Are you looking for a way to streamline communication with your clients regarding their account statements? A well-crafted letter template can make all the difference in ensuring that important financial information is conveyed clearly and professionally. By using a standardized format, you can save time while also leaving a positive impression on your clients. Curious to learn more about creating an effective letter template for client account statements? Read on!

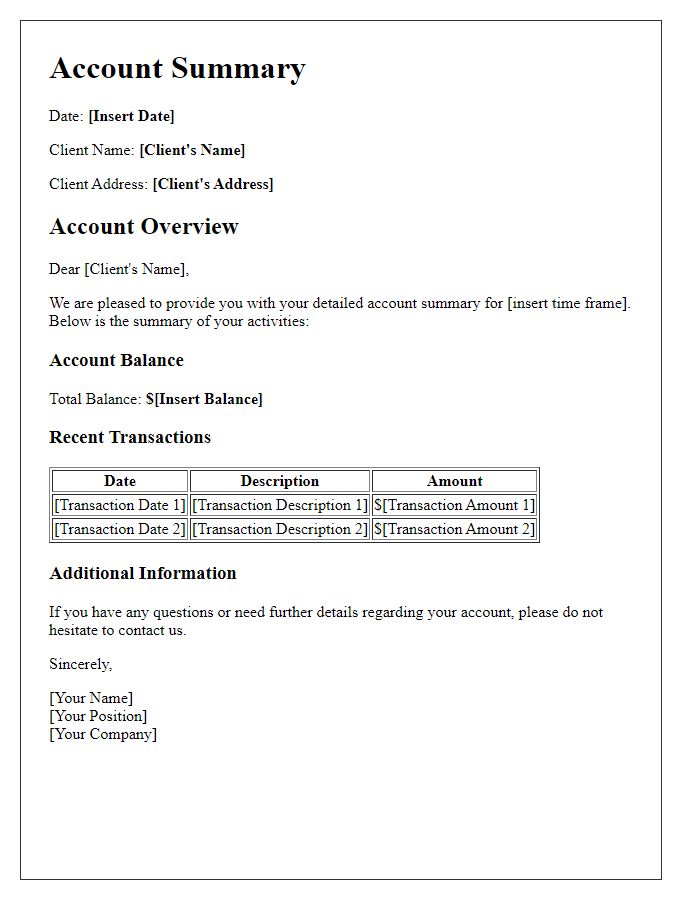

Client Information

Client information encompasses essential details, including the client's name (John Smith), account number (123456789), contact information (email: john.smith@email.com, phone: +1-555-1234), and address (123 Elm Street, Springfield, USA). This data serves as the foundation for personalized account statements, enabling accurate financial tracking and communication. Account statements may include transaction history, which highlights deposits, withdrawals, and fees, as well as the current account balance reflecting the client's financial position. Timely and precise reporting ensures transparency, essential for effective client relationship management in various industries, such as banking or investment services.

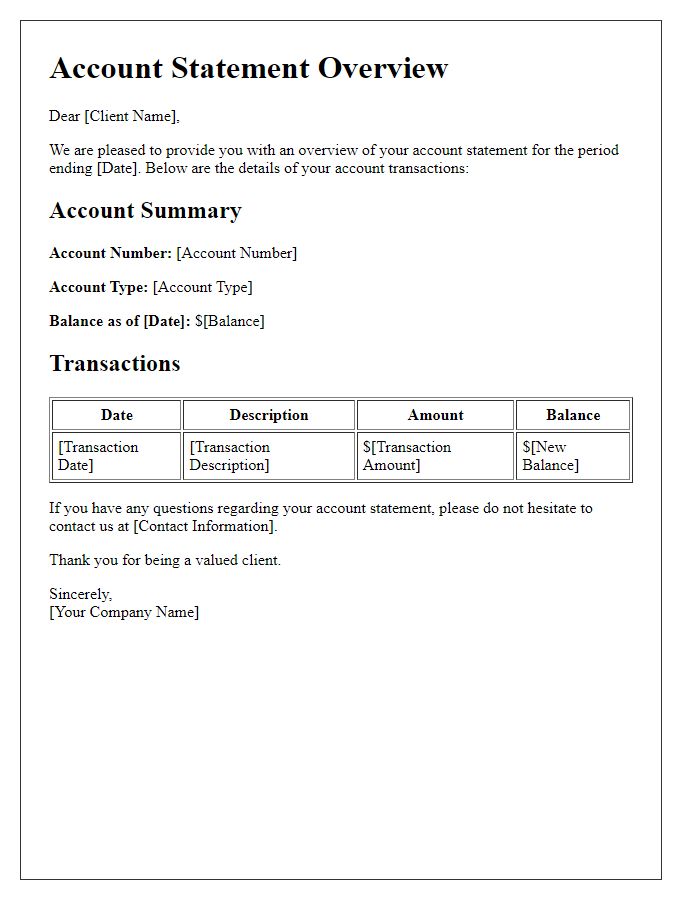

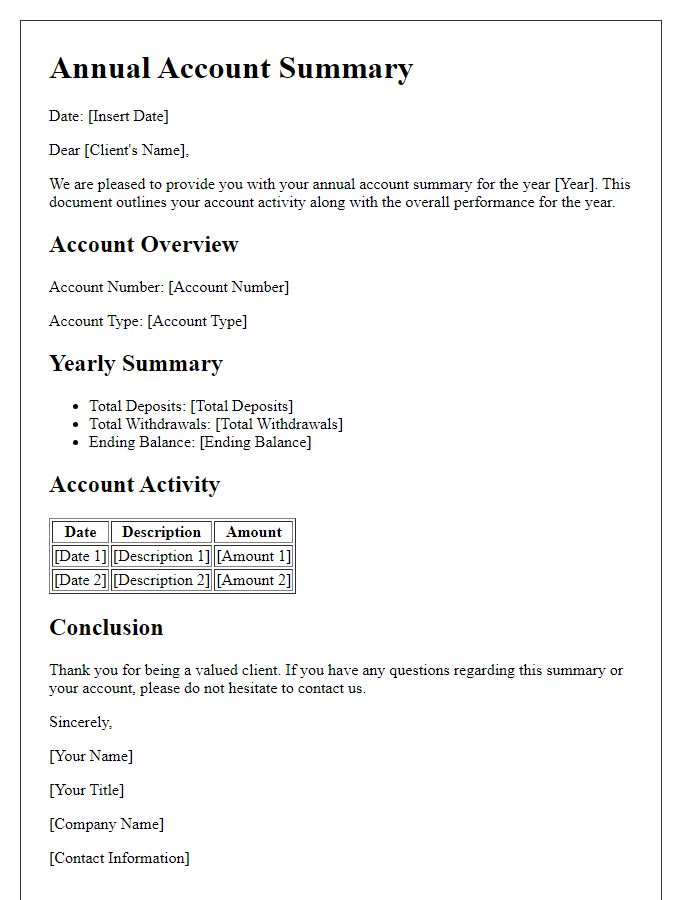

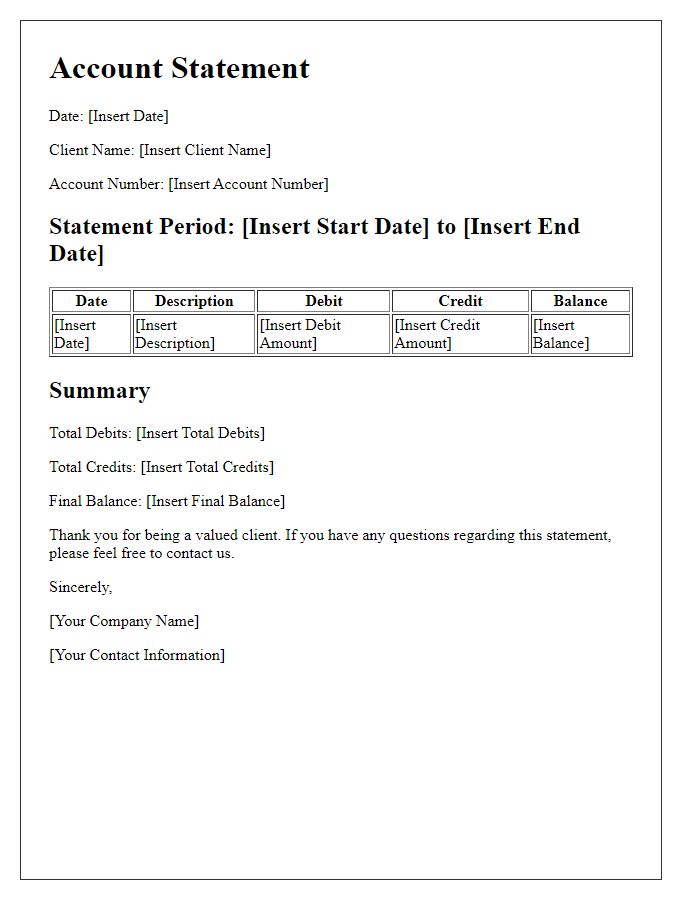

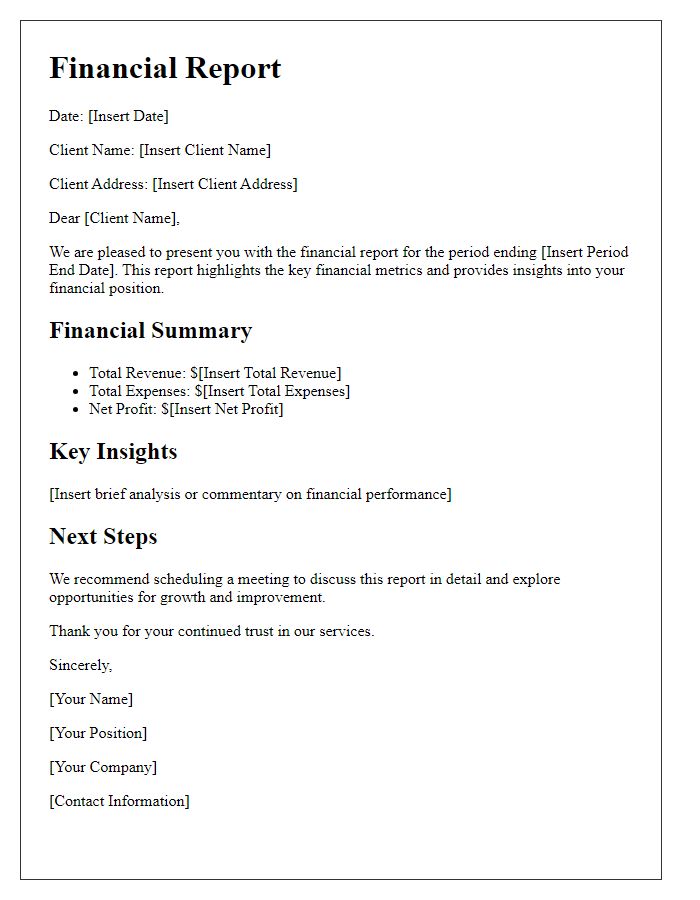

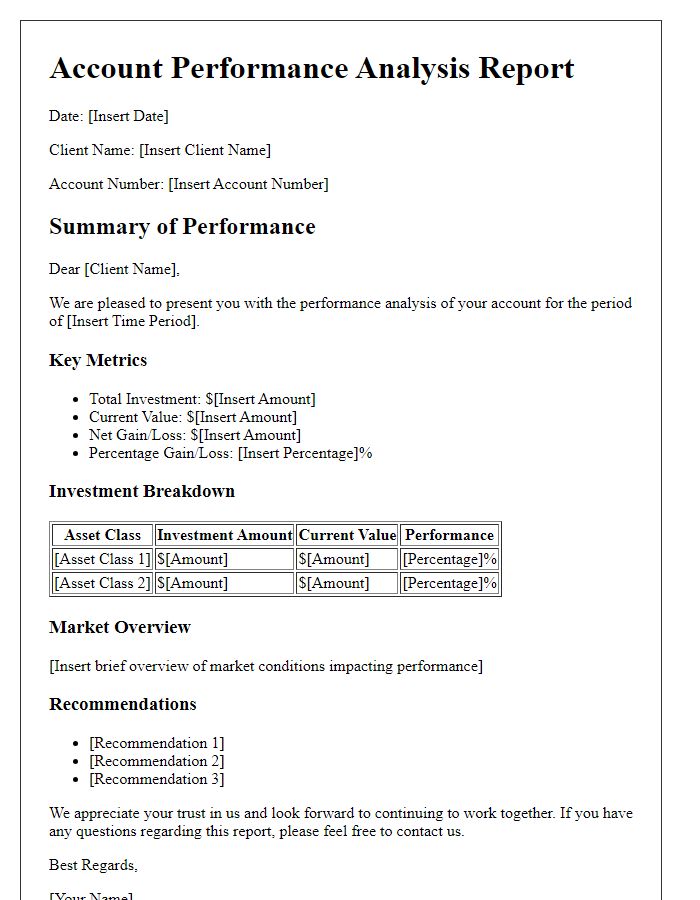

Account Summary

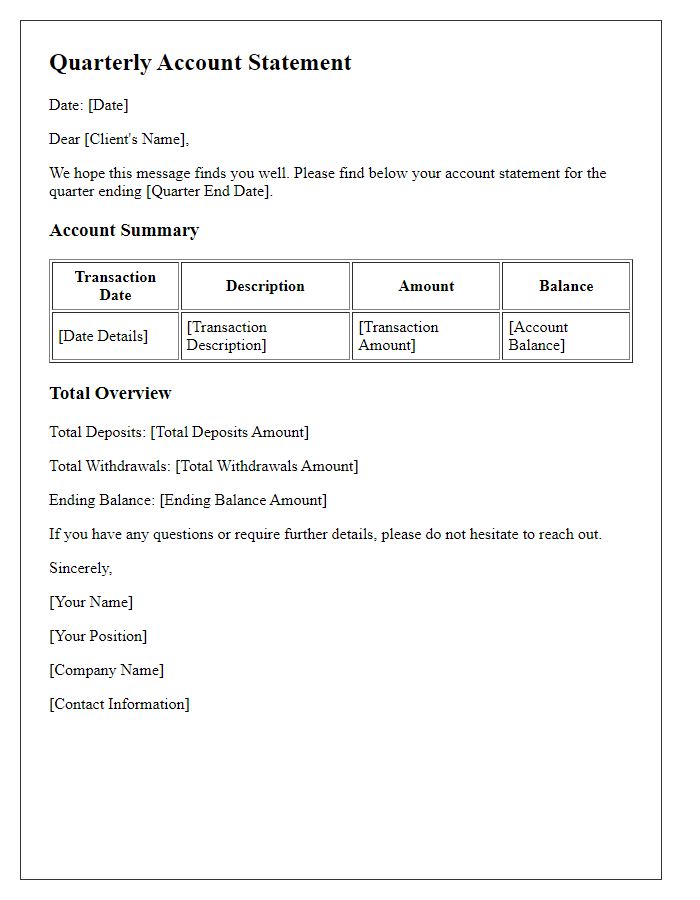

Client account statements provide a comprehensive view of financial transactions and balances. These statements typically encompass monthly activity from the client's account, including deposits, withdrawals, and fees. Account balances reflect the net total after all transactions are accounted for, ensuring clients have a clear insight into their financial status. Transaction details often include timestamps, transaction types, and reference numbers, enhancing the transparency of each entry. Regularly reviewing these statements ensures clients can monitor their spending, manage their budgets effectively, and identify any discrepancies that may arise in their accounts throughout the year.

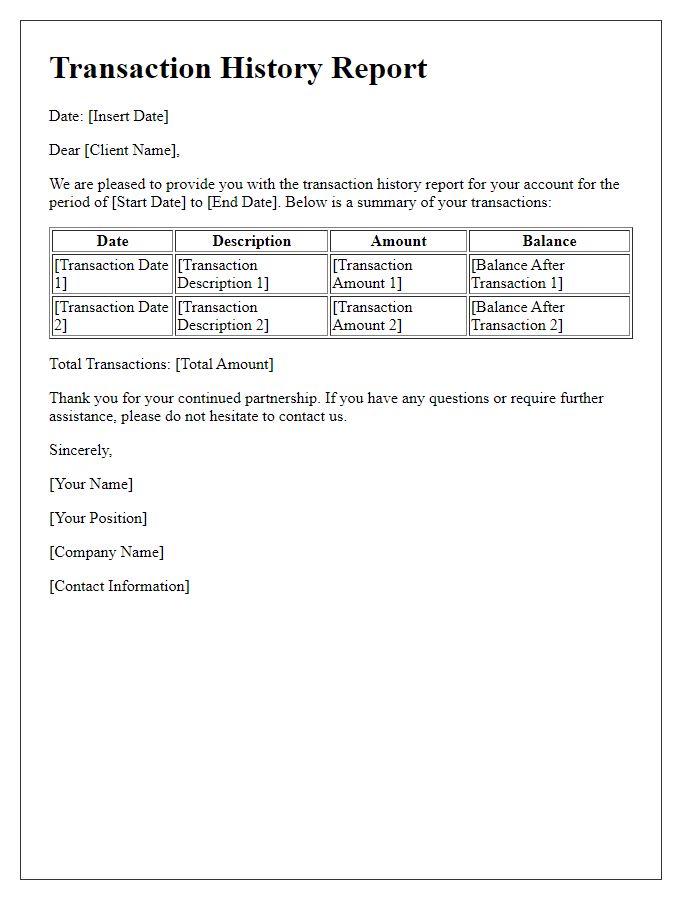

Transaction Details

Client account statements provide a comprehensive overview of financial transactions, including dates, descriptions, amounts, and balance updates. Each transaction detail emphasizes the nature of the activity, whether deposits, withdrawals, or fees, enhancing clarity for the client. For example, a deposit of $1,500 on March 15, 2023, directly certified via bank transfer (ACH), represents a significant influx of funds. Conversely, a $250 monthly service fee, identifiable through the description "Monthly Account Maintenance," is documented on the first of each month, ensuring consistent record-keeping. The cumulative impact of these entries is reflected in the ending balance, presenting a clearer financial picture for clients reviewing their account activity.

Payment Due Dates

Client account statements often detail payment due dates, crucial in maintaining financial clarity and responsibility. Invoicing systems generate these statements, highlighting amounts owed, due dates, and invoice numbers for precise tracking. Payment due dates typically fall within 30 or 60 days of the invoice date, depending on business agreements. Clients often receive notifications via email or postal mail, prompting timely action to avoid late fees. Financial institutions may impose interest rates starting at 1.5% per month for overdue accounts, creating potential financial strain. Understanding and adhering to payment due dates fosters positive client relations and supports cash flow stability for businesses.

Contact Information

Client account statements are essential documents that provide a detailed overview of financial transactions and balances. Typically, these statements include key information such as account numbers, transaction dates, and descriptions of each entry. Contact information for the financial institution is also prominently featured, including telephone numbers, email addresses, and physical addresses for client inquiries. For instance, the account statement from Bank of America might list the customer service line at 1-800-432-1000 for immediate assistance or questions regarding the account details. Additionally, statements may indicate specific departments such as the billing inquiries department, ensuring clients can connect with the appropriate representatives for support.

Comments