Are you feeling overwhelmed by multiple debts and high-interest rates? You're not alone, and many people find themselves in the same boat, seeking relief through debt consolidation. This process can simplify your finances, lower monthly payments, and reduce stress, giving you a clearer path to financial freedom. Ready to learn more about how to take control of your debt situation? Stick around as we dive into the details!

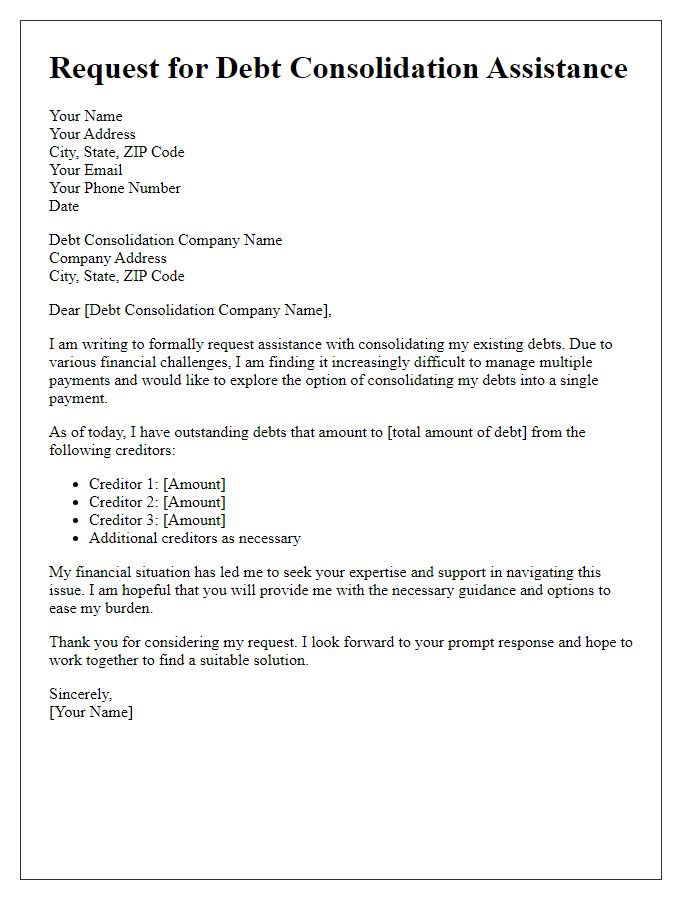

Personal Information and Account Details

Debt consolidation can provide a streamlined approach to managing multiple debts, simplifying finances into a single payment. Consumers, particularly those in the United States with an average credit card debt of $6,194, often seek this relief for easier monthly budgeting. Institutions such as banks and credit unions typically offer consolidation loans, which may vary in interest rates and terms. Additionally, personal information including credit scores from agencies like Experian and personal financial details play a crucial role in qualifying for favorable consolidation options. Understanding the impact of debt-to-income ratios, ideally below 36%, can significantly influence the approval process for prospective borrowers seeking debt relief measures.

Explanation of Current Financial Situation

Facing a growing financial burden, many individuals encounter challenges managing multiple debts with varying interest rates and payment schedules, particularly credit card balances averaging 20% interest or more. This situation is often exacerbated by unexpected expenses such as medical bills or vehicle repairs, which may arise suddenly and strain monthly budgets. According to recent statistics, the average American household carries approximately $8,000 in credit card debt. With dwindling savings accounts and rising living costs, late fees and missed payments can further erode financial stability. This highlights the urgent need for debt consolidation, a strategy that merges all existing debts into a single, more manageable payment with potentially lower interest rates, often facilitated through financial institutions or credit counseling agencies. By addressing these challenges promptly, individuals can regain control over their finances and work towards a debt-free future.

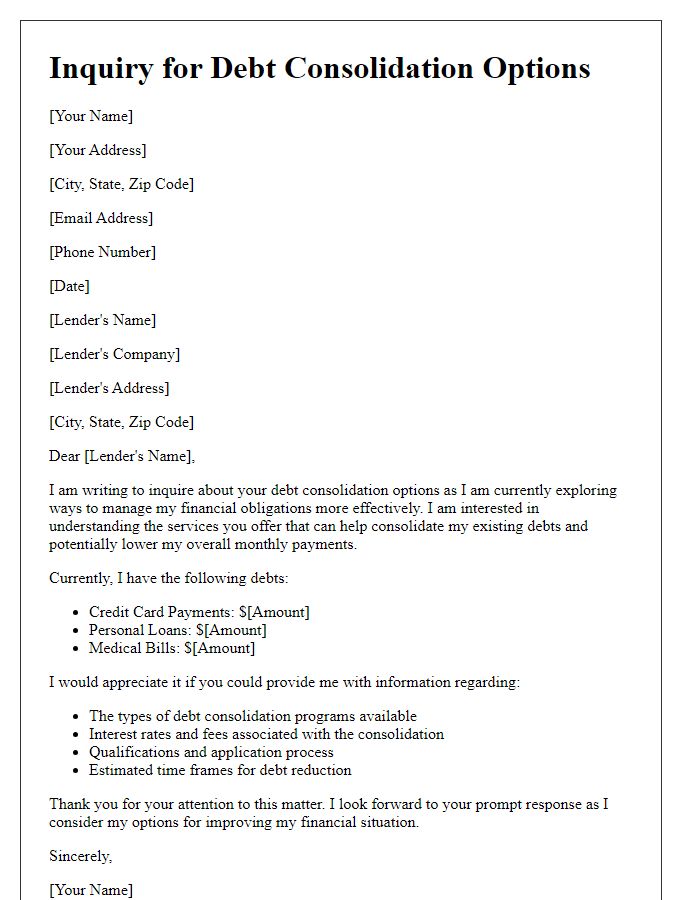

Reason for Requesting Debt Consolidation

Debt consolidation provides a strategic financial solution for individuals overwhelmed by multiple debts. It combines various outstanding debts, such as credit card balances averaging 18% interest rates, personal loans, and medical bills into a single, manageable monthly payment. This process simplifies financial management and can lead to lower overall interest rates, potentially reducing total repayment costs. According to studies, debt consolidation can decrease monthly payments by up to 50%, easing the burden on monthly budgets. Individuals often seek consolidation services from reputable lenders like credit unions or specialized nonprofit organizations, ensuring that they receive professional guidance tailored to their specific financial circumstances.

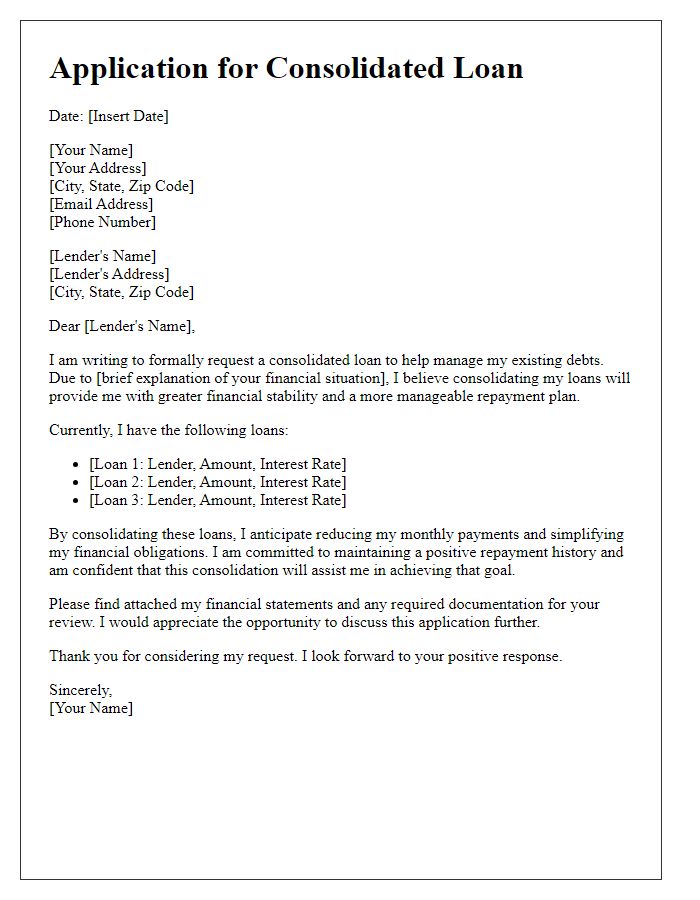

Proposed Repayment Plan and Terms

Debt consolidation involves combining multiple debts into a single loan to simplify repayment. This process can help individuals manage their financial obligations more effectively by reducing monthly payments and interest rates. A proposed repayment plan may include fixed monthly payments over a defined period, often ranging from three to five years, allowing borrowers to budget more easily. Terms can vary widely depending on the lender, but often involve lower interest rates than existing debts. Financial institutions may require documentation such as income verification, details of current debts, and a credit report to evaluate the borrower's eligibility. Additionally, many borrowers pursue debt consolidation to improve their credit score over time as they consistently make on-time payments.

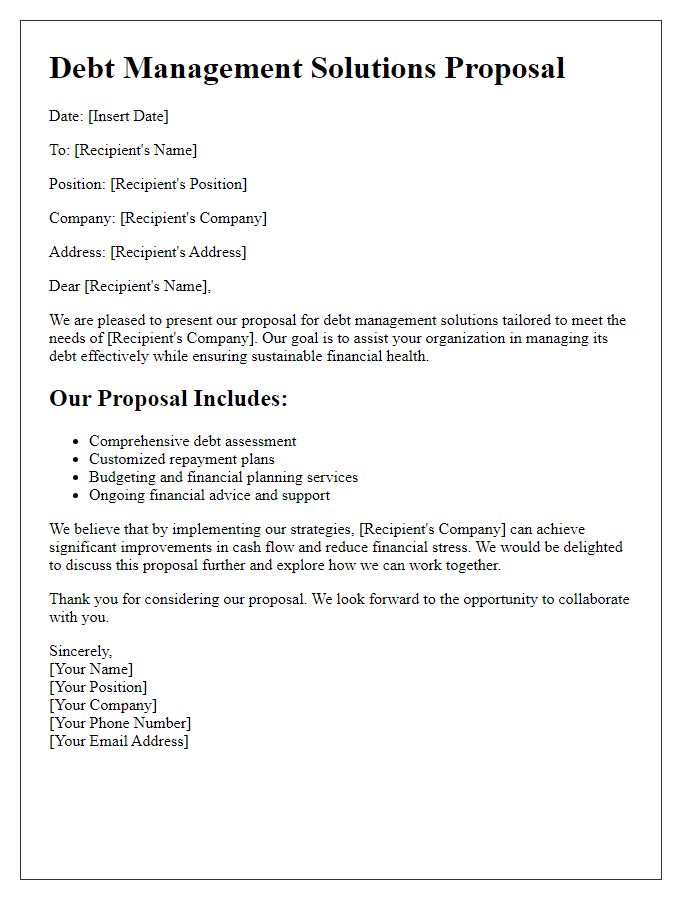

Contact Information and Preferred Communication Method

Debt consolidation can effectively simplify financial management, often involving the merging of multiple debts into a single monthly payment. Organizations such as credit unions or financial institutions may offer debt consolidation loans, typically at lower interest rates than existing debts. Prior credit score (above 620 for most lenders) significantly impacts approval chances. A detailed budget (including monthly expenses and incomes) prepares borrowers for the application process. Additionally, understanding preferred communication methods, like email or phone calls, allows better organization during interactions. Seeking professional financial advice from certified credit counselors can also provide valuable insights into the best debt consolidation options tailored to individual needs.

Comments