Are you considering diving into the world of real estate investment but don't know where to start? This can seem overwhelming, but with the right guidance, it can also be incredibly rewarding. In this article, we'll explore key strategies and insider tips to help you make informed decisions and maximize your returns. So, grab a cup of coffee and let's unravel the secrets to successful real estate investing together!

Market Analysis and Trends

Current real estate market analysis shows diverse trends impacting investment prospects. Urban areas such as New York and San Francisco continue to experience demand for multi-family housing, with rental prices surging by 15% annually. Suburban properties in states like Texas and Florida are witnessing growth as remote work drives migration, resulting in a 20% increase in home sales in the last quarter. Interest rates from the Federal Reserve currently hover around 3.5%, influencing mortgage affordability. Additionally, projected population growth in metropolitan regions indicates potential for increased property values. Market reports from sources such as Realtor.com and Zillow highlight neighborhoods with promising appreciation, suggesting areas like Austin and Denver as key locations for investment. Investors should also monitor legislative changes affecting rental regulations, which could impact cash flow and property management strategies.

Investment Goals and Objectives

Investing in real estate requires a clear understanding of investment goals and objectives. Defining these goals, such as generating passive income, achieving capital appreciation, or diversifying a portfolio, is essential for a successful strategy. Specific objectives, like targeting properties in high-growth areas (such as downtown urban centers), can drive decision-making. For instance, utilizing metrics like the average annual return on investment (ROI) of 8% or more in regions with strong job growth can help assess potential properties. Additionally, considering the long-term holding period (typically 5 to 10 years) and aligning investments with personal financial goals can create a structured approach. Understanding market trends, such as the rise in rental demand during economic recovery phases, further informs strategic choices and enhances overall investment performance.

Financial Considerations and Budget

When investing in real estate, understanding financial considerations and establishing a comprehensive budget are crucial for success. Investors must analyze overall property costs, including purchase price, closing costs (usually 2-5% of the sale price), and ongoing expenses such as property taxes (averaging 1.07% of home value in the U.S.), homeowners insurance (approximately $1,000 annually), and maintenance fees (often estimated at 1% of property value each year). Additionally, evaluating potential rental income is essential, with average rental yields ranging from 8-12% depending on location and market demand. Investors should also consider financing options such as mortgage loans, which typically require a down payment of 20%, alongside interest rates fluctuating around 3 to 4% for fixed-rate loans. Understanding these financial elements ensures investors remain within budget and achieve desired returns on their real estate investments.

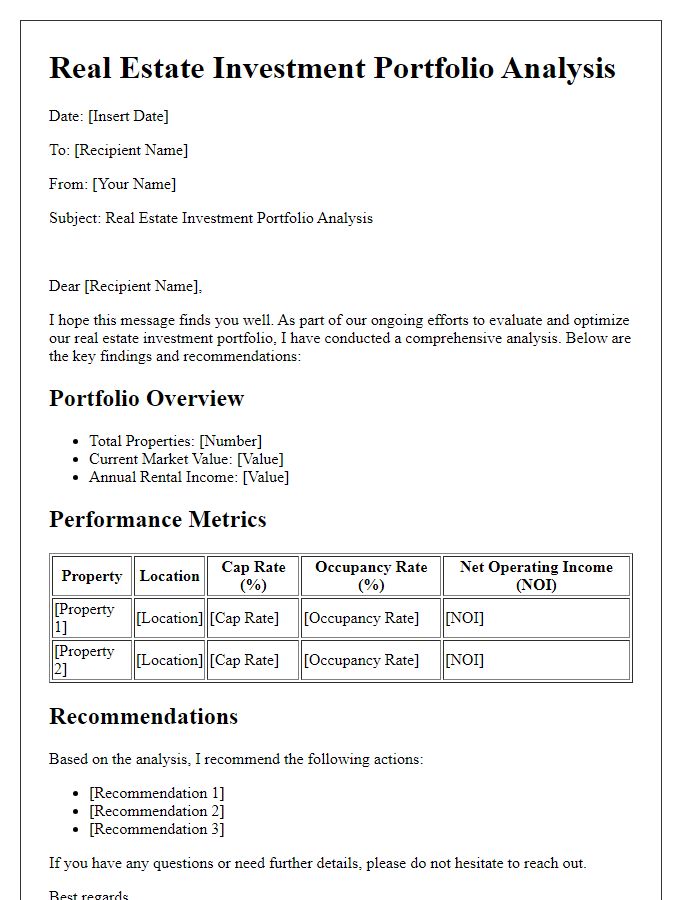

Property Evaluation and Due Diligence

Property evaluation involves comprehensive assessments of commercial and residential real estate assets to determine market value and investment viability. Key elements include comparative market analysis (CMA), property condition assessment, and understanding local market trends. Due diligence encompasses a systematic investigation to uncover potential risks, legal issues, or financial liabilities associated with a property. This process includes reviewing title documents, zoning regulations, and environmental impact assessments. Successful investors often utilize detailed financial modeling to analyze projected cash flows, return on investment (ROI), and overall asset performance against benchmarks in specific regions, such as urban centers or up-and-coming neighborhoods. Engaging professionals like appraisers, inspectors, and real estate attorneys enhances the robustness of due diligence efforts.

Legal and Tax Implications

Real estate investments often involve various legal and tax implications that can significantly impact profitability and sustainability. Investors must consider property laws, including zoning regulations and titles, which vary by jurisdiction, such as counties in California, known for their stringent housing laws. Additionally, understanding tax obligations, especially capital gains tax, is crucial; for example, in the United States, selling an investment property may result in a capital gains tax of up to 20% on profits. Further complexities arise with tax deductions related to mortgage interest, property depreciation, and related expenses, which can be beneficial if leveraged correctly. Legal advice from a qualified attorney familiar with real estate law can provide guidance on navigating contracts, leases, and potential liabilities, ensuring compliance with local laws and minimizing risks. Therefore, thorough research and professional consultation are vital for informed decision-making in real estate investing.

Comments