Are you feeling a bit lost with all the updates regarding your health insurance? You're not aloneânavigating the world of patient health insurance can sometimes feel overwhelming. In this article, we'll break down the most important changes and what they mean for your coverage, so you can stay informed and confident in your healthcare decisions. Join us as we delve into the latest updates that matter most to you!

Personal Identification Details

Updating personal identification details is crucial for maintaining accurate health insurance records. Patients, such as those enrolled in plans like Blue Cross Blue Shield or Aetna, must ensure their full name, date of birth, and Social Security number (SSN) are correct. Providing an updated address is vital for receiving timely notifications regarding claims and policy changes. Patients should also check their policy numbers, ensuring any recent changes are reflected. Misalignment in personal details can lead to delays in claim processing and potential disruptions in receiving necessary medical services. Insurers usually require supporting documents, like government-issued IDs or utility bills, for verification during the update process.

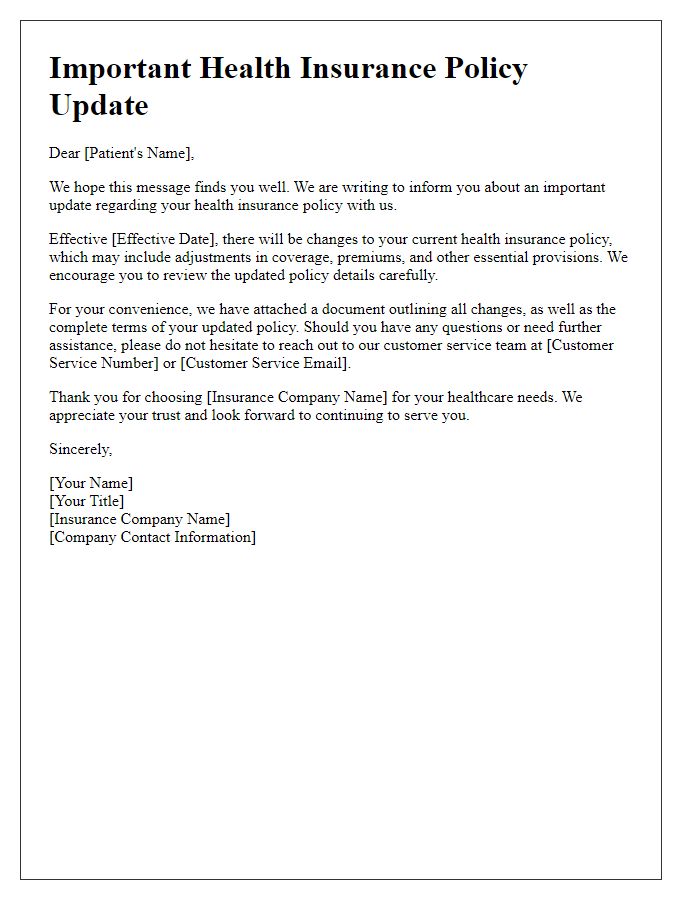

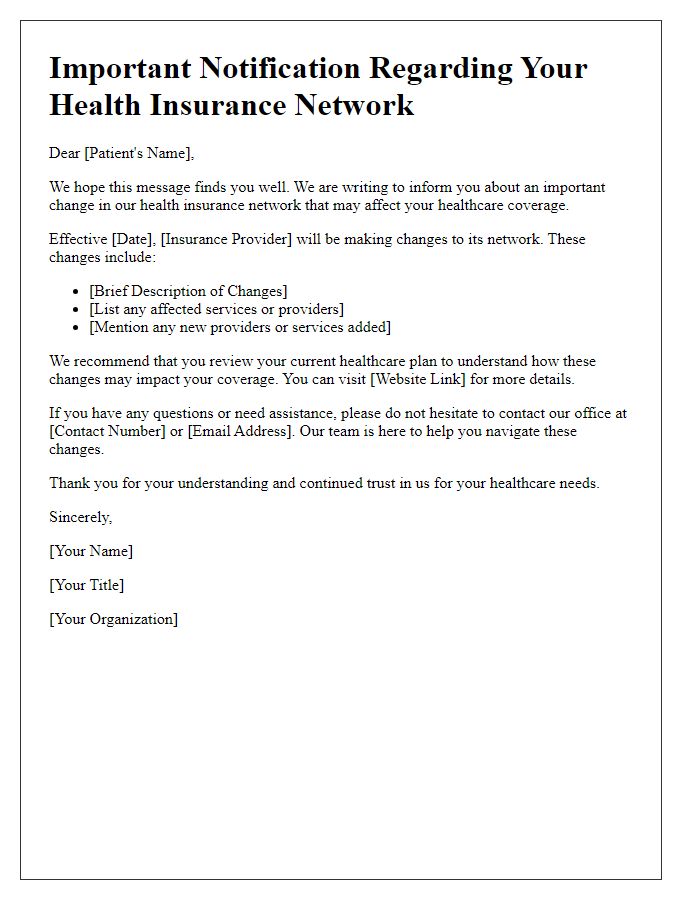

Insurance Policy Information

Healthcare insurance updates can significantly impact patient care and financial responsibilities. Insurance policies, such as those from Blue Cross Blue Shield or UnitedHealthcare, include specific coverage details that define benefits and limitations. Patients should be aware of premium costs, deductibles, and co-pays, which can vary annually and influence overall healthcare expenses. Important documents, like Explanation of Benefits (EOB), detail what services are covered and any out-of-pocket costs incurred. Additionally, changes in policy may stem from specific life events, such as marriage or job loss, affecting eligibility and plan options. Ensuring that patients are informed and understand their coverage is essential in navigating healthcare services effectively.

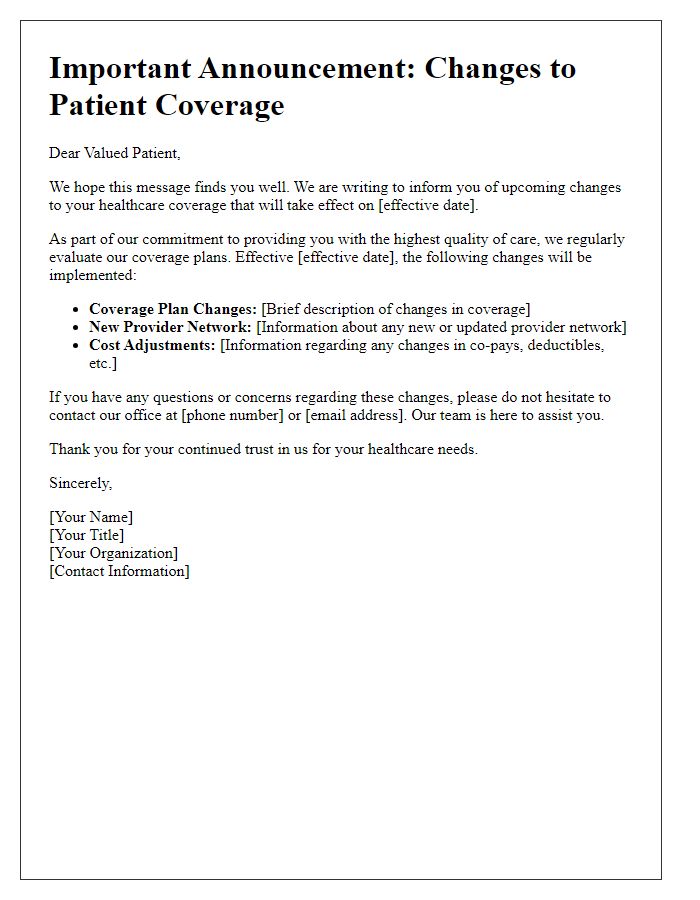

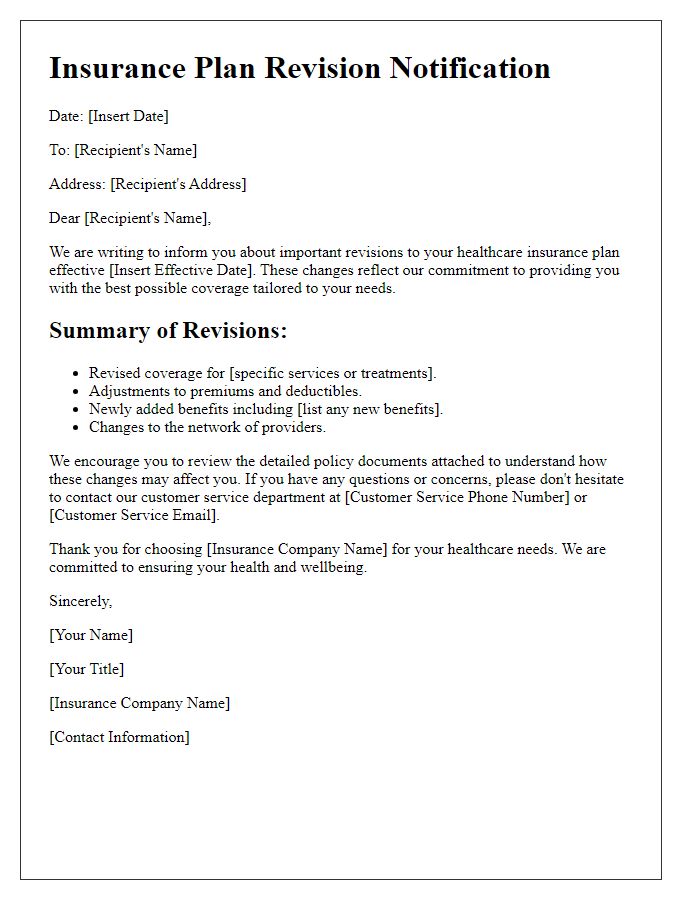

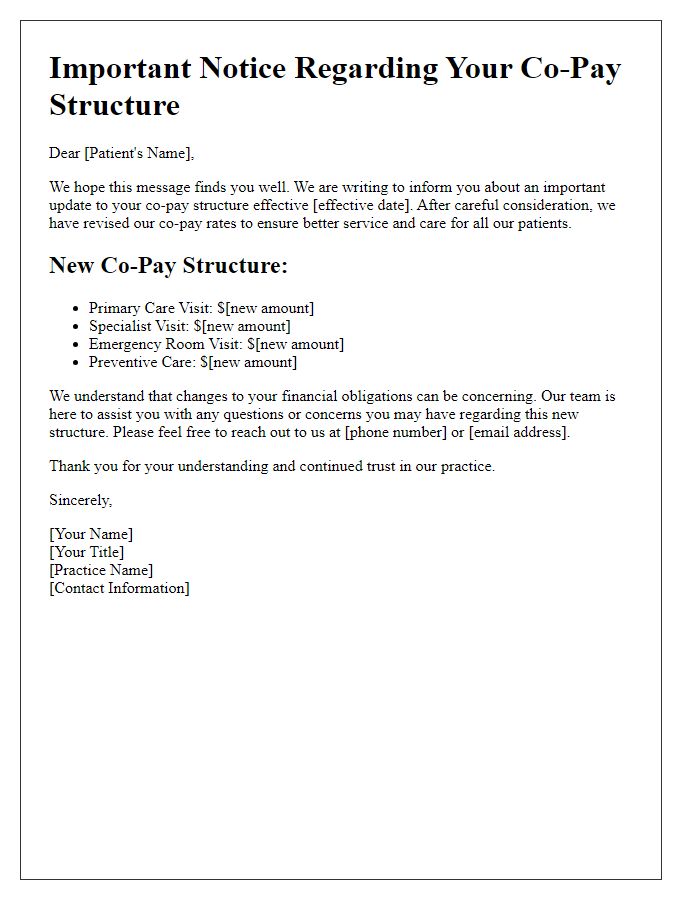

Updates on Coverage Changes

Health insurance coverage changes can significantly impact patient access to medical services and treatments. Recent alterations in coverage policies may affect various plans, including Employer-Sponsored Insurance (ESI) and Individual Marketplace plans. Patients in the United States should remain informed about modifications to their coverage, especially regarding essential health benefits mandated by the Affordable Care Act (ACA). For instance, a revision in the plan may result in adjustments to co-pays, deductibles, and the list of covered medications. Additionally, changes in provider networks can influence which healthcare providers are available to patients. It's crucial for patients to review their policy details and contact their insurance company for clarification on how these updates may affect their overall healthcare costs and access.

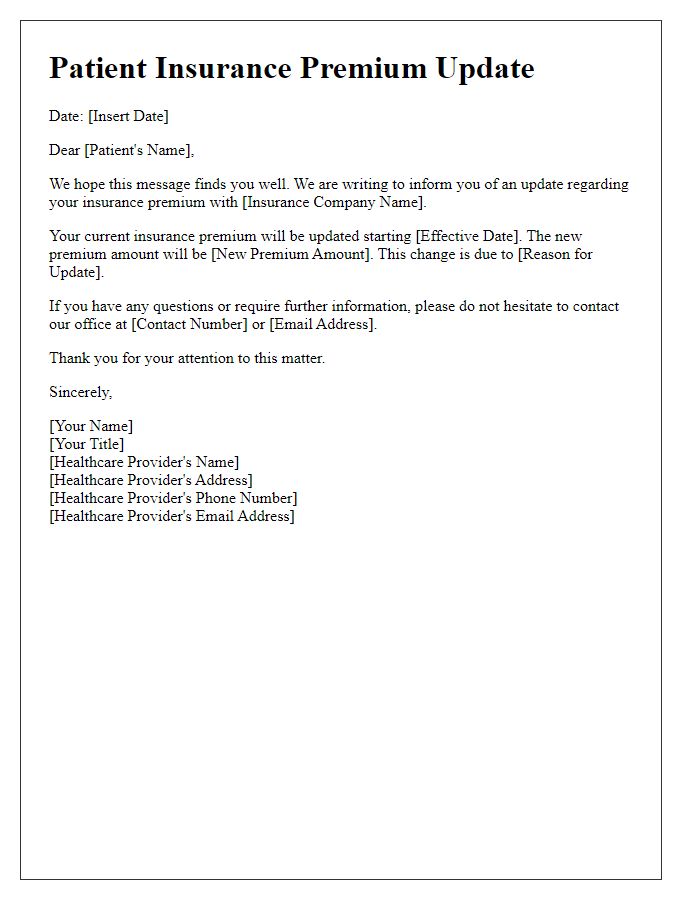

Payment and Premium Adjustments

Updating patient health insurance information is crucial for maintaining accurate coverage, particularly regarding adjustments in payment and premium. Accurate records must reflect changes in monthly premium amounts, which could vary due to factors such as enrollment status in a different healthcare plan or demographic changes. Insurance providers typically notify patients through official channels, detailing specific adjustments, including due dates and payment methods available, such as direct debit or online payments. Ensuring timely updates prevents lapses in coverage, critical for ongoing treatments, medical appointments, and access to necessary prescription medications. Failure to keep this information current could result in denied claims or unexpected out-of-pocket expenses.

Contact Information for Assistance

Patient health insurance updates often require accurate and timely information to ensure proper coverage and services. Contact information is essential to facilitate assistance with inquiries related to policy changes, coverage details, and claims processing. For example, insurance companies typically provide customer service phone numbers (often toll-free), email addresses for support, and online chat options through their websites. Additionally, local offices may have specific contact numbers for regional representatives who can offer more personalized assistance. Maintaining current contact information is crucial, as outdated details can lead to delays in receiving necessary medical care or reimbursement for expenses incurred.

Letter Template For Patient Health Insurance Updates Samples

Letter template of health insurance policy update notification for patients

Comments