If you're feeling a bit overwhelmed by your auto loan payments, you're not alone! Life can throw unexpected challenges our way, and sometimes a little breathing room is exactly what we need. A payment deferral might just be the lifeline you're looking for to help you get back on track. Curious to learn how to request one effectively?

Borrower's personal information

Auto loan payment deferral options provide borrowers with temporary relief during financial hardships. Borrowers experiencing difficulties may request a deferral from their lenders to postpone payments, often for one to three months. Key details include the borrower's full name, account number, and contact information for personalized assistance. Lenders may request a brief explanation of the financial situation, including unemployment or medical emergencies. Specific terms regarding the deferral period, potential fees, and the impact on credit scores will vary between financial institutions. Understanding these conditions is crucial for borrowers to make informed decisions while managing their loan obligations.

Loan account number

In 2023, auto loan payment deferrals have become a common request due to various financial challenges. For borrowers managing loans through institutions like Bank of America or Wells Fargo, understanding the deferral process is essential. An auto loan payment deferral may allow borrowers to postpone one or more monthly payments without penalties, depending on specific conditions like employment status or unforeseen expenses. The loan account number, a crucial element in processing requests, helps lenders identify the borrower's contract and assess eligibility for assistance. Documentation may be required to substantiate the need for deferral, which can ultimately provide temporary relief during challenging financial periods.

Reason for deferral request

Due to unforeseen financial difficulties, an auto loan payment deferral is requested. Recent events, such as job loss in October 2023 and unexpected medical expenses, have significantly impacted monthly income. Consequently, making timely payments towards the auto loan has become challenging. The current loan account, set up with XYZ Bank, associated with the vehicle's VIN # 1HGBH41JXMN109186, is in good standing prior to these issues. A temporary deferral will provide the necessary relief to regain financial stability and ensure future payment consistency. Immediate assistance regarding this request is greatly appreciated to avoid potential late fees and preserve credit score integrity.

Deferral period requested

Auto loan payment deferral requests can significantly benefit borrowers facing financial hardships, particularly during unforeseen events such as job loss or medical emergencies. Typically, lenders provide a deferral period ranging from one to six months, allowing individuals to temporarily halt their payments without incurring additional penalties. This option can help maintain vehicle ownership while providing the necessary financial relief. Key factors to consider include the specific policies of the lending institution, potential impacts on credit scores, and how deferred payments might extend the overall loan term or accrue additional interest. Borrowers should reach out promptly to their lenders to discuss available options and requirements for initiating a deferral agreement.

Contact information for follow-up

Auto loan payment deferral options provide financial relief during challenging times, enabling borrowers to manage unexpected expenses. Many lenders offer a grace period (typically 30 to 90 days) for missed payments without penalties, assisting individuals facing hardships like job loss or medical emergencies. Specific terms vary by lender, often requiring formal requests submitted via secure online portals or dedicated customer service lines. In regions like California, borrowers may find additional protections under state regulations designed to prevent repossession during deferral periods. Proper documentation (such as proof of income loss) may be required to process requests efficiently.

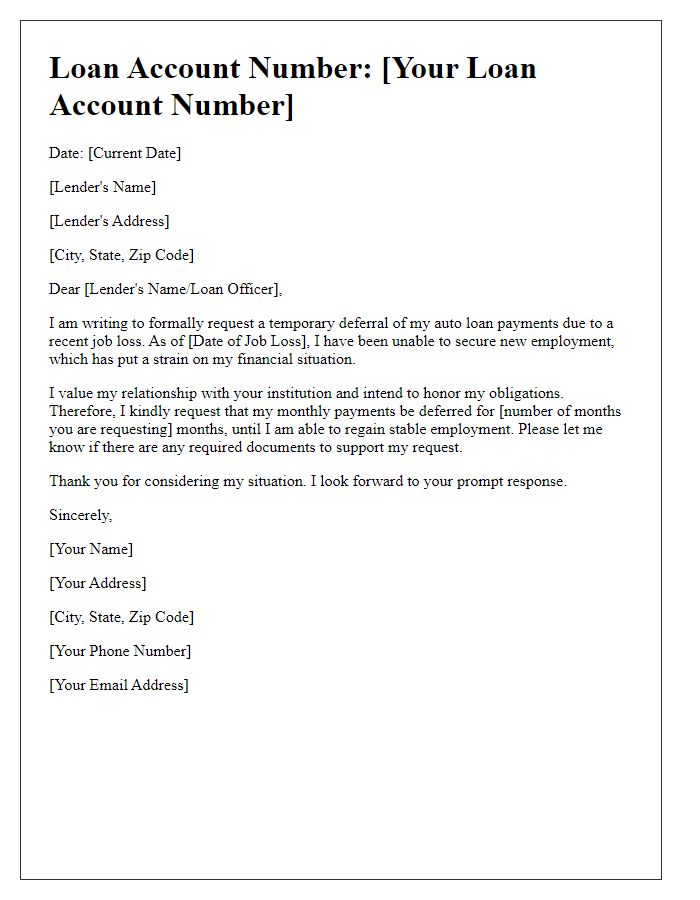

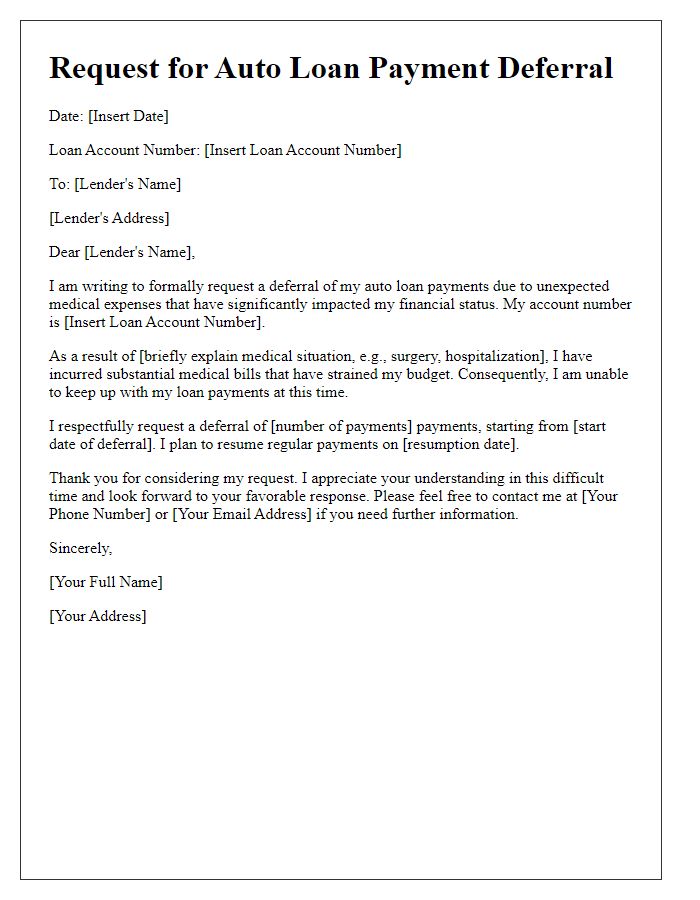

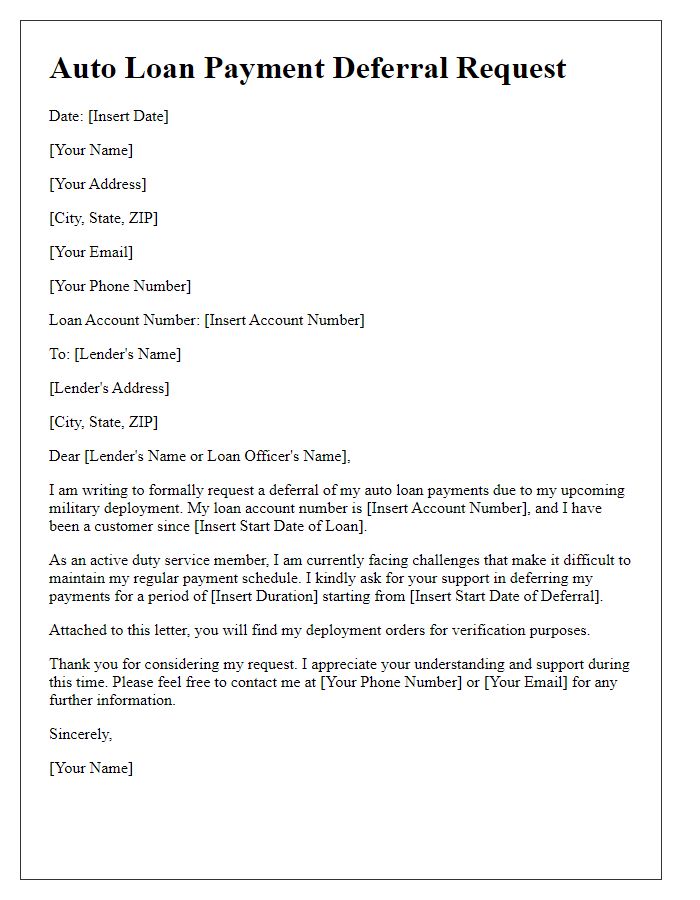

Letter Template For Auto Loan Payment Deferral Samples

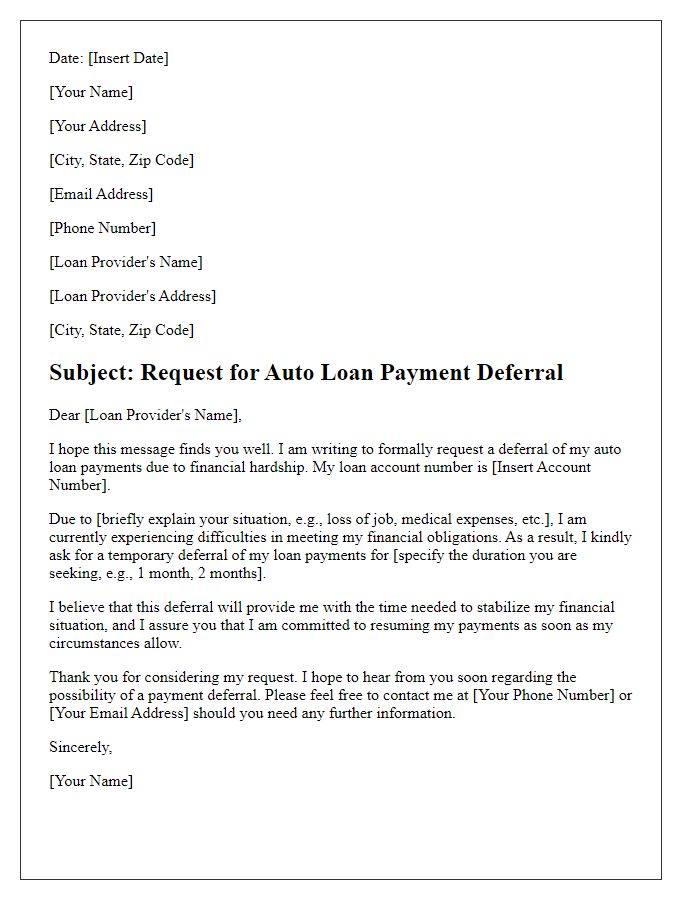

Letter template of auto loan payment deferral request due to financial hardship.

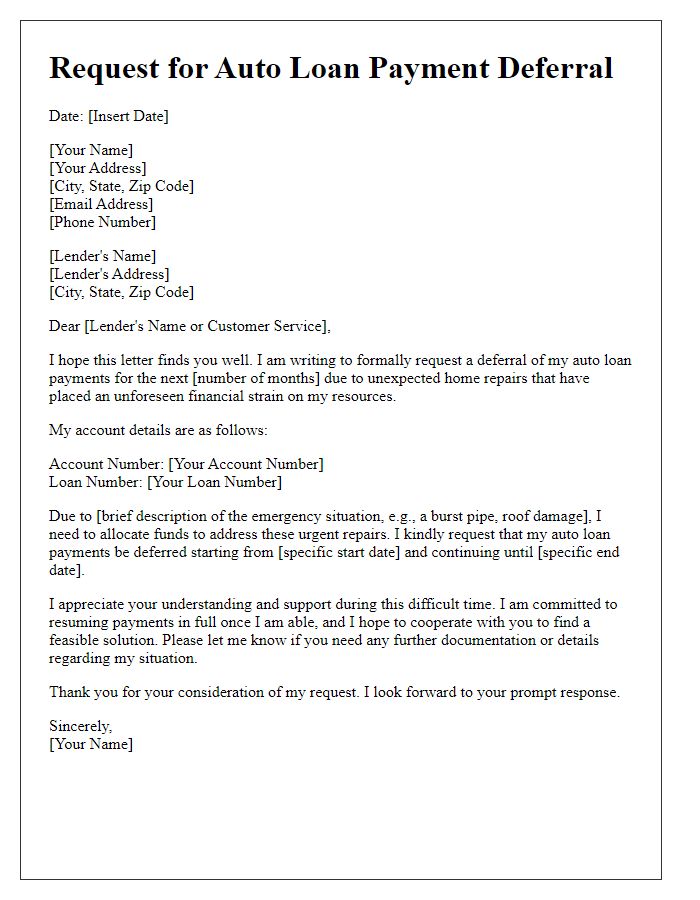

Letter template of auto loan payment deferral for unexpected home repairs.

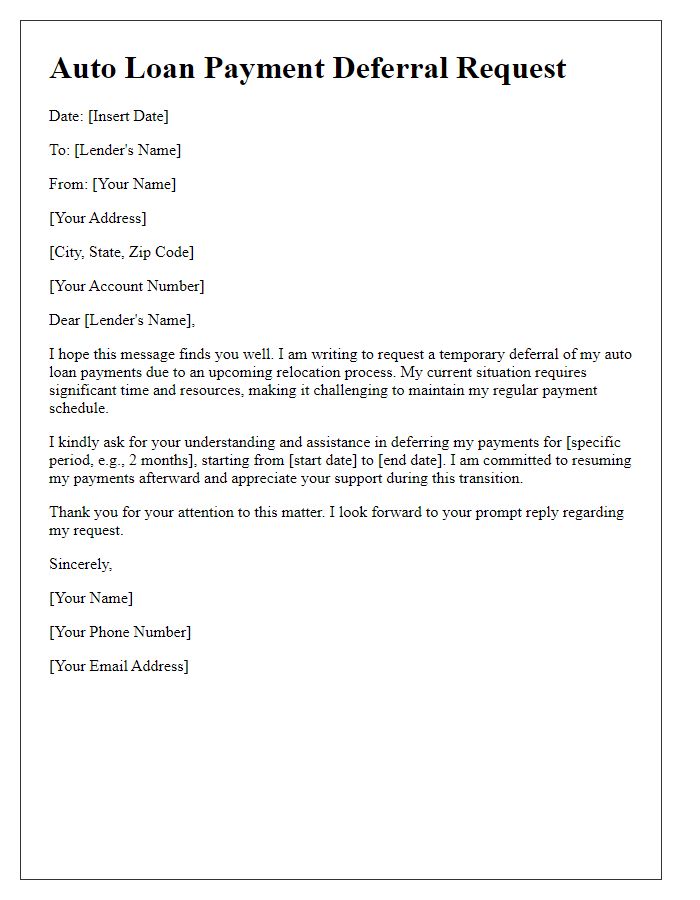

Letter template of auto loan payment deferral during relocation process.

Letter template of auto loan payment deferral related to family emergencies.

Letter template of auto loan payment deferral for small business impacts.

Letter template of auto loan payment deferral due to education expenses.

Letter template of auto loan payment deferral following natural disasters.

Comments