Are you feeling overwhelmed by the complexities of family finances? You're not alone! Many families find themselves navigating a maze of budgeting, saving, and investing in order to secure their financial future. Join us as we explore effective strategies for family financial planning that can help bring peace of mind and stability to your householdâread on for valuable insights!

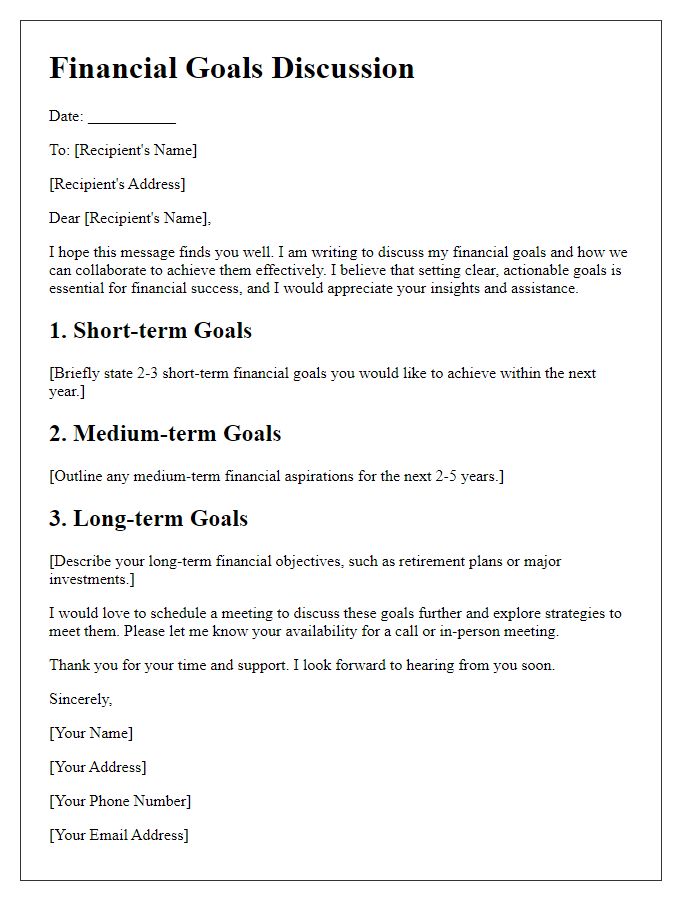

Financial Goals and Priorities

Creating a comprehensive family financial plan involves setting clear financial goals and prioritizing them effectively. Establishing short-term objectives, such as saving for a family vacation costing approximately $5,000, can provide motivation for budgeting. Mid-term goals may include saving for children's college education, with expenses averaging $30,000 per year for four years per child at institutions like public universities. Long-term objectives often focus on retirement savings, aiming for a nest egg of $1 million by age 65 to ensure financial security during retirement years. Additionally, it is crucial to prioritize debt management, particularly high-interest debts like credit card balances exceeding 20% APR, as this can hinder overall financial progress. Regular assessments of financial priorities, at least quarterly, can help adapt to changing life circumstances and ensure alignment with family values and aspirations.

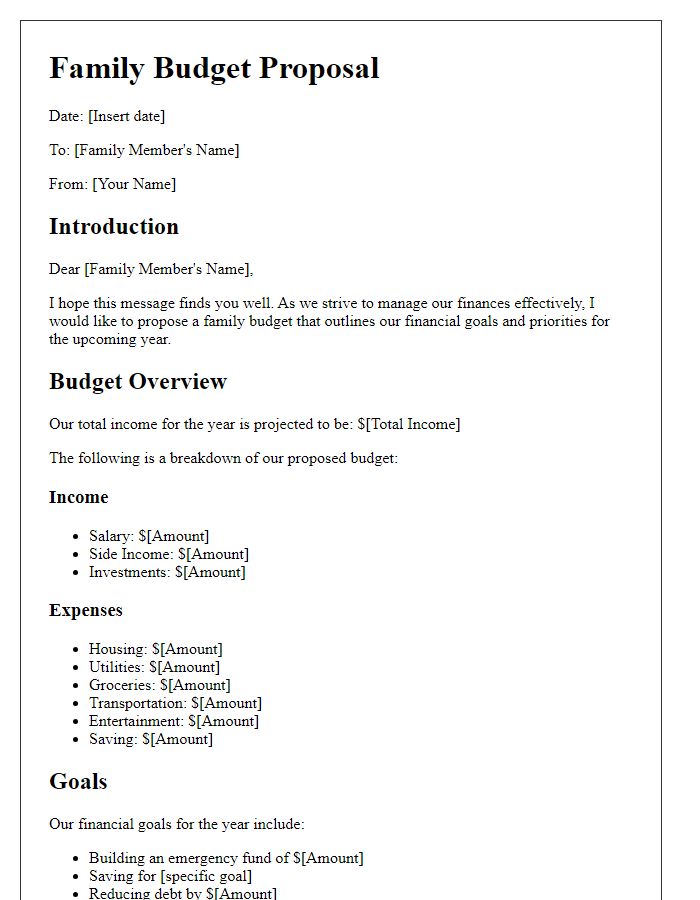

Current Income and Expenses

The process of family financial planning begins with a thorough assessment of current income and expenses. Households, for instance, often categorize their income sources, including salaries (from full-time positions) and other potential streams such as freelance work or rental income from properties. On the expenses side, fixed costs like mortgage or rent payments, utilities such as electricity and water bills, and variable costs including groceries and entertainment must be accounted for meticulously. It is essential to track discretionary spending habits that can significantly influence overall financial health. By organizing these elements, families can visualize their cash flow, allowing for better strategic planning regarding savings goals, investments, and debt management initiatives.

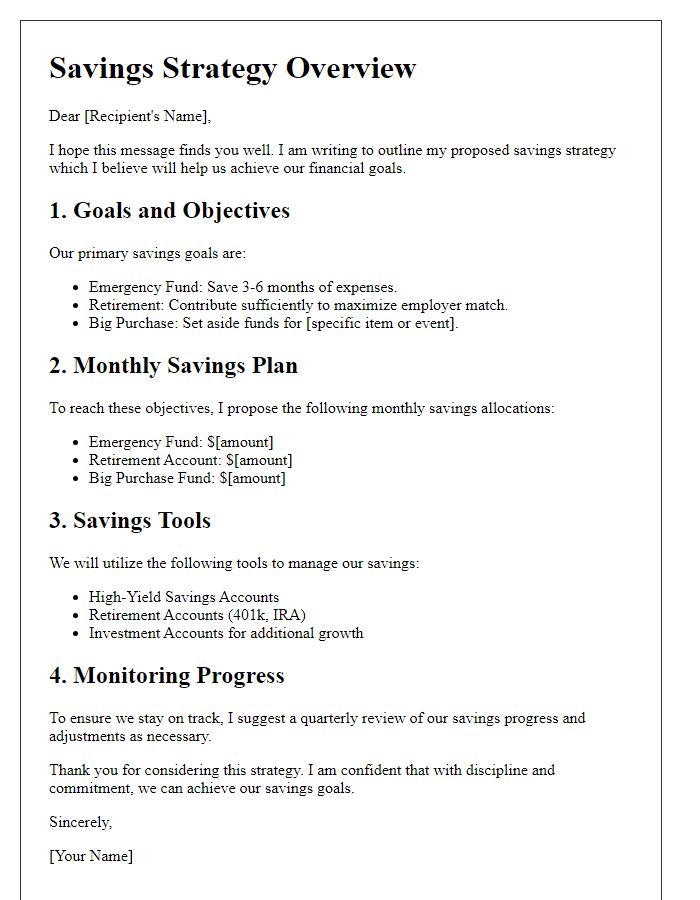

Savings and Investments Strategy

Family financial planning is essential for securing long-term stability and achieving financial goals. A well-structured savings strategy, targeting at least 20% of monthly income, can accumulate a robust emergency fund, ideally three to six months' worth of living expenses. Investment options, such as diversified portfolios including stocks (potentially earning over 7% annually historically), bonds, and real estate (which appreciates significantly in a thriving market like Denver), allow for wealth growth over time. Tax-advantaged accounts like IRAs and 401(k)s encourage retirement savings, maximizing growth through compounding. Regular financial reviews, ideally every quarter, keep the plan on track amid changing circumstances, ensuring adjustments based on market trends and family needs.

Risk Management and Insurance

Risk management and insurance play crucial roles in ensuring family financial stability and security. Identifying risks, such as unexpected medical expenses or property damage, allows families to prepare adequately through comprehensive insurance policies, including health, auto, home, and life insurance. Evaluating potential risks can lead to selecting appropriate coverage amounts, ensuring that financial obligations are met even in emergencies. For instance, a family with children may prioritize life insurance to secure their future education and living expenses. Additionally, understanding deductibles and premiums helps families budget effectively, preventing financial strain. Incorporating risk management strategies, such as emergency savings, complements insurance coverage, further safeguarding family finances from unforeseen circumstances.

Estate Planning and Legal Documents

A letter template for family financial planning serves as an essential tool for outlining crucial aspects of estate planning and legal documents. This template guides families in organizing their financial affairs, ensuring that assets such as properties, investments, and personal belongings are distributed per their wishes after passing. Key legal documents highlighted include wills, which delineate the distribution of assets, and trusts, which can provide greater control over asset distribution during and after one's lifetime. Additionally, powers of attorney are essential, granting designated individuals the authority to make decisions regarding finances and healthcare in emergencies. The clarity provided by this template fosters open communication among family members, ultimately aiming for a well-structured, thoughtful approach to financial legacy and familial security.

Comments