In today's unpredictable economy, preparing for a downturn has never been more important. Many individuals and businesses alike are wondering how to navigate potential financial challenges while maintaining stability. By implementing smart budgeting strategies and building an emergency fund, you can better weather any storm that comes your way. Join me as we explore practical tips and resources to help you prepare and thrive in uncertain times!

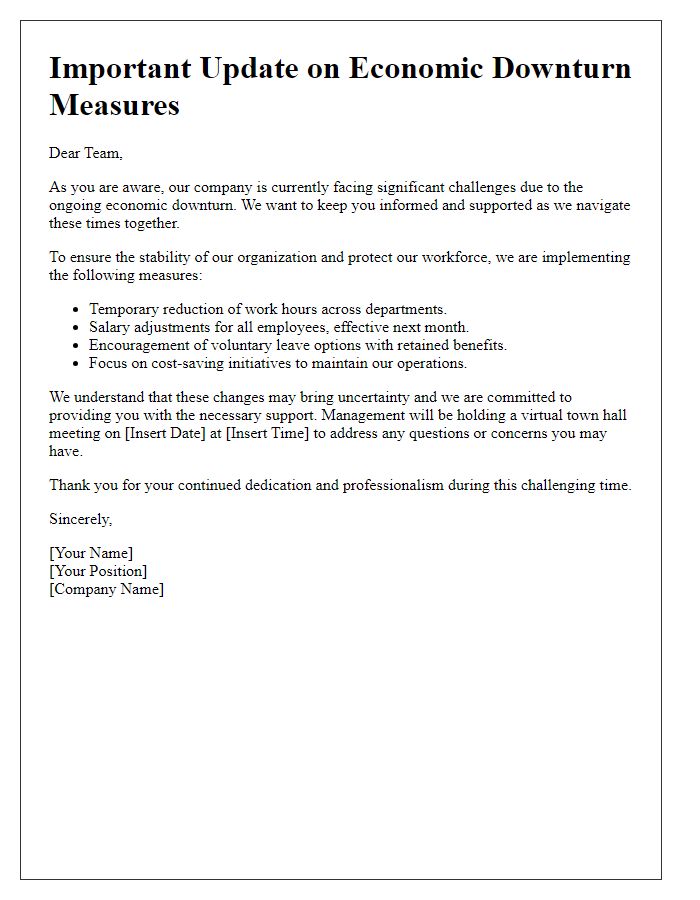

Clear communication

Clear communication during an economic downturn is essential for organizations to maintain transparency and trust among stakeholders. Companies should develop comprehensive strategies that outline key messages regarding financial health, anticipated challenges, and adaptive measures. Effective communication channels, such as email updates, virtual town hall meetings, and social media platforms, enable timely and consistent dissemination of information. Engaging leadership teams must address employee concerns while providing necessary resources and support. Data-driven approaches, including market analysis from sources like the International Monetary Fund (IMF) or World Bank, can lend credibility to messages about adjustments in business strategies. Additionally, understanding regional economic conditions, such as unemployment rates or inflation statistics, is crucial for tailoring communication to specific audiences.

Financial assessment

During economic downturns, comprehensive financial assessment becomes crucial for businesses to navigate challenges effectively. Key performance indicators (KPIs) such as revenue growth, profit margins, and cash flow need thorough analysis. Industries like retail and hospitality, often severely impacted, require special attention due to customer spending declines. For instance, during the 2008 financial crisis, the global economy contracted by approximately 4.3%, highlighting the importance of maintaining liquidity. Strategies such as cost-cutting measures, renegotiating supplier contracts, and diversifying revenue streams can enhance resilience. Additionally, assessing debt levels and ensuring access to credit lines becomes essential for sustaining operations amid uncertainty. Implementing these financial assessment strategies can fortify businesses against the inevitable strains of fluctuating market conditions.

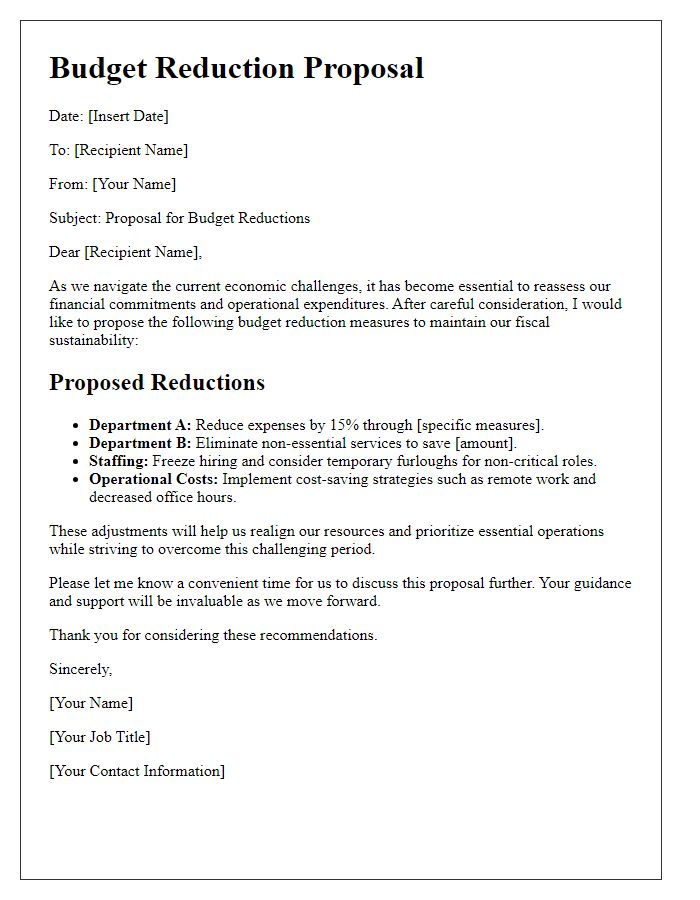

Cost-cutting strategies

In times of economic downturn, businesses often implement cost-cutting strategies to maintain financial stability and ensure long-term sustainability. Key approaches include reduction of operational expenses, such as renegotiating supplier contracts for essential materials and services, often resulting in savings of up to 15%. Workforce optimization may involve temporary reductions in hours or implementing voluntary unpaid leave, affecting staff engagement and productivity levels. Additionally, analyzing overhead costs related to utilities and rent can lead to renegotiated terms or relocation to cost-effective spaces, especially in urban areas where real estate prices fluctuate. Streamlining inventory management can minimize excess stock, reducing holding costs significantly. Overall, these strategic adjustments can prepare organizations for economic challenges while preserving cash flow and operational efficiency.

Employee support measures

In response to the economic downturn affecting various sectors, a range of employee support measures will be implemented to aid staff during this challenging period. These programs will include financial wellness workshops focusing on budgeting and resource management to help employees navigate reduced income or job insecurity. Access to mental health resources through counseling services will be prioritized, addressing the psychological impact of economic stress. Flexible work arrangements will be introduced, allowing for remote work options and flexible hours to accommodate personal needs. Additionally, skill development programs will be offered, enabling employees to enhance their skill sets, making them more competitive in the job market as conditions improve. Support groups will also be established, fostering a sense of community among employees facing similar challenges, and promoting open dialogue about their experiences.

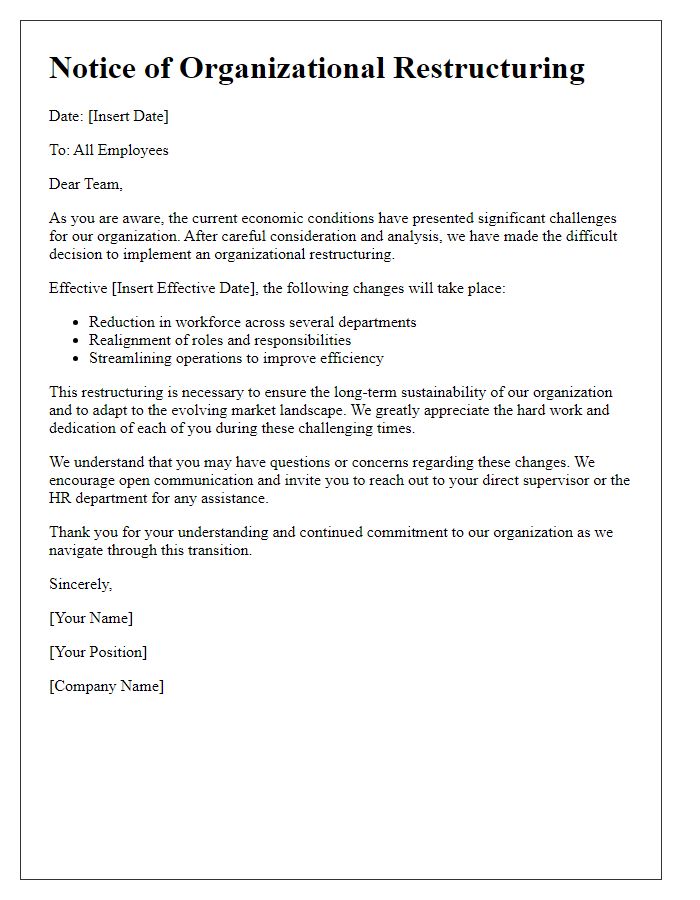

Long-term resilience planning

During economic downturns, businesses must prioritize long-term resilience planning to navigate challenges effectively. Implementing robust financial strategies, such as diversifying revenue streams, can safeguard against significant losses. Establishing a reserve fund (ideally holding three to six months of operating expenses) enables companies to weather financial storms. Developing adaptable supply chains (especially relying on local suppliers) is crucial for minimizing disruptions. Additionally, investing in technology, such as cloud computing solutions, enhances operational efficiency and remote work capabilities. Regular market analysis and consumer trends assessment aid in anticipating shifts, allowing for agile adjustments. Comprehensive employee training programs improve workforce versatility, ensuring teams can pivot in response to evolving demands. Overall, a proactive approach creates a foundation for sustained growth, even in turbulent economic climates.

Letter Template For Economic Downturn Preparation Samples

Letter template of budget reduction proposals during economic challenges.

Letter template of employee communication regarding economic downturn measures.

Letter template of organizational restructuring due to economic conditions.

Letter template of community support initiatives during economic decline.

Letter template of investor relations during economic downturn scenarios.

Comments