Are you intrigued by the complex world of forensic financial investigations? In today's rapidly evolving financial landscape, understanding the nuances of forensic accounting can illuminate hidden assets and unveil financial discrepancies that may go unnoticed. This specialized field combines sharp analytical skills with an investigative mindset to uncover the truth behind financial statements. Join us as we delve deeper into the essential components and practices of forensic financial investigations in this article!

Clear Subject Line

A forensic financial investigation involves a comprehensive analysis of financial records, transactions, and accounts to uncover any discrepancies, fraud, or wrongful activities. Emphasis on identifying suspicious activities such as unusual wire transfers, patterns of money laundering, or concealed assets is crucial. Key documents for review typically include bank statements from major financial institutions, tax returns spanning several years, and ledgers detailing income and expenses. Establishing a clear timeline of events relating to financial transactions often reveals critical insights into the integrity of financial dealings. Expert forensic accountants, utilizing advanced software tools for data analysis, play a vital role in uncovering hidden financial irregularities, providing evidential support for legal proceedings if needed.

Detailed Introduction

Forensic financial investigations focus on uncovering financial fraud, discrepancies, and misconduct within organizations or individuals. These investigations often involve the detailed analysis of financial records, transaction patterns, and accounting practices to identify illegal activities, such as embezzlement, money laundering, or tax evasion. Forensic accountants, using specialized skills and techniques, may scrutinize documents such as bank statements, invoices, and tax returns, often requiring the examination of data dating back several years. Notable cases, like the Bernie Madoff Ponzi scheme, highlight the critical role forensic investigations play in returning misappropriated funds and pursuing legal action against perpetrators. Locations of these investigations can span various industries, including healthcare, finance, and government entities, emphasizing the importance of robust financial oversight and compliance.

Scope of Investigation

Forensic financial investigations examine the details of financial records to uncover fraud, embezzlement, or other financial misconduct. These investigations scrutinize accounting practices, bank statements, and transaction histories to assess discrepancies. Investigators utilize various tools such as software analysis and interviews with financial personnel, aiming to discover potential red flags like unusual patterns in spending or transfers exceeding typical limits. The investigation's scope may extend into multiple years, focusing on specific events such as mergers, acquisitions, or audits. Geographic locations, like corporate headquarters or branch offices, play a critical role, with attention given to their operational procedures and compliance with financial regulations.

Required Documentation

Forensic financial investigations often necessitate a comprehensive range of documentation to ensure accuracy and thoroughness. Essential records may include bank statements detailing transactions over the last five years, payroll records identifying salary payments, tax returns indicating annual income, and invoices related to business expenses. Additionally, documents such as contracts and agreements showcasing any financial commitments, credit card statements reflecting personal and business expenditures, and any correspondence (emails or letters) related to financial transactions play crucial roles. Collecting detailed records of asset ownership, including property deeds and vehicle registrations, as well as documentation of liabilities like loan agreements and mortgage statements, provides a complete financial picture. Each piece of evidence contributes significantly to uncovering financial discrepancies and ensuring a fair investigation outcome.

Contact Information

Forensic financial investigations require meticulous attention to detail, particularly in the context of financial documents and records. The investigator must consider aspects such as account numbers, transaction dates, and financial compliance regulations that govern the jurisdiction in question, like the Sarbanes-Oxley Act in the United States. Financial statements (balance sheets, income statements) provide critical insight, contributing to the overall assessment of fraud potential. Furthermore, involvement of relevant entities such as banks, companies, or individuals adds necessary layers of complexity, necessitating direct communication with stakeholders. Additionally, utilization of software tools designed for forensic accounting can enhance the accuracy of data analysis and simplify the interpretation of complex financial patterns.

Letter Template For Forensic Financial Investigation Samples

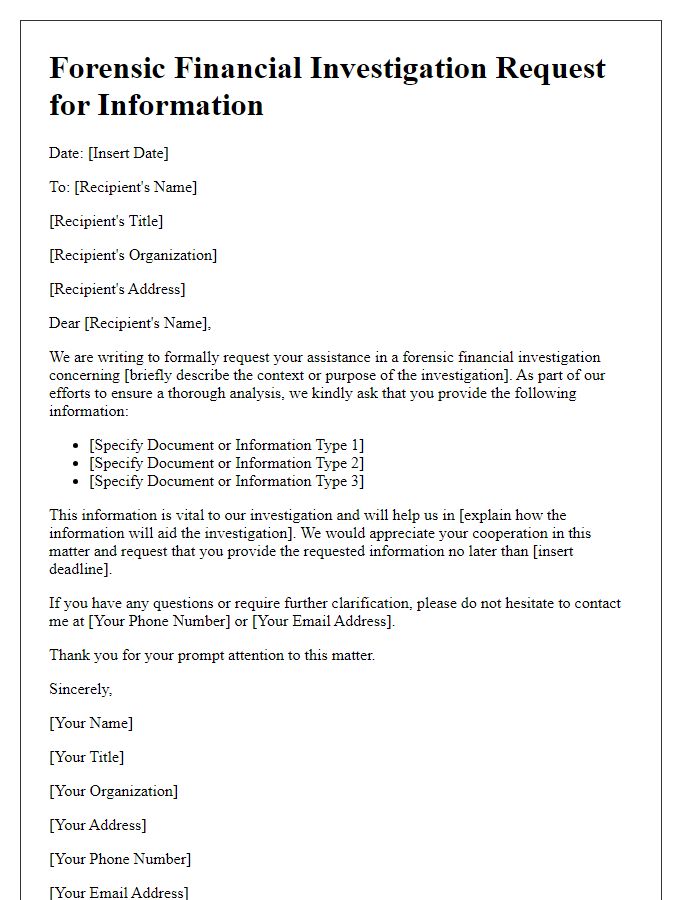

Letter template of forensic financial investigation request for information.

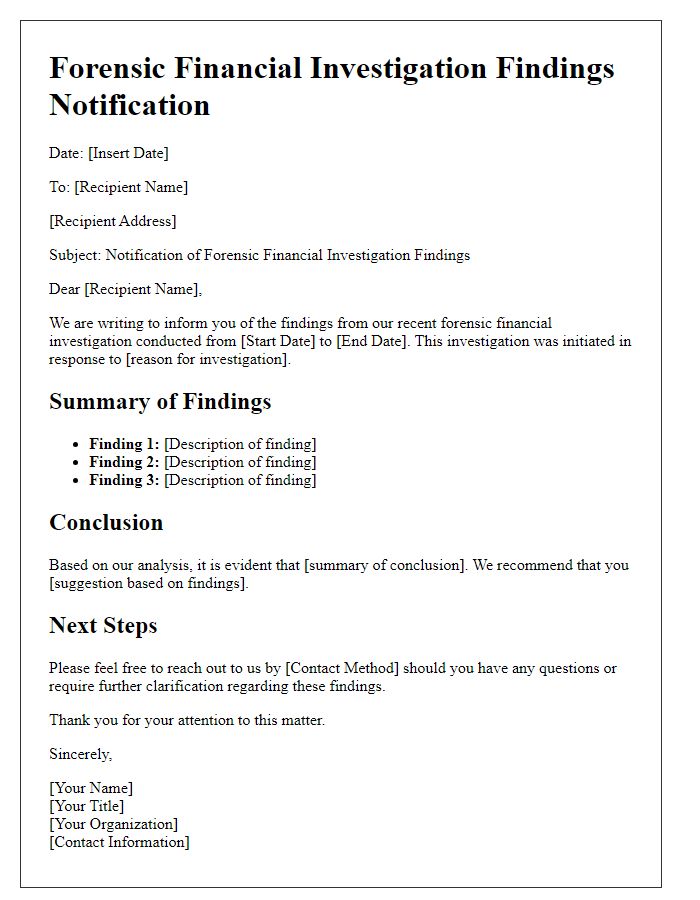

Letter template of forensic financial investigation findings notification.

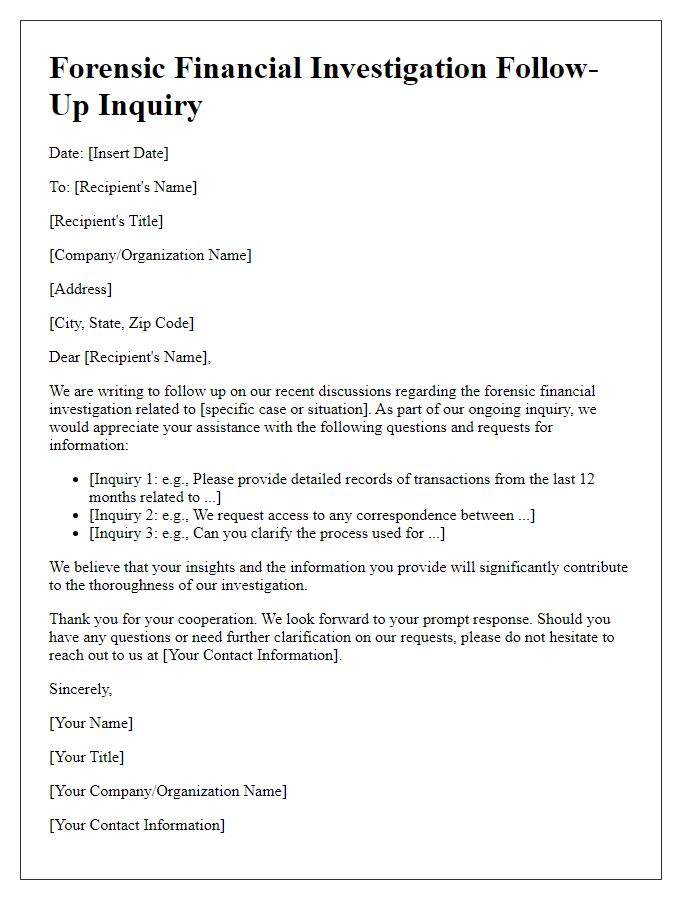

Letter template of forensic financial investigation follow-up inquiries.

Letter template of forensic financial investigation confidentiality agreement.

Letter template of forensic financial investigation conclusion statement.

Letter template of forensic financial investigation audit results communication.

Comments