Are you ready to take the next step towards securing your financial future? In this article, we'll explore a comprehensive letter template for bank loan approval that can make your application process smoother and more effective. Whether you're looking to buy a home, start a business, or manage personal expenses, having the right letter can significantly increase your chances of approval. So, let's dive in and discover how to craft that perfect letter together!

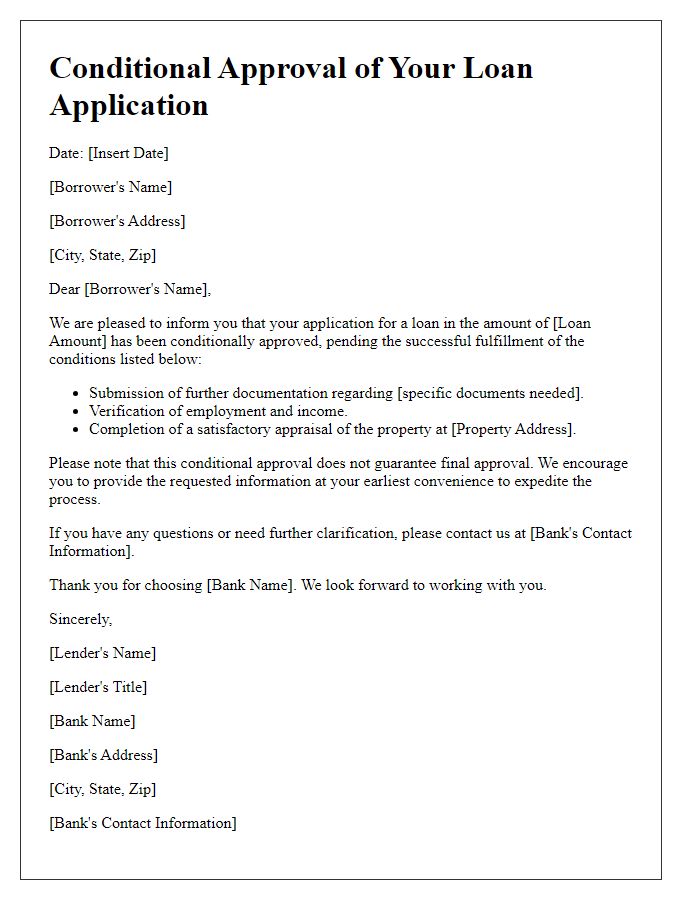

Applicant Information

The applicant information section for a bank loan approval includes essential details about the individual seeking financial assistance. Key elements include the applicant's full name, which identifies the individual, and date of birth, providing age verification for eligibility. The Social Security Number (or National Identification Number), typically a nine-digit code in the United States, assists in verifying creditworthiness and financial history. Address information, including street address, city, state, and zip code, ensures accurate correspondence and locating of the applicant. Additionally, employment information, such as job title and annual income, demonstrates the applicant's ability to repay the loan. Lastly, contact information, including phone number and email address, facilitates further communication. Each of these components plays a crucial role in assessing the applicant's suitability for loan approval.

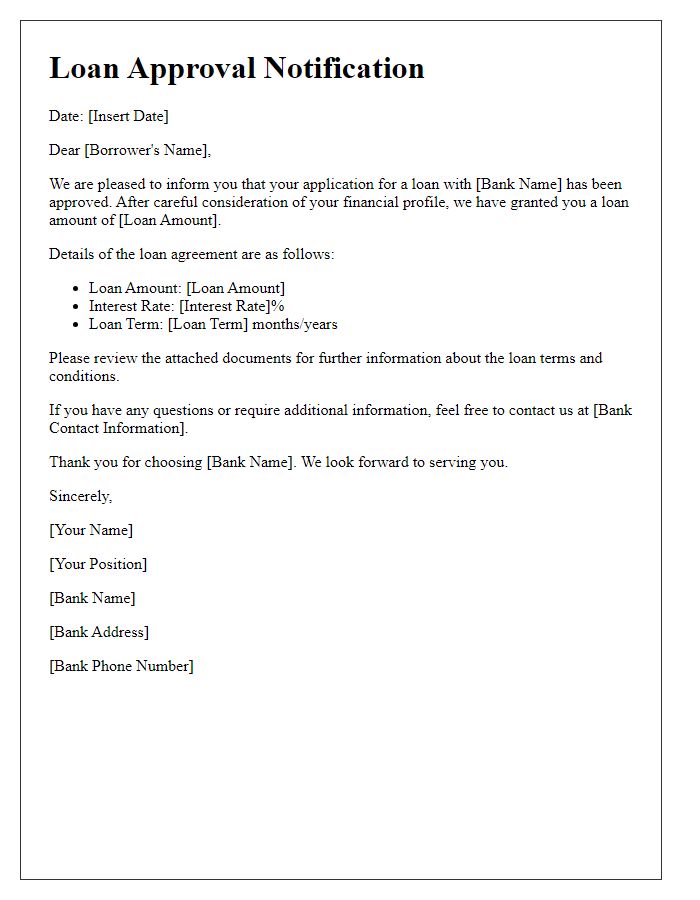

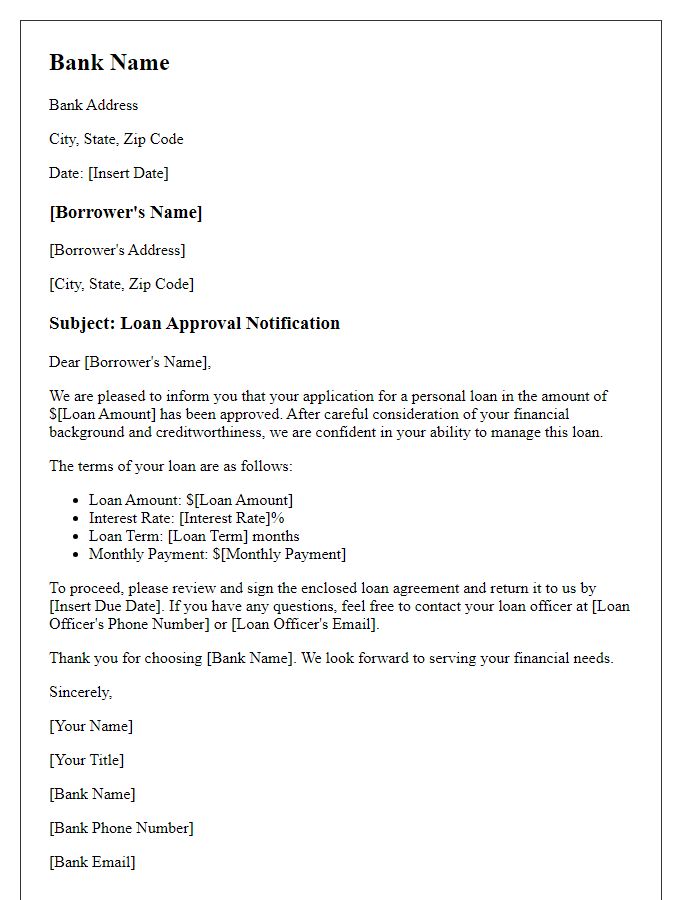

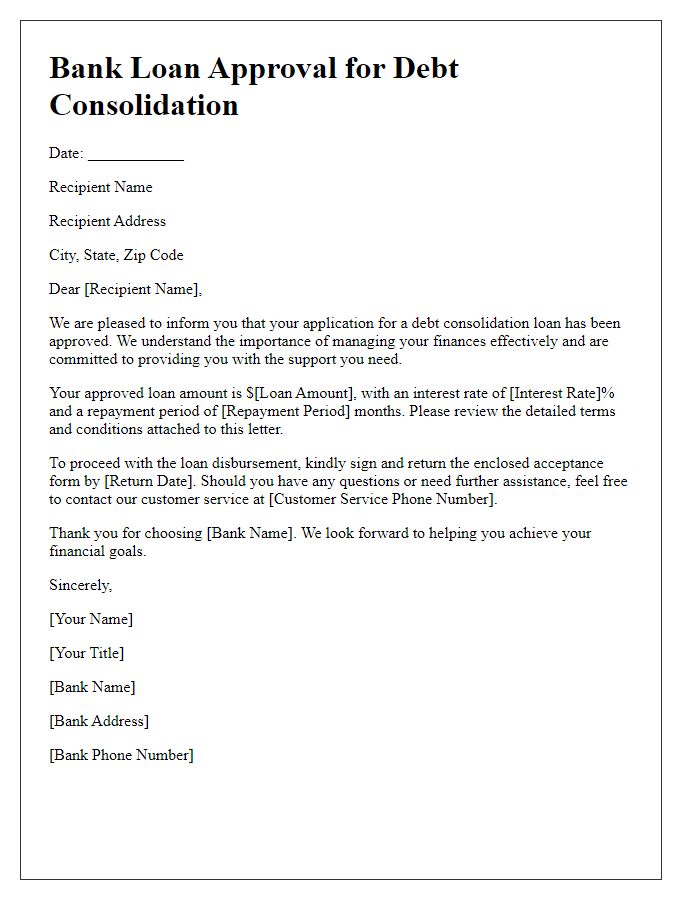

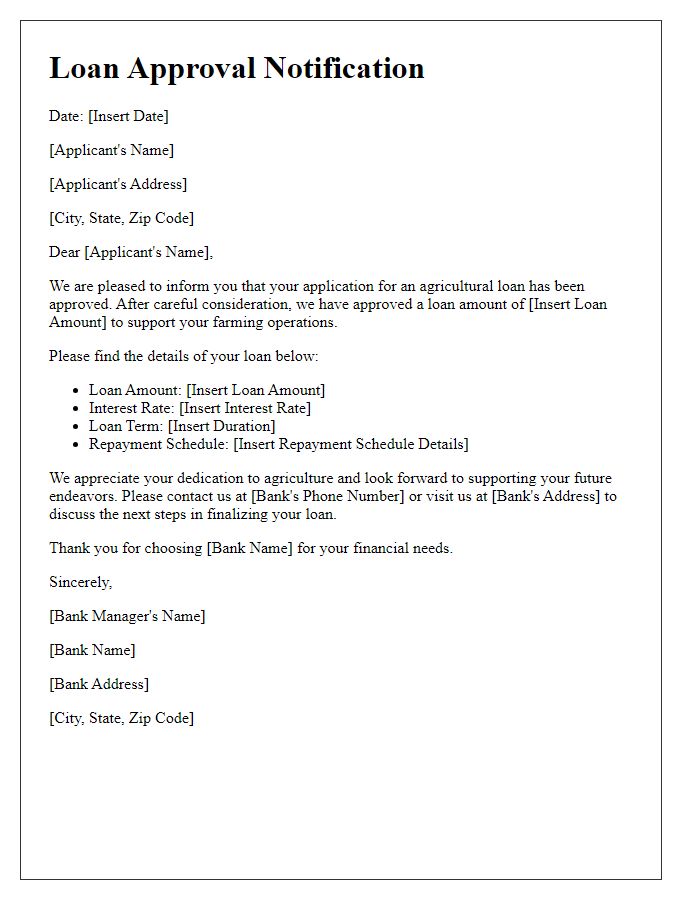

Loan Details

Loan details play a crucial role in securing approval from financial institutions. A comprehensive summary should include the loan amount, which is the principal sum requested (e.g., $150,000 for a mortgage), and the interest rate, typically fixed or variable (often between 3% and 7% depending on market conditions). The loan term specifies the duration for repayment, commonly 15 to 30 years for home loans. Additionally, monthly payments must be outlined, reflecting the installment schedule and aligning with borrower income. Collateral details are essential, particularly for secured loans, where property or assets back the loan. Furthermore, including the purpose of the loan--whether for home purchase, business expansion, or debt consolidation--provides context to lenders, allowing them to assess risk and suitability effectively.

Terms and Conditions

The approval of a bank loan often comes with specific terms and conditions crucial for both the lender and borrower. These conditions typically include the interest rate, which may vary (e.g., fixed at 5% or variable based on market conditions), repayment period (ranging from 1 to 30 years depending on the loan type), and monthly payment schedules. Secured loans may require collateral such as property or vehicles, while unsecured loans typically involve higher interest rates due to increased risk. Borrowers must also adhere to specific financial requirements, such as maintaining a minimum credit score (often above 650) and debt-to-income ratio (generally not exceeding 43%). In addition, the loan agreement might stipulate penalties for late payments, generally around 5% of the missed installment, and the possibility of prepayment penalties if the borrower pays off the loan early, aiming to protect the lender's interests. Understanding these terms is essential for successful loan management and compliance.

Repayment Schedule

The repayment schedule for a bank loan typically outlines specific details regarding the structure of repayments, including the loan amount (e.g., $10,000), interest rate (e.g., 5% annual), and duration (e.g., 5 years). Monthly payments will commence one month after the loan disbursement date, with the first payment due on the first of the month following disbursement. The schedule, provided in a tabular format, will detail monthly installment amounts, principal payment allocations, interest accruement, and the remaining balance after each payment. For example, the initial payment may be approximately $188.71, gradually reducing the total principal balance, thus ensuring complete repayment by the end of the five-year period. All terms will adhere to the Financial Freedom Act of 2022, ensuring transparency and borrower protection.

Contact Information

Contacting your bank for loan approval requires clear and concise communication. Include relevant contact information such as your full name, address, phone number, and email address, ensuring it matches the records on file with the bank. Mention the loan amount required, the purpose of the loan, and any specific types of collateral provided, such as property or vehicles. Highlight your financial history by referencing your current income, existing debts, and credit score, which should ideally be above 700 for favorable terms. Clarify if past loan agreements or accounts have been maintained in good standing, showcasing your reliability as a borrower. Providing detailed information bolsters your application and enhances the likelihood of obtaining the desired loan from the financial institution.

Comments