Are you curious about how blockchain is revolutionizing the world of finance? In today's fast-paced digital landscape, blockchain technology is empowering transparency, security, and efficiency in financial applications like never before. From seamless cross-border transactions to innovative decentralized finance solutions, the possibilities seem limitless. Join us as we explore the transformative power of blockchain in finance and uncover its potential to reshape our financial future!

Clarity and specificity in language

Blockchain technology has revolutionized financial applications by increasing transparency, security, and efficiency in transactions. Smart contracts, self-executing contracts with the terms directly written into code, facilitate automated agreements without intermediaries, reducing costs associated with traditional financial processes. Cryptographic algorithms ensure the integrity of transactions on platforms such as Ethereum and Bitcoin, preventing unauthorized alterations. Decentralized finance (DeFi) protocols allow users to access financial services, including lending and trading, without relying on centralized institutions like banks. Regulatory compliance remains crucial, particularly with evolving legislation in jurisdictions such as the European Union and the United States, as companies strive to balance innovation and legal obligations.

User-friendly tone

Blockchain financial applications prioritize user accessibility while ensuring secure transactions. These platforms employ decentralized technology, such as Ethereum or Hyperledger, which facilitates peer-to-peer interactions without intermediaries. Features like digital wallets enable users to store cryptocurrencies, such as Bitcoin or Litecoin, in a manner that guarantees privacy. User interfaces often include clear navigation aids, interactive dashboards, and tutorials to help individuals understand blockchain fundamentals, reducing complexity. Additionally, transaction speeds can vary significantly, with some networks processing blocks in under 10 minutes, attracting users seeking efficient alternative finance solutions. Security protocols, including two-factor authentication and encryption, provide users with confidence against fraud and cyber threats.

Comprehensive coverage of terminology

Blockchain financial applications utilize decentralized technology to enhance transaction security and transparency. Key terms include smart contracts, self-executing agreements with code embedded on the blockchain, and cryptocurrency, a digital currency based on cryptographic principles like Bitcoin and Ethereum. Decentralized finance (DeFi) removes intermediaries from financial transactions, enabling direct peer-to-peer interactions on platforms such as Uniswap and Aave. Tokenization refers to converting physical assets into digital tokens on the blockchain for easier transfer and ownership verification, often seen in real estate or art. Furthermore, consensus mechanisms, like Proof of Work or Proof of Stake, are crucial for maintaining network integrity by validating transactions. Security tokens represent ownership in assets, while utility tokens provide access to services within a specific ecosystem, like Binance Coin for trading on Binance Exchange. Understanding this terminology is vital for navigating and developing blockchain financial applications effectively.

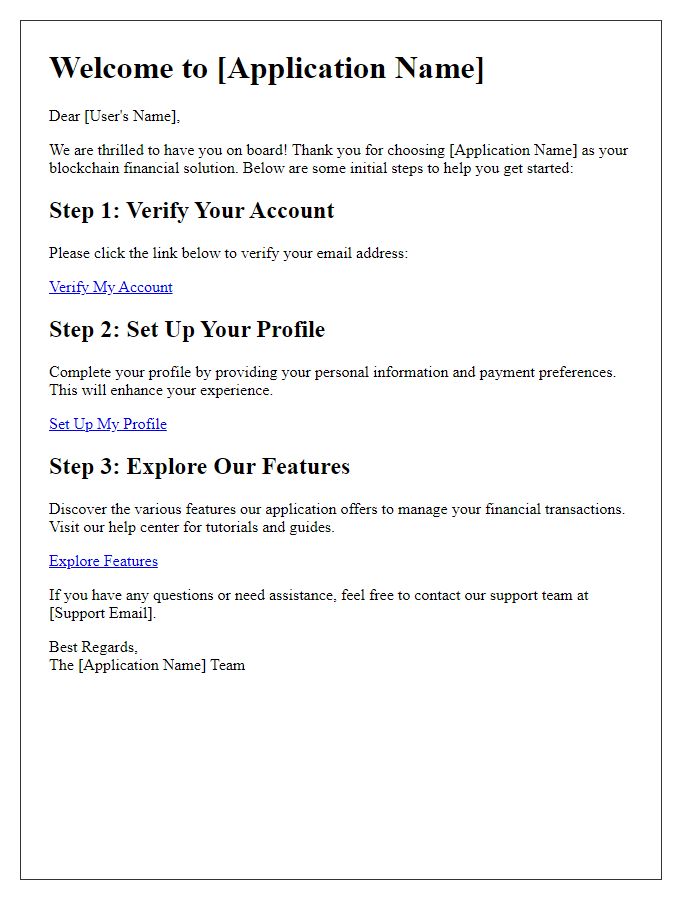

Clear call-to-action

Blockchain financial applications facilitate secure transactions using decentralized ledger technology, ensuring transparency in financial operations. The Ethereum blockchain, enabling smart contracts, exemplifies innovative applications in finance, such as decentralized finance (DeFi) platforms that allow users to earn interest, borrow, and trade without traditional banks. Bitcoin, the pioneering cryptocurrency, dominates market capitalization, surpassing $800 billion, reflecting the growing interest in digital assets. Users must navigate wallets and private keys for secure access, emphasizing the importance of cybersecurity measures in this evolving landscape. Adopting these technologies signifies a shift toward efficient, peer-to-peer financial systems that empower individuals globally.

Emphasis on security and privacy

Blockchain financial applications, such as Bitcoin and Ethereum wallets, prioritize robust security measures and privacy protection. Advanced encryption techniques, including AES-256 and elliptic curve cryptography, ensure that user data remains confidential during transactions. Decentralized ledger technology offers an immutable record of transactions, safeguarding against unauthorized access and fraud. Additionally, privacy-focused protocols like zk-SNARKs and CoinJoin enhance anonymity, preventing third-party tracing while users engage in financial activities. Regulatory compliance with standards such as GDPR further reinforces user rights and data protection, establishing a trustworthy environment for digital financial interactions.

Comments