financial stability. Timely reminders for payment due dates, such as the 30-day and 60-day marks past the original due date, are essential for maintaining healthy consumer relationships. An increased number of missed payments may lead to escalated fees, interest rates, or even legal actions through collection agencies. Providing contact information for assistance--such as a dedicated customer service hotline at (800) 555-0123 or email support at support@company.com--ensures customers can address concerns and avoid further complications. Establishing clear communication channels also fosters trust and demonstrates commitment to resolving any payment issues.

Comments