Navigating the insurance claim process can feel overwhelming, but it doesn't have to be! Whether you're dealing with property damage or health-related claims, knowing the right steps can make all the difference. In this article, we'll break down the essential components of a successful insurance claim letter, ensuring you have all the tools you need for a smooth experience. Keep reading to discover expert tips and sample templates that will guide you through the process effortlessly!

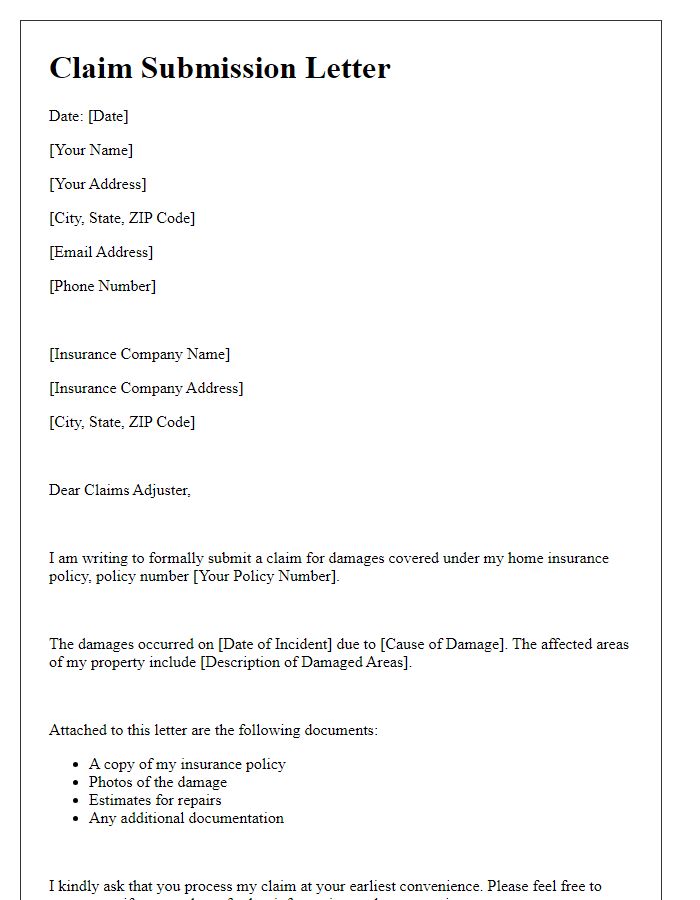

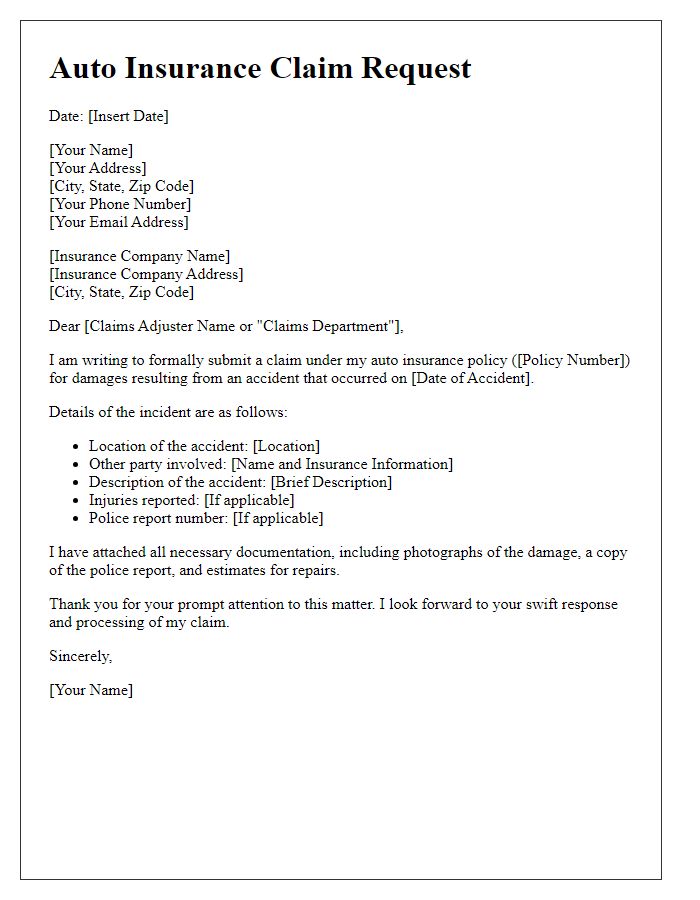

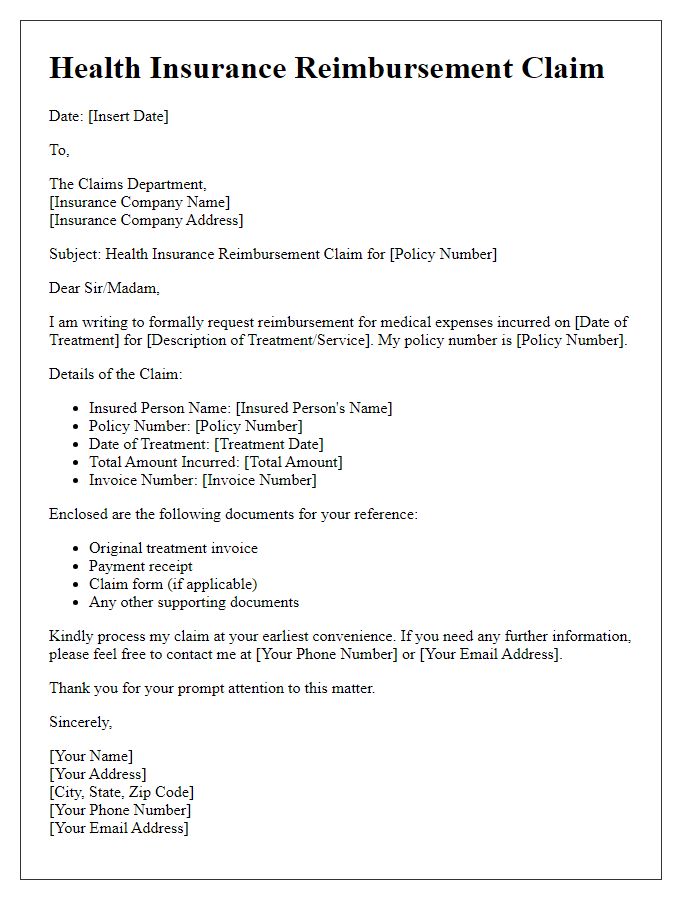

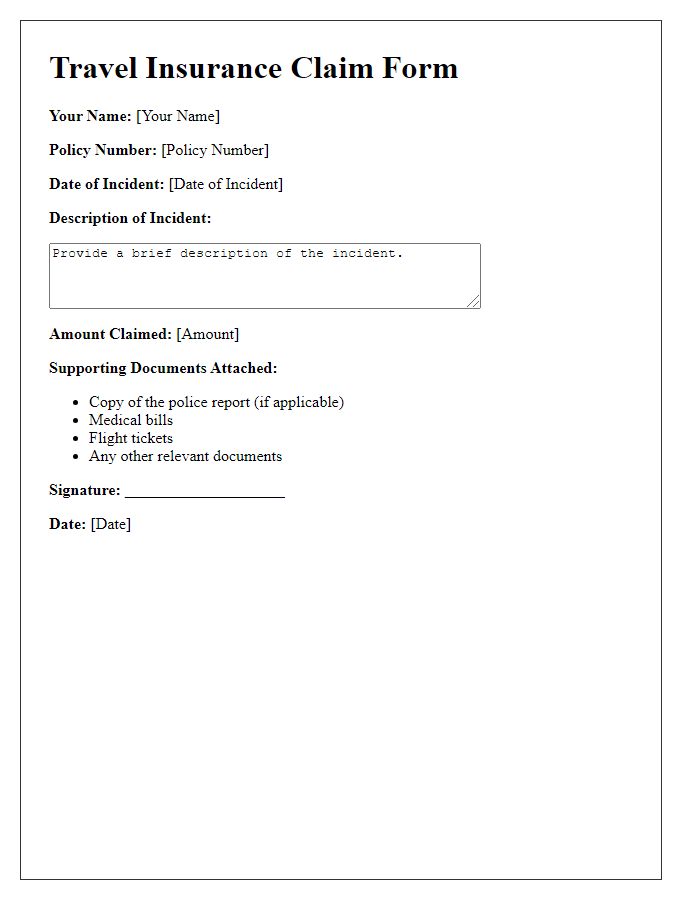

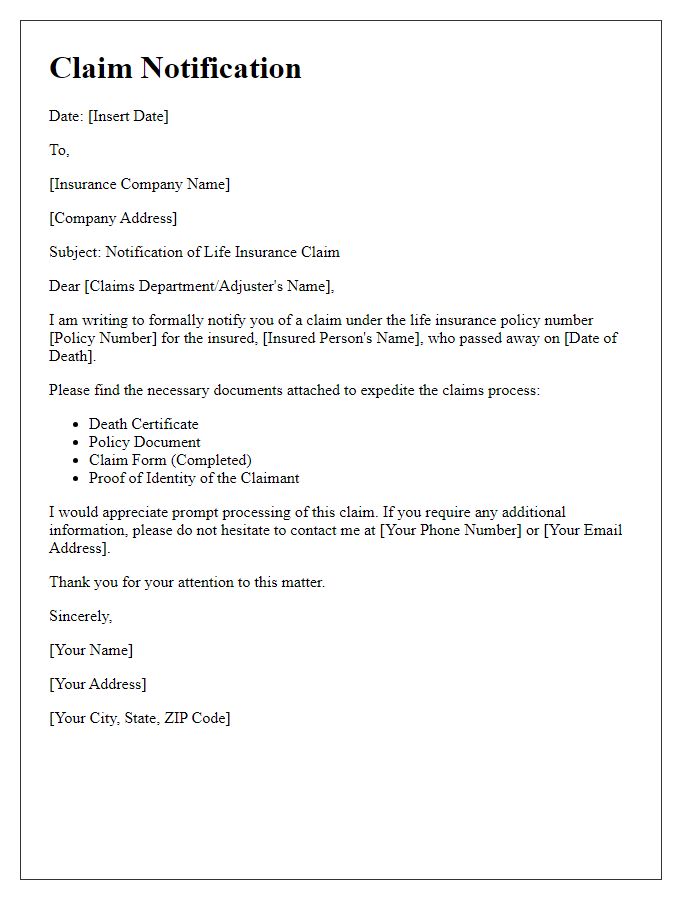

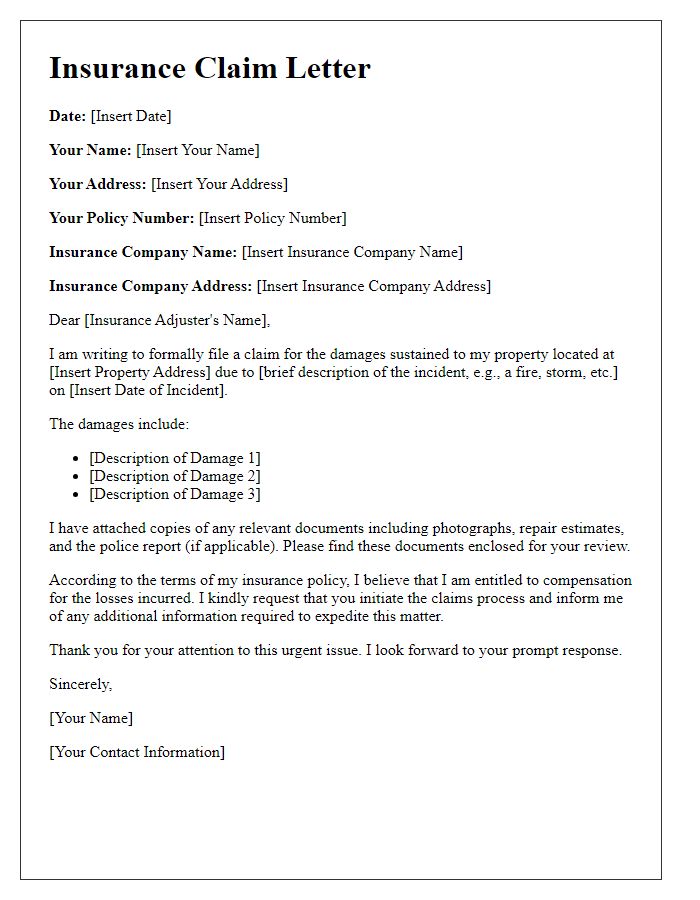

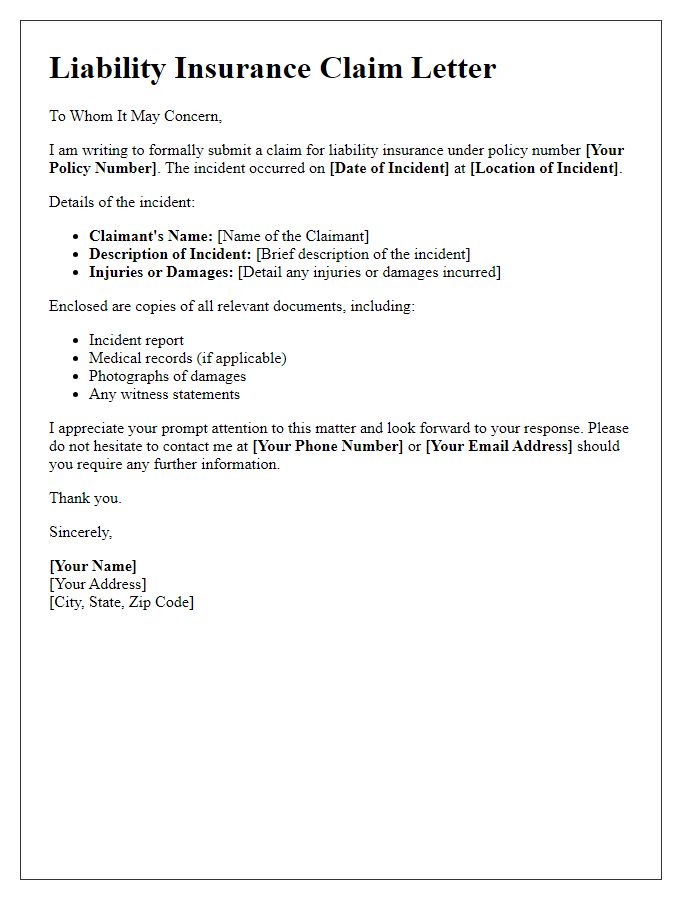

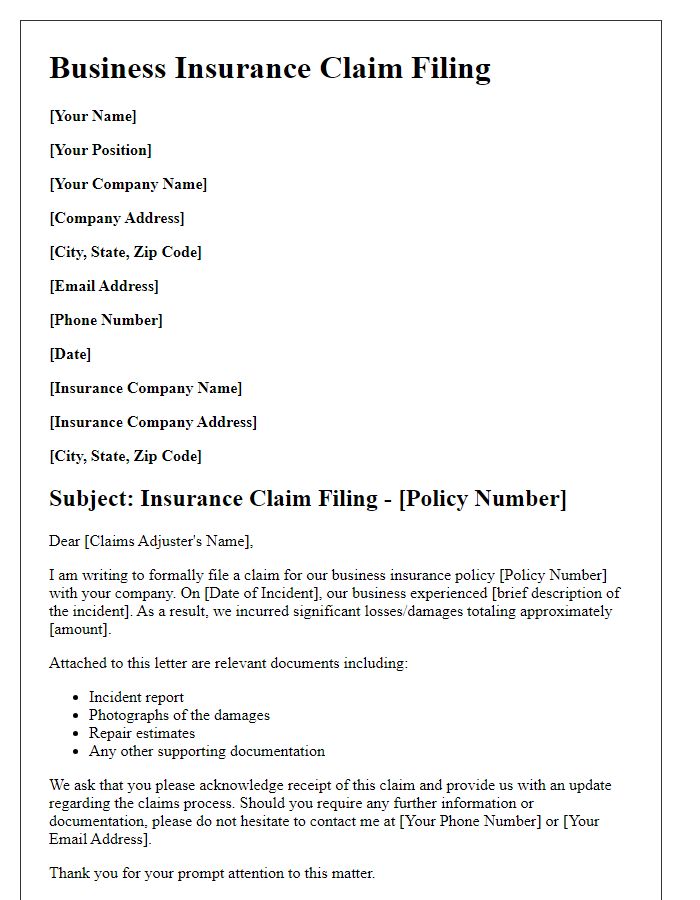

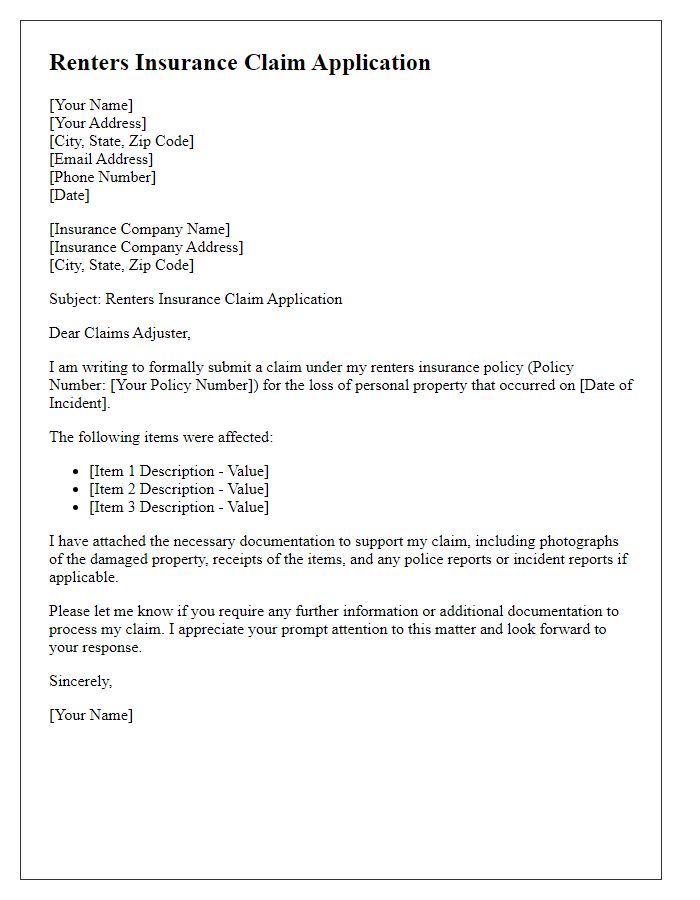

Claimant's Information

The insurance claim process requires detailed information about the claimant. Essential aspects include the claimant's full name, date of birth (which provides identification), and contact details such as phone number and email address. The address must include the street number, city, state, and zip code to ensure timely correspondence. Policy information is crucial, including the policy number and type of coverage, whether it relates to health, auto, or home insurance, as these details help streamline the claim review process. Furthermore, a clear description of the incident or loss, including dates, locations of occurrence, and any involved parties, aids in establishing context and validating the claim. Providing this comprehensive information can expedite resolution and facilitate communication with the insurance provider.

Policy Details

Insurance policy details serve a crucial role in the claims process, outlining the specific coverage and exclusions associated with a given policy. Essential information includes policy number, unique identifier that assigns the claim to the correct account, and the effective dates, defining the period during which coverage is active. The insured amount, representing the maximum payout limit for claims, also plays a significant part in determining eligibility. Moreover, understanding the specific type of coverage, such as liability, collision, or comprehensive, informs claimants about the protections in place for various incidents. Premium payment status is another key detail, as lapsed policies may result in denied claims. Notably, additional riders or endorsements can enhance basic coverage, underscoring the importance of thorough documentation when filing claims.

Incident Description

A comprehensive incident description for an insurance claim process should detail the event in a clear manner, emphasizing the circumstances surrounding the occurrence. For example, on March 15, 2023, at approximately 3:30 PM, a severe hailstorm struck the vicinity of Elm Street in Springfield, resulting in significant damage to residential properties. The size of the hailstones measured approximately 2 inches in diameter, impacting roofs, vehicles, and windows. This unexpected weather event created hazardous conditions, leading to multiple reports of broken glass and damaged roofing materials. The aftermath included debris scattered across the area, with local authorities receiving over 100 claims related to property damage in the following days. Prompt documentation of this incident, including photographs and witness statements, highlights the urgency and extent of the damages sustained, essential for the thorough assessment of the insurance claim.

Documentation and Evidence

The insurance claim process involves meticulous documentation and substantial evidence to support claims, ensuring a smooth evaluation by the insurance provider. Essential documents include photographs capturing the extent of damages (preferably timestamped), receipts for repairs or replacements, and medical reports if applicable. Witness statements can provide additional corroboration of the incident details, while police reports may be required for liability and accident claims. Each state or region may have specific requirements, such as claim forms or notification deadlines, that must be adhered to for successful processing. Accurate organization of this documentation enhances the credibility of claims and minimizes processing delays.

Claimant's Signature and Date

The insurance claim process involves several critical steps to ensure a smooth filing experience. A claimant (person filing the claim) must provide necessary documentation, including a signed claim form, detailing the incident, policy numbers, and any relevant dates (such as the event date) that led to the claim. In most cases, the signature of the claimant is required on the form to validate the authenticity of the claim. The exact date of signing is equally important, as it marks the beginning of the processing timeline. Properly completing these elements can significantly expedite the review process by insurance adjusters, who assess the validity and amount of the claim based on the provided information.

Comments