In today's fast-paced financial landscape, understanding money management is more crucial than ever. Teaching financial literacy equips individuals with the skills to save, invest, and secure a brighter future. With practical tools and resources, anyone can learn to navigate their finances confidently. Join us as we explore how you can enhance your financial literacy and take control of your financial destiny!

Personalization Elements

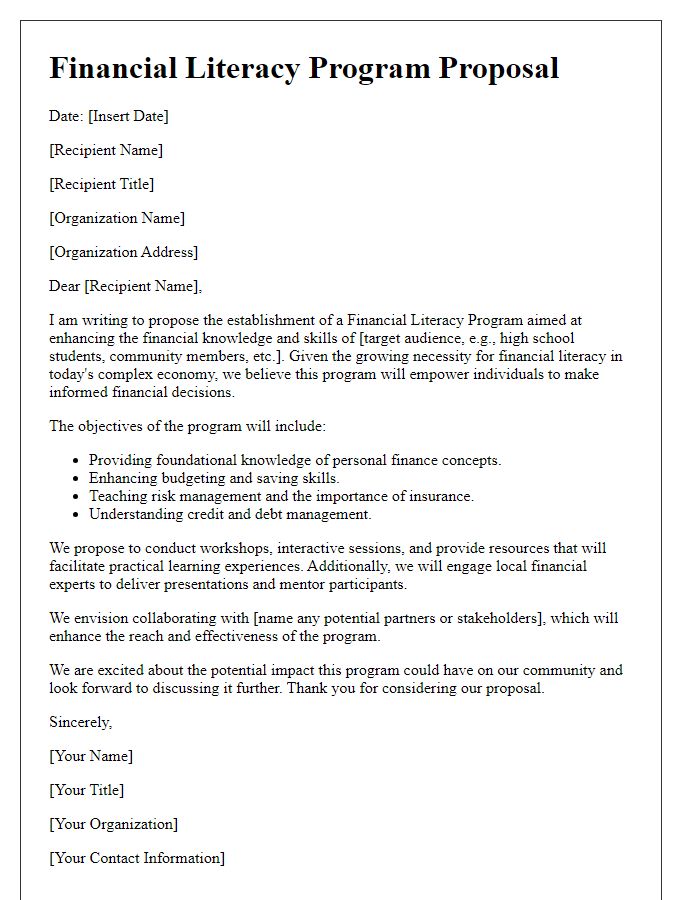

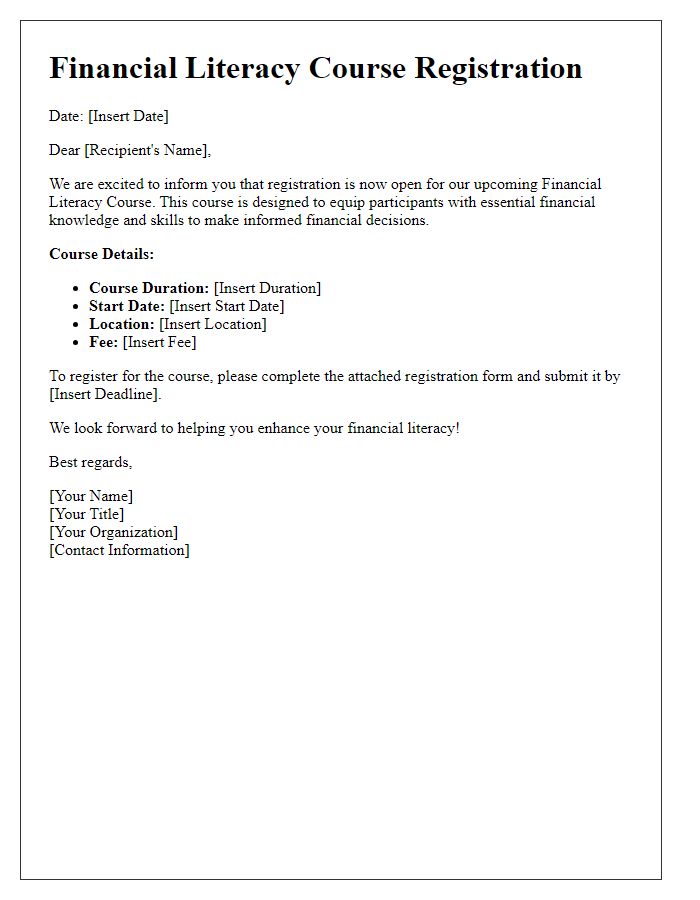

Financial literacy education programs aim to empower individuals with knowledge about managing personal finances, including budgeting, saving, investing, and understanding credit. Participants often receive personalized assessments to tailor learning experiences based on income levels, age demographic, and financial goals. Various tools like budgeting apps and investment simulators enhance engagement, allowing learners to apply concepts to real-life scenarios. Local organizations, such as community centers or schools, frequently host workshops and seminars, providing attendees with resources to improve financial decision-making. Adjustments based on participant feedback ensure that the curriculum remains relevant and effective in addressing diverse financial needs.

Clear Objectives and Goals

Financial literacy education aims to equip individuals with essential knowledge and skills necessary for effective management of personal finances. Understanding foundational concepts such as budgeting, saving, investing, and debt management is crucial. For instance, setting clear financial goals like building an emergency fund equivalent to three to six months of expenses can promote financial stability. Additionally, grasping the principles of compound interest, particularly in investment accounts, can significantly enhance wealth accumulation over time. Engaging in workshops and courses provided by organizations such as the National Endowment for Financial Education (NEFE) can further deepen understanding. Ultimately, fostering financial literacy empowers individuals to make informed decisions, avoid costly mistakes, and achieve long-term financial success.

Engaging Content and Tone

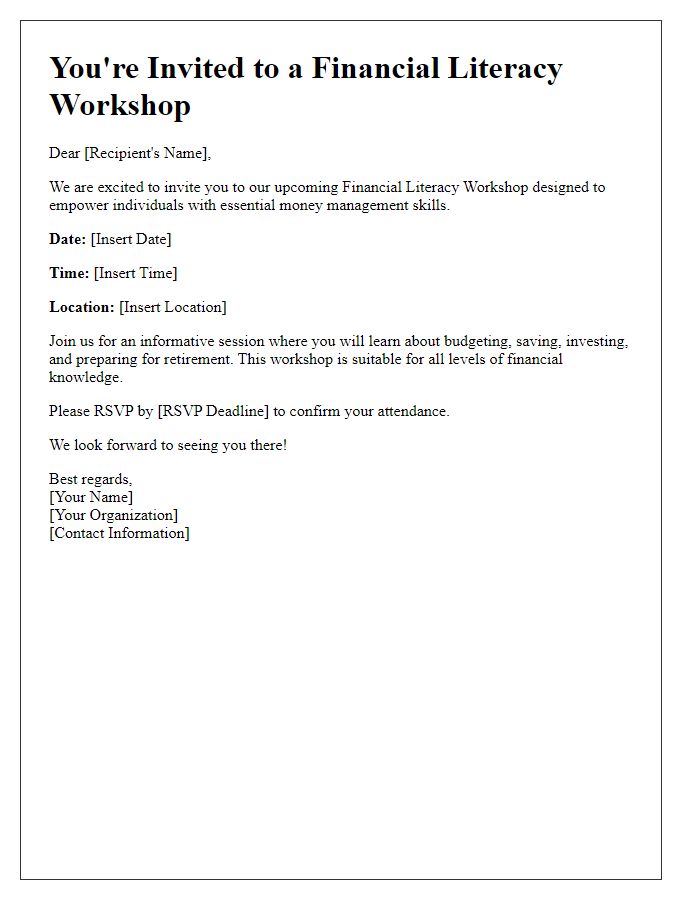

Financial literacy education programs equip individuals with essential skills for managing personal finances effectively. Workshops often cover topics such as budgeting strategies, investment principles, and debt management techniques tailored for various demographics, including teenagers and retirees. Interactive sessions encourage participation through real-life scenarios and problem-solving exercises, fostering a practical understanding of complex financial concepts. Resources such as digital tools and informative pamphlets provide ongoing support, enabling learners to access information conveniently. Community partnerships with local banks and credit unions enhance program credibility, offering participants opportunities for hands-on experience in a supportive environment. Engaging activities, like online quizzes and gamified learning platforms, aim to create an enjoyable and relatable atmosphere, ultimately promoting sustainable financial habits for participants of all ages.

Structured Framework and Flow

Financial literacy education provides individuals with essential skills for managing personal finance. A structured framework typically includes key components such as budgeting, savings, investments, credit management, and financial goal setting. In budgeting, learners understand the importance of tracking income and expenses. Savings modules often emphasize emergency funds, ideally covering three to six months of living expenses. Investment education covers stocks, bonds, and mutual funds, highlighting essential concepts like risk tolerance and diversification. Credit management focuses on understanding credit scores, with numbers ranging from 300 to 850 impacting loan eligibility. Financial goal setting encourages participants to define short-term, medium-term, and long-term objectives, providing clarity in achieving financial security. Effective flow of education includes interactive workshops, real-life case studies, and digital resources to support independent learning and application.

Call to Action and Resources

Financial literacy education is crucial for individuals seeking to improve their understanding of personal finance management. Workshops (interactive sessions held in community centers) focusing on budgeting techniques, investment strategies, and debt management are essential for equipping participants with practical skills. Online resources, such as educational platforms like Khan Academy, provide free courses on economic fundamentals and personal finance concepts. Local financial institutions often offer seminars and one-on-one counseling to aid individuals in making informed financial decisions. National organizations like the Jump$tart Coalition advocate for improved financial literacy across various age groups, emphasizing the importance of early education. Access to these resources and community initiatives encourages proactive financial behavior, ultimately fostering a financially savvy population capable of achieving long-term economic stability.

Comments