Hello there! As we approach the time for our annual financial review, it's essential to reflect on our achievements and areas for growth over the past year. This is not just a routine exercise; it's an opportunity to align our financial strategies with our overall goals and ensure we're on the right track. Join us as we delve into the key insights and figures that shaped our financial landscape and discover what lies ahead. Continue reading to uncover the details of our performance and future roadmap!

Clear Purpose Statement

An annual financial review provides an opportunity for organizations to evaluate their financial health. This process typically involves a comprehensive analysis of key financial statements, including balance sheets and income statements. Identifying trends in revenue (such as year-over-year growth percentages) and expenses (noticeable fluctuations or increases) is crucial. The review may also encompass assessments of cash flow (the movement of cash in and out of the organization) and liquidity ratios (to measure the organization's ability to meet short-term obligations). Such evaluations help stakeholders understand the financial situation, facilitating informed decision-making for future investments or cost-cutting measures. Additionally, benchmarking against industry standards, analyzing financial ratios (such as profit margins or return on equity), and ensuring adherence to regulatory requirements can enhance strategic planning.

Financial Performance Overview

The annual financial review provides a comprehensive assessment of the organization's monetary health for the fiscal year ending December 31, 2022. Key performance indicators (KPIs) such as revenue growth, expense management, and profitability ratios reveal trends crucial for stakeholders. Revenue for the year reached $5 million, reflecting a 15% increase from 2021, driven largely by the launch of three innovative product lines in Q2 and Q3. Operating expenses totaled $3 million, a 10% rise predominantly attributed to increased marketing efforts and talent acquisition. Net profit margins rose to 20%, showcasing enhanced operational efficiency. Asset management figures indicate total assets of $12 million, primarily composed of cash reserves and inventory, reinforcing the organization's stability and capacity for investment. Looking ahead, strategic initiatives aim to sustain growth and manage costs effectively to optimize future profitability.

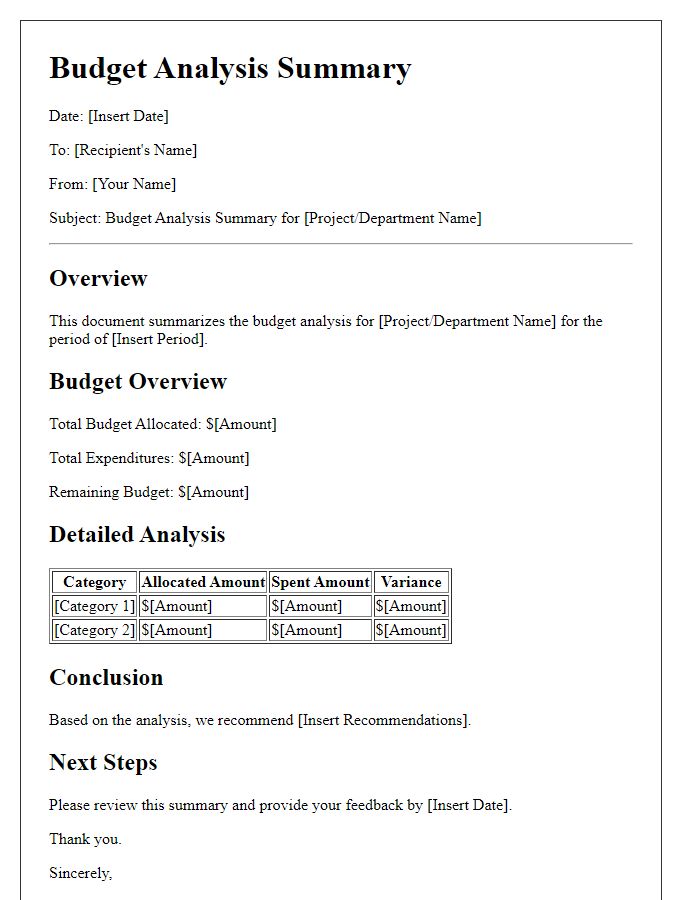

Key Data and Metrics

The annual financial review encompasses critical data and metrics reflecting the organization's performance. Key performance indicators (KPIs) such as revenue growth (10% increase year-over-year), net profit margin (15% in the previous fiscal year), and operating expenses ($2 million in Q4) are essential for strategic assessment. Significant assets, including total assets amounting to $5 million and cash reserves of $1 million, highlight the organization's financial stability. Debt-to-equity ratio (0.5) indicates a balanced approach towards leveraging. Comparative analysis with industry benchmarks provides insights into competitive positioning and growth potential in the market. Additionally, year-end reports on customer acquisition rates (20% growth) and retention rates (85%) reveal trends vital for future forecasting and planning.

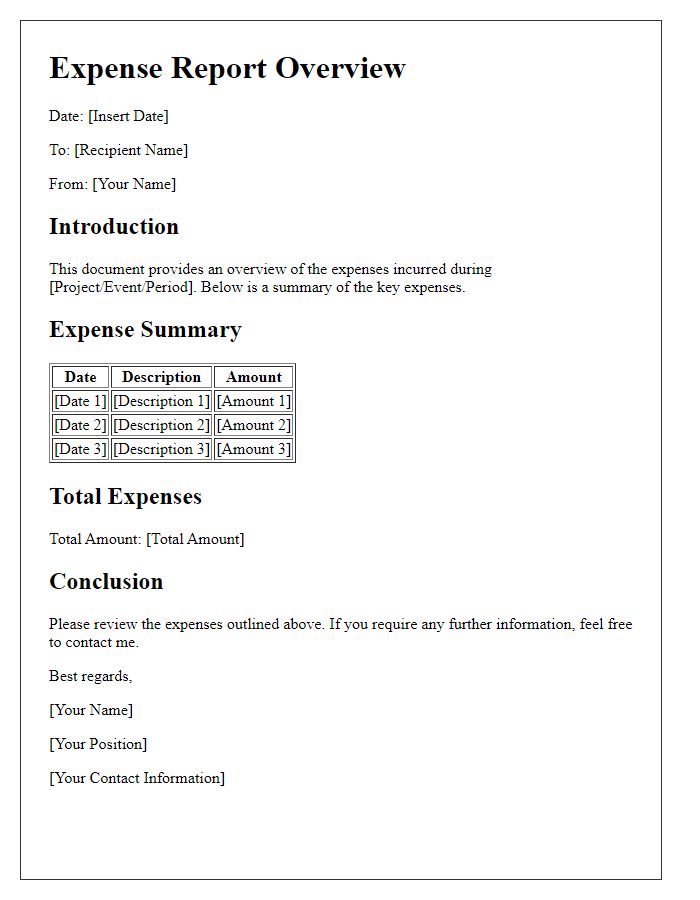

Recommendations for Improvement

Annual financial reviews reveal critical insights into organizational performance and financial health. Recommendations for improvement often highlight key areas needing attention, such as cost management strategies, streamlined operational processes, and enhanced revenue generation techniques. Financial ratios, including the debt-to-equity ratio (averaging around 1.5 in the industry) or net profit margin (often ranging from 5% to 10% for similar companies), serve as benchmarks for evaluating current performance. Organizations might consider implementing advanced financial software systems to improve budget tracking and forecasting accuracy. Additionally, personnel training programs can elevate financial literacy within teams, enabling better decision-making. Regular auditing practices, scheduled quarterly reviews, and stakeholder engagement can also ensure adherence to financial goals and accountability measures.

Call to Action

Annual financial reviews provide critical insights into the financial health of organizations, guiding strategic decisions for the coming year. Key financial metrics, such as revenue growth (often assessed through year-over-year comparisons), profit margins (indicating operational efficiency), and cash flow statements (reflecting liquidity status), are crucial components. Additionally, examining expense reports (highlighting areas for cost reduction), asset allocation (determining investment effectiveness), and budgeting performance (measuring adherence to financial plans) enhances understanding. Stakeholders, including investors (seeking returns), management (implementing strategies), and employees (affected by financial stability), should actively engage in discussions derived from these analyses to foster transparency and collaborative decision-making.

Comments