Are you considering making changes to your retirement plan? It's a crucial step that can significantly impact your financial future, and understanding the adjustments available to you is essential. Whether it's redefining your investment strategies or optimizing your contributions, ensuring your plan aligns with your goals is key to a secure retirement. Join us as we dive deeper into effective retirement plan adjustments and how they can cater to your unique situation!

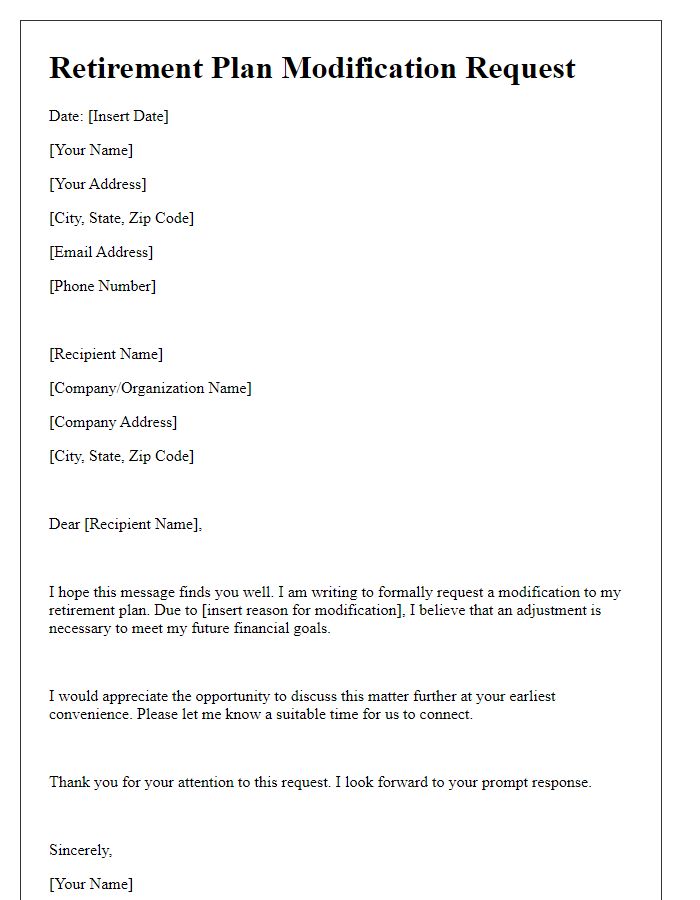

Personal Information and Contact Details

Retirement planning adjustments can significantly influence future financial stability for individuals. Essential details to consider include personal information such as full name, date of birth, and Social Security number, which are crucial for identifying and validating accounts. Contact details like email addresses and phone numbers facilitate seamless communication with financial advisors or institutions. Furthermore, specifics regarding existing retirement accounts, including 401(k) plans or IRAs, and their current balance reflect the status of individual investments. Understanding contribution limits (such as the IRS guidelines for 2023) along with anticipated retirement age can guide the appropriate adjustments needed for optimal financial readiness during retirement years.

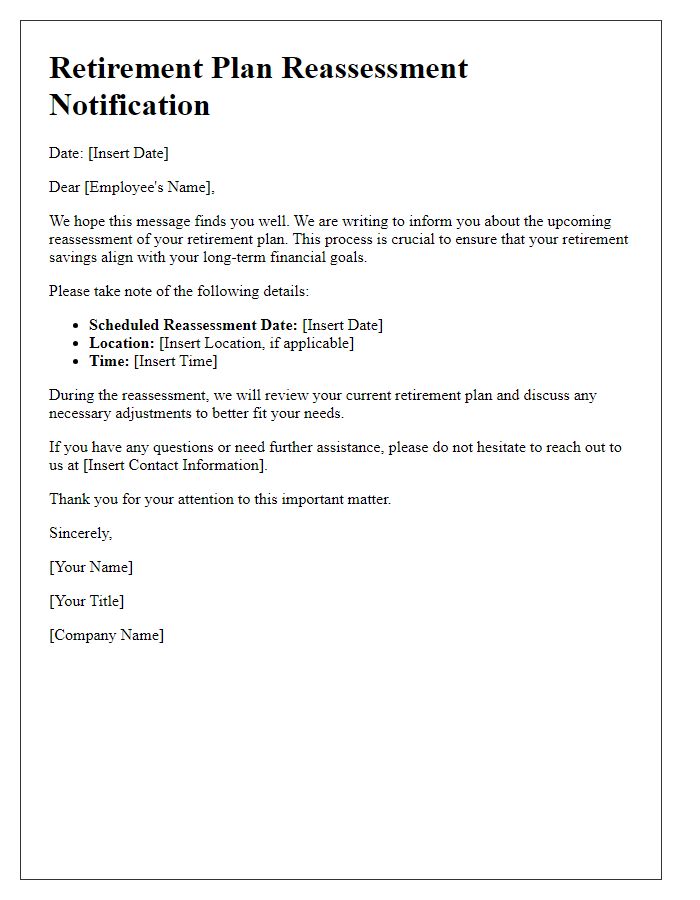

Retirement Plan Overview and Goals

Retirement plans serve as crucial financial frameworks designed to secure an individual's life after employment. A comprehensive retirement plan, such as a 401(k) or IRA, typically requires regular contributions, often ranging from 10% to 15% of annual income, to ensure the accumulation of adequate funds, aimed at covering expenses for an average of 20 to 30 years in retirement. Factors influencing retirement goals include desired retirement age, expected lifestyle changes, and estimated healthcare costs, which can average between $300,000 and $400,000 for retirees. Geographic location also plays a significant role; for example, states like Florida and Arizona attract retirees due to their favorable tax policies and lower living costs. Adjustments to existing plans must consider market conditions and inflation rates, which can average around 3% annually, impacting the purchasing power of retirement savings. Regular reviews and adjustments to asset allocations within retirement accounts are essential for optimizing growth and managing risks, particularly during economic downturns that can substantially affect stock market performance.

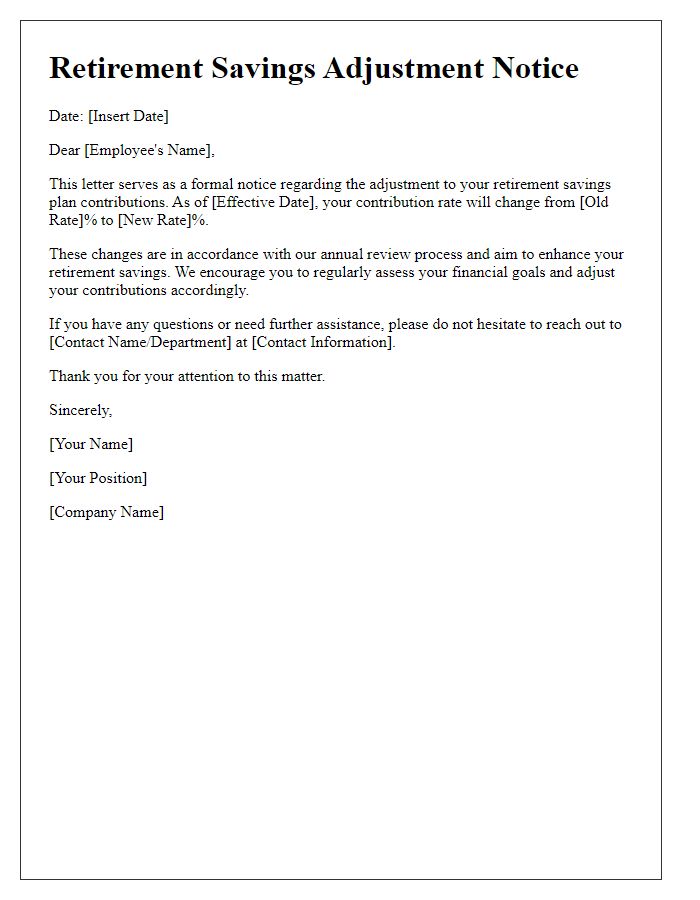

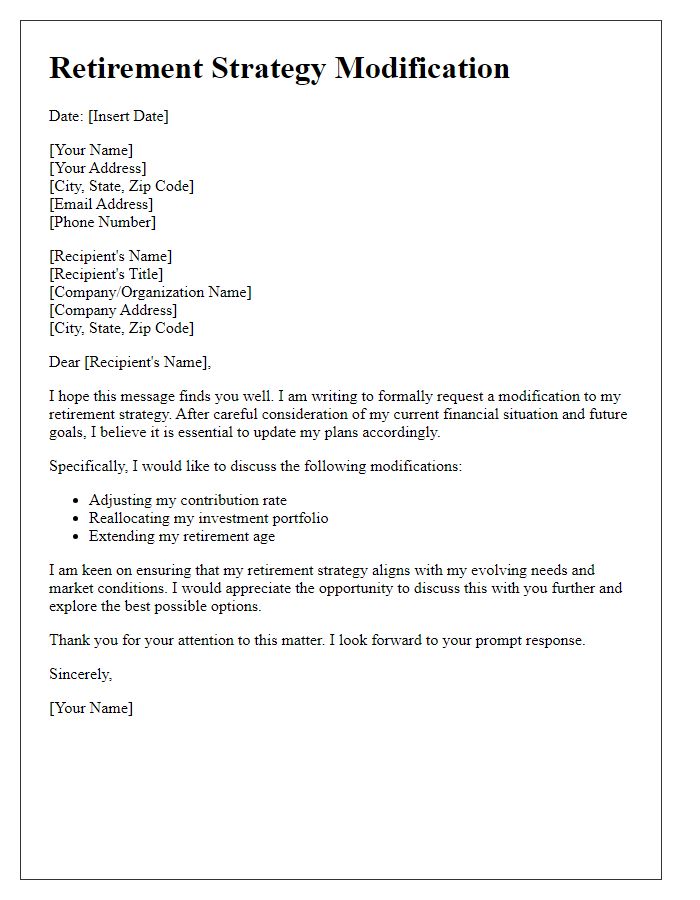

Reason for Adjustment Request

Retirement plan adjustments often stem from various factors influencing financial strategies in retirement. Changes in personal circumstances such as a significant life event (e.g., marriage, divorce, or the birth of a child) can prompt reassessment of contribution levels. Economic fluctuations, such as market downturns affecting investment performance, may necessitate altering asset allocation to mitigate risk. Additionally, shifts in retirement goals, such as aiming for early retirement or adjusting expected living expenses, require a reevaluation of current savings strategies. Monitoring these dynamics in relation to specific retirement accounts (e.g., 401(k), IRA) is essential for ensuring alignment with long-term financial objectives.

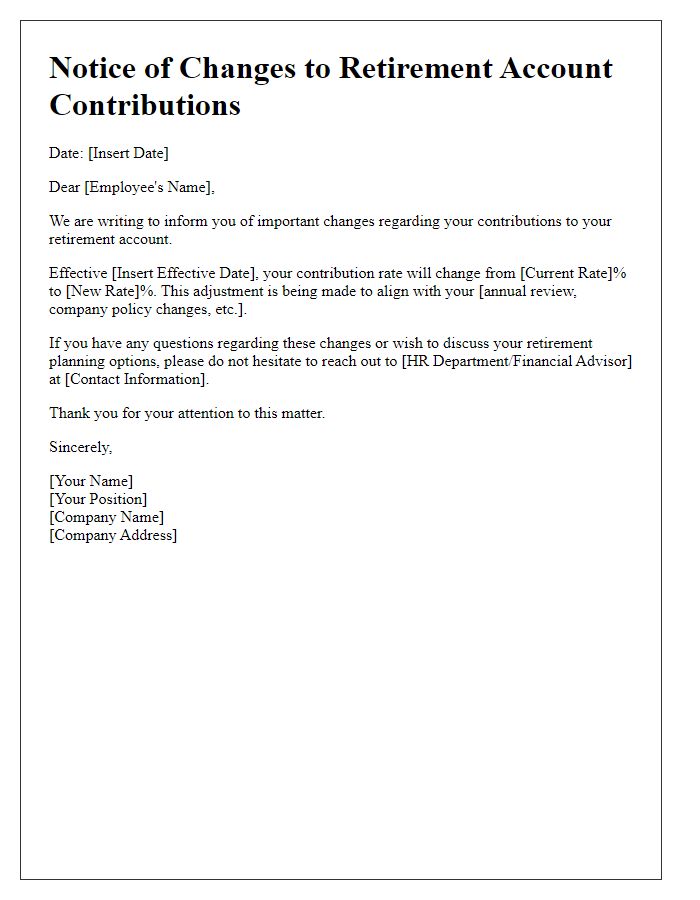

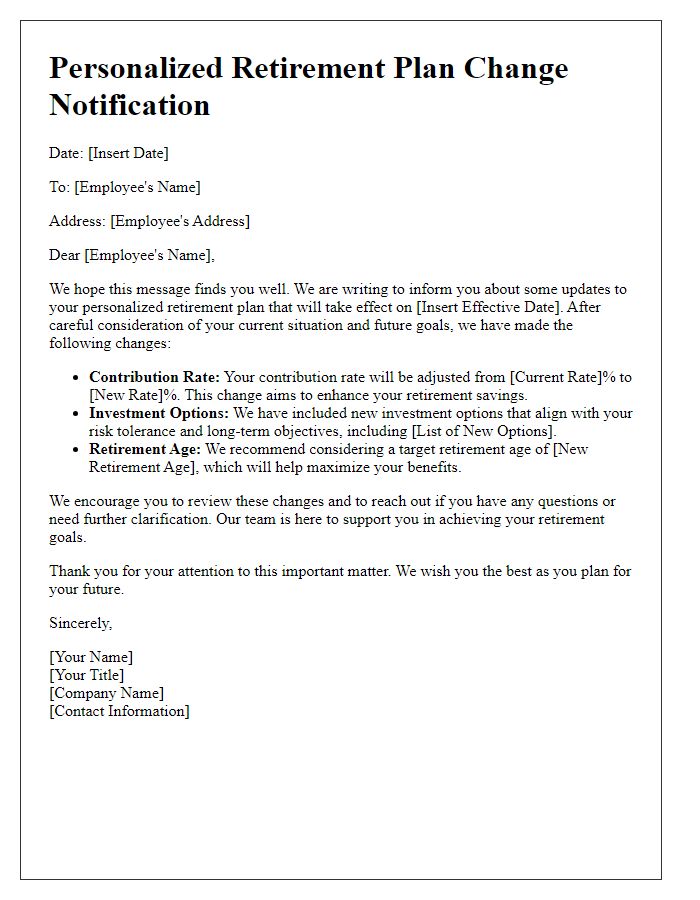

Proposed Adjustments and Justification

Proposed adjustments to retirement plans involve significant changes to contribution limits and investment options. For example, the annual contribution limit for 401(k) accounts may increase to $20,500, providing individuals greater savings potential. Additionally, the introduction of socially responsible investment (SRI) options allows retirees to align their investments with personal values, potentially boosting financial performance given the growing demand for sustainable investing. Furthermore, adjusting the retirement age eligibility from 65 to 67 can help accommodate increasing life expectancies, ensuring that funds remain solvent. Assessments of current financial trends and demographic data justify these proposed adjustments, aiming to enhance retirement security for individuals in the long run.

Contact Information for Further Discussion

Retirement plan adjustments are pivotal to ensuring financial security during one's post-employment years. Participants aged 50 and above can benefit from catch-up contributions, which currently allow an additional $7,500 in 2023 on top of standard contribution limits for 401(k) plans. Consultation services are available through financial advisors with expertise in retirement planning, particularly in navigating complex issues such as tax implications and investment strategies. Specific organizations, like the Certified Financial Planner Board, provide listings of qualified professionals who can assist individuals in tailoring their retirement plans according to evolving personal financial situations. Keeping lines of communication open with retirement plan administrators can also facilitate timely updates or modifications to existing plans.

Comments