In today's fast-paced world, keeping the family finances in check can feel overwhelming, but it doesn't have to be! Hosting regular family financial meetings can empower everyone in the household to stay informed and engaged with money matters. These gatherings encourage open communication, allowing everyone to voice their thoughts and ideas on budgeting, saving, and future goals. Ready to dive deeper into how to structure these meetings for success? Let's explore the details!

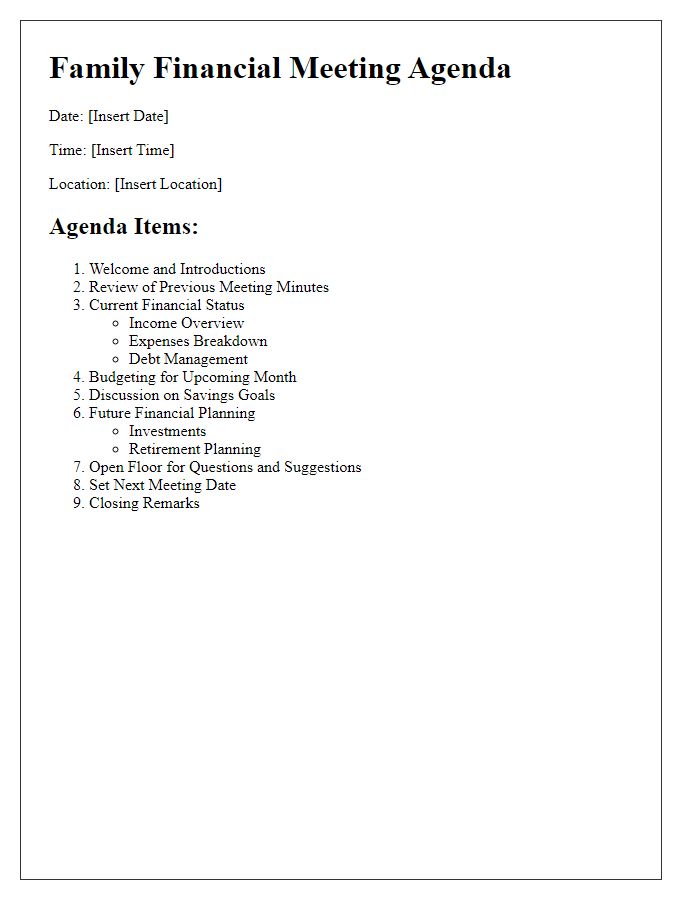

Meeting Agenda & Objectives

Family financial meetings play a crucial role in ensuring transparency and collaboration among family members regarding financial matters. During these meetings, key topics such as budgeting (allocating monthly income for essential expenses like groceries and utilities), savings goals (establishing targets for future purchases, including vacations or home purchases), and debt management (strategies for paying off loans or credit card debt) can be discussed in detail. Additionally, investment opportunities (exploring options like stocks or real estate) and financial education resources (books or online courses on personal finance) will be addressed to enhance collective financial literacy. Regularly scheduled meetings can foster a supportive environment for discussing challenges and successes related to family finances while promoting accountability and shared responsibility in achieving financial objectives.

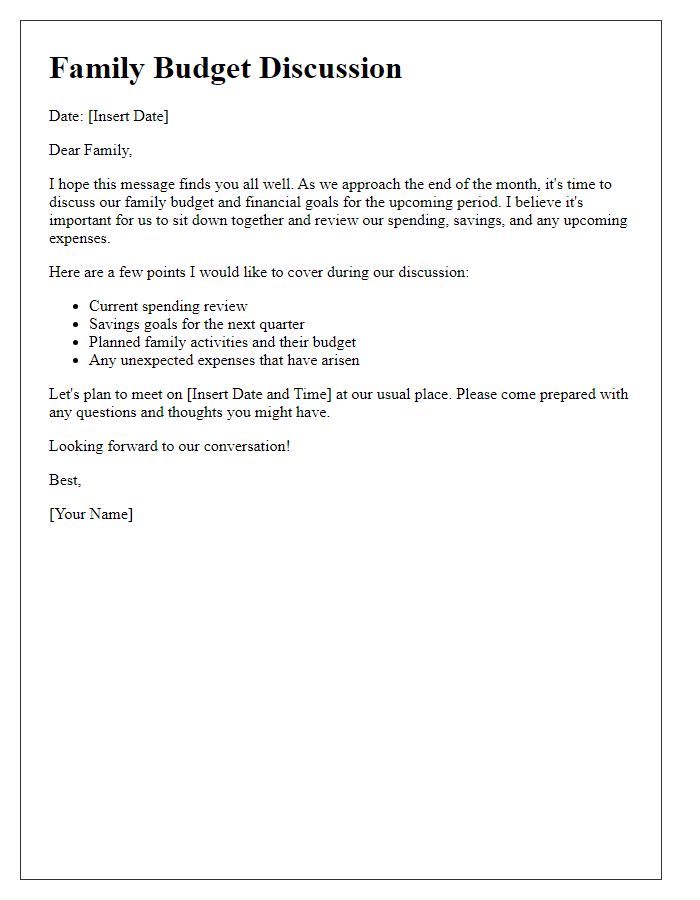

Financial Overview

Family financial meetings provide an essential platform for discussing budget management, tracking expenses, and planning for future investments. Presenting a financial overview involves detailing income sources, including salaries, passive income, and any side business earnings. Documenting monthly expenses such as mortgage payments, utility bills, and groceries encourages transparency. Additionally, reviewing savings and investment accounts, like 401(k) plans, IRAs, or stock portfolios, can facilitate informed decision-making. Setting specific financial goals, such as saving for a vacation or planning for higher education expenses, gives direction to discussions. Regular assessments ensure that family members remain aligned on financial strategies, promoting collective responsibility towards achieving fiscal stability.

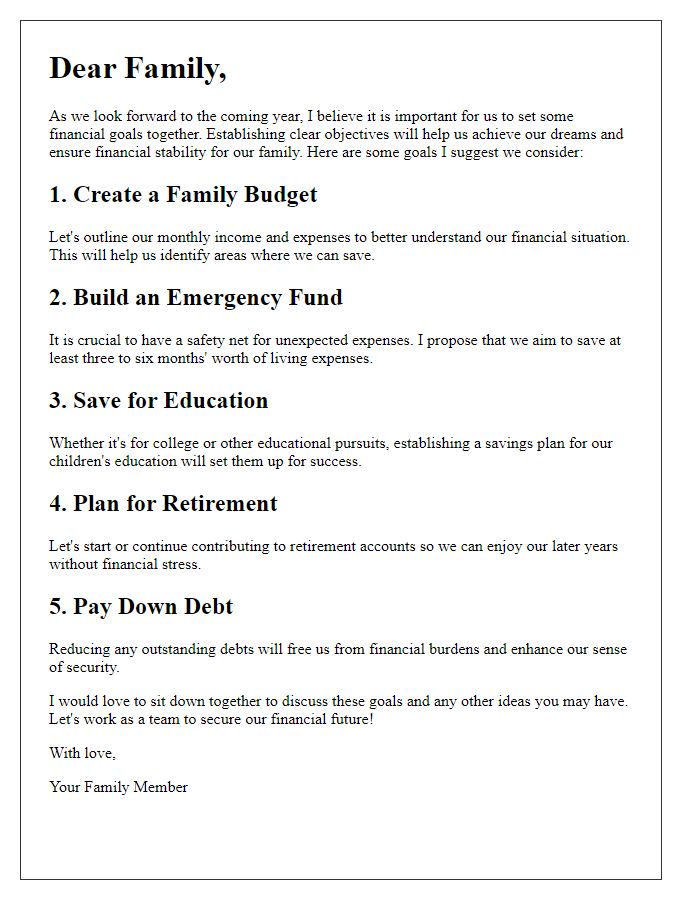

Key Discussion Topics

Family financial meetings provide essential opportunities for discussing key financial topics and making informed decisions. Budgeting highlights the importance of tracking income, expenses, and savings goals while focusing on short-term needs (monthly expenses) and long-term objectives (retirement savings). Debt management addresses handling existing debts, including student loans, credit card balances, and mortgages, emphasizing strategies for reducing interest costs through consolidation or refinancing options. Investment discussions should cover current stock market conditions, asset allocation, and diversification strategies to mitigate risks while maximizing potential returns. Emergency funds play a critical role in financial security, typically recommending at least three to six months' worth of living expenses. Future planning topics often involve education savings for children (targeting amounts like $50,000 for college costs) and estate planning, ensuring assets are distributed according to family wishes. Regular reviews of insurance coverage, including health, life, and property insurance, ensure adequate protection against unforeseen events, helping maintain family stability.

Action Items & Responsibilities

Action items from family financial meetings often involve key tasks and responsibilities that each family member must fulfill. Regular financial evaluations provide insight into budgeting methods, expense tracking, and future saving goals (like a college fund or retirement). Responsibilities typically include reviewing monthly budgets, monitoring expenses (like groceries or subscriptions), updating financial spreadsheets, and attending workshops to enhance financial literacy. Discussions may cover prioritizing debts, understanding interest rates, and evaluating investments (like stocks or real estate). Each action item should have assigned due dates to ensure accountability, fostering an environment of teamwork and shared fiscal responsibility among family members.

Future Meeting Schedule

Establishing a clear future meeting schedule is essential for effective family financial discussions, ensuring all members are informed and engaged. The proposed calendar includes monthly meetings (first Monday of each month) starting from January 2024, focusing on key topics such as budgeting, saving goals, investment strategies, and debt management. This structured approach facilitates accountability and encourages participation, allowing family members to bring their ideas and concerns before critical decisions are made. Key events such as annual budget reviews (scheduled for December) and tax preparation discussions (timed for February and March) will also be integrated, ensuring a comprehensive approach to managing family finances together.

Comments