Hey there! Navigating the world of healthcare bills can feel overwhelming, but it doesn't have to be. With the right template in hand, you can easily communicate with your healthcare provider about your bill payments and ensure everything is clear and manageable. Join me in exploring this essential guide to creating an effective healthcare bill payment letter, and let's take the stress out of your financial responsibilities!

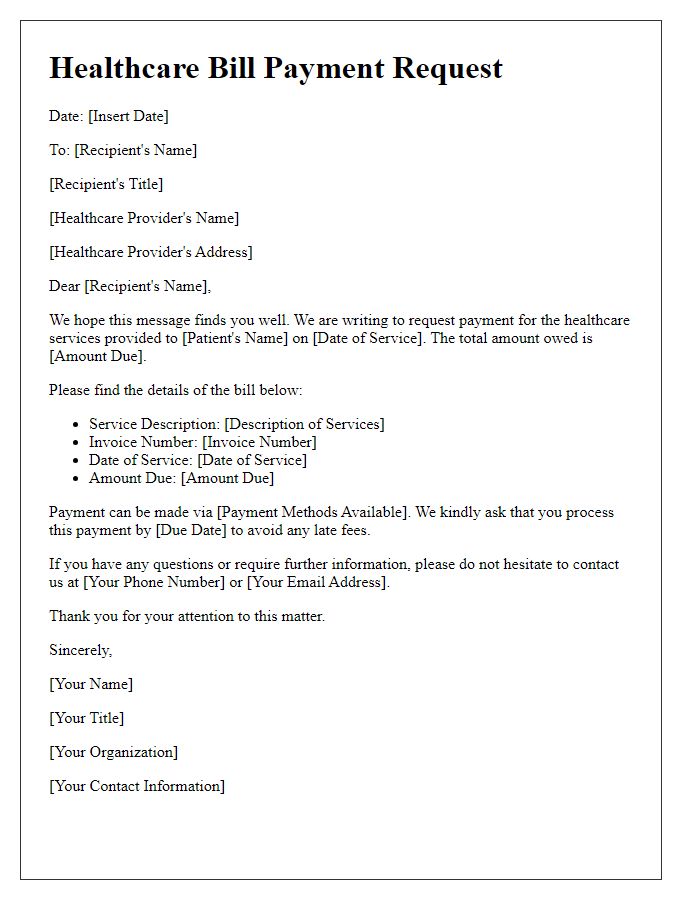

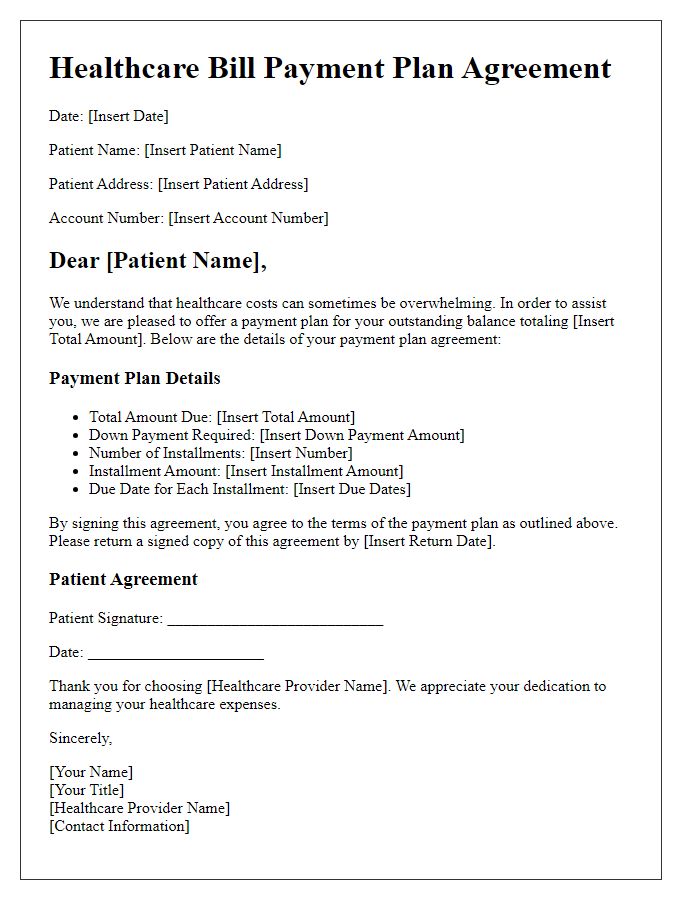

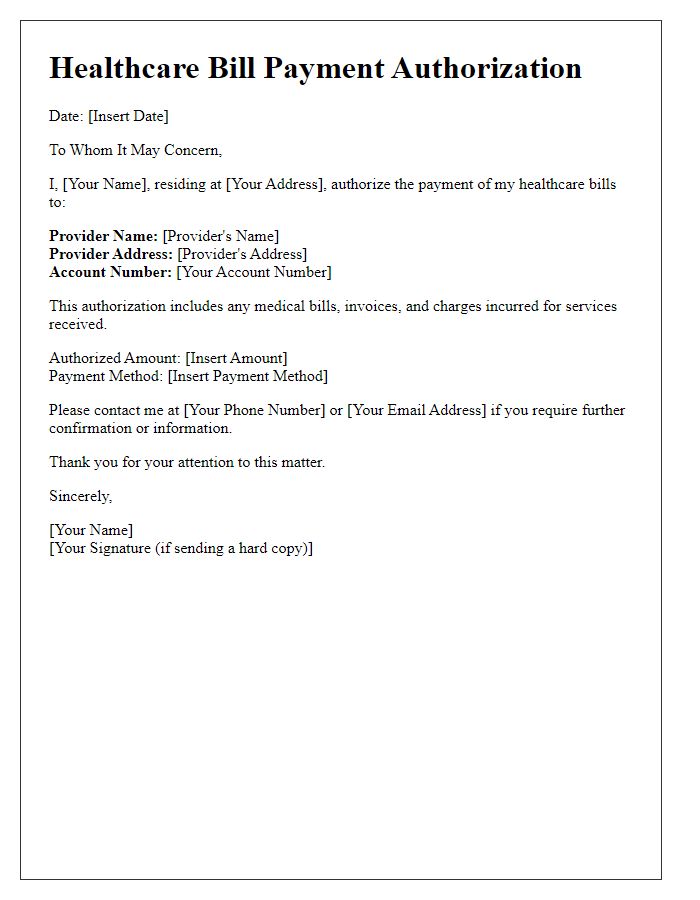

Patient Information

Patient information plays a crucial role in healthcare billing, ensuring accurate communication and financial transactions. Essential details include full name of the patient, unique identification number assigned by the healthcare provider, and date of birth for verification purposes. Additionally, insurance information, such as policy number and provider name, is vital for processing claims with insurance companies like Blue Cross Blue Shield or Aetna. Address of residence aids in sending correspondence regarding the billing statement or payment reminders. Contact details, including phone number and email address, facilitate quick resolution of billing inquiries. Accurate patient information minimizes errors and streamlines the healthcare billing process, ensuring timely payments and maintaining patient trust.

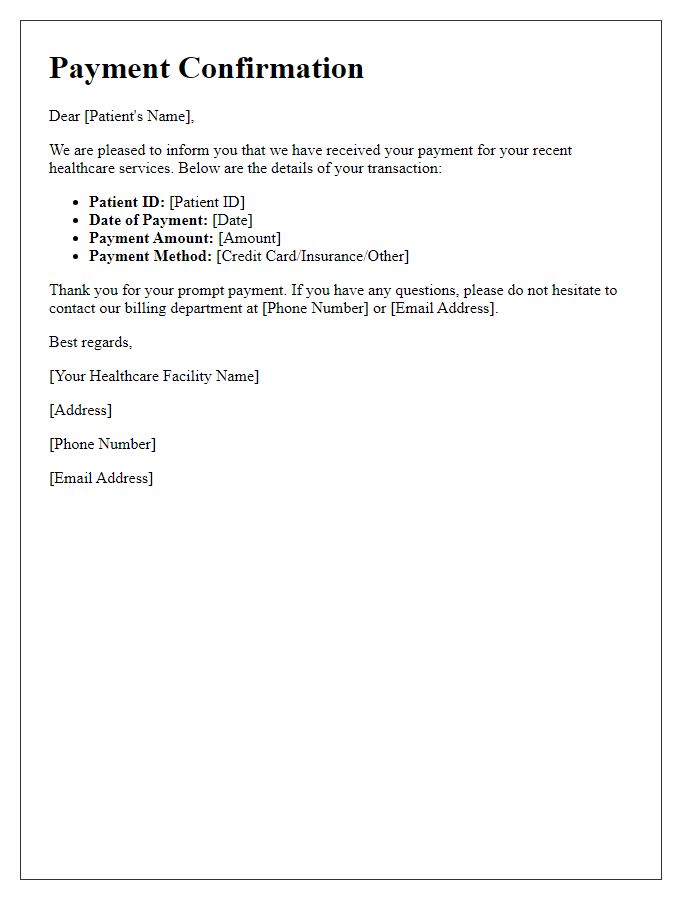

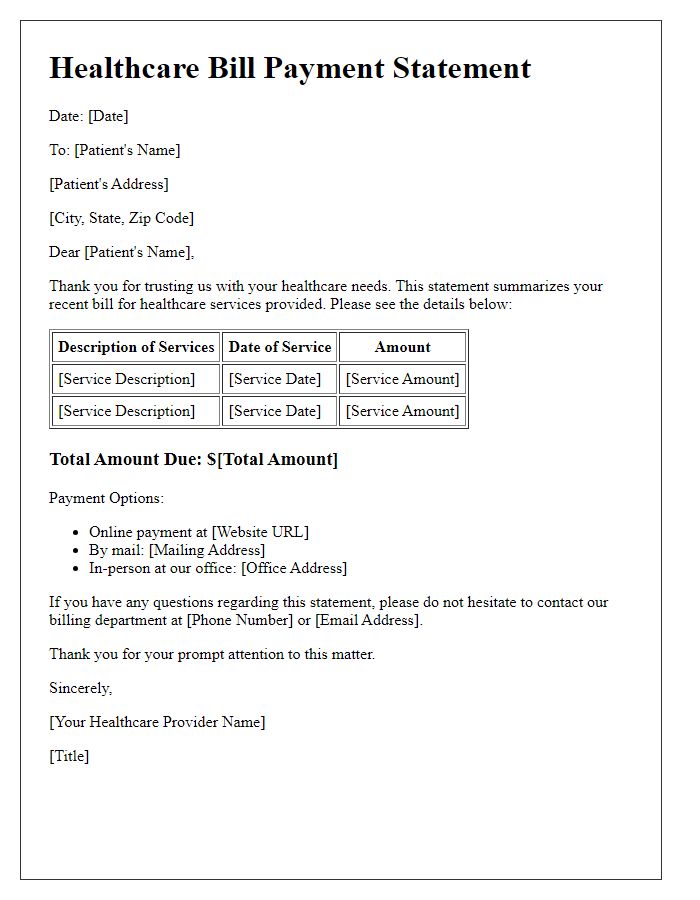

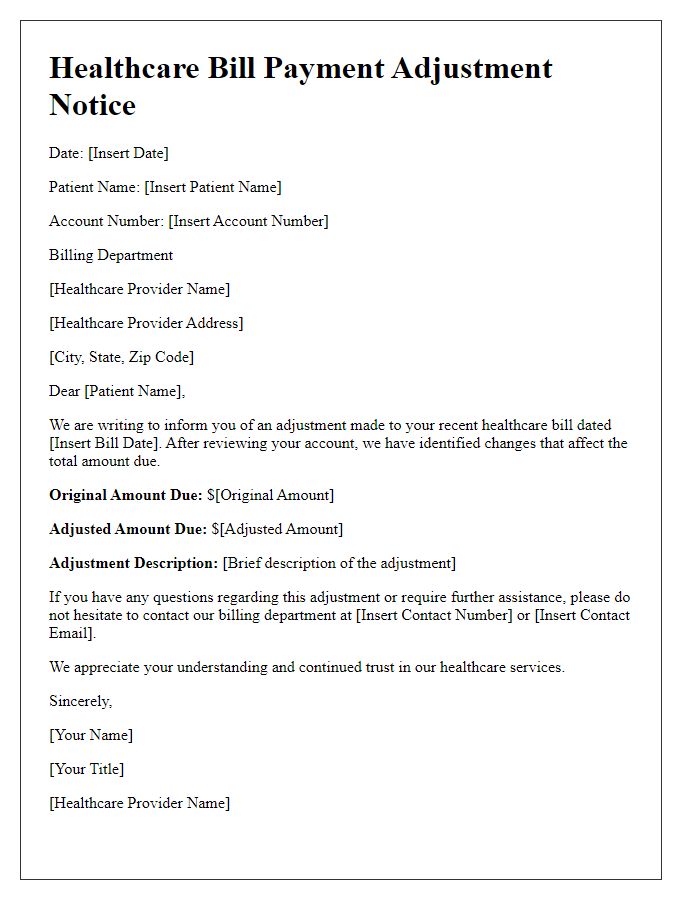

Billing Details

Healthcare billing statements provide essential information regarding medical expenses. Each statement typically includes patient details, such as the patient's name, insurance information, and account number. The billing date signifies when the statement was issued, which aids in tracking payment timelines. Itemized charges detail services rendered, including medical procedures or consultations, often accompanied by specific codes (like CPT codes) for reference. Outstanding balance indicates the remaining amount due, while payment terms outline the deadline for settlement to avoid penalties. Contact information for billing inquiries ensures that patients can clarify any discrepancies or seek assistance regarding their accounts.

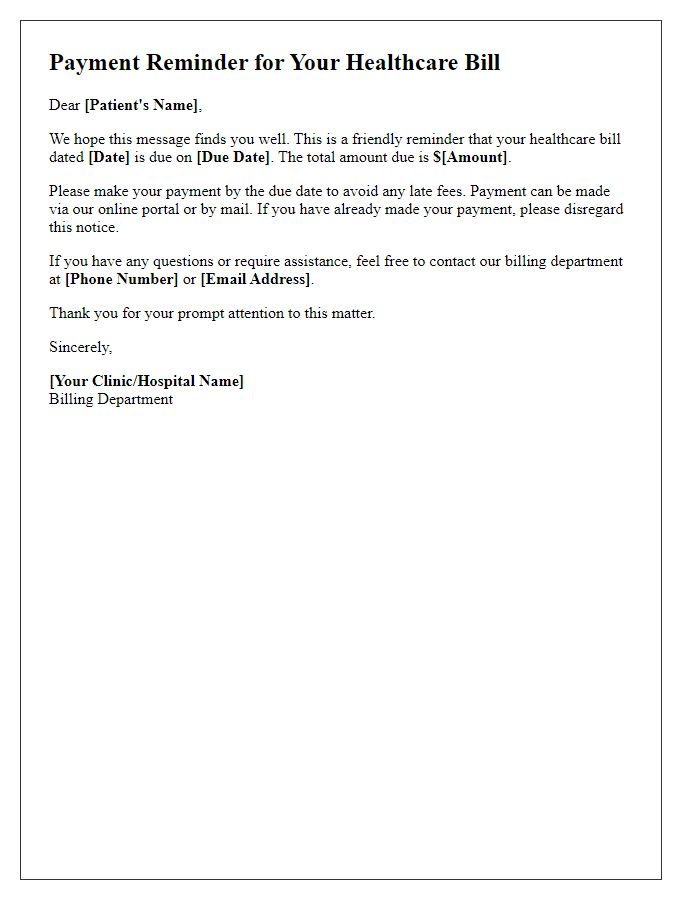

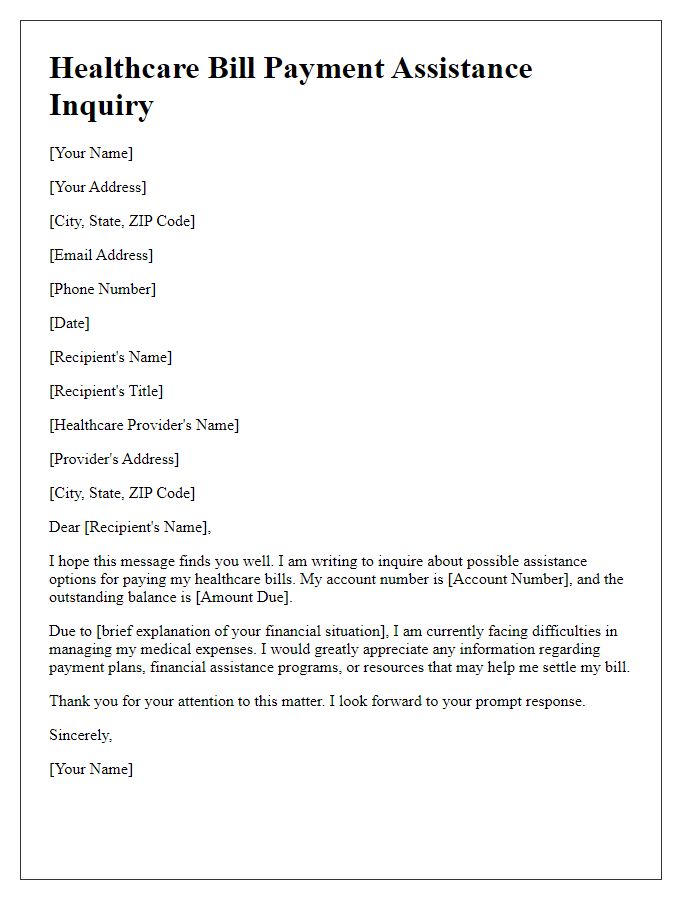

Payment Instructions

Healthcare billing processes require strict adherence to payment instructions for services rendered in facilities like hospitals or clinics. Patients often receive detailed statements outlining balance amounts, due dates, and acceptable payment methods. Payment options typically include electronic fund transfers, credit card transactions, or mailing checks to specified addresses. Timely payments are crucial to avoid late fees, which may amount to 1.5% of the outstanding balance each month. Additionally, various healthcare providers may offer financial assistance programs to help manage costs. Understanding billing codes and insurance contributions can significantly affect out-of-pocket expenses for patients, ensuring clarity in their financial responsibilities.

Contact Information

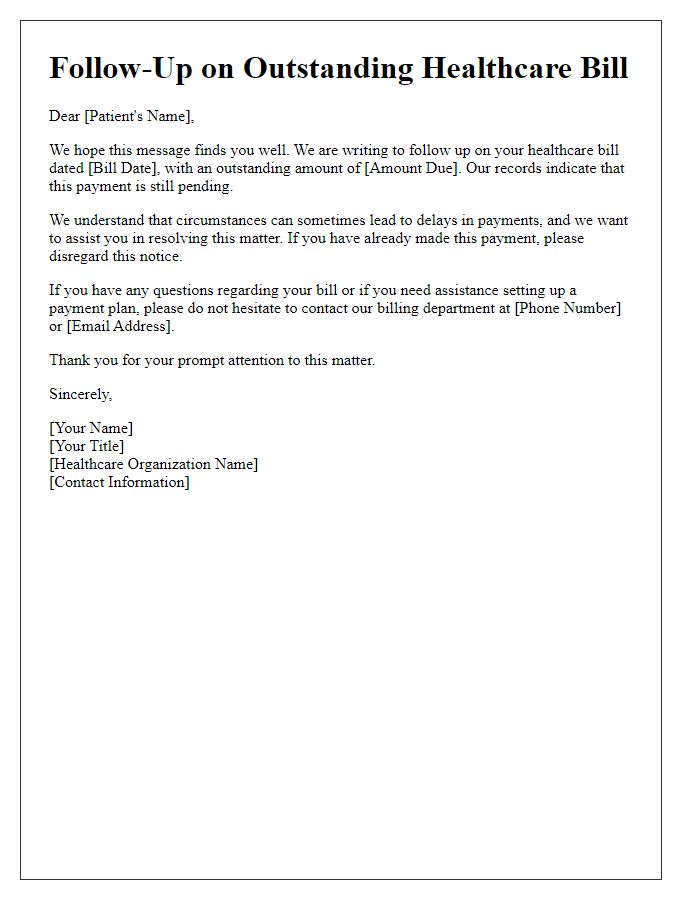

Patients often receive healthcare bills reflecting medical services rendered at hospitals. Clear contact information should be included on these bills to facilitate prompt payment. Common billing entities include insurance companies, healthcare providers, and billing departments, located in facilities such as metropolitan hospitals or urgent care centers. Contact details often encompass a combination of phone numbers, typically toll-free for patient convenience, email addresses for inquiries, and physical addresses for mailed payments. Promptly addressing billing queries can prevent late fees, which may incur additional charges, creating a more manageable financial experience for patients navigating their healthcare costs.

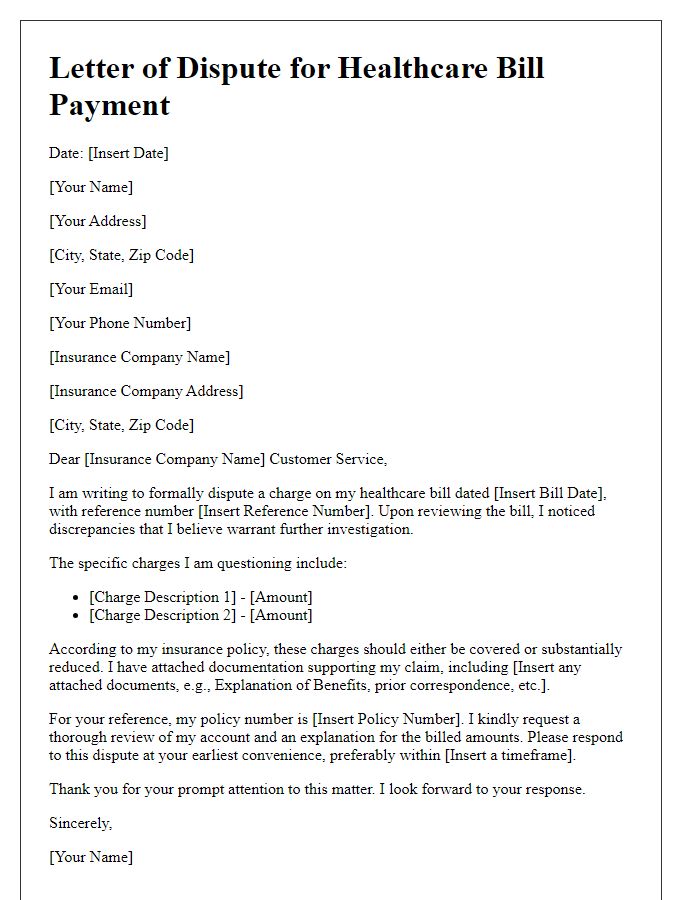

Due Date and Deadlines

Healthcare bills often come with strict due dates and deadlines that require careful attention. Typically, insurance providers, such as Blue Cross Blue Shield or Aetna, expect payment within a specified timeframe, often 30 days from the statement date. Late fees, averaging around 1.5% monthly, may apply after the due date, potentially increasing the total bill significantly. For those enrolled in government programs, like Medicare or Medicaid, adherence to deadlines is crucial to maintaining coverage and avoiding lapses in benefits. Healthcare providers, including hospitals like Mayo Clinic, may offer payment plans but usually require initial payments within a set period to keep accounts in good standing. Understanding these timelines is vital for effective financial management and healthcare access.

Comments