Are you considering equity release as a way to unlock the value tied up in your home? This financial option can provide you with the freedom to fund your dreams, whether that's a holiday, home improvements, or simply enjoying a more comfortable lifestyle in retirement. In this article, we'll explore the essentials of equity release, including its benefits, potential pitfalls, and what to consider before making a decision. So, grab a cup of tea, settle in, and let's dive deeper into this intriguing topic!

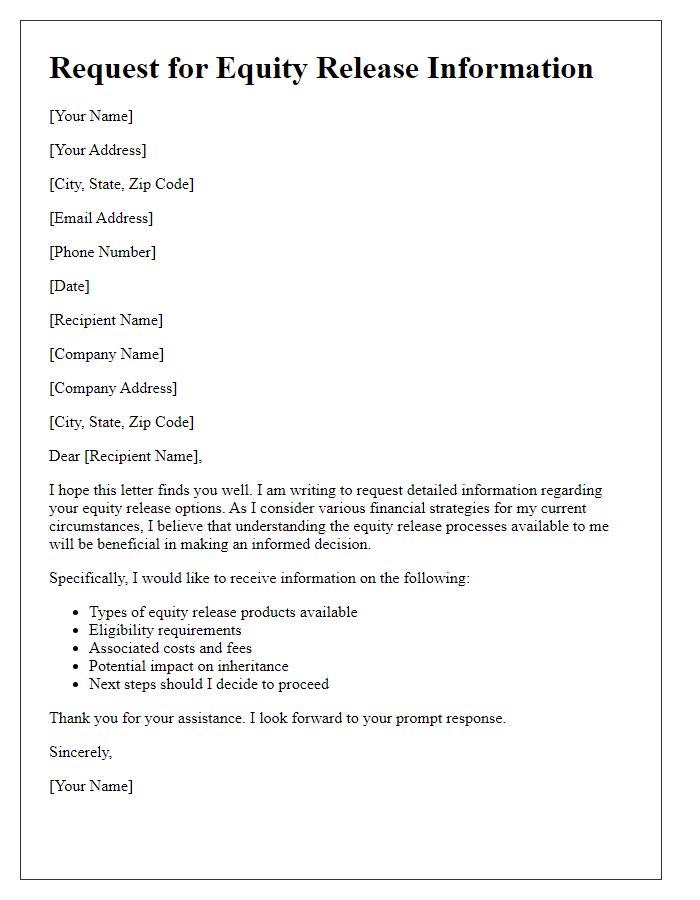

Personal Details

Equity release plans can provide homeowners with access to funds based on their property value, allowing them to unlock cash without needing to sell their home. Typically available for individuals aged 55 and over, schemes like lifetime mortgages or home reversion plans allow homeowners to retain ownership while accessing a proportion of their property's equity. Key factors include the property location, current market value, and any outstanding mortgage balance. Homeowners often seek equity release due to needs such as funding home improvements, covering healthcare costs, or supplementing retirement income. It is crucial to understand terms and conditions, including potential effects on inheritance and eligibility for means-tested benefits, when considering equity release options.

Equity Release Purpose

Equity release serves as a financial solution for homeowners aged 55 and above who wish to access the value of their property without having to sell it. This process allows homeowners to unlock a portion of their home equity, which can be used for various purposes such as funding retirement activities, covering home renovations, paying off debts, or assisting family members with significant expenses like education or buying their first home. The most common forms of equity release include lifetime mortgages and home reversion plans, each offering different structures and repayment options. Understanding local property market trends and evaluating the potential impact on inheritance are critical considerations for homeowners contemplating equity release. This financial option can provide essential financial support while allowing individuals to continue enjoying their homes.

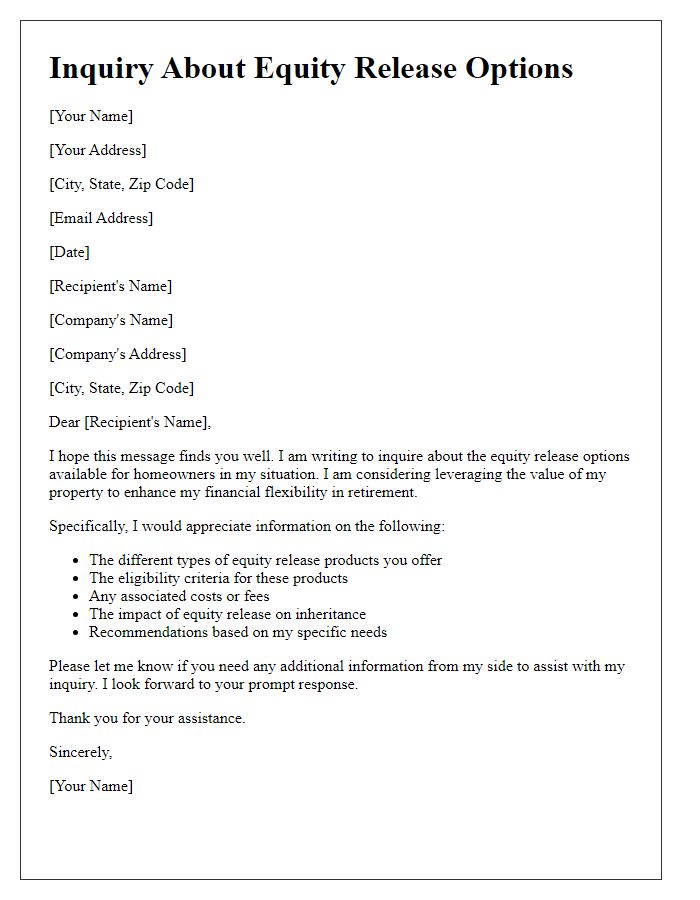

Property Information

Property information, such as location details, construction type, and total square footage, plays a crucial role in equity release assessments. Properties in prime areas, like London or Manchester, tend to hold higher market values, while older constructions may require maintenance considerations. The current property market trends, including average house prices and demand fluctuations, directly influence potential equity release amounts. Essential factors include the property's age, condition, and accessibility features, which all contribute to the overall assessment. Additionally, legal documents, such as land registry details and title deeds, are necessary to establish ownership and ensure seamless processes in equity release arrangements.

Financial Situation

Equity release offers homeowners an opportunity to access funds tied up in property value, allowing them to address financial needs, such as home renovations, healthcare costs, or retirement savings. Home equity, often accumulated over decades in residential properties, can be substantial in regions like London, where average property values exceed PS500,000. Financial advisers often assess an individual's overall financial situation, including income sources, existing debts, and future expenses, to determine the suitability of equity release. Factors such as age, property condition, and market trends also play vital roles in deciding the most beneficial approach. Interest rates, sometimes as low as 2.5%, impact the total amount owed over time, leading to increased costs if the homeowner lives longer than expected. Understanding these dynamics is crucial for making informed decisions about leveraging home equity responsibly.

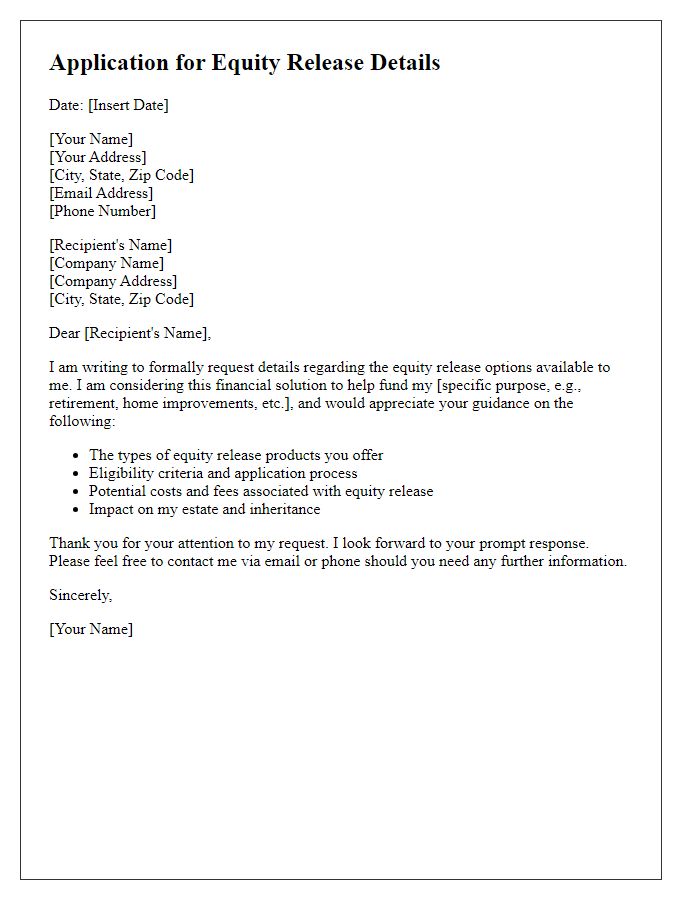

Legal Considerations

Equity release schemes offer homeowners, particularly those aged 55 and above, a method to access the cash tied up in their properties, such as residential houses and flats, without the need to sell. One key legal consideration involves understanding the implications of taking out a lifetime mortgage or home reversion plan, which can significantly affect inheritance rights and the estate's value. Homeowners must be aware that in a lifetime mortgage, interest accumulates and could result in substantial debt over the years, potentially eroding equity. For home reversion plans, selling part or all of the home may restrict future ownership and settlement options. Legal documents should be reviewed meticulously, ensuring compliance with the Financial Conduct Authority (FCA) guidelines and obtaining independent legal advice is highly recommended to navigate the complexities of these products effectively. Additionally, local regulations and tax implications (such as Capital Gains Tax and Inheritance Tax) must be considered, as they can influence the overall financial impact of releasing equity.

Comments