Are you feeling overwhelmed by tax season and unsure where to start? Engaging a tax consultancy can simplify your financial journey and ensure you're making the most of your deductions. With expert guidance tailored to your unique situation, you can maximize your tax efficiency and alleviate the stress that often comes with filing. Curious about how to get started? Read on to discover the essential elements of drafting a professional letter for tax consultancy engagement!

Client Information and Identification

In tax consultancy engagements, precise client information and identification are paramount for compliance. Essential details include the client's legal name, such as John Smith Enterprises LLC, registered tax identification number (TIN), and contact information, consisting of phone numbers and email addresses. Additionally, information regarding the client's fiscal year, such as January 1 to December 31, must be noted for accurate tax preparation. Business structure classifications, like sole proprietorship, corporation, or partnership, also influence tax obligations. Furthermore, key stakeholder information including the names and roles of managing partners and shareholders, as well as financial data such as gross income or deductible expenses, establishes a comprehensive picture for effective tax strategy formulation. Identifying principal business activities, including industry codes and revenue sources, helps in understanding applicable tax laws and regulations.

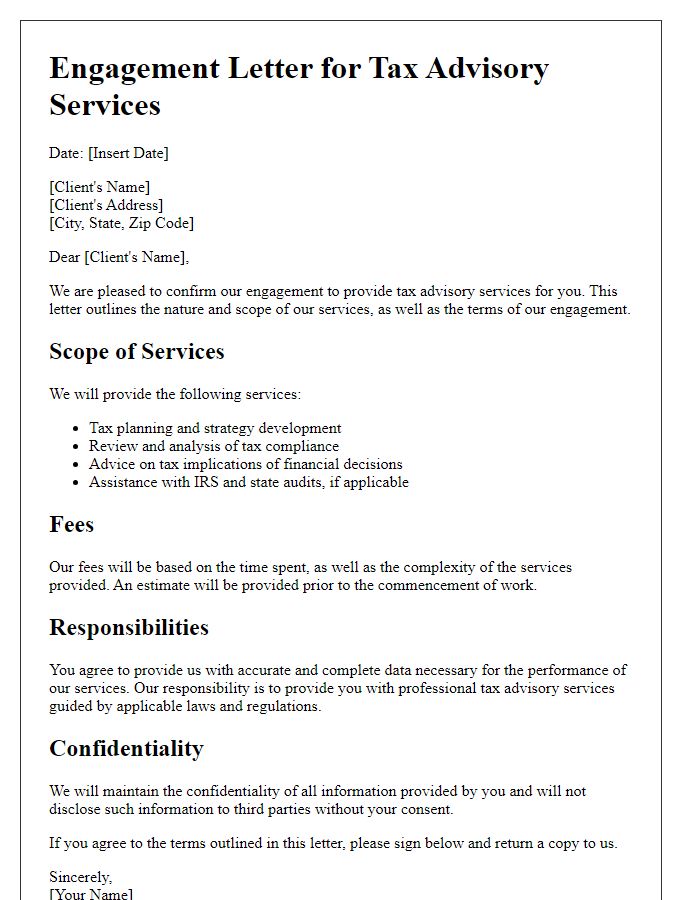

Scope of Services

A tax consultancy engagement typically covers various services designed to assist clients with tax-related issues. Comprehensive analysis of federal and state tax regulations, including Internal Revenue Service (IRS) guidelines and local tax laws, is a crucial component. Preparation and filing of tax returns for individuals and businesses, ensuring compliance and accuracy, form an essential part of the service. In-depth tax planning, aiming to minimize tax liability through strategic financial decisions like retirement contributions and investment choices, is also provided. Clients receive ongoing support and advice regarding changes in tax legislation and implications for their financial situation. Additionally, representation in case of audits or disputes with tax authorities such as the IRS is part of the engagement. Customized financial reporting may also be included, enhancing clients' understanding of their tax position and cash flow management.

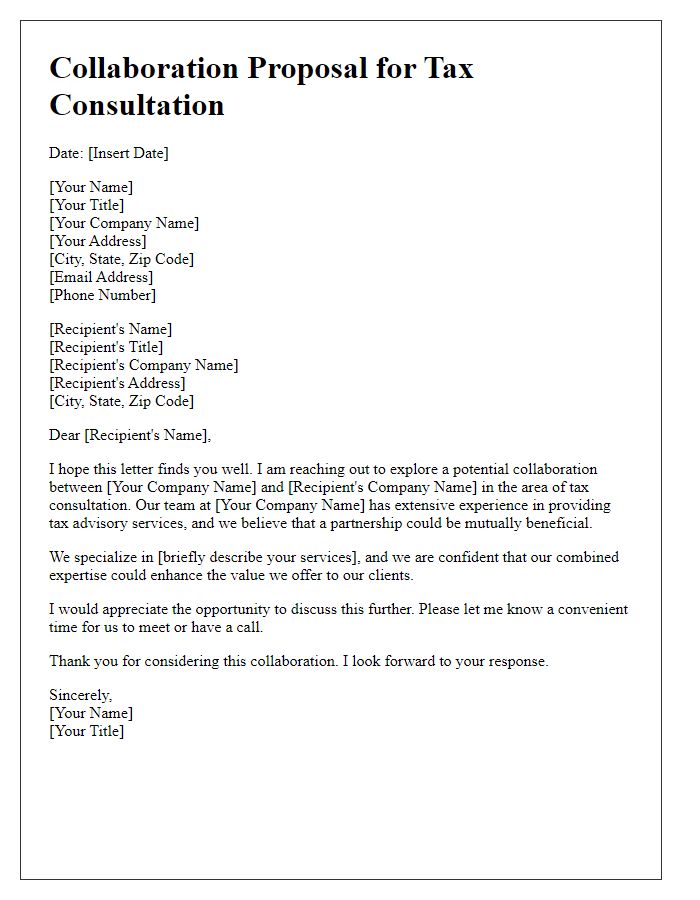

Roles and Responsibilities

In a tax consultancy engagement, responsibilities typically fall into distinct categories among parties involved. Tax consultants, possessing expertise in tax law and regulations, are responsible for providing strategic advice to clients such as corporations or individuals regarding tax planning and compliance. They may prepare and file tax returns, ensuring adherence to deadlines set by authorities like the Internal Revenue Service (IRS) in the United States. Clients are expected to provide accurate financial information and documentation, including income statements and expense records, necessary for the completion of tax forms. Communication is essential in this relationship, with periodic updates and meetings scheduled to discuss tax strategies and changes in tax legislation. Additionally, both parties should understand the implications of providing incorrect information, potentially leading to audits or penalties from tax authorities. Clear delineation of these roles fosters a productive partnership focused on optimizing tax liabilities and ensuring compliance.

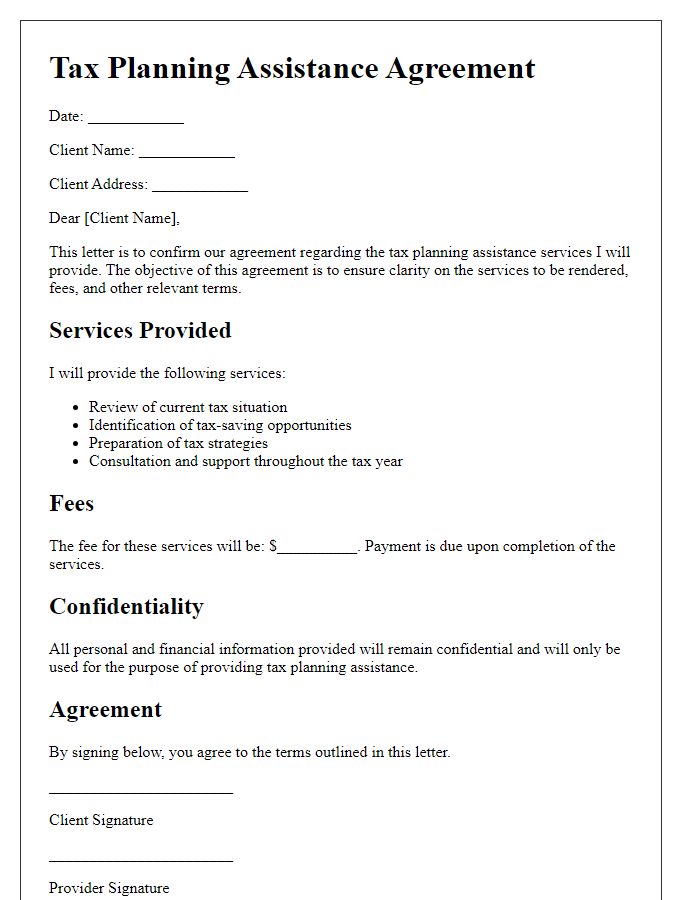

Fees and Billing Arrangements

Tax consultancy fees typically vary based on the complexity of services rendered, such as income tax preparation or corporate tax compliance. Standard hourly rates range from $100 to $500, depending on the consultant's expertise and geographic location, like metropolitan areas versus rural regions. Fixed fees for specific services, such as preparation of Form 1040 or corporate return Form 1120, can average between $200 and $2,000, influenced by factors like business entity type and state-specific laws. Billing arrangements may include retainer agreements for ongoing consultations or payment plans for larger projects, ensuring clients can budget for necessary tax advisory services without unexpected expenses. Additional administrative costs, such as filing fees or software subscriptions, may also impact overall billing, emphasizing the importance of clear communication regarding total costs.

Confidentiality and Data Protection

Confidentiality in tax consultancy is paramount, particularly when handling sensitive financial data. Tax consultants must adhere to strict data protection regulations, such as the General Data Protection Regulation (GDPR) established by the European Union, which governs the processing of personal data. This involves secure storage solutions to prevent unauthorized access to confidential client information, including personal identification numbers (such as Social Security Numbers), financial records, and tax returns. In the United States, compliance with the Internal Revenue Service (IRS) guidelines on taxpayer confidentiality is crucial. Maintaining robust encryption protocols during data transmission safeguards against potential breaches, ensuring that sensitive data remains protected throughout the consultancy engagement. Furthermore, tax consultants are obligated to train their staff on data protection policies to foster a culture of security awareness. Regular audits can also help identify vulnerabilities in data handling processes, enhancing the overall security framework.

Comments