Are you considering applying for a loan but unsure where to start? Crafting a compelling loan application letter is crucial, as it sets the tone for your request and showcases your financial needs. In this article, we'll guide you through the essential elements of an effective letter, ensuring you present yourself in the best light. So, let's dive in and help you take that first step toward securing your loan!

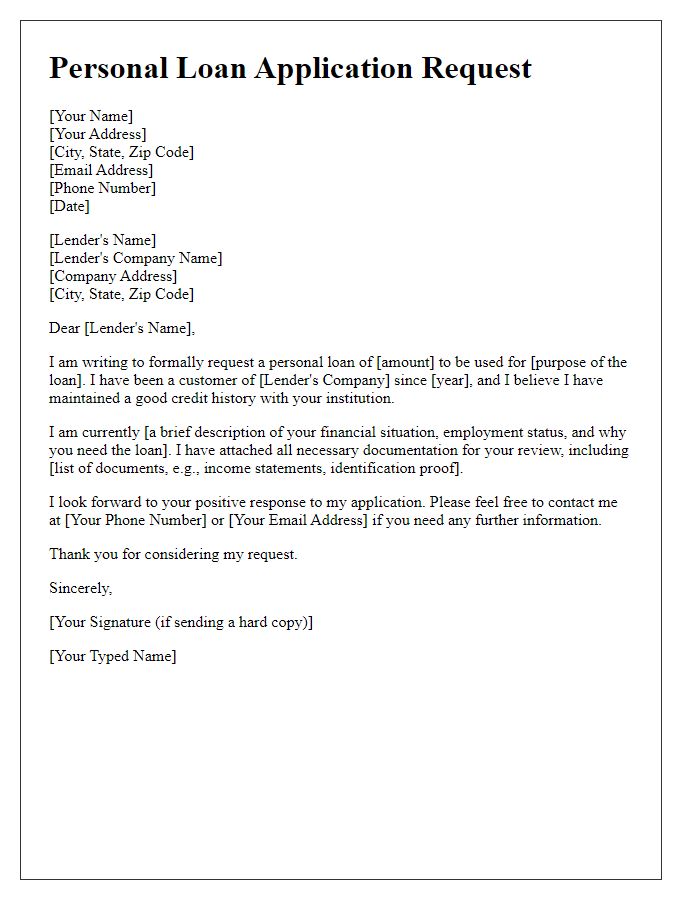

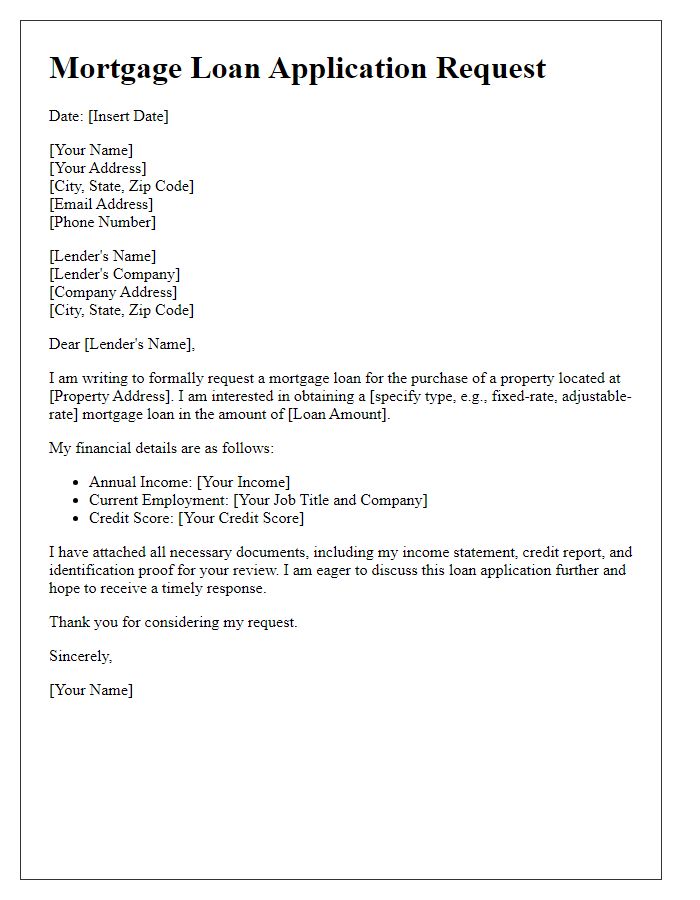

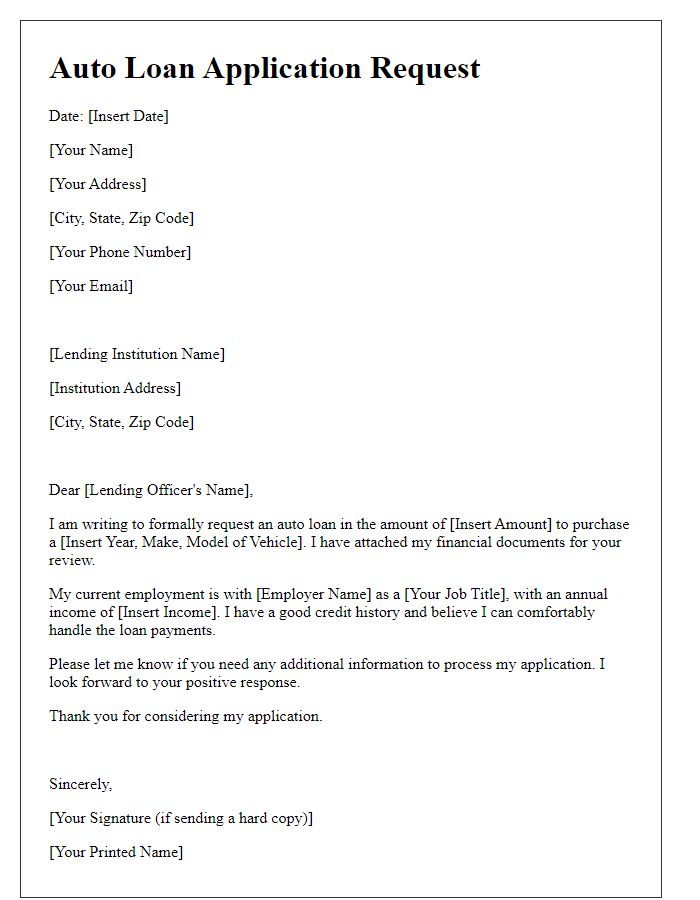

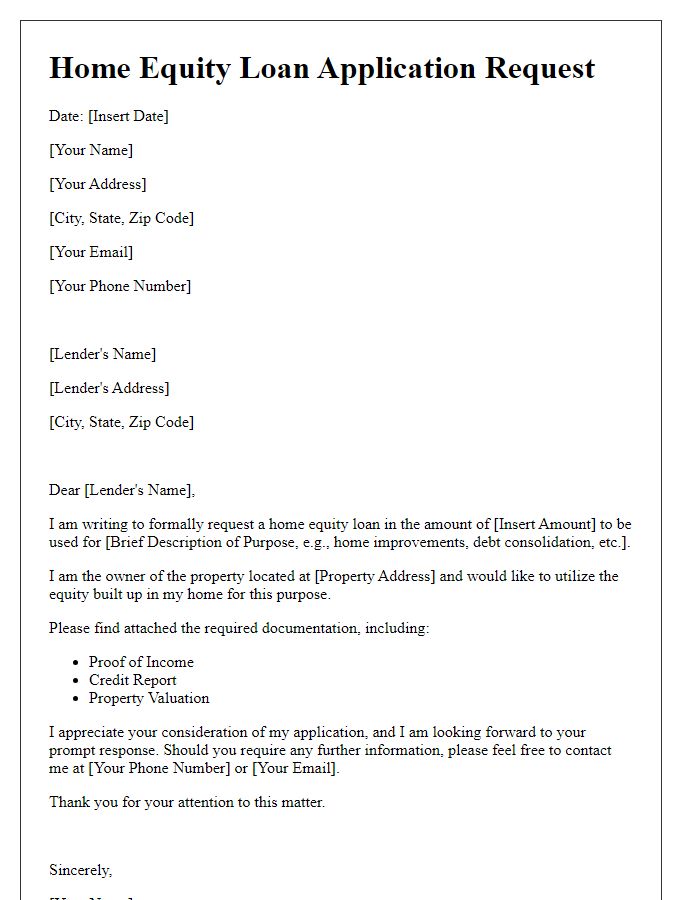

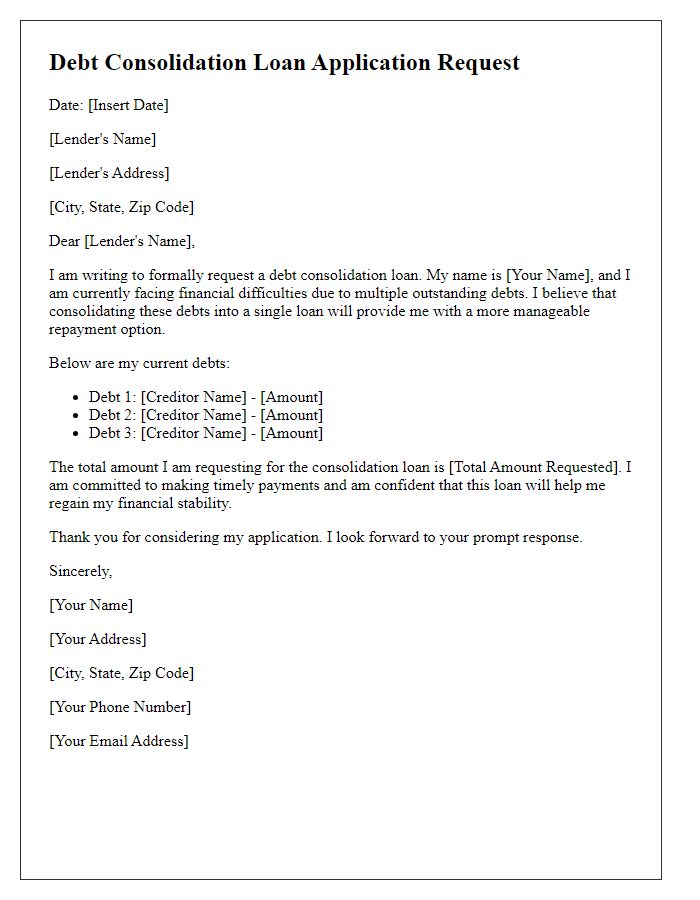

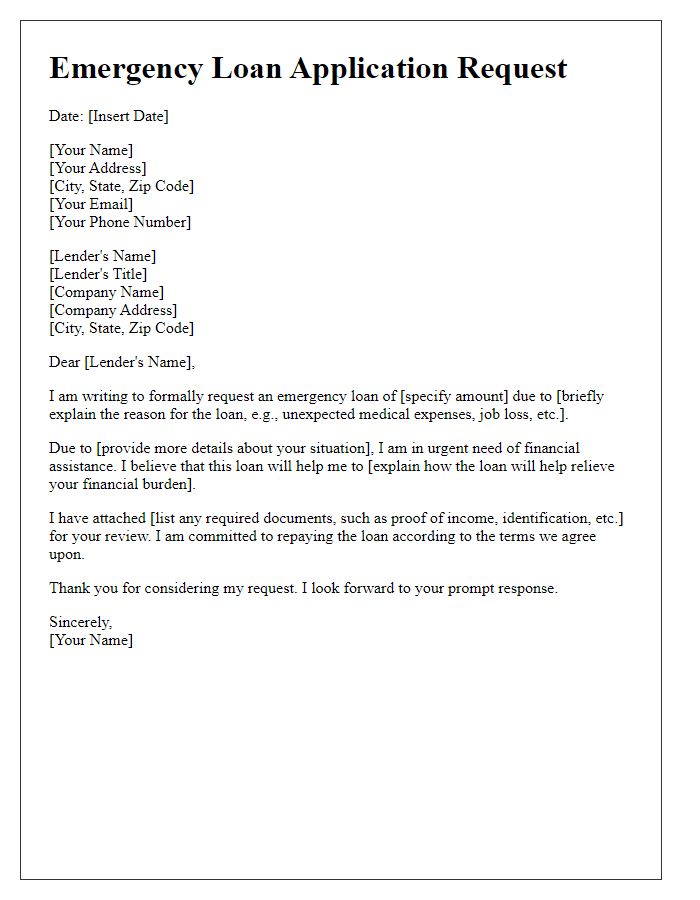

Applicant's Personal and Contact Information

The applicant's personal information, crucial for loan processing, typically includes full name, date of birth, and social security number, which helps verify identity. Contact information includes home address, email address, and phone number, ensuring seamless communication throughout the loan application process. Additional details may encompass employment history, including job title and employer name, as well as income details, such as annual salary or hourly wage, providing lenders insight into financial stability and repayment capability.

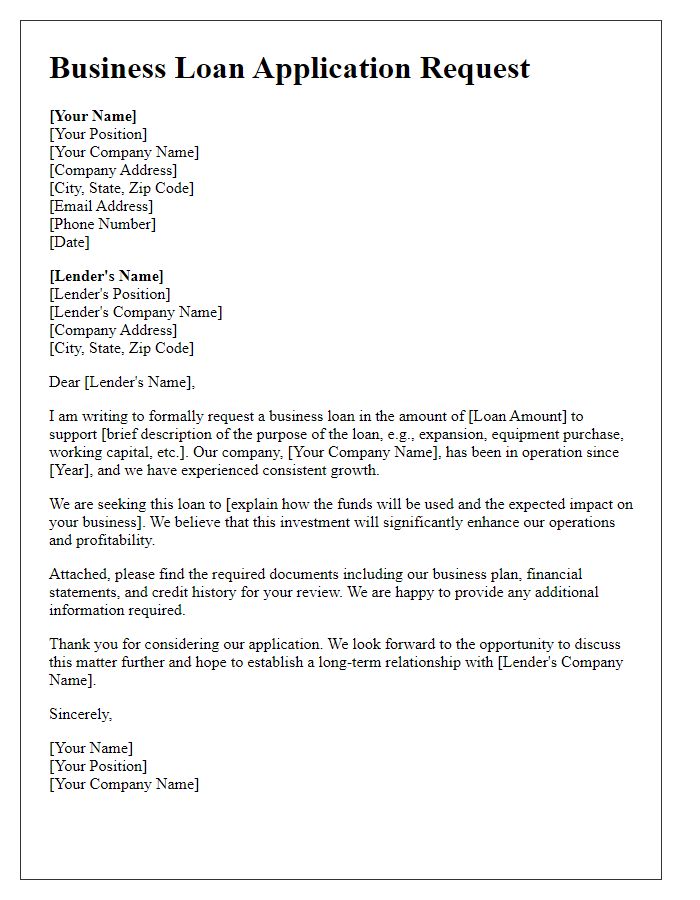

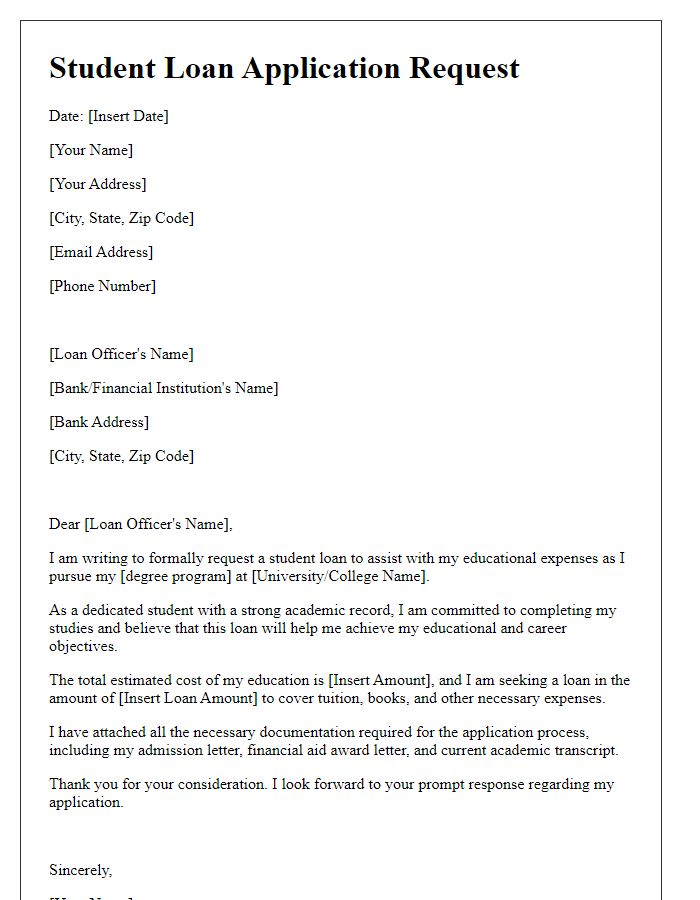

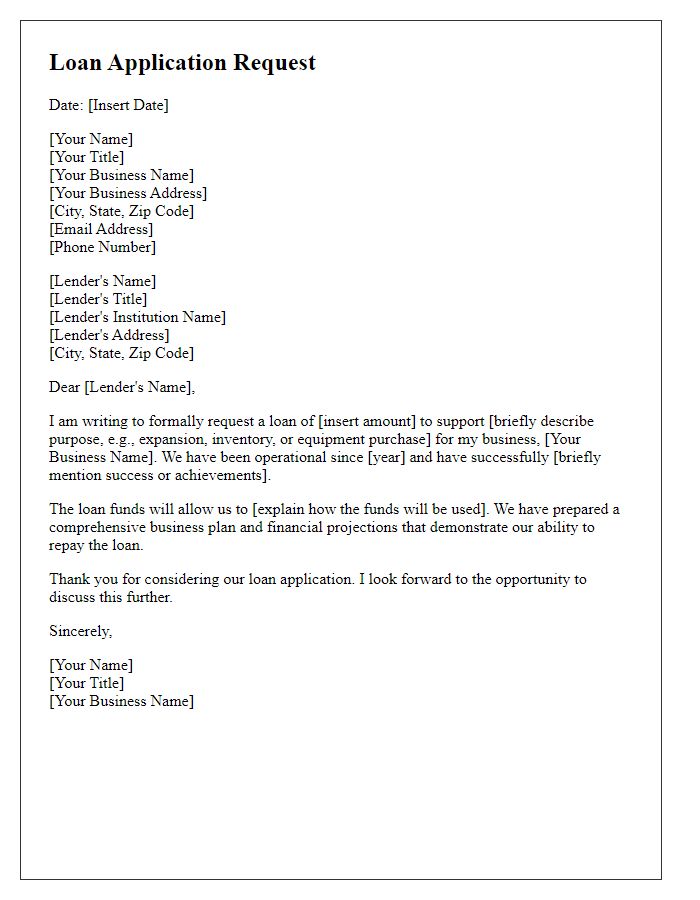

Loan Purpose and Amount Requested

Individuals often seek loans to finance significant purchases or investments that enhance their quality of life or meet essential needs. Common purposes for requesting loans include home renovations, educational expenses, or starting a new business venture. For instance, a homeowner may apply for a $20,000 personal loan to remodel a kitchen, improving both functionality and property value. Students frequently request education loans, ranging from $5,000 to $50,000, to cover tuition fees and living expenses while attending universities such as Harvard or Stanford. Entrepreneurs might seek capital investment of $10,000 to $100,000 to launch a startup in sectors like technology or retail, aiming for sustainable growth within competitive markets.

Financial Status and Employment Details

A successful loan application requires detailed financial status (accurate documentation of income and expenses) and employment details (current job position, length of employment). Financial status should include monthly income (net salary, bonuses) and expenses (rent, utilities, groceries) to showcase affordability for repayments. Employment details must specify company name (public, private) and duration (in years/months) at the current job, reflecting job stability. Additionally, providing any relevant changes in financial circumstances (medical expenses, education costs) adds context to the application, improving chances of approval. Documentation like pay stubs (latest three months), bank statements (last six months), and tax returns (previous two years) supports financial claims, presenting a comprehensive overview for lenders.

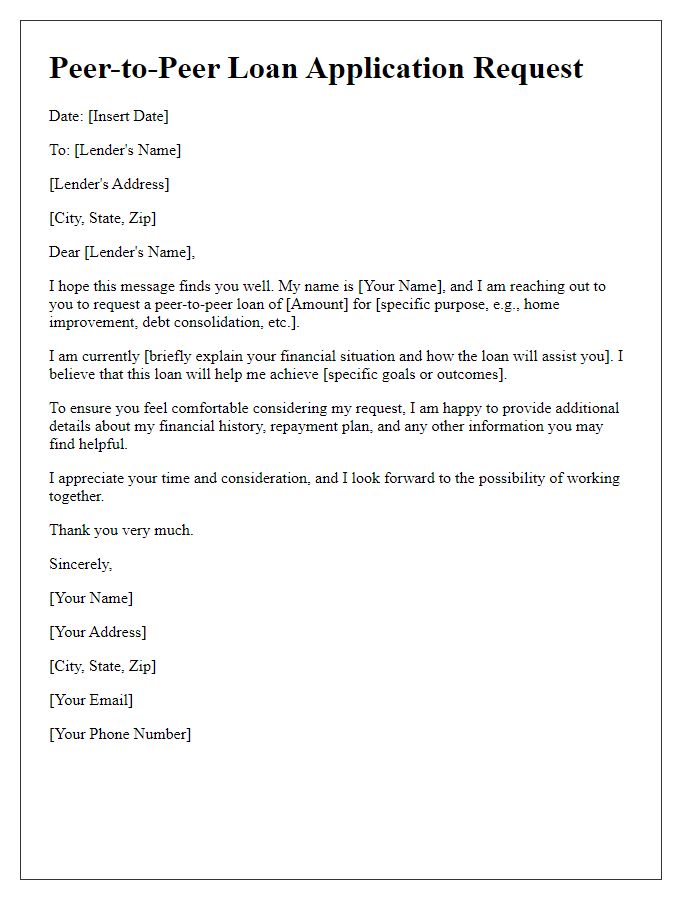

Repayment Plan and Loan Term

A well-structured loan application clearly outlines the repayment plan and loan term. For instance, applicants might specify a five-year term, detailing monthly installments amounting to $500. This amount would include principal and interest based on an interest rate of 6% APR, calculated from a total loan amount of $25,000. The repayment plan necessitates consistency, with the first payment due one month after the loan's disbursement date. Additionally, applicants should highlight the purpose of the loan, such as financing home renovations or purchasing a vehicle, ensuring lenders understand the intended use of funds, which can influence approval rates. A solid repayment plan is vital for establishing credibility with lenders, showcasing the applicant's financial responsibility and ability to meet obligations.

Supporting Documentation and Credit History

Submitting a loan application requires comprehensive supporting documentation to evaluate credit history. Essential documents include income verification such as pay stubs from the past three months, tax returns for the last two years, and bank statements reflecting financial stability. Credit history typically involves a credit report detailing outstanding debts, credit utilization ratios, and payment history spanning three to five years. Moreover, personal identification, such as a driver's license or social security number, provides lenders with essential information to confirm identity. Preparing these critical documents enhances the likelihood of securing loan approval by building a trustworthy financial profile.

Comments