Are you considering a personal loan from your employer but unsure of how to ask? Writing a clear and concise request can set the right tone for your application. In this article, we'll walk you through a sample letter template, helping you express your needs while maintaining professionalism. Ready to take the next step? Let's dive in!

Purpose and Justification

To obtain a personal loan from an employer, a clear understanding of the purpose and justification is essential. A personal loan request, typically ranging from $500 to $5,000, may be needed for various reasons such as medical expenses, home repairs, or educational purposes, which can significantly impact an employee's life. For instance, unexpected medical bills averaging $1,500 can strain financial resources, necessitating prompt assistance. Justification for the loan includes demonstrating reliable employment, typically over one year, and a steady income that assures timely repayment. Employers may also consider the overall financial stability of the employee as a factor, further enhancing the request's credibility. Proper documentation, such as pay stubs and proposed repayment plans, can solidify the justification, making it easier for employers to review and approve the loan.

Loan Amount and Repayment Plan

Request for a personal loan from an employer involves clear articulation of the desired loan amount, which could range from a few hundred to several thousand dollars, depending on individual circumstances. The repayment plan should detail a proposed schedule, often based on a percentage of monthly salary, such as 10% of gross income, over a period typically spanning 6 to 24 months. Interest rates, if applicable, could be specified, often between 0% to 5%, reflecting favorable terms compared to commercial lenders. Additionally, the purpose of the loan (such as unexpected medical expenses or home repairs) should be clearly stated to provide context and demonstrate responsible financial planning.

Financial Stability and Employment History

Requesting a personal loan from an employer can provide employees with financial support while maintaining a secure employment relationship. Providing details such as the employee's financial stability, encompassing current income figures (for example, a monthly gross salary of $5,000) and any existing debts (like a $10,000 credit card balance), can enhance the loan's credibility. Highlighting the employee's job tenure, such as three years at a reputable company (e.g., ABC Corp), showcases reliability and commitment. Including a purpose for the loan, like funding educational expenses at a local university (for instance, a $15,000 tuition fee for a master's program), helps to strengthen the case for approval. Clear repayment terms, detailing how the loan will be repaid through payroll deductions, can further reassure the employer of the employee's responsible financial planning.

Terms and Conditions Agreement

A personal loan from an employer, often categorized under workplace lending programs, can provide financial support for personal projects or emergencies. Typically, terms and conditions outline the repayment schedule, which may extend over several months or years, with interest rates usually lower than traditional personal loans offered by financial institutions. The process often requires filling out a formal application detailing the purpose of the loan and the amount requested, which could range from a few hundred to several thousand dollars, depending on company policies. Documentation such as employment verification, pay stubs, and potentially a credit check may be necessary to assess eligibility. Employers generally outline the implications of default, which can affect future employment or salary adjustments, making it essential for employees to understand their financial commitments before proceeding.

Contact Information and Follow-Up Plan

Requesting a personal loan from an employer involves formal communication that demonstrates professionalism and clarity. This request should include pertinent contact information, showcasing essential details such as your full name, position, and department within the company. The follow-up plan is crucial, suggesting a timeline for response, typically one to two weeks to allow for consideration. Engaging with the human resources department can be beneficial, as they may have specific guidelines or forms necessary for processing such requests. Being proactive in following up can reflect your seriousness about the loan request.

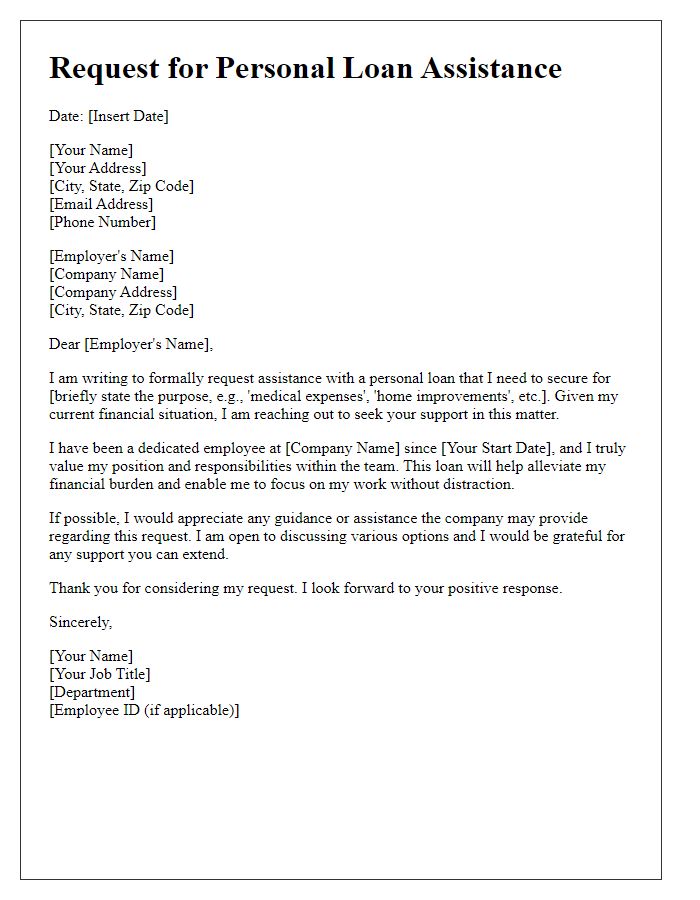

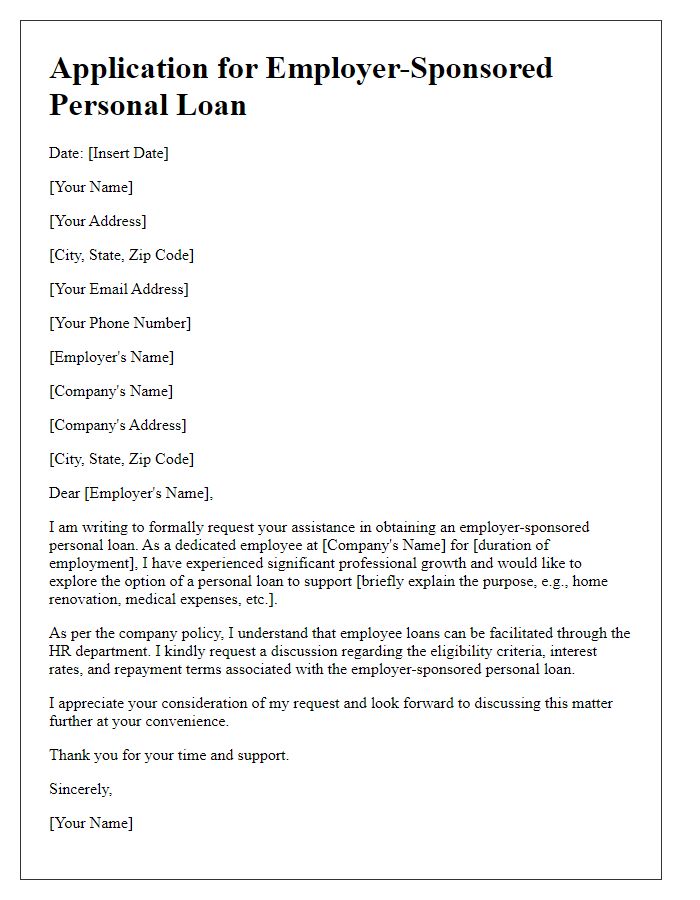

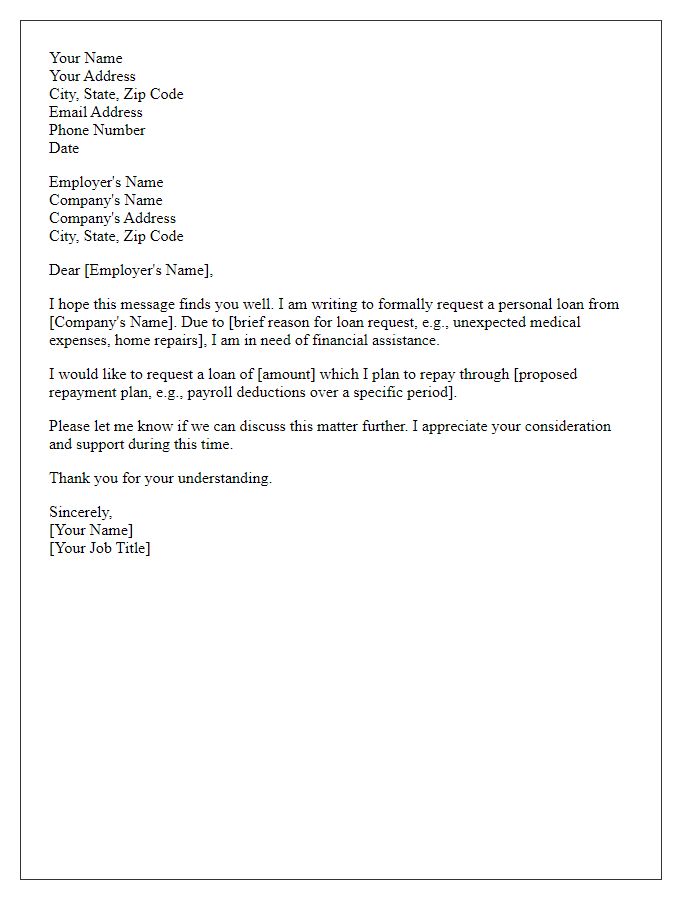

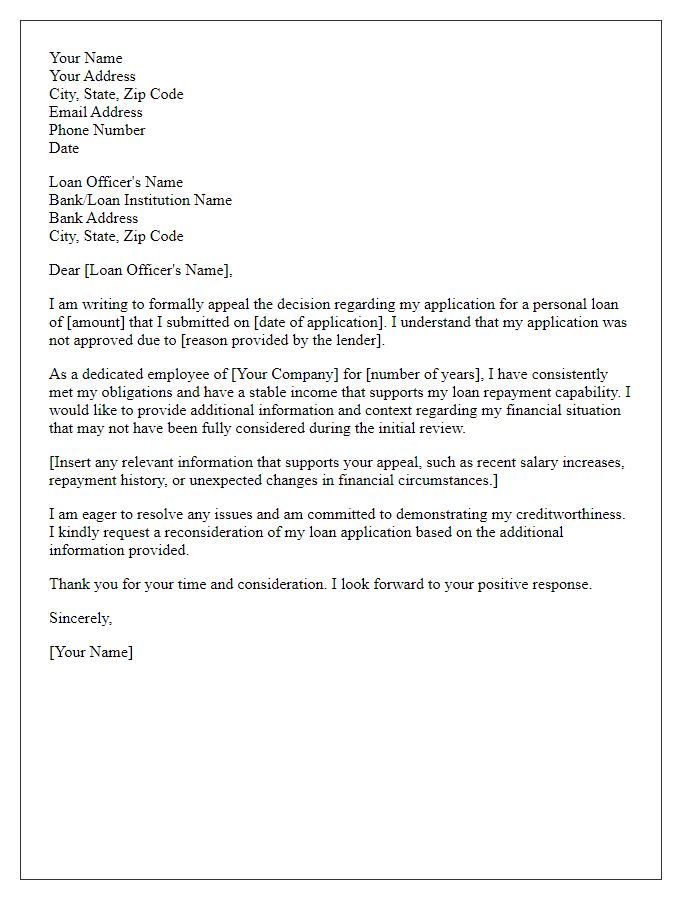

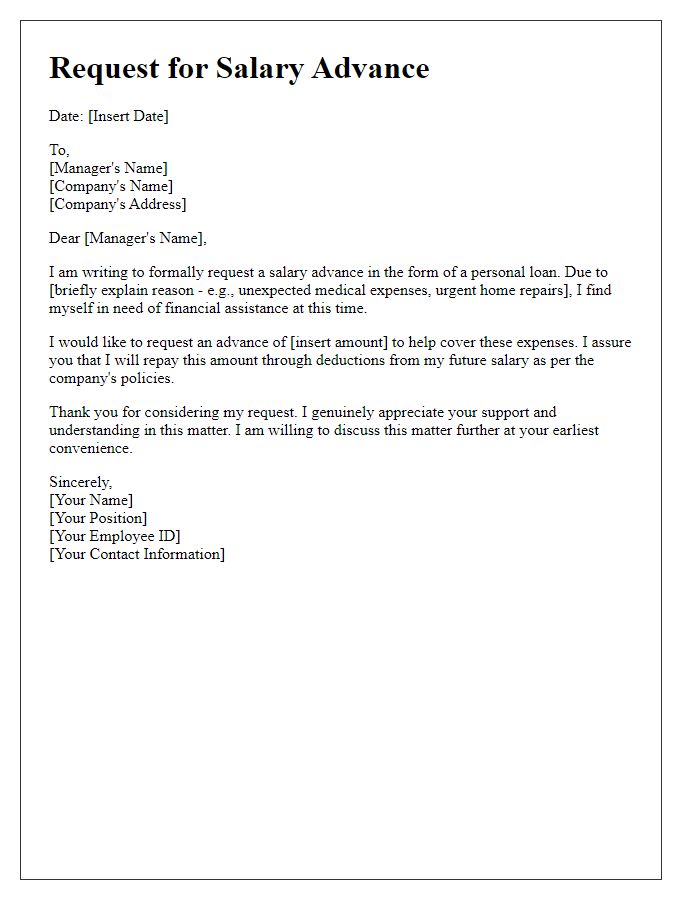

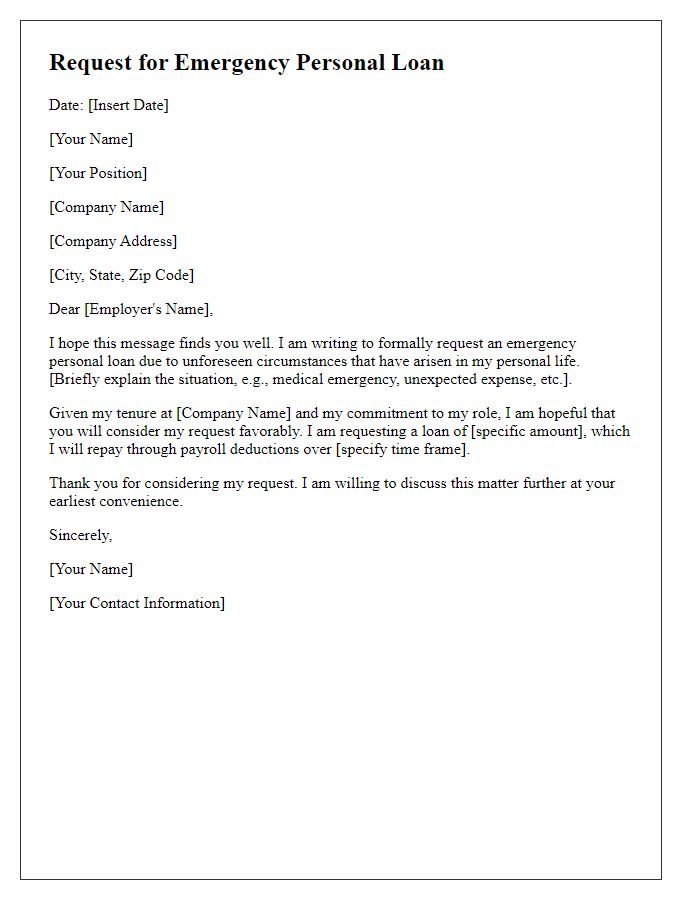

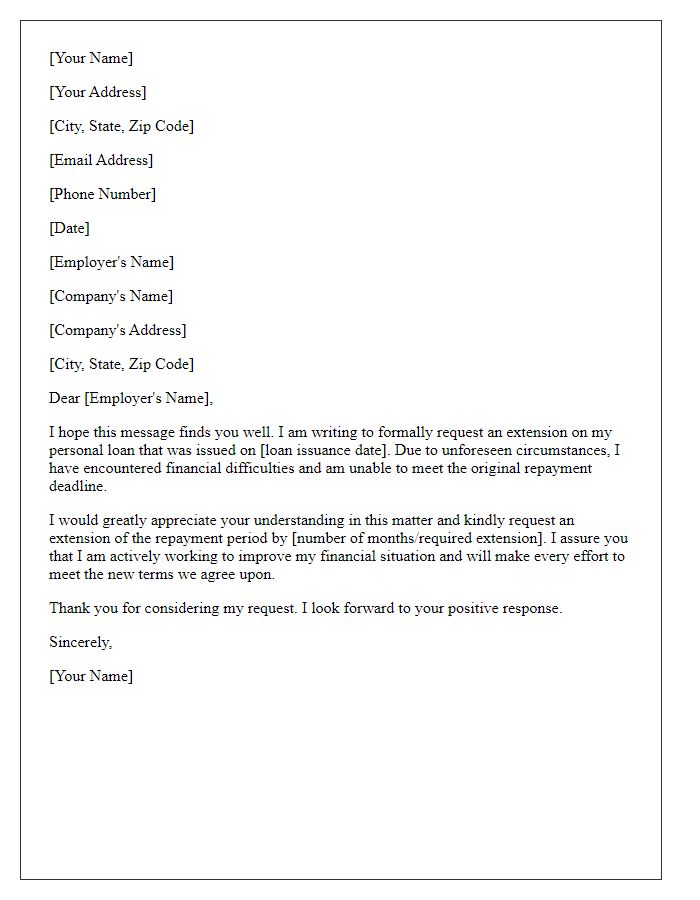

Letter Template For Requesting Personal Loan From Employer Samples

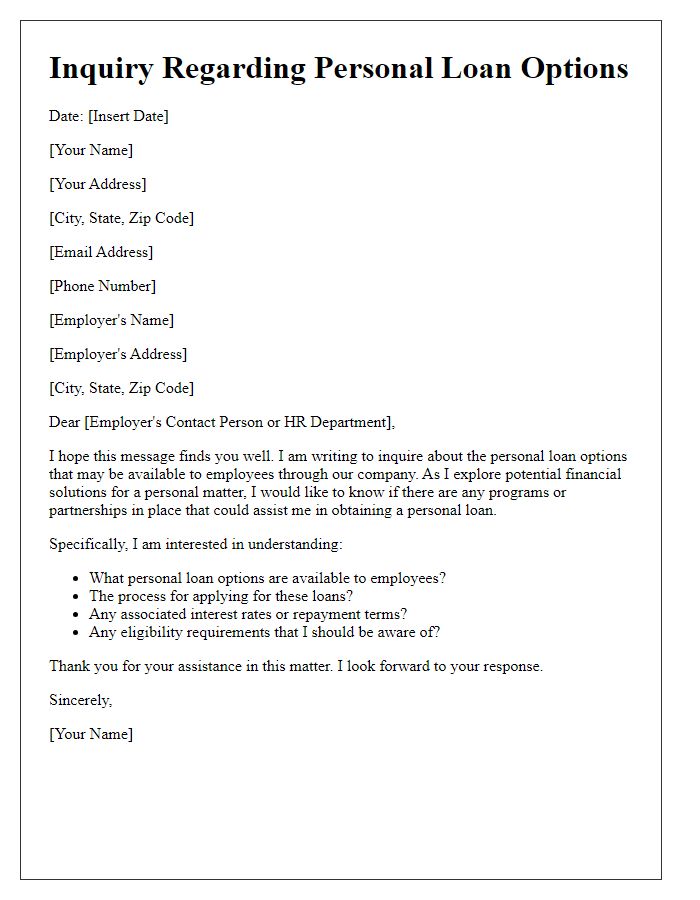

Letter template of inquiry regarding personal loan options through employer

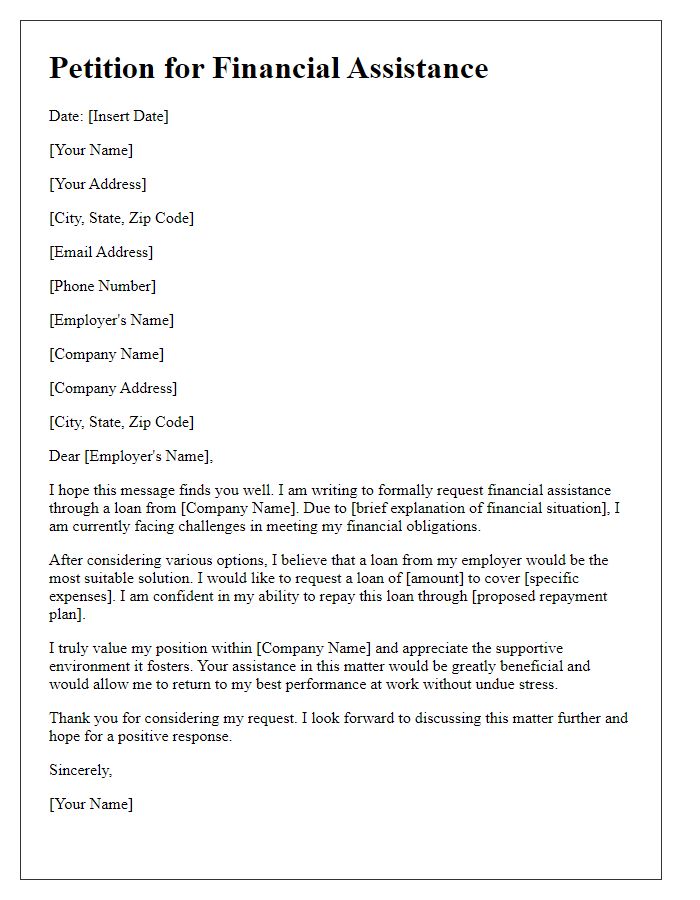

Letter template of petition for financial assistance through an employer loan

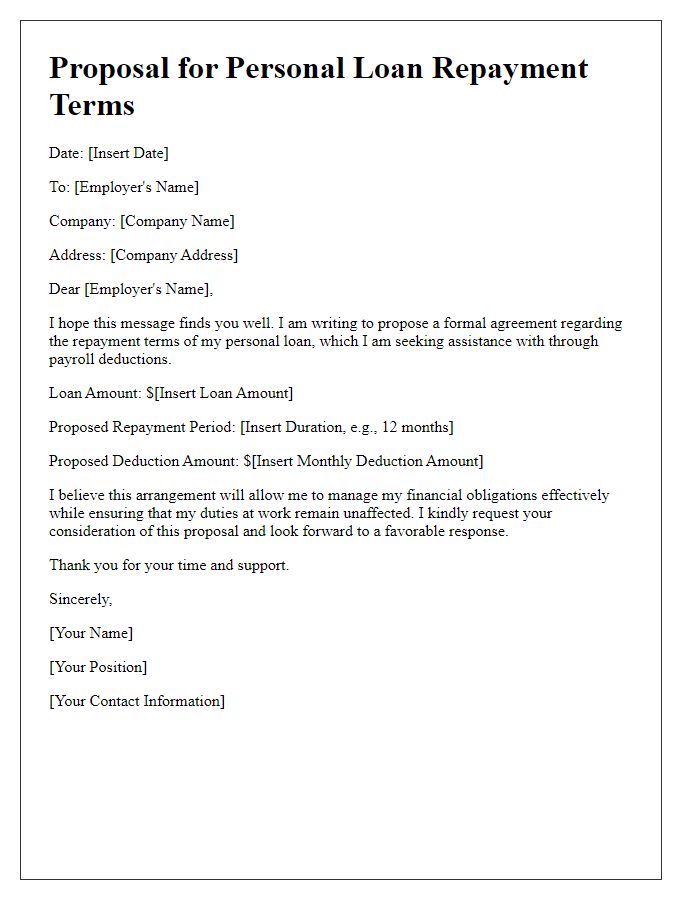

Letter template of proposal for personal loan repayment terms with employer

Comments