Are you curious about ensuring you have the right insurance coverage for your needs? Understanding your insurance options can feel overwhelming, but it's essential for protecting your assets and peace of mind. In this article, we'll break down the key elements of an effective insurance coverage assessment and offer tips on how to choose the right plan for your lifestyle. So, let's dive in and uncover the essentials together!

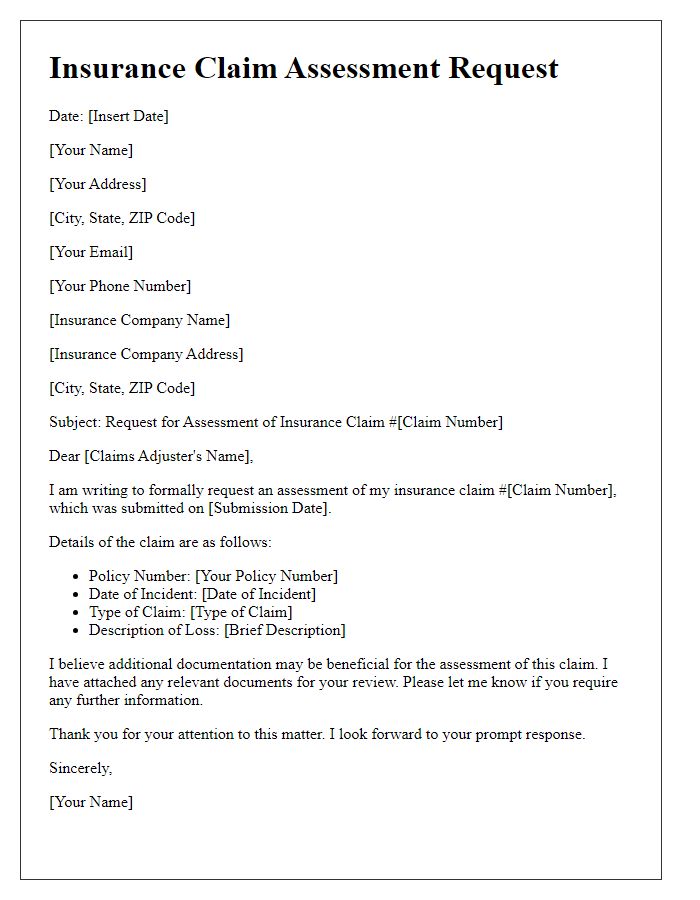

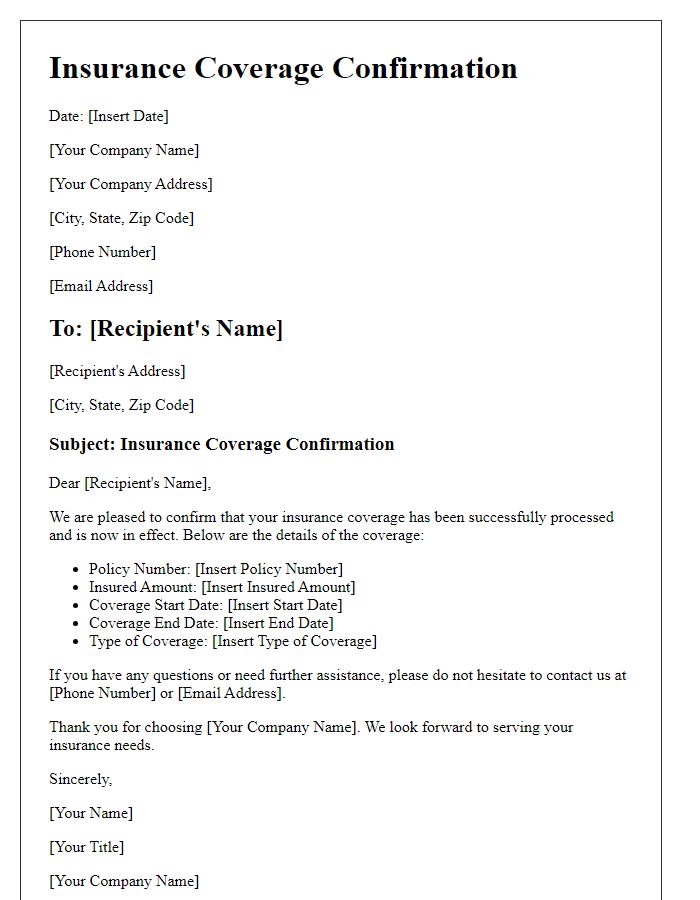

Header: Include sender's contact information and recipient's details.

When assessing insurance coverage, meticulous evaluation of policy details is essential. Clear communication of the sender's contact information, including name, address, phone number, and email, sets a professional tone for correspondence. Incorporating recipient's details, such as the insurance company's name, department, and address, ensures the request reaches the correct division. Including a reference number can expedite processing and organization within the insurance firm. Details about the specific coverage being assessed, such as policy numbers, dates of coverage, and types of claims, provide context for the request, facilitating a more thorough review. An organized format establishes clarity in communication, enhancing the efficiency of the assessment process.

Subject Line: Clear and concise description of the letter's purpose.

The insurance coverage assessment for policy number 123456789, issued by Acme Insurance Company, provides an overview of current limits, deductibles, and exclusions as of October 2023. Coverage includes property damage with a limit of $250,000, personal liability coverage of $500,000, and an annual premium of $1,200. Important exclusions involve flood and earthquake damage, emphasizing the necessity of additional riders for specific natural disasters. A detailed review of policy documents is recommended to ensure comprehensive understanding and adequate protection tailored to individual risk profiles.

Statement of Purpose: Reason for the assessment request or response.

Insurance coverage assessment evaluates policyholder's eligibility for financial protection against unforeseen events, such as accidents, natural disasters, and health emergencies. Comprehensive reviews often involve analysis of specific documents, including policy agreements and claim submissions, to determine coverage levels in light of incidents occurring at designated locations, such as homes or businesses. Assessors utilize guidelines established by regulatory bodies, often referencing state-specific legislation, to ensure compliance and adequate support for claims. Factors like premium costs, coverage limits, and deductibles play critical roles in shaping the assessment process, guiding both insurer and policyholder through the complexities of risk management and financial security.

Coverage Details: Specific policies, terms, and coverage limits.

The insurance coverage assessment focuses on specific policies, including health, auto, and homeowner plans, detailing terms such as deductibles, exclusions, and conditions. Coverage limits often define the maximum payout for certain events like natural disasters or accidents, typically ranging from $25,000 to $1 million, depending on the policy. Additional features may include endorsements like personal property protection or comprehensive coverage for vehicles, enhancing the overall security of insured assets. It's essential to review both the standard coverage areas and any applicable riders to ensure that all potential risks are adequately addressed for comprehensive financial protection.

Closing: Contact information for follow-up and additional queries.

During the insurance coverage assessment, it is crucial for clients to have clear contact information for follow-up inquiries. Providing an email address (such as insurance_agent@email.com), a direct phone number (like (555) 123-4567), and office hours (Monday to Friday, 9 AM to 5 PM) ensures that clients can reach out easily for any additional questions about their coverage. Establishing a dedicated point of contact, such as a specific insurance agent or representative, can help streamline the communication process. Creating a comprehensive FAQ section on the company's website, alongside these contact details, may further assist clients in understanding their policies and any necessary documentation for their claims.

Comments