In today's ever-evolving financial landscape, understanding investment risks is more crucial than ever. Whether you're a seasoned investor or just starting out, navigating the complexities of potential pitfalls can be daunting. This letter template serves as a vital tool to clearly communicate the risks associated with investments you may be considering. So, if you're ready to ensure that you make informed decisions, read on for more insight!

Clear Purpose Statement

Investment risk disclosure serves the critical purpose of informing investors about potential risks associated with various investment opportunities. This disclosure typically includes details such as market volatility (significant fluctuations in asset prices), liquidity risk (the difficulty of selling an investment without incurring losses), and credit risk (the chance that a borrower will default on a loan). Additionally, specific asset classes, such as stocks (equity ownership in a company) or bonds (debt securities issued by corporations or governments), carry unique risks that must be understood. The objective of clear risk disclosure is to promote transparency, enable informed decision-making, and encourage responsible investment practices among individuals and institutional investors alike.

Detailed Risk Description

Investment in financial markets carries inherent risks that can result in losses or reduced returns. Market volatility (fluctuations in asset prices due to economic conditions) can significantly impact investments, particularly in stocks, bonds, or commodities. Economic downturns (periods of reduced economic activity), such as recessions, can further exacerbate these risks, leading to declining asset values. Additionally, interest rate changes (alterations in the cost of borrowing money by central banks) can have profound effects on fixed-income securities, influencing their yield and market value. Currency risk (the potential for loss due to currency fluctuations) is also a concern for investments in international markets. Regulatory changes (alterations in laws governing financial markets) can abruptly change the landscape for various sectors, impacting investment strategies. Furthermore, sector-specific risks (unique risks associated with particular industries) such as technological disruption or changes in consumer behavior can affect investment performance. It is essential for investors to conduct thorough due diligence and consider their risk tolerance before making investment decisions.

Terminology Definitions

Investment risk disclosure documents provide essential information to investors about potential risks associated with various investment instruments. Key terms like "volatility" (the degree of variation of trading prices over time), "liquidity" (how quickly assets can be converted into cash), "diversification" (spreading investments across different asset classes to reduce risk), and "credit risk" (the possibility of a loss due to a borrower's failure to repay a loan) are crucial. Understanding "market risk" (the risk of losses due to changes in market prices) and "interest rate risk" (the risk that changes in interest rates will negatively affect investment value) is vital for informed decision-making. Investors should also be familiar with "systematic risk" (the inherent risk in the entire market) and "unsystematic risk" (specific to a company or industry), as these factors can significantly impact potential returns.

Potential Impact Outline

Investment risk disclosure outlines potential impacts investors may face when engaging in financial activities. Market volatility often results in fluctuations in asset values, leading to possible capital loss. Economic downturns, such as recessions, can significantly impact sectors like real estate or technology, reducing investment returns. Geopolitical events, including trade wars or sanctions, may create uncertainty, driving stock prices down. Regulatory changes, such as tax reforms or alterations in investment policies, can also affect profit margins for companies in specific industries. Currency risk plays a crucial role for investors holding foreign assets, as exchange rate shifts can diminish returns. Understanding these factors is essential for making informed investment decisions and managing potential risks effectively.

Regulatory Compliance Information

Investment risk disclosure is crucial for ensuring transparency for investors. Regulations like the Securities Act of 1933 outline obligations about providing clear risk assessments associated with investment products. Compliance involves adhering to standards set by the Securities and Exchange Commission (SEC) to safeguard investor interests. Key risks may include market volatility, liquidity challenges, and credit risk stemming from potential defaults. Various financial instruments, such as stocks and bonds, carry distinct risk profiles that require diligent assessment. Regular reports and prospectuses must communicate these risks effectively to ensure that investors can make informed decisions based on comprehensive and accurate information.

Letter Template For Investment Risk Disclosure Samples

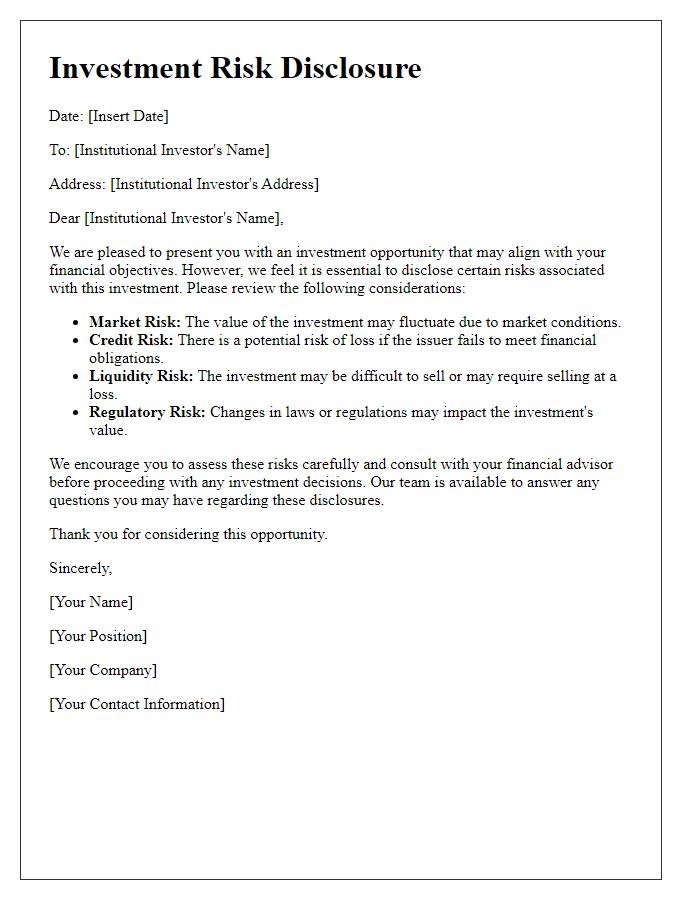

Letter template of investment risk disclosure for institutional investors

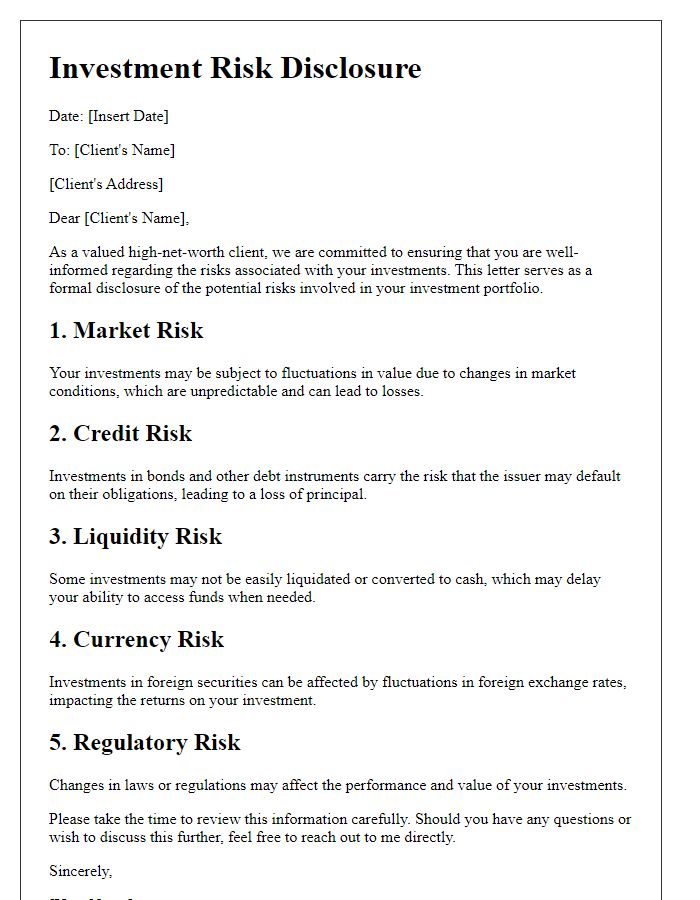

Letter template of investment risk disclosure for high-net-worth clients

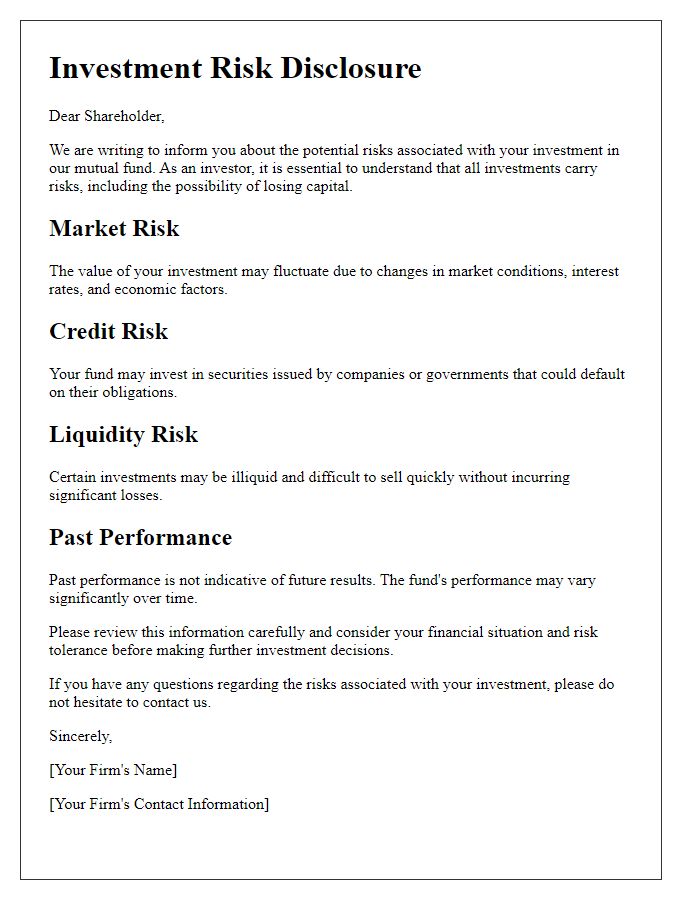

Letter template of investment risk disclosure for mutual fund shareholders

Letter template of investment risk disclosure for venture capital investors

Letter template of investment risk disclosure for private equity clients

Letter template of investment risk disclosure for real estate investments

Letter template of investment risk disclosure for cryptocurrency investors

Comments