Are you feeling a bit overwhelmed by your debt situation and looking for clarity on your current balances? We understand that managing finances can be tricky, and having an accurate picture of your debt is essential for making informed decisions. In this article, we'll guide you through the process of crafting an effective letter to request an updated debt balance, ensuring you get the information you need in no time. So, grab a cup of coffee and let's dive into the steps to make this task easier for you!

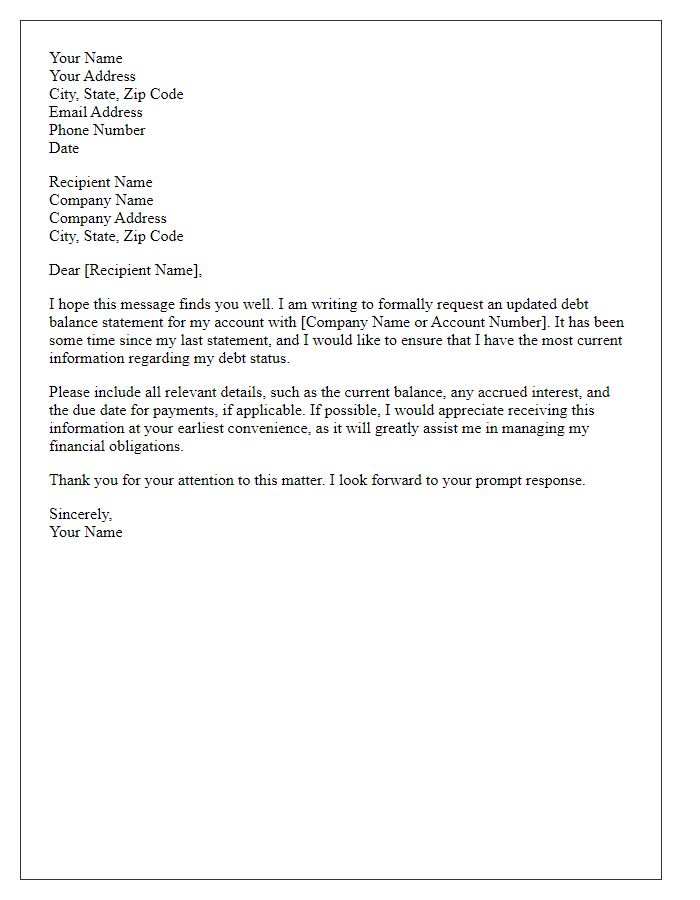

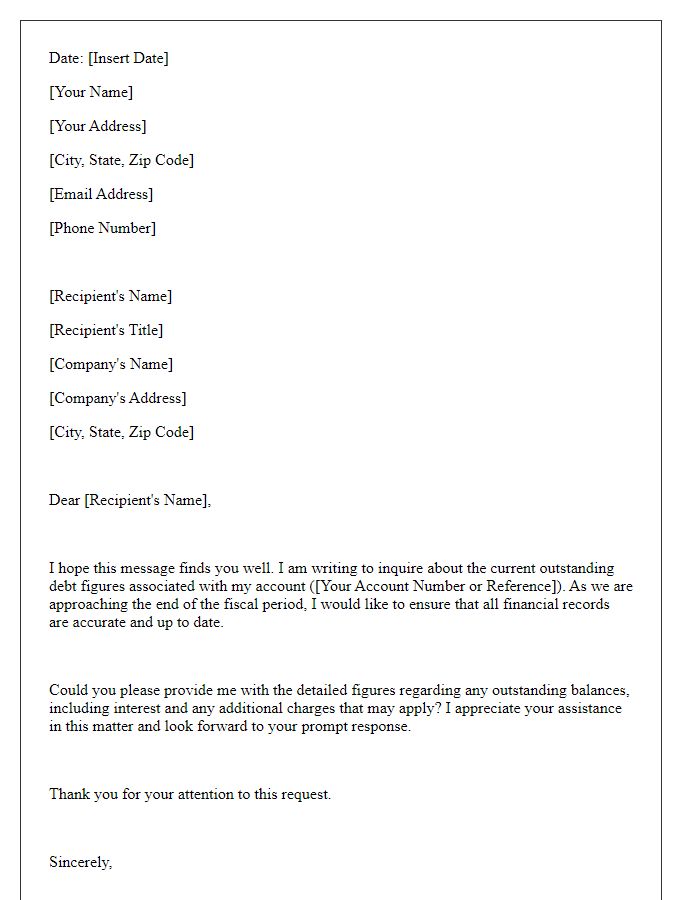

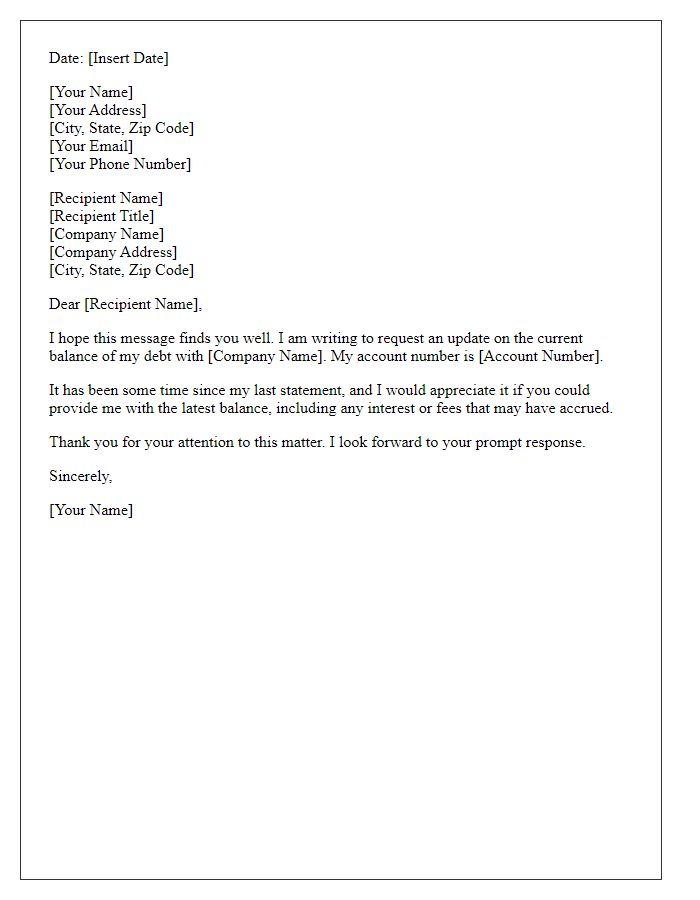

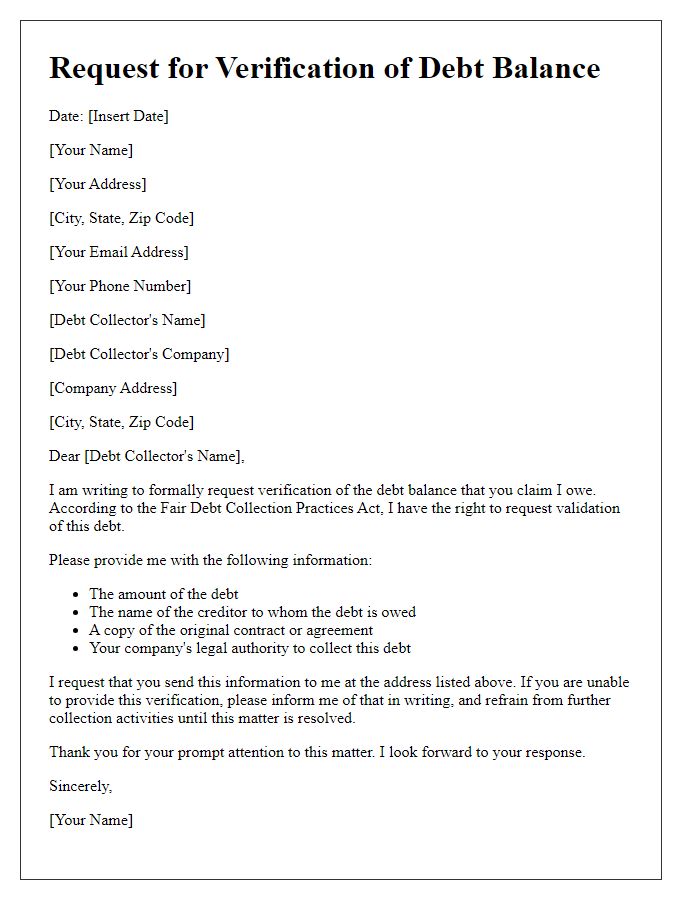

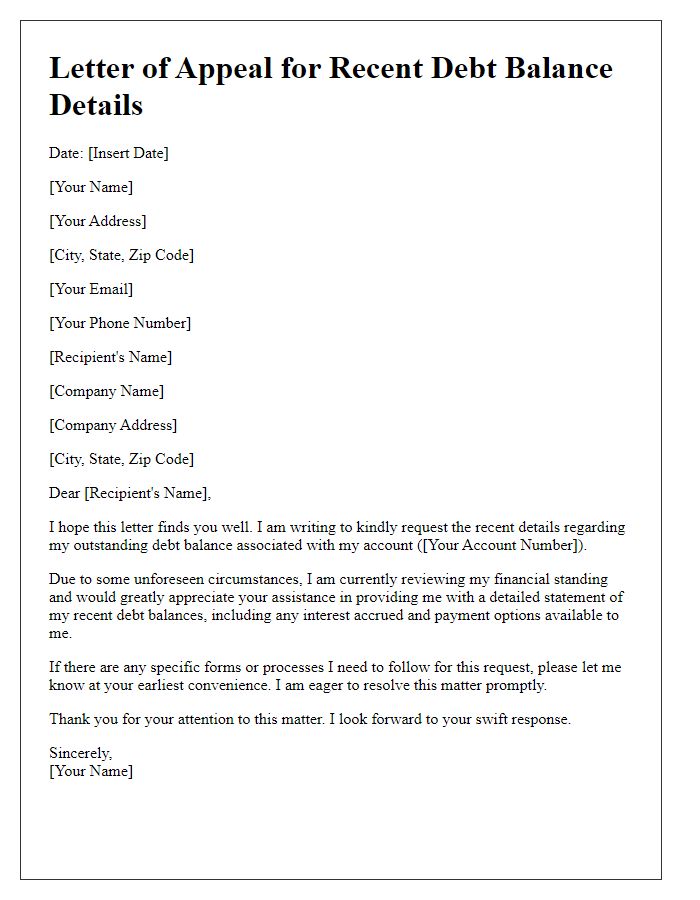

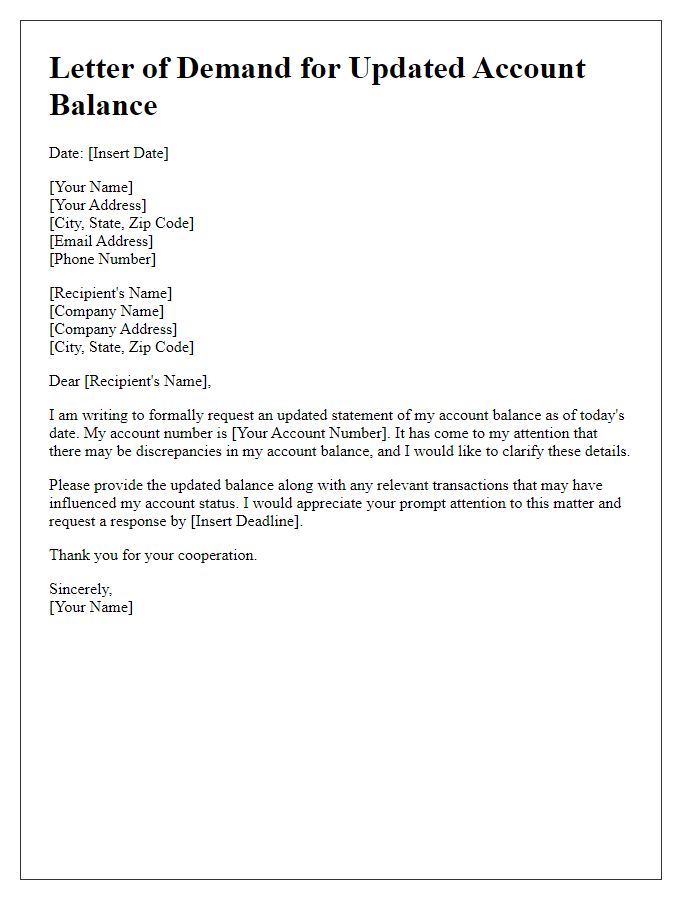

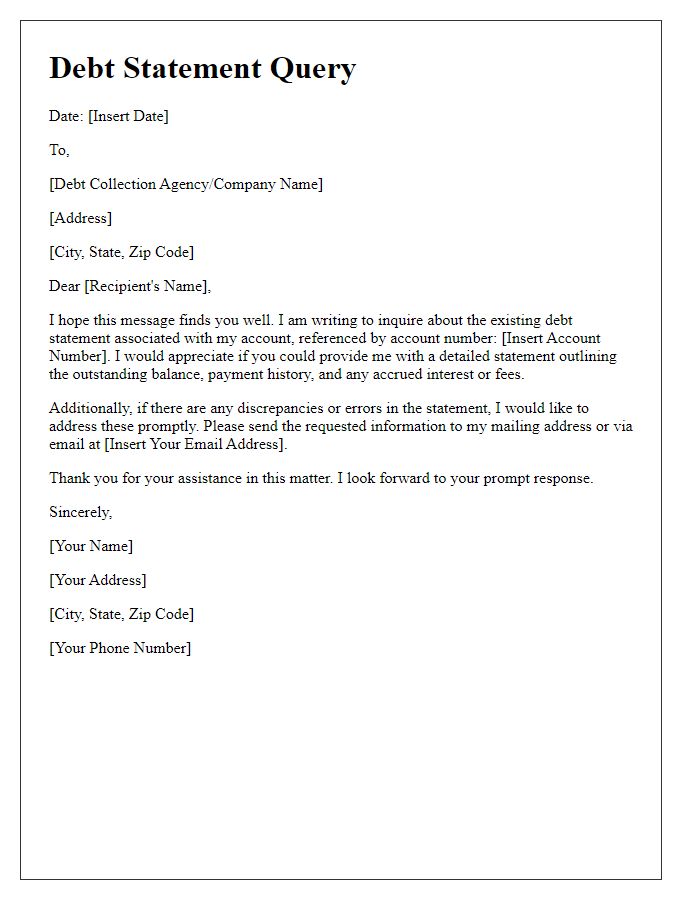

Clear identification details

When requesting an updated debt balance, clear identification details are essential. Include your full name, account number, and any reference number associated with the debt to ensure accurate processing. Specify the nature of the debt, such as personal loans or credit card balances, and mention the creditor's name, like XYZ Bank or ABC Credit Union. Clearly state the request for an updated balance as of a specific date, ensuring to clarify any recent payments made or disputes in question. Provide your contact information, including an email address and phone number, for any follow-up inquiries.

Specific account information

A detailed debt balance request should include essential account information, such as the account holder's name, the unique account number (often a combination of letters and numbers), outstanding balance amount, and specific dates related to the debt (like origination date, last payment date). Requesting an updated balance can clarify financial responsibilities, helping the account holder understand any accrued interest (which may be compounded daily or monthly) and fees associated with late payments or missed deadlines. Including contact information for the creditor or agency (such as a customer service phone number or email address) ensures streamlined communication regarding the account.

Clear request for updated balance

Requesting an updated debt balance is essential for maintaining accurate financial records. The balance inquiry should specify the account number associated with the debt, such as a loan from a financial institution like Wells Fargo or a credit card with a balance owing. It's important to emphasize the date for which the updated balance is required, particularly for year-end financial reports or tax returns. Detailed information about the debt, including interest rates or payment history, can also be helpful. Timely responses to these requests are crucial, especially in situations where outstanding debts affect credit scores or financial decisions.

Contact information for response

An updated debt balance request typically involves reaching out to creditors to obtain the most current information regarding outstanding balances. This process may include providing personal information (full name, address, and account number) to ensure accurate identification. The creditor may require contact information for response, such as an email address or phone number, which ensures timely communication concerning the requested balance. Additionally, clarity in writing, including a clear subject line referencing the debt account and the urgency of the request, can facilitate an efficient response from the creditor.

Deadline for response

An updated debt balance request involves asking for the current total amount owed, which can include principal, interest, late fees, and other applicable charges. Accurate details regarding the debtor's account (including account number) and the creditor's contact information (company name, address) are essential for clarity. A deadline for response (typically within 30 days) helps establish urgency, allowing the debtor to plan accordingly for repayment. Clear communication ensures that both parties are aligned on the outstanding balance, avoiding potential disputes in the future. This request may often occur in financial negotiations or legal settings, where transparency regarding debts is crucial for resolution.

Comments