If you're facing financial challenges, crafting a well-structured financial crisis management plan can be a game-changer. This type of letter template is designed to guide you through outlining your strategic steps to regain control over your finances. By addressing the key components of your situation, such as identifying potential risks and developing actionable solutions, you can create a clearer path forward. Ready to dive into the details and make your plan effective? Let's explore how to create a solid foundation for your financial recovery.

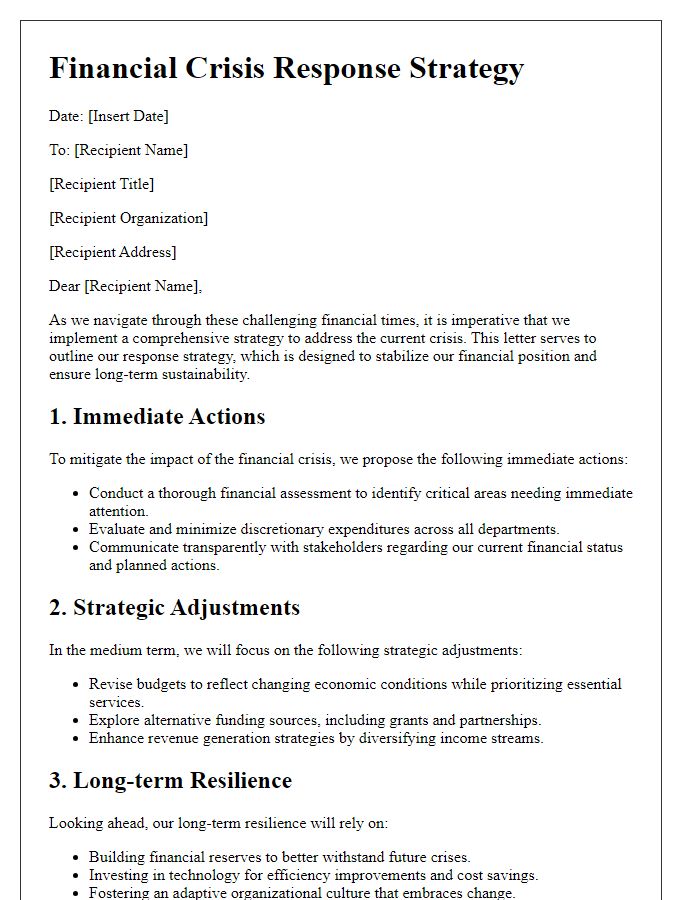

Clear communication strategy

A clear communication strategy is crucial during financial crises to maintain investor confidence and support stakeholder engagement. Establishing regular updates (at least bi-weekly) helps ensure transparency concerning organizational decisions and financial standing. Key messages should focus on the crisis's impact on revenue, operational adjustments, and future projections. Designated spokespersons, typically from the finance department or executive leadership, should convey consistent information to prevent mixed messages. Utilizing multiple channels, such as press releases, social media platforms like Twitter and LinkedIn, and internal newsletters, aids in reaching diverse audiences. Assessing feedback from stakeholders frequently allows for real-time adjustments in messaging to address concerns effectively, fostering trust and reinforcing commitment to recovery strategies.

Stakeholder identification

In a financial crisis management plan, identifying stakeholders is crucial to ensuring effective communication and strategic response. Key stakeholders include shareholders (individuals or entities owning company shares), employees (staff members directly impacted by financial decisions), suppliers (businesses providing essential goods and services), customers (clients purchasing products or services), and regulatory agencies (government bodies enforcing financial regulations). Additionally, creditors (institutions or individuals owed money by the company) and community members (local businesses and residents affected by the company's operations) further contribute to the stakeholder landscape. Each group has unique interests and potential impacts on the organization during a financial crisis, making their identification and engagement vital for a comprehensive management strategy.

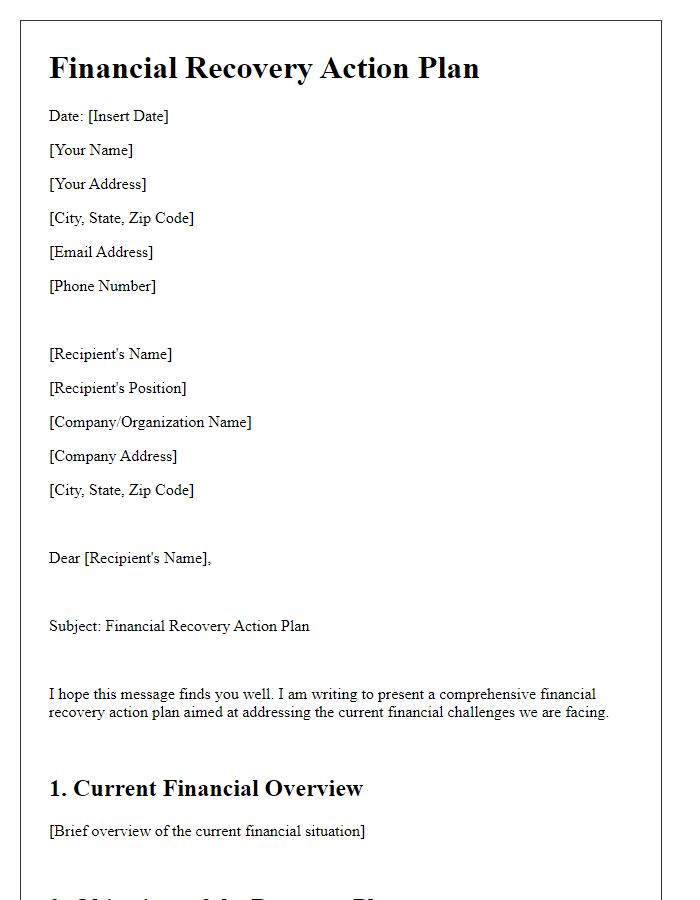

Risk assessment and mitigation

A comprehensive financial crisis management plan necessitates a robust risk assessment and mitigation strategy tailored for organizations facing economic challenges. Key elements include identifying potential risks, such as sudden market fluctuations or economic downturns, which can severely impact revenue streams. For instance, the 2008 financial crisis revealed vulnerabilities in various sectors, necessitating proactive measures. Risk analysis should incorporate quantitative metrics, like the Debt-to-Income Ratio, which helps gauge financial stability. Implementing a mitigation strategy may involve diversifying investments across sectors, enhancing cash reserves to cover at least six months of operational expenses, or establishing emergency lines of credit with financial institutions such as banks. Regular monitoring of market conditions and adapting the plan accordingly will be crucial to navigating uncertain economic landscapes effectively.

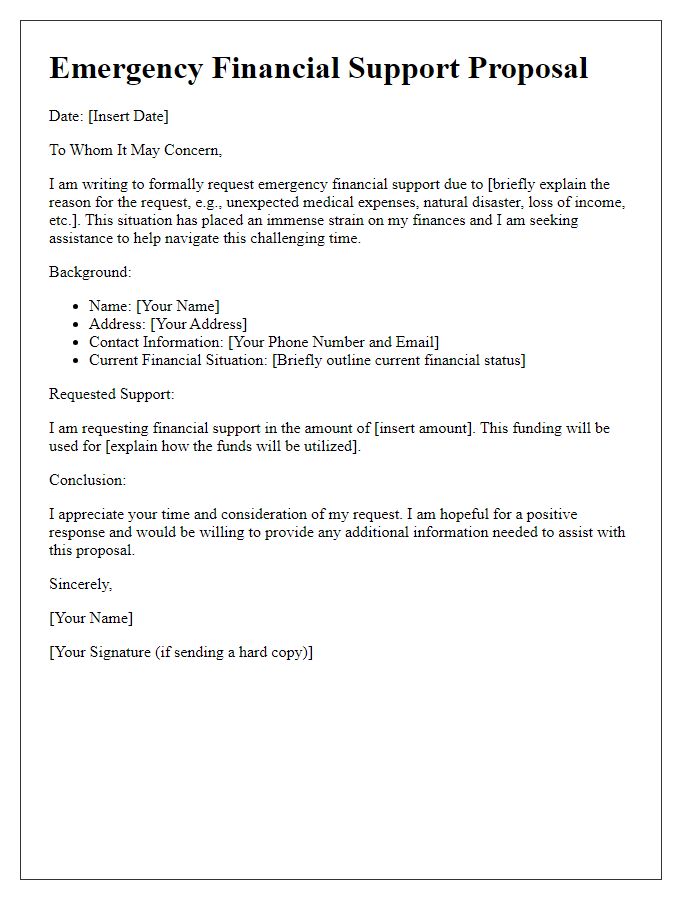

Resource allocation

In resource allocation during a financial crisis, organizations must strategically distribute limited assets to maintain operations and ensure survival. Evaluating current revenue streams like product sales or service fees becomes crucial for prioritizing investments. Identifying critical areas such as payroll, supply chain continuity, and essential operational costs ensures workforce stability and prevents disruption. Implementing cost-cutting measures like renegotiating contracts with vendors or reducing discretionary spending can enhance liquidity, ensuring funds are available for necessary expenditures. Additionally, developing contingency plans for various scenarios like further economic downturns or unexpected expenses fosters resilience, enabling organizations to adapt swiftly and maintain financial health.

Compliance and legal considerations

Financial crisis management plans must include a thorough analysis of compliance and legal considerations. Regulatory frameworks, such as the Sarbanes-Oxley Act of 2002, require transparent financial reporting that adheres to Generally Accepted Accounting Principles (GAAP). Companies facing financial distress must assess potential violations of financial obligations to creditors, which could lead to bankruptcy filings under Chapter 11 in the United States. Legal obligations regarding employee rights, such as the Worker Adjustment and Retraining Notification (WARN) Act, mandate notification of mass layoffs. Furthermore, risk management strategies must consider the implications of contract law, ensuring that renegotiation or termination of contracts does not infringe on existing legal agreements. The role of legal counsel becomes paramount for navigating complex situations, ensuring all actions align with federal and state laws to mitigate potential litigation risks.

Comments