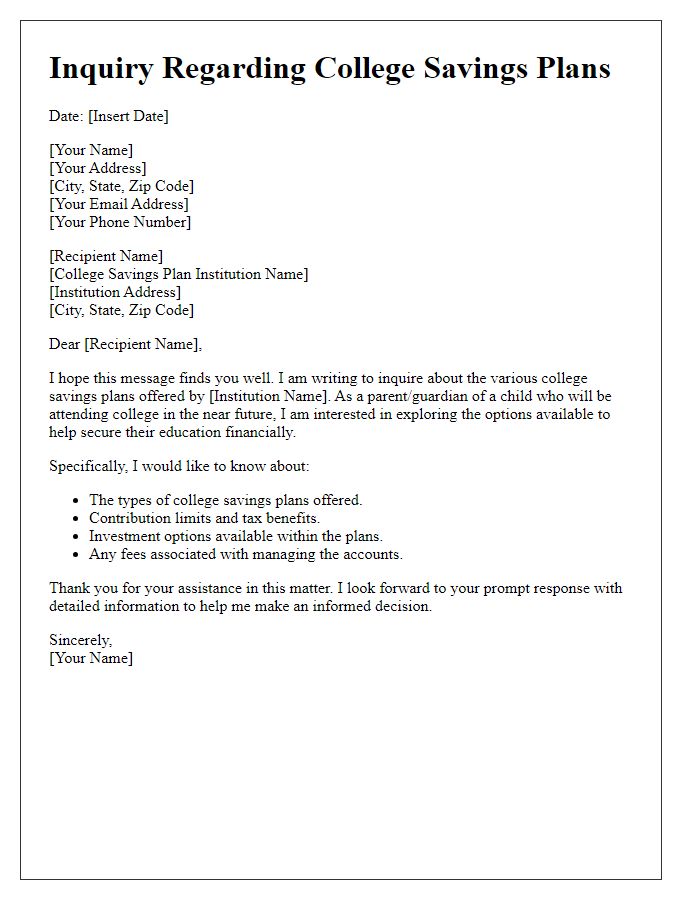

Are you looking to secure a brighter future for your child's education? Creating a college savings plan is a fantastic step towards making higher education more accessible and affordable. With the rising costs of tuition, it's crucial to start planning early and exploring your options. So, whether you're just starting out or looking to fine-tune your existing plan, let's dive into some essential tips and strategies to help you navigate the world of college savings!

Clear Objective Statement

College savings plans, such as 529 plans, provide families with tax-advantaged options for funding higher education expenses. These investment vehicles enable parents to save early for their children's college tuition, fees, room and board, and other related costs. By setting a clear objective to save a specific amount by the time the child reaches college age, families can determine monthly contributions based on current education costs, projected inflation rates, and desired investment growth. Exploring different plans, such as prepaid tuition or education savings accounts, allows families to choose a structure that aligns with their financial situation and educational goals. Furthermore, understanding the rules and tax benefits, including state-specific deductions, can significantly increase savings effectiveness. Engaging with a financial advisor can enhance decision-making, ensuring the chosen plan meets the family's educational aspirations and financial capacity.

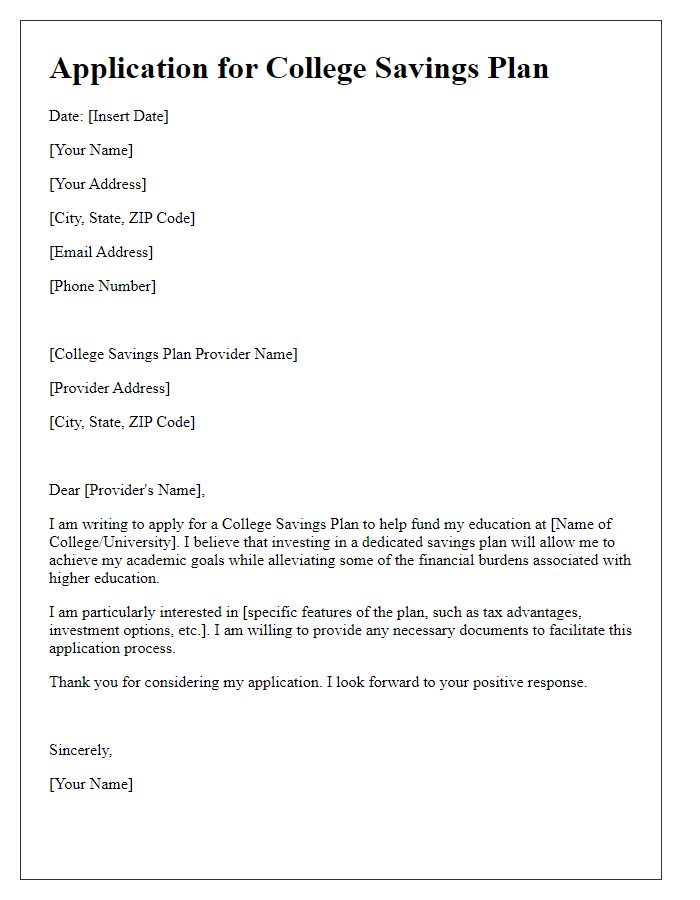

Precise Financial Goals

Establishing precise financial goals is crucial for effective college savings plans like 529 plans, Coverdell ESAs, or custodial accounts. These plans facilitate tax-free growth while parents save for higher education expenses, with average tuition costs exceeding $20,000 annually for in-state public universities and over $40,000 for private institutions. Setting a specific savings target, such as $100,000 by the time a child reaches 18 years, ensures a clearer path. Monthly contributions can be calculated based on the desired amount; for example, saving $400 monthly can yield approximately $100,000, assuming a 6% annual return. Regularly reviewing and adjusting these goals helps account for inflation, which is currently around 3% annually for educational expenses, ensuring financial readiness for college.

Personalized Investment Strategy

A personalized investment strategy for college savings plans, such as 529 plans, requires careful consideration of various factors, including individual financial goals, time horizon, and risk tolerance. For instance, starting contributions early, ideally during the child's birth year, can utilize the power of compound interest over 18 years leading up to college enrollment. Research indicates that average college tuition fees in the U.S have increased by approximately 3-5% annually, necessitating a proactive approach to savings. Asset allocation plays a critical role: younger investors might lean towards equities (historically yielding higher returns) whereas those closer to the college start date may prefer bonds (offering stability). Moreover, utilizing tax-advantaged accounts allows growth without incurring federal taxes on earnings, fostering a more robust financial foundation. Understanding state-specific tax benefits, such as deductions or credits for contributions, can further enhance savings outcomes for families considering future educational expenses.

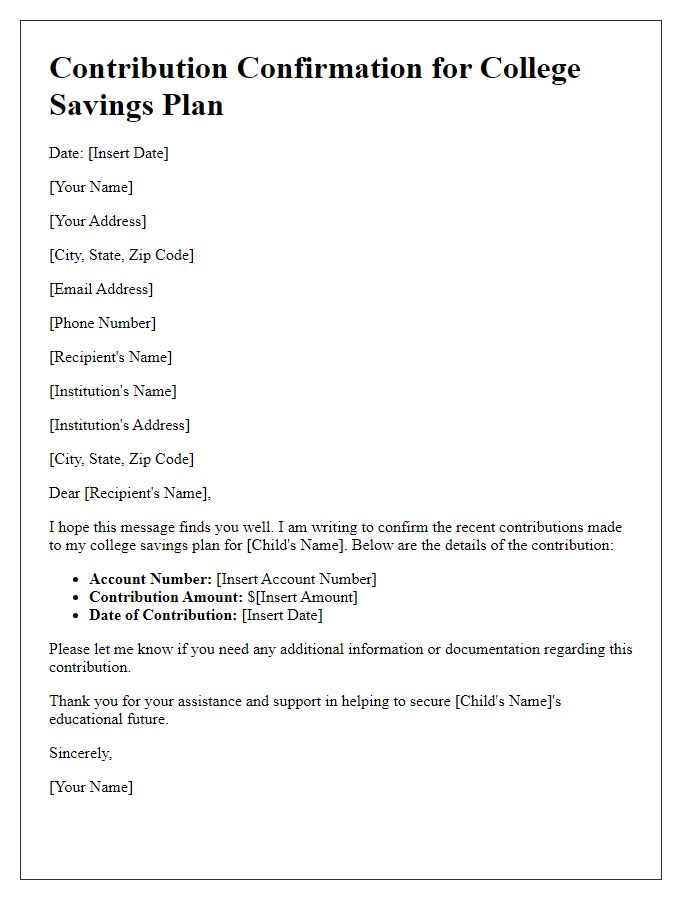

Relevant Tax Implications

College savings plans, commonly known as 529 plans, offer significant tax advantages for families preparing for education expenses. Contributions to these plans can grow tax-free, meaning any earnings resulting from investments will not be subject to federal income tax if used for qualified expenses like tuition, fees, room, board, and even textbooks. States such as New York and California may also provide tax deductions or credits for contributions made, enhancing the overall savings potential. Withdrawals for eligible educational costs remain tax-free, which can lead to substantial savings over time. Moreover, the Gift Tax exclusion allows individuals to contribute up to $15,000 annually without triggering a tax event, enabling families to boost their savings effectively. Understanding these tax implications is crucial for maximizing the benefits of college savings plans.

Contact Information for Further Assistance

College savings plans, such as 529 plans, provide parents and guardians a structured method to save for higher education expenses, including tuition, room and board, and textbooks. These plans offer tax advantages, allowing contributions to grow tax-free, providing significant benefits over time, especially when invested early (preferably starting before the child's birth). To maximize savings, consider researching state-specific plans that may offer additional tax deductions or credits. Institutions like the U.S. Department of Education or financial advisors specializing in educational savings can provide valuable resources for optimizing savings strategies and understanding the implications of college debt. For personalized assistance, contact professional education savings consultants or utilize state-sponsored program helplines.

Comments